Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

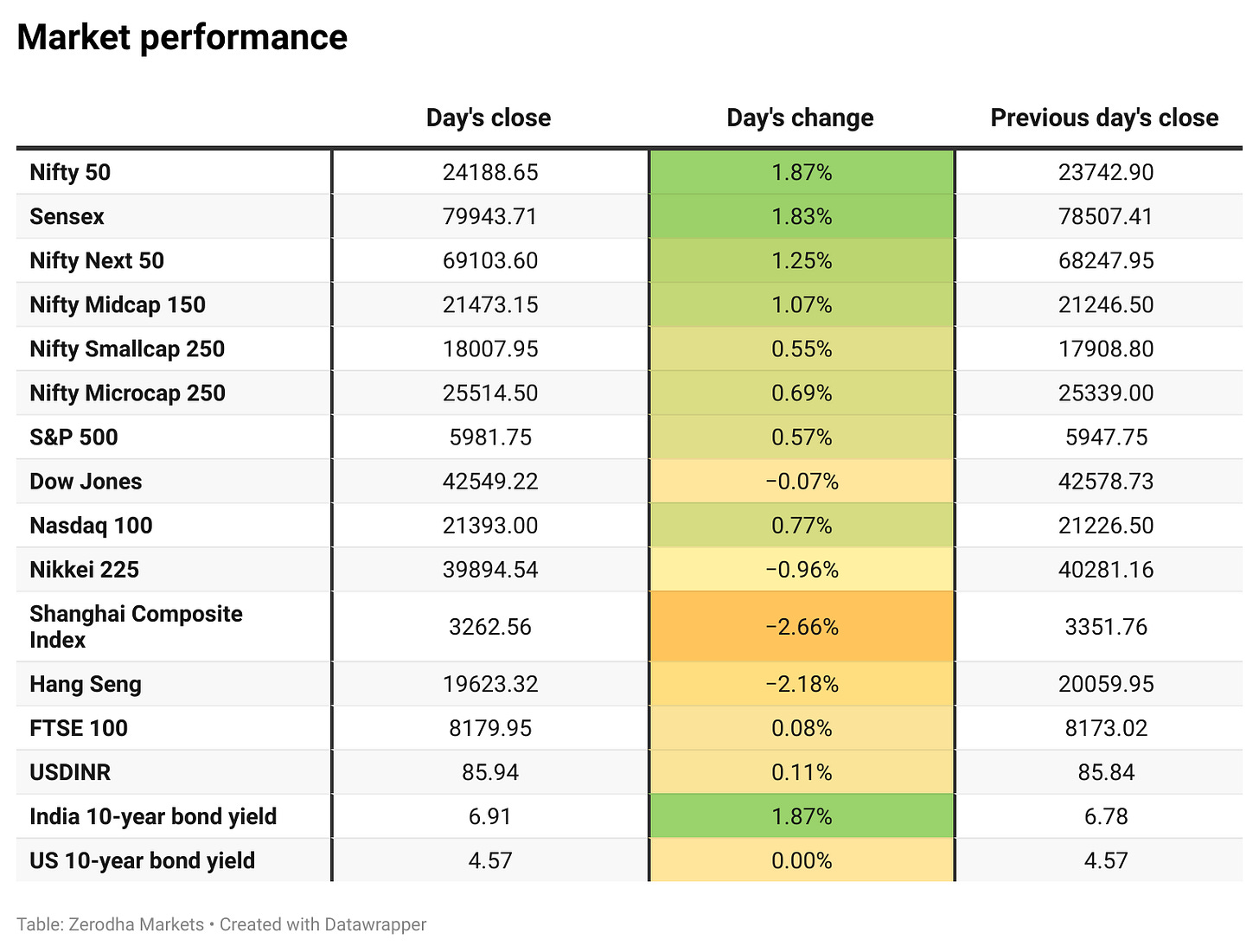

Nifty opened 40 points higher at 23,783. After filling the small gap up and hitting the day’s low of 23,751.55 within the first 15 minutes, it maintained a steady upward movement throughout the session. By 11:30 AM, Nifty reached its major resistance zone at 23,950 and consolidated within a narrow 50-point range for an hour. It eventually broke past 24,000, climbing further to surpass 24,100 and even crossing 24,200 intraday. The index touched the day’s high of 24,226.70 before closing at 24,188.65, marking a 1.87% gain. The rally was broad-based, led by strong performances in Autos, IT, Financials, and other indices.

Broader Market Performance:

Driven by positive movements in the headline indices, the broader market maintained its upward momentum. A total of 1,824 stocks advanced, 997 declined, and 90 remained unchanged.

Sectoral Performance:

The sectoral performance showcased positive trends, with Nifty Auto leading as the top gainer, rising by 3.79%, driven by strong momentum following better-than-expected December sales figures. Except for the Media sector, all others ended the day in positive territory.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 9th January:

The maximum Call Open Interest (OI) is observed at 24,200, followed by 24,500, while the maximum Put Open Interest (OI) is at 24,000, followed by 23,900 and 23800.

Immediate support is observed in the 23,800–24,000 range, while resistance lies between 24,200 and 24,400.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

India's manufacturing sector faced another setback in December as factory activity hit a 12-month low, following a weak November, according to the HSBC India Manufacturing PMI. The seasonally adjusted index slipped marginally from 56.5 in November to 56.4 in December, reflecting the lowest levels of new orders and output in 2024. Despite the decline, the PMI remained above 50, indicating continued, albeit slower, expansion. Dive deeper

Petronet LNG shares dropped 5.7% after the Petroleum and Natural Gas Regulatory Board (PNGRB) criticized the company for profiting at the expense of gas consumers. The regulator highlighted Petronet's practice of annually raising tariffs at its Dahej terminal without passing on the benefits of capacity expansions and better utilization, and it is now advocating for a framework to regulate its regasification activities. Dive deeper

Petronet LNG clarified that LNG terminal regulation requires PNGRB Act amendment and reaffirmed competitive regas charges amid negative share price movement. Dive deeper

Hindustan Zinc reported record highs in mined and refined metal production for 9MFY25, with strong operational performance. Silver production decreased due to mining sequence changes. The introduction of the EcoZen brand highlights its commitment to sustainability. Dive deeper

Hi-Tech Pipes achieved record sales in Q3 & 9M FY25, with 26% and 30% YoY growth respectively. Dive deeper

Camlin Fine Sciences announced ₹225 crore rights issue at ₹110/share, increasing equity shares from 16.75M to 18.79M upon full subscription. Dive deeper

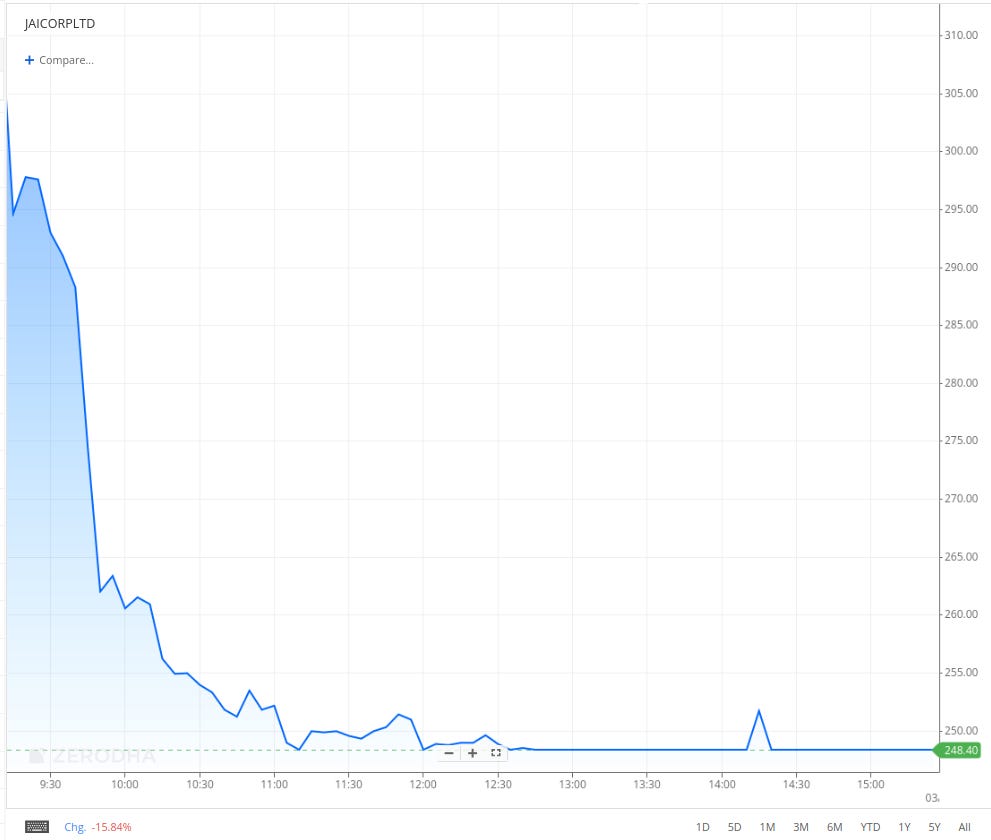

Jai Corp shares plummeted nearly 20% after Urban Infrastructure Holdings Pvt. Ltd., in which Jai Corp holds a 32% stake, sold a 5,286-acre industrial land parcel to Reliance Industries Ltd. for ₹2,200 crore. As part of the deal, Urban Infrastructure’s unit sold its 74% stake in Navi Mumbai IIA Pvt. for ₹1,628.03 crore. Dive deeper

Eicher Motors, the maker of Royal Enfield motorcycles, surged 9% to a 52-week high of ₹5,325.75 on the BSE after reporting strong December sales figures. The company recorded a 25% YoY growth in Royal Enfield sales, with 79,466 units sold compared to 63,887 last year. Motorcycles up to 350cc and those above 350cc both saw 25% growth, with 69,476 and 9,990 units sold, respectively, while exports skyrocketed 90% YoY to 11,575 units. Dive deeper

What’s happening globally

European gas prices surged on the first trading day of the year, rising 4.3% to €51 per megawatt-hour, the highest since October 2023, as the region faced freezing winter temperatures and the cessation of Russian gas deliveries via Ukraine. The halt followed the expiration of a transit contract between the two nations, with no replacement agreement in place. Dive deeper

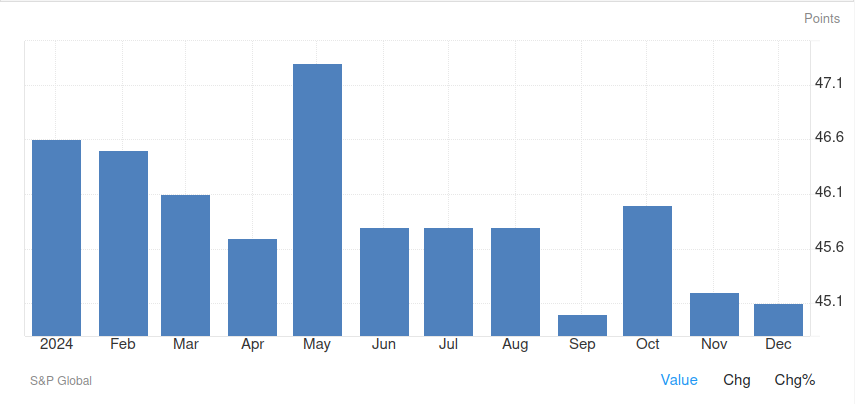

Euro zone manufacturers ended the year on a weak note as factory activity contracted further in December, with the HCOB Manufacturing PMI dropping to 45.1, below the 50-point threshold for growth. The industrial downturn was widespread, affecting major economies like Germany, France, and Italy, while Spain stood out with robust manufacturing expansion. Dive deeper

Oil prices climbed today as investors began the new year with optimism about China's economic prospects and fuel demand, following President Xi Jinping's pledge to boost growth. Brent crude futures rose 1.39% to $75.68 per barrel by 12:05 GMT, building on a 65-cent gain from the final trading day of 2024. Similarly, U.S. West Texas Intermediate crude advanced 1.42% to $72.74 per barrel. Dive deeper

China's manufacturing activity expanded in December but fell short of expectations, indicating that recent stimulus measures may not be providing the desired boost to the world's second-largest economy. The Caixin Manufacturing PMI came in at 50.5, below forecasts of 51.6 and November's 51.5. This follows government data earlier showing modestly slower-than-expected growth in the manufacturing sector for December. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Himanshu Baid, Managing Director at Poly Medicure Ltd.

“The domestic healthcare industry is growing between 12% to 15%. We are very much dependent on the healthcare growth in the segment,”“We feel that with import substitution we are doing right now in India, especially in the renal space, oncology space, cardiology space, we will see growth upwards of 20% in the next two or three years in the domestic business,” - Link

Yashish Dahiya, CEO of PB Fintech

Growth in 2024 was strong and real, outlook for near-term growth is very strong. Should be able to deliver 30% growth over the next 5 years.

"We are creating new markets, adding value to the industry."

India's health insurance industry is $10 billion, while the US health insurance industry is a $1 trillion industry — 100x bigger than India.

India has 5x more people than the US, with a health insurance industry 1/100th the size of the US.

Paisa Bazaar is a profitable entity, a cash-generative entity.

Paisa Bazaar now moving into secured lending; the outlook on secured lending is positive. - Link

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Why did you guys stop giving promoter buying data in this report 😐