Nifty powers above 22,800 riding global tailwinds

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

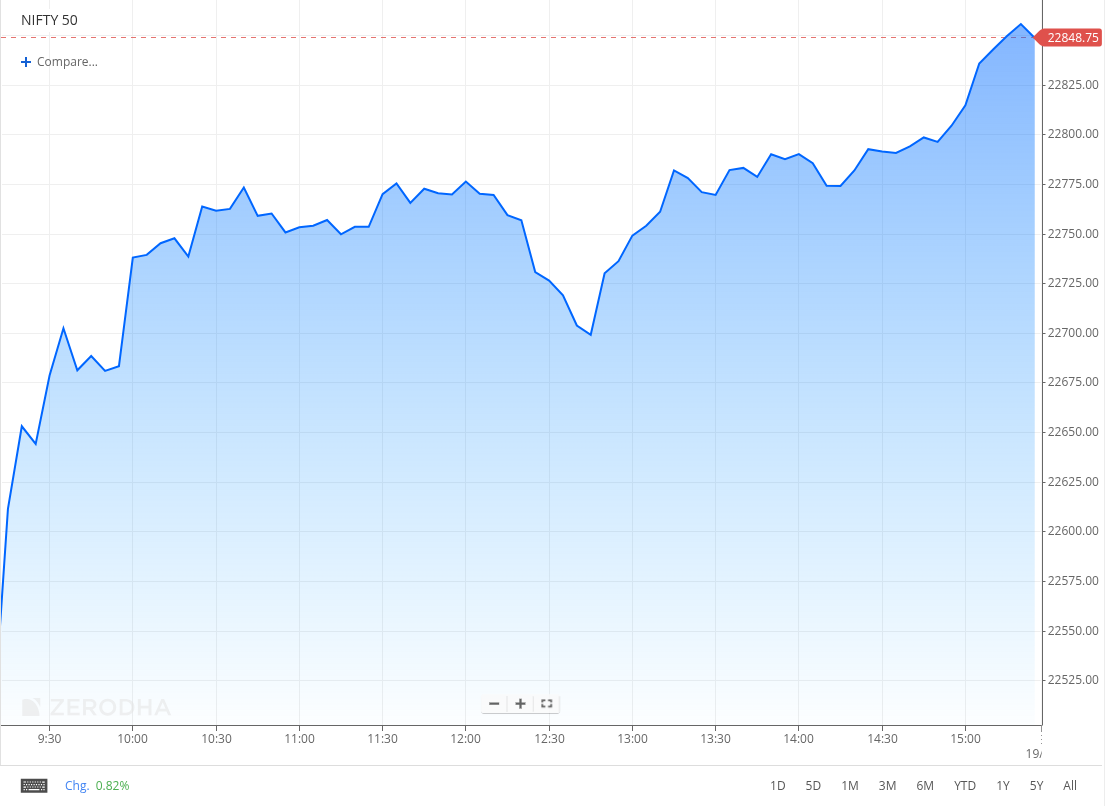

Nifty started strong, opening with a gap up of over 150 points at 22,662.25, and continued to surge throughout the day. After a brief dip between 12 and 1 o'clock, the index quickly reversed course, reaching a high of 22,857.80 before closing 1.45% higher at 22,834.30.

Investor sentiment was supported by positive global cues, particularly expectations that the Federal Reserve may consider interest rate cuts later in the year following softer than expected US retail sales data. Despite ongoing concerns over FII outflows and tariff uncertainties, the domestic market's positive momentum carried the indices higher, with gains across all sectors.

Broader Market Performance:

The broader market showed a positive performance today, with 3,016 stocks traded on the NSE. Of these, 2,288 advanced, 646 declined, and 82 remained unchanged.

Sectoral Performance:

All the indices ended the day positive. Nifty Media led the gains with a 3.62% jump, driven by strong buying interest. Realty and Consumer Durables followed, rising 3.16% and 2.62%, respectively. Auto and PSU Banks also added over 2%. While IT was the slowest mover, it still closed 1.33% higher.

Note: The above numbers for Commodity futures were taken around 5 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 20th March:

* The maximum Call Open Interest (OI) is observed at 23,000, followed by 23,100 and 23,200, indicating strong resistance at these levels.

* The maximum Put Open Interest (OI) is at 22,500, followed by 22,600 and 22,700, suggesting strong support at 22,500, with additional support at 22,600 and 22,700.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

India’s goods trade deficit narrowed to a 42-month low of $14.05 billion in February 2025, driven by reduced gold, silver, and crude imports. Imports dropped to a 22-month low of $50.9 billion, while exports stood at $36.9 billion. ICRA expects a current account surplus of $5 billion in Q4 FY25, aided by the lower deficit. Dive deeper

Tata Motors will hike the prices of its commercial vehicles by up to 2% from April 1, 2025, to partially offset rising input costs. The increase will vary by model and variant. Dive deeper

IndusInd Bank raised ₹11,000 crore via certificates of deposit (CDs) to strengthen liquidity after an accounting lapse disclosure. The RBI’s assurance of the bank’s capital adequacy boosted investor confidence, helping it raise funds despite slightly higher rates. Dive deeper

Canara Bank raised ₹4,000 crore via 10-year tier-II bonds at a 7.46% coupon, with a 5-year call option. The issue saw strong demand, supported by a AAA rating and the bank’s healthy capital adequacy ratio of 16.44%. Dive deeper

Bajaj Finserv will acquire Allianz’s 26% stake in their life and general insurance JVs for ₹24,180 crore, taking full ownership. The 24-year-old partnership ends as both groups pursue independent insurance strategies, amid India’s move to allow 100% FDI in the sector. Dive deeper

SEBI resolved 4,986 investor complaints through its SCORES platform in February. Fresh complaints stood at 3,969, while 4,376 remained unresolved by month-end. The average resolution time in February was eight days. Dive deeper

Paytm Money received SEBI’s approval as a registered Research Analyst, allowing it to offer investment research and advisory services. The move aligns with plans to strengthen its investment platform. Dive deeper

India's solar power output may fall by 600-800 GWh by 2041 due to air pollution and climate change, an IIT Delhi study warned. The northern, western, and southern grids could face significant performance challenges as reduced solar radiation and rising temperatures impact efficiency. Dive deeper

NTT Data has announced a $400 million, 8,100-km submarine cable system connecting Malaysia, India, Singapore, and Thailand, set for commissioning by June 2025. The company also plans major investments in India, including a 500 MW data centre campus in Navi Mumbai and expanded AI and quantum computing projects. NTT aims for 100% renewable energy use in its data centres by 2030. Dive deeper

PC Jeweller's board approved the allotment of 51.71 crore shares at ₹29.20 each to 14 banks, settling ₹1,510 crore debt under a Joint Settlement Agreement. The shares rank pari-passu with existing equity. The company had opted for a one-time settlement (OTS) of dues. Dive deeper

The Competition Commission of India (CCI) approved JSW Neo Energy’s 100% acquisition of O2 Power Midco and O2 Energy SG. Both entities operate in wind and solar power generation. The deal is part of JSW’s ₹12,468 crore acquisition of a 4,696 MW renewable platform. Dive deeper

The Competition Commission of India (CCI) approved Hindustan Unilever’s ₹2,955 crore acquisition of Uprising Science, the parent company of skincare brand Minimalist. HUL will acquire 90.5% initially and the remaining 9.5% within two years. The Minimalist team will continue managing operations for the next two years. Dive deeper

Ircon International secured a ₹1,096 crore order from the Meghalaya government for constructing a new secretariat complex in Shillong. The project will be executed on an Engineering, Procurement, and Construction (EPC) basis over three years through a joint venture, with Ircon holding a 26% share. Dive deeper

LG Electronics India and Innovision received SEBI approval for their IPOs. LG’s ₹15,000 crore IPO is a 15% stake sale via Offer for Sale, with no proceeds to the company. Innovision plans a fresh issue of ₹255 crore and an OFS of 17.72 lakh shares. Dive deeper

Reliance Industries earned €724 million (₹6,850 crore) from exporting fuel made from Russian crude oil to the US between January 2024 and January 2025. The fuel, primarily petrol and diesel, was refined at Reliance’s Jamnagar refineries. The report by CREA highlighted that Russian crude was involved in significant portions of India’s fuel exports to the US. Dive deeper.

What’s happening globally

Brent crude rose to $71.5 per barrel, gaining for a third session on Middle East tensions after Israel’s Gaza strike and US warnings to Iran. Hopes of China demand recovery also supported prices, while Russia-Ukraine peace talks and trade tensions capped gains. Dive deeper

Gold crossed $3,020 to hit a record high as tariff uncertainty and rising Middle East tensions lifted safe-haven demand. Israel’s airstrikes on Gaza and Trump’s warning to Iran added to geopolitical risks, while markets await the Fed’s policy outlook. Dive deeper

US retail sales rose 0.2% in February 2025, rebounding from a 1.2% drop but missing estimates. Gains in nonstore retailers and health stores offset declines in restaurants, gas stations, and clothing. Core retail sales, used for GDP calculation, jumped 1%. Dive deeper

European markets extended gains for a third session, with the STOXX 50 and STOXX 600 up 0.3%, as investors tracked Germany's vote on debt reform and US-Russia talks on a Ukraine ceasefire. German automakers and defence stocks led gains, while real estate and household goods lagged. Dive deeper

The British pound crossed $1.30, its highest in over four months, supported by expectations of higher-for-longer UK interest rates. Markets see the Bank of England cutting rates slower than the Federal Reserve, while a weaker dollar and hopes of UK infrastructure investments also lifted sentiment. Dive deeper

The Hang Seng jumped 595 points or 2.5% to a 3-year high of 24,740, led by tech stocks as Baidu surged 12.2% on new AI models. BYD hit a record, while Alibaba and Tencent gained over 5%. Strong consumer spending and record foreign inflows also lifted sentiment. Dive deeper

Spain’s trade deficit widened to €6.19 billion in January 2025, the highest since October 2022, as exports declined 1.2% mainly due to lower automotive and energy shipments while imports grew 6.2% led by chemicals and consumer goods. Dive deeper

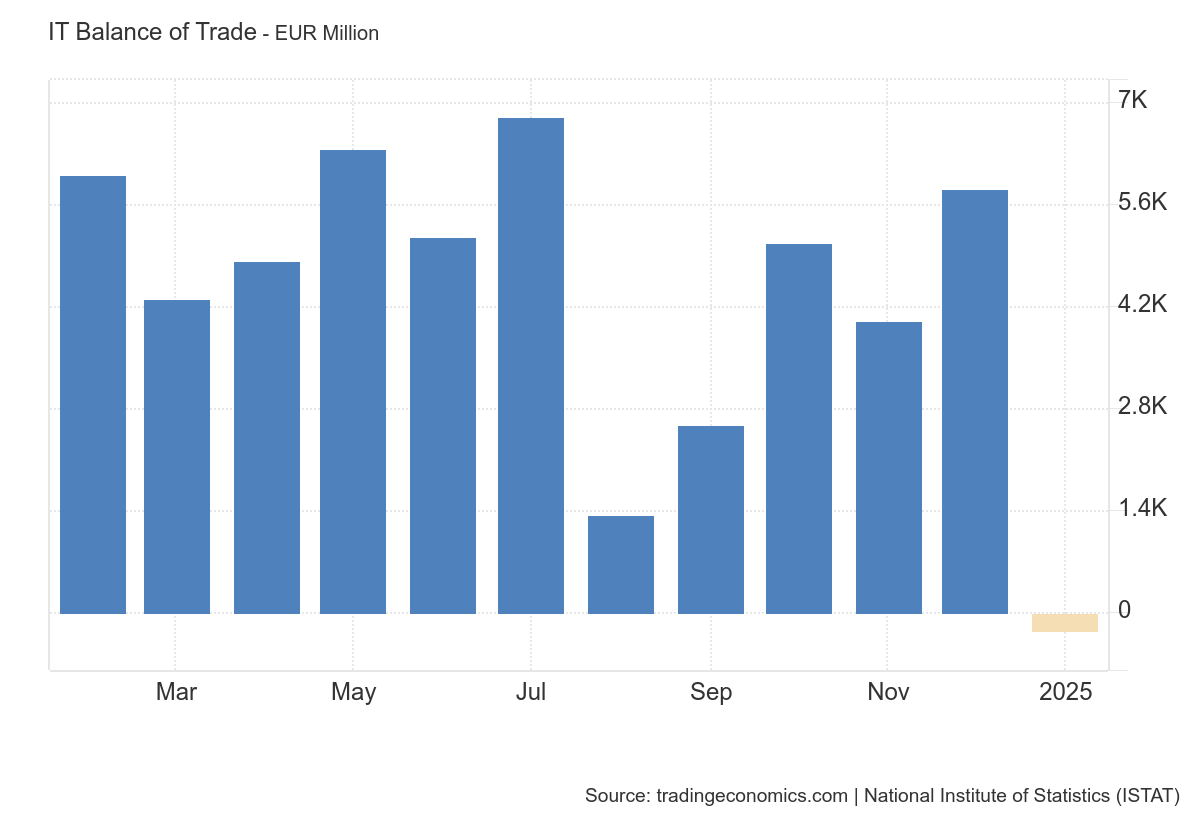

Italy posted a trade deficit of €264 million in January 2025, its first in two years, against a surplus of €2.49 billion last year and missing the €5.15 billion surplus estimate. Imports jumped 8.8%, led by natural gas, machinery, metals, and chemicals, while exports rose 2.5%, supported by pharmaceuticals but dragged by weaker machinery sales. Dive deeper

Salaries in Europe’s ETF industry are surging as asset managers scramble for experienced talent, especially in capital markets roles critical to ETF liquidity. With limited in-house capabilities, firms are forced to hire from rivals, driving annual pay for senior specialists above £300,000. Dive deeper

Alphabet is in talks to acquire cybersecurity startup Wiz for around $30 billion, potentially marking its biggest deal. Wiz offers AI-powered cloud security solutions and was last valued at $12 billion in May 2024. If finalized, the deal may face regulatory scrutiny given its size and impact. Dive deeper

Hedge funds made $16.2 billion as Tesla’s stock crashed 50% in three months, erasing $700 billion in value and $100 billion from Elon Musk’s net worth. Sales slumped, political controversies grew, and short bets surged 16%. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

State Bank of India (SBI) on Global Tariffs Impact and India’s Position

"The decline in exports from India to the U.S. could be in the range of 3-3.5% post reciprocal tariffs, if any, but should be negated through higher export goals and diversified routes.”

“India has signed 13 FTAs in the last five years, covering manufacturing, agriculture, services trade, digital issues, and intellectual property rights.”

“The FTA with the UK alone is expected to increase bilateral trade by $15 billion by 2030, while the digital economy could add $1 trillion to India’s GDP by 2025.” - Link

Lip-Bu Tan, Incoming CEO, Intel on Manufacturing and AI Strategy Overhaul

“The company will need to make tough decisions,” including restructuring AI operations and trimming a slow-moving middle management layer.

“We will restore Intel’s position as a world-class foundry,” focusing on winning large customers and improving chip manufacturing yields.

“Lip-Bu will be spending a lot of time listening to customers, partners, and employees as he comes on board and works closely with our leadership team to position the business for future success.” - Link

Calendars

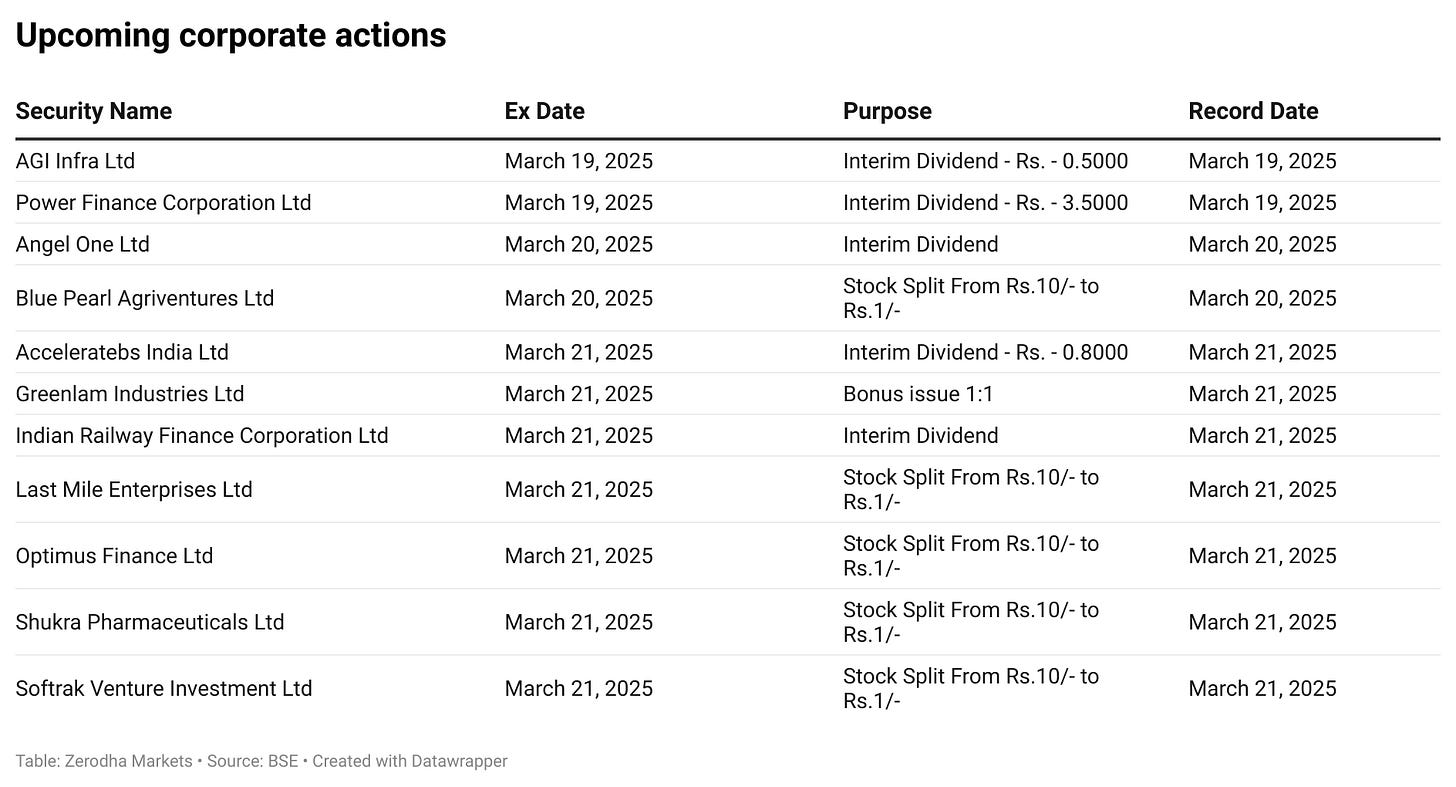

In the coming days, we have the following significant events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.