Nifty overcomes disappointing GDP numbers to close higher

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Market Overview

Nifty opened flat at 24,140.85 but quickly dropped over 130 points to test the 24,000 level. After hitting the day’s low, the market recovered swiftly and remained flat and rangebound until 1:45 PM. In the afternoon session, Nifty surged to test the 24,300 mark and stayed in the upper range, eventually closing at 24,276.05, up 0.60%.

The broader market showed strength, with 1,804 stocks gaining, 1,043 declining, and 77 remaining unchanged out of 2,924 traded stocks. Sectoral indices witnessed broad-based buying, reflecting positive sentiment.

Markets appear to have priced in the weaker-than-expected GDP numbers and are now likely focused on the upcoming RBI monetary policy.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 5th December:

The maximum CE OI is at 24800 followed by 24500 and 24300, and the maximum Put OI is at 24000 closely followed by 24100 and 23800.

Massive puts OI addition of 48.93 Lakh contracts around 24000 levels today indicates that these levels hold the key for the market trend in the coming week.

Immediate support on the downside can be seen at 24100 levels followed by 24000 levels. Resistance on the upside is at 24300-350 levels followed by 24500.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

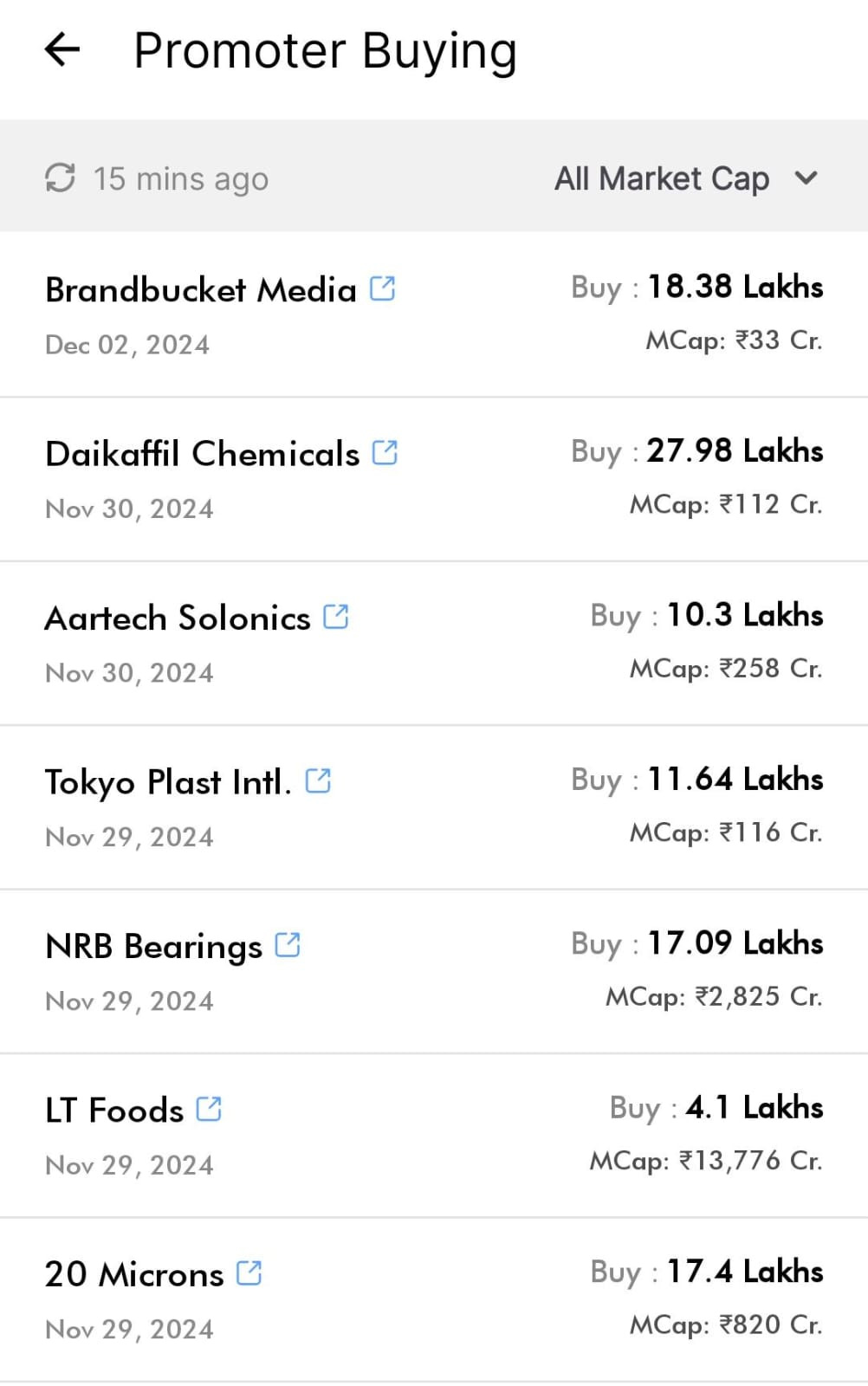

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

The Indian government has abolished the windfall profit tax on domestically produced crude oil and the export of aviation turbine fuel, petrol, and diesel, effective immediately. - Dive deeper

In November 2024, auto sales performance varied across segments:

Passenger Vehicles: Maruti Suzuki (+10.4%) and M&M Domestic (+15.6%) showed strong growth, while Hyundai (-6.9%) declined, and Tata Motors grew modestly (+2.1%).

Two-Wheelers: TVS Motors (+11.5%) and Bajaj Auto (+5.5%) performed well, but Hero MotoCorp saw a decline (-6.4%).

Three-Wheelers: M&M surged (+22.5%), Bajaj Auto stayed flat (-0.7%), and TVS Motors dropped sharply (-27.6%).

Commercial Vehicles: Ashok Leyland (-0.6%) and Tata Motors (-1.4%) reported slight declines, while Volvo Eicher rose (+7.3%).

Farm Equipment: M&M grew steadily (+4.1%), but Escorts Kubota declined (-9.4%) - Dive deeper

India's GST collection for November 2024 increased by 8.5% YoY to ₹1.82 lakh crore, with net revenue rising 11% to ₹1.63 lakh crore after refunds. Domestic revenue grew by 9.4%, and revenue from imports rose by 6%. Maharashtra led state-wise collections at ₹29,948 crore, while Lakshadweep recorded the lowest at ₹5 crore. This marks the ninth consecutive month of GST collections surpassing ₹1.7 lakh crore. Dive deeper

India's Manufacturing PMI eased to 56.5 in November 2024, down from 57.5 in October, reflecting slower expansion. Input costs for chemicals, cotton, and rubber rose, leading to the fastest price hikes in over 11 years. While export orders grew at a four-month high, domestic demand softened slightly. Employment increased for the ninth consecutive month and finished goods stocks rose for the first time since 2017. Optimism remains supported by new product launches and marketing efforts. Dive deeper

Source: Trading Economics

Ambuja Cements has partnered with Finland-based Coolbrook to adopt RotoDynamic Heater (RDH) technology, using renewable electricity for high-temperature heating to reduce fossil fuel use and emissions. This supports its goals of 60% green power and 28% alternative fuel use by 2028, advancing its Net Zero efforts in cement manufacturing. Dive deeper

Dixon Technologies shares rose 6.5% during the day, touching ₹16,836.65 and crossing ₹1 lakh crore market capitalization, after its unit, Padget Electronics, began mass production of Google Pixel smartphones at its Noida facility in partnership with Compal Smart Device India. Dive deeper

Ola Electric plans to expand its store network from 800 to 4,000 by December 20, 2024, covering all pin codes in India. The new stores will also include service facilities to enhance support. This initiative aims to increase the accessibility and adoption of electric vehicles across various regions. Dive deeper

Sterling and Wilson Renewable Energy Limited (SWREL) has received an order valued at ₹504 crore for the supply, installation, and commissioning of a 305 MW AC / 396 MWp DC solar project in Rajasthan from a private Independent Power Producer (IPP). Dive deeper

Tata Consumer Products plans to expand Tata Starbucks, its joint venture with Starbucks Corporation, to 1,000 outlets by FY 2027-28, up from 457 stores across 70 cities as of September 2024. Despite recent losses due to expansion, store profitability remains strong. The company is also focusing on its vending business, Tata MyBistro, which currently operates 2,000 machines in a market of 1.5-2 lakh machines, seeing significant growth potential in both coffee and tea segments, particularly in tier-II and tier-III cities. Dive deeper

RBL Bank and Bajaj Finance have ended their eight-year partnership for issuing new co-branded credit cards, though existing cards will remain active. This decision aligns with an RBI directive limiting co-brand partners' roles. RBL has already reduced reliance on the partnership, with co-branded card originations dropping to 36% from 65-70% in the past 18 months. RBL Bank will continue servicing the existing 3.4 million co-branded cards but will issue RBL-branded cards upon renewal. Bajaj Finance has decided to exit the co-branded card business entirely. Dive deeper

Cochin Shipyard shares rose 5% to ₹1,655.75 after signing a ₹1,000 crore contract with the Ministry of Defence for the refit and dry docking of a large Indian Naval Vessel. In Q2 FY25, the company reported a 4% YoY increase in net profit to ₹189 crore, with revenue rising 13% to ₹1,143.2 crore. Its shares have gained 131% in 2024, with a market cap of ₹43,570 crore. Dive deeper

G.G. Tronics India Private Limited (GGT), a subsidiary of CG Power and Industrial Solutions Limited, has secured a significant KAVACH order from Chittaranjan Locomotive Works, West Bengal. The contract involves the supply, installation, testing, and commissioning of onboard KAVACH equipment in compliance with RDSO specifications, along with 11 years of annual maintenance. The scope also includes wiring, harnessing, cabling, and integration with the locomotive KAVACH system. - Dive deeper

Suprajit Engineering Limited (SEL), India, has signed a Memorandum of Understanding (MoU) with Chuo Spring Company Limited, Japan, to form a 50:50 joint venture in India. The JV will focus on designing, manufacturing, and supplying transmission cables, leveraging Chuo's advanced Japanese transmission cable technology under a Technical Assistance (TA) agreement. The initial projects will cater to India’s two leading Japanese passenger vehicle OEMs. - Dive deeper

What’s happening globally

President-elect Donald Trump has threatened to impose 100% tariffs on the BRICS nations—Brazil, Russia, India, China, and South Africa—if they pursue creating a new currency to challenge the U.S. dollar's global dominance. This warning extends to recent BRICS additions: Iran, Saudi Arabia, the United Arab Emirates, Ethiopia, and Egypt. - Dive deeper

China's 10-year government bond yield has fallen below 2% for the first time, hitting a record low of 1.9750%, driven by an economic slowdown, expectations of further monetary easing by the People's Bank of China (PBOC), and deposit rate adjustments aligning with its 1.5% reverse repo rate. This reflects investor caution amid weaker growth and a preference for safer assets, while PBOC’s liquidity measures and loose monetary policy are expected to push yields even lower. The growing yield gap with U.S. bonds highlights the contrasting economic and policy conditions between the two nations. - Dive deeper

Italy's unemployment rate fell to 5.8% in October, its lowest since April 2007, with 47,000 jobs added during the month, the Italian National Institute of Statistics (ISTAT) reported. Youth unemployment dropped to 17.7% from 18.9% in September. Employment rose 0.5% in the August-to-October period, but GDP stagnated in the third quarter, with 2024 growth projected at 0.4%. Dive deeper

The Euro Area unemployment rate remained at a record low of 6.3% in October 2024, unchanged from September and down from 6.6% a year ago, according to Eurostat. The number of unemployed individuals decreased by 3,000 to 10.841 million. The youth unemployment rate rose slightly to 15%, the highest since October 2023. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Chirag Setalvad, Head, Equities, HDFC AMC

It is noteworthy that after COVID-19 there was a marked improvement in corporate profitability across large, mid, and smallcap companies. This was due to a combination of cost-cutting, benign raw material costs, and operating leverage. It has played a big role in the robust equity market performance over the past few years. One needs to temper down expectations of earnings growth. While revenue may continue to grow at a reasonable pace, earnings growth may be harder to deliver with the tailwinds from lower raw material costs behind us. - Link

Anil Singhvi, Executive Chairman of Shree Digvijay Cement

Cement is a good barometer for understanding growth.

If GDP growth slips below 6%, it will be tough to recover to 7-8%.

We will be lucky if we see a ₹700/t EBITDA in FY25.

Seeing muted demand, and this year has been a disappointment.

Expect some consolidation to take place in the industry but not at an accelerated rate. - Link

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.