Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Nifty opened flat at 23,383.55 but quickly slipped below 23,300, gradually declining toward 23,200 by 12:30 PM, with brief 15-20 point bounces in between. In the second half, the decline accelerated, with Nifty plunging 200 points in just 30 minutes. During the last two hours, the index hit fresh lows near 22,986.65, fluctuating between 23,000 and 23,080, before closing at 23,071.80, down 1.32%.

The market sentiment was dampened by concerns over Trump's tariffs and overall weakness in the broader markets. Looking ahead, Nifty is expected to track global cues, domestic economic developments, and key market events, including the final phase of the earnings season.

Broader Market Performance:

Underperforming the headline indices, the broader market saw an even sharper decline in advance-to-decline ratios. Out of 2,918 stocks traded on the NSE, 326 advanced, 2,532 declined, and 60 remained unchanged. Notably, 306 stocks out of 2,918 stocks have hit a lower circuit today.

Sectoral Performance:

All sectoral indices closed in the red, with Nifty Realty emerging as the worst performer, dropping 3.07%, followed by Nifty Media, which fell 2.85%. On the other hand, Nifty Bank recorded the smallest decline, losing 1.16%, making it the least affected sector. Overall, all 12 sectors ended in negative territory, with no gainers, indicating a broad-based market downturn.

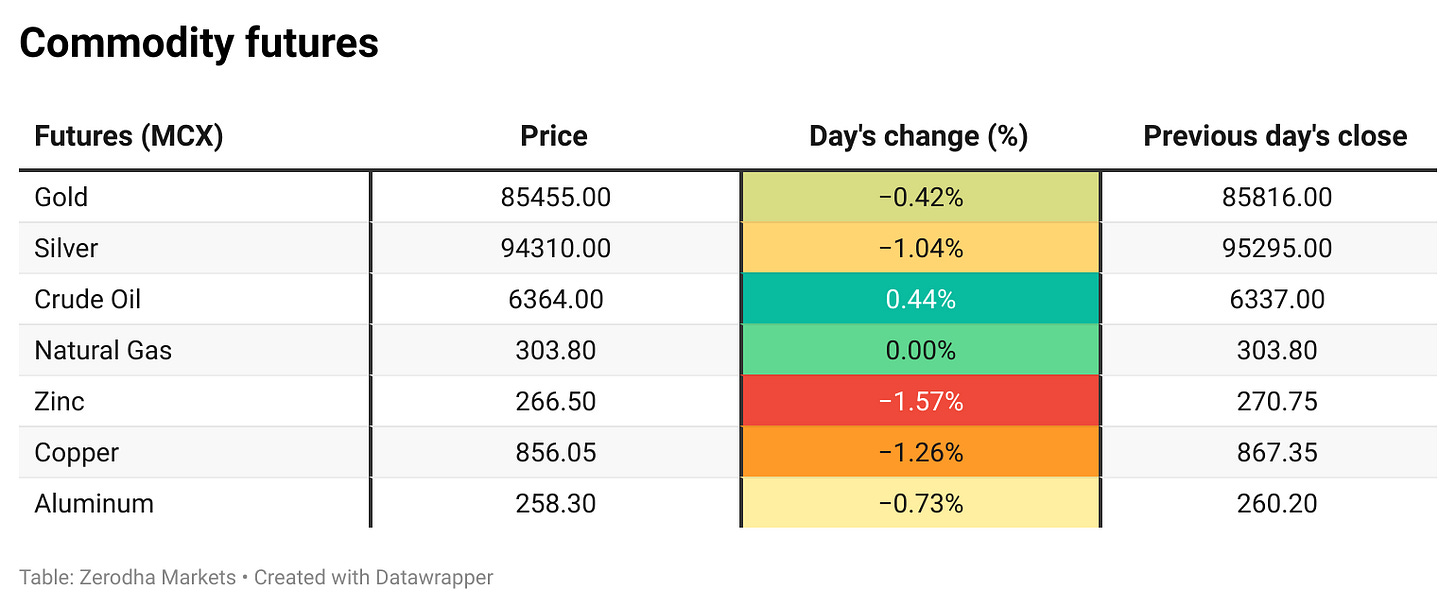

Note: The above numbers for Commodity futures were taken around 4 pm.

Net Flow Breakdown for the day:

FII: Net outflow of ₹4,486.41 crore (Bought ₹11,495.99 crore, Sold ₹15,982.40 crore)

DII: Net inflow of ₹4,001.89 crore (Bought ₹13,787.72 crore, Sold ₹9,785.83 crore)

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 13th February:

The maximum Call Open Interest (OI) is observed at 23,500, followed by 23,400. Meanwhile, The maximum Put Open Interest (OI) is at 22,700, followed by 22,800.

Immediate support is identified in the 23,900–23,800 range, while resistance is expected between 23,400 zones followed by 23,500.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

The Indian rupee posted its biggest gain in over two years, rising nearly 1% to 86.6362 per dollar, likely driven by strong intervention from the central bank. This marks its sharpest surge since November 2022. Dive deeper

Rail Vikas Nigam Ltd (RVNL) gained after emerging as the lowest bidder for a ₹335.4 crore contract from South Western Railway. The project covers the survey, design, supply, installation, testing, and commissioning of Kavach equipment and related works across 790 route kilometers in the Hubballi and Mysuru divisions. Dive deeper

Telangana state has permitted an increase in beer prices starting Tuesday, following a temporary supply halt by Heineken's United Breweries over pricing disputes. United Breweries holds a 70% market share in the state. Dive deeper

Ahmedabad-based Torrent Group is set to acquire a 66% stake in Gujarat Titans for around ₹7,500 crore ($856 million), pending BCCI approval. Currently owned by CVC Capital Partners, the franchise was acquired in 2021 for ₹5,625 crore ($745 million). The deal includes a put option for CVC to sell its remaining stake later. Dive deeper

The Reserve Bank of India has doubled its bond purchases to ₹40,000 crore on February 13, up from ₹20,000 crore, to address the banking system's liquidity deficit, which stood at ₹1.32 lakh crore as of February 9. Dive deeper

Mankind Pharma's board approved selling its entire stake in Mahananda Spa and Resorts to Chalet Hotels for ₹530 crore. The proceeds will be used to reduce debt, with the deal expected to close by February 28. Dive deeper

HG Infra Engineering, in partnership with DEC Infrastructure and Projects (India), has received a letter of acceptance from the Rail Land Development Authority (RLDA), New Delhi, for an EPC project valued at ₹2,195.68 crore. Dive deeper

Escorts Kubota Ltd. has amended its business transfer agreement with Sona BLW Precision Forgings Ltd. for the sale of its railway equipment division. The revised terms include changes to the ₹1,600 crore consideration, with a portion placed in escrow and released in tranches upon meeting specific milestones. Dive deeper

What’s happening globally

Gold prices surged by ₹2,430 to a record high of ₹88,500 per 10 grams in the national capital on Monday, driven by strong global trends and a weaker rupee. The metal crossed $2,950 an ounce globally after U.S. President Donald Trump announced new 25% tariffs on steel and aluminum imports. Dive deeper

The European Union vowed to take "firm and proportionate countermeasures" after U.S. President Donald Trump raised tariffs on aluminium to 25%, removing country exceptions and quota deals, escalating trade war concerns. Dive deeper

The United Kingdom is set to issue a record $16 billion in 10-year bonds after attracting over $175 billion in investor orders, driven by demand for high yields. The bond sale is being conducted through a syndication process via banks. Dive deeper

The annual inflation rate in Hungary accelerated to 5.5% in January 2025 from 4.6% in the previous month, well above market expectations of 4.8%. This marked the highest inflation rate since December 2023. Prices rose further for food (6% vs 5.4% in December 2024). Dive deeper

Newcastle coal futures fell to $105 per tonne in February, extending its recent plunge to the lowest in over four years amid an increasingly oversupplied market. China announced that its output is set to expand 1.5% to 4.82 billion tons in 2025 following a record-setting 2024, aiming to expand mining capacity to avoid availability risks from carbon emission limits and mine shutdowns for safety protocol breaches. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

EIH Associated Hotels (-3.56%)

Financials:

Revenue: ₹133 crores, up by 5% YoY.

EBITDA: ₹53.8 crores, up by 3% YoY.

Net Profit: ₹39.9 crores, up by 5% YoY.

EPS: ₹6.55, up by 5% YoY.

Key Highlights:

EIH Associated Hotels has maintained steady growth in revenue and profits, reflecting resilience in its operational performance.

The company has continued to optimize costs and improve operational efficiencies across its properties.

Outlook:

EIH Associated Hotels anticipates sustained growth with an emphasis on enhancing guest experiences and expanding its luxury hotel portfolio to capitalize on the recovery in the hospitality sector.

Devyani International (-4.53%)

Financials:

Revenue: ₹1,294 crores, up by 54% YoY.

EBITDA: ₹213 crores, up by 46% YoY.

Net Profit/Loss: ₹-7.64 crores, down by 110% YoY

EPS: ₹0.00, down by 100% YoY from ₹0.08.

Key Highlights:

Devyani International has seen robust sales growth driven by expanded operations and increased consumer footfall across its retail outlets.

The food and beverages segment showed remarkable growth, contributing significantly to the overall revenue increase.

Outlook:

The company is focused on expanding its market reach and optimising operational efficiencies to return to profitability.

BLS E-Services (+0.26%)

Financials:

Revenue: ₹128 crores, up by 78% YoY.

EBITDA: ₹15.8 crores, up by 53% YoY.

Net Profit: ₹14 crores, up by 75% YoY.

EPS: ₹1.44, up by 29% YoY.

Key Highlights: BLS E-Services reported significant growth across all key financial metrics, driven by enhanced service offerings and expansion in new markets.

Outlook: The company is focusing on leveraging technology to improve service delivery and expand its customer base.

Schneider Electric Infrastructure Limited (+2.51%)

Financials:

Revenue: ₹857 crores, up by 15% YoY.

EBITDA: ₹140 crores, up by 27% YoY.

Net Profit: ₹111 crores, up by 7% YoY.

EPS: ₹4.62, up by 22% YoY.

Key Highlights:

Schneider Electric has successfully enhanced its Medium Power Transformers capacity to meet rising market demand.

The company revised several policies to align with recent regulatory changes, ensuring continued compliance and governance enhancement.

Outlook:

The company remains focused on leveraging technological advancements to expand its infrastructure solutions, anticipating further growth in the energy sector.

Birlasoft Limited (-4.19%)

Financials:

Revenue: ₹1,362.7 crores, up by 1.47% YoY.

Net Profit (PAT): ₹116.9 crores, down by 27.4% YoY.

EPS: ₹4.20, down from ₹5.82 YoY.

Key Highlights

Moderate revenue growth driven by Banking, Financial Services & Insurance (BFSI) and Manufacturing segments.

Life Sciences & Services segment saw a decline in revenue compared to last year.

Employee expenses remained a significant cost, while depreciation and finance costs remained stable.

Other comprehensive income stood at ₹15.4 crores, mainly due to foreign exchange gains.

Outlook

The company remains focused on improving margins and optimizing operational efficiencies to drive sustainable growth.

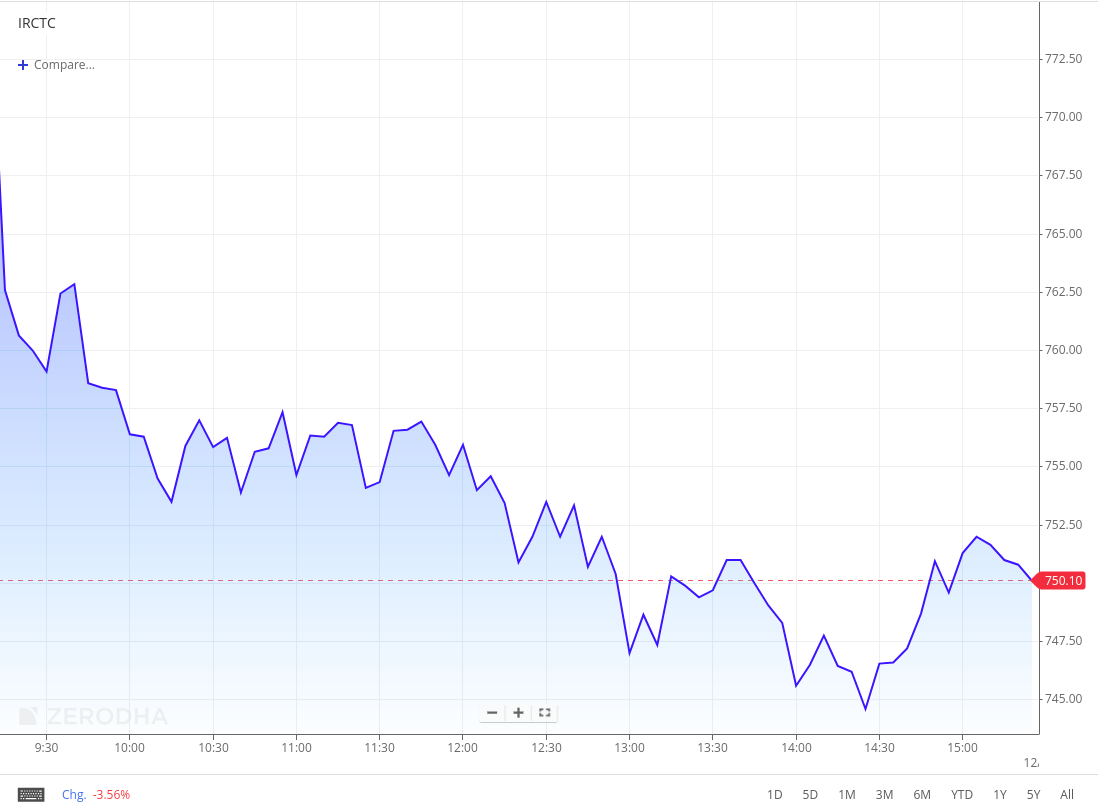

Indian Railway Catering and Tourism Corporation (-2.94%)

Financials:

Revenue: ₹1,224.65 crores, up by 9.7% YoY.

Net Profit (PAT): ₹341.21 crores, up by 13.7% YoY.

EPS: ₹4.27, up from ₹3.75 YoY.

Key Highlights

Growth driven by Internet Ticketing and Catering segments.

Rail Neer revenue increased, contributing to overall performance.

Tourism revenue saw moderate growth but remains volatile due to market demand fluctuations.

The company announced a second interim dividend of ₹3 per share.

Outlook

The company remains focused on enhancing digital services, catering expansion, and tourism growth to drive future earnings.

Procter & Gamble Hygiene and Health Care Limited (-1.29%)

Revenue: ₹1,247.63 crores, up by 11.9% YoY.

Net Profit (PAT): ₹268.59 crores, up by 17.3% YoY.

EPS: ₹82.74, up from ₹70.51 YoY.

Key Highlights

Strong revenue growth driven by increased sales across key product categories.

Advertising and sales promotion expenses surged to ₹158.34 crores, supporting brand visibility.

Improved cost efficiencies and stable input costs helped boost profitability.

The company announced an interim dividend of ₹110 per share.

Outlook

The company remains focused on driving revenue growth and sustaining margin improvements through strategic investments in marketing and cost optimization.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Rishma Kaur, Chairman of Berger Paints Ltd. on competition

"We don't have any such ego that we must be number one or number two. Our priority is to stick to our planned targets and budgets. As long as we meet our own growth objectives, we are satisfied,"

"We have our plans, whether competition is high or low. We will deal with it in a structured manner. If a good acquisition opportunity arises, we will evaluate it based on the price-benefit equation. However, we have the capability to grow organically, and that remains our priority. We have acquired companies in the past and will continue to consider acquisitions if they align with our strategic goals." - Link

Sandeep Poundrik, Steel Secretary on impact of US tariffs on Indian steel

"The U.S. President has said about putting tariffs on steel. How much steel actually we export to the U.S.? We produced 145 million tonnes of steel last year, of which 95,000 tonnes was exported to the U.S. So, how does it matter if out of 145 million tonnes, you are not able to export 95,000 tonnes," - Link

Calendars

In the coming days, we have the following major events, corporate actions, and upcoming earnings releases:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Laudable effort. Everything you want to know about scrips today.