Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

The Nifty opened 130 points higher at 22,960.45 and climbed to an intraday high of 23,137.95 but slid in the final hour to close below the 23,000 mark at 22,957.25, up 0.56% for the day, snapping its two-day losing streak.

RBI’s liquidity measures, including open market operations and repo auctions, boosted market sentiment. Banking stocks led the gains, with rate-sensitive sectors like real estate also advancing.

With the US Fed decision and Budget 2025 in focus, attention also shifts to the RBI's policy meeting from February 5 to 7, amid expectations of a potential rate cut under new Governor Sanjay Malhotra.

Broader Market Performance:

The broader market showed some resilience today, with a stronger performance from advancing stocks. On the NSE, 940 stocks advanced, 1,920 declined, and 77 remained unchanged.

Sectoral Performance:

Sectoral performance was mixed, with Nifty Realty leading the gains at 2.17%, followed by Nifty PSU Bank and Nifty Bank at 1.71% and 1.67%, respectively. Nifty Pharma saw the biggest drop, falling 2.33% due to concerns over the US pausing foreign aid, potentially impacting HIV drug revenues. Other declines included Nifty Energy at -1.39% and Nifty Media at -1.25%.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 30th January:

The maximum Call Open Interest (OI) is observed at 23,000, followed by 23,300 and 23,200, indicating resistance levels around these strikes.

The maximum Put Open Interest (OI) is at 23,000, followed by 22,500, 22,900, and 22,800, suggesting support levels in the 22,500–22,800 range.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

The rupee weakened past 86.4 per USD, nearing its record low, as RBI interventions tightened liquidity and raised rate cut expectations. Slowing growth has shifted investor focus to other Asian markets. Dive deeper

The RBI announced measures to ease a ₹3.13 lakh crore liquidity deficit, including a ₹60,000 crore Open Market Operation (OMO) in three tranches, a $5 billion/INR swap on January 31, and a ₹50,000 crore VRR auction on February 7. These steps aim to stabilize liquidity ahead of the February 5 MPC meeting. Dive deeper

TP-Link has teamed up with Optiemus Electronics to produce telecom and IoT devices in India, supporting "Make in India" and export goals. The partnership includes a 6-million-device annual capacity and a focus on building a local supply chain. Dive deeper

Godrej Enterprises Group announced plans to invest over ₹1,200 crore in digital solutions, AI, and generative AI technologies over the next 3-5 years. The initiative aims to create a unified, customer-first ecosystem and enhance employee skills with over 6 lakh training hours. Dive deeper

Nakul Jain, CEO of Paytm Payments Services, has resigned effective by March 31, 2025, to pursue an entrepreneurial journey. Paytm is seeking a replacement while awaiting RBI approval for its Payment Aggregator license. Dive deeper

UltraTech Cement is reportedly in advanced talks to acquire a 69% stake in HeidelbergCement India, valued at ₹33.8 billion. Earlier, Adani Group had shown interest in the stake, but the status of those talks remains unclear. Dive deeper

RBI Governor Sanjay Malhotra urged banks to enhance systems to combat digital fraud and improve oversight of third-party providers. He also emphasized IT risk management, financial inclusion, and customer service as part of RBI's efforts to strengthen financial stability. Dive deeper

DLF plans to generate ₹23,000 crore from 247 remaining ultra-luxury units in 'The Dahlias' project, following ₹11,816 crore sales from 173 units. Launched in October 2024 in Gurugram, the project has seen strong demand, with total revenue expected to exceed ₹35,000 crore. Dive deeper

ACME Solar Holdings has partnered with NHPC for a 680 MW Firm & Dispatchable Renewable Energy project across multiple states. The initiative integrates solar, wind, and battery storage, supporting India’s clean energy goals while ensuring efficiency and sustainability. Dive deeper

L&T will construct Uzbekistan's first AI-enabled, sustainable 10-megawatt data centre in Tashkent, focusing on energy efficiency and advanced security. The project highlights L&T's expertise in executing global infrastructure developments. Dive deeper

TP Solar, Tata Power’s manufacturing arm, secured a ₹455 crore contract from MSPGCL to supply 300 MWp ALMM-certified solar modules for the Mukhyamantri Saur Krushi Vahini Yojana 2.0. Modules will be delivered in 2025, showcasing TP Solar’s commitment to advancing India’s renewable energy goals. Dive deeper

360 One has received the necessary approval under SEBI (Research Analysts) Regulations, 2014, for the acquisition of Moneygoals Solutions Limited (MGSL) and its wholly-owned subsidiary, Banayantree Services Limited (BTSL). Dive deeper

Hatsun Agro Product Limited (HAP) has acquired a 96.79% stake in Milk Mantra Dairy Private Limited for ₹229.40 crore, making it a subsidiary as of January 27, 2025. Dive deeper

Ujjivan SFB, Arohan Financial, and Asirvad Micro Finance lowered lending rates by 75-250 bps in January, aligning with RBI's emphasis on fair and transparent pricing. The rate adjustments follow recent regulatory engagement with the RBI. Dive deeper

SpiceJet will re-induct a grounded Boeing 737 MAX into service from Jan 29, starting with high-demand routes like Jeddah and Riyadh. Under its fleet restoration plan, it aims to bring back 10 aircraft, including four 737 MAX, by mid-April. The airline has also added 10 planes since October, expanding its network with 60+ new flights. Dive deeper

What’s happening globally

US stock futures steadied after a selloff in AI-related stocks on Monday, driven by concerns over Chinese startup DeepSeek’s competitive AI model. The S&P 500 and Nasdaq fell sharply, with Nvidia and Broadcom among the biggest decliners. Investors now focus on earnings, the Fed decision, and inflation data this week. Dive deeper

Nvidia shares plunged 19.98% over two sessions amid concerns over China's AI competitor DeepSeek. The stock closed 16.86% lower at $118.58, wiping over $600 billion in market capitalization. Dive deeper

The US 10-year Treasury yield rose above 4.55% as investors awaited the Fed’s policy decision, expected to hold rates steady despite Trump’s push for cuts. The focus remains on the Fed’s inflation outlook and Friday’s PCE report. Earlier, yields dipped amid concerns over China’s DeepSeek and Trump’s tariff threats. Dive deeper

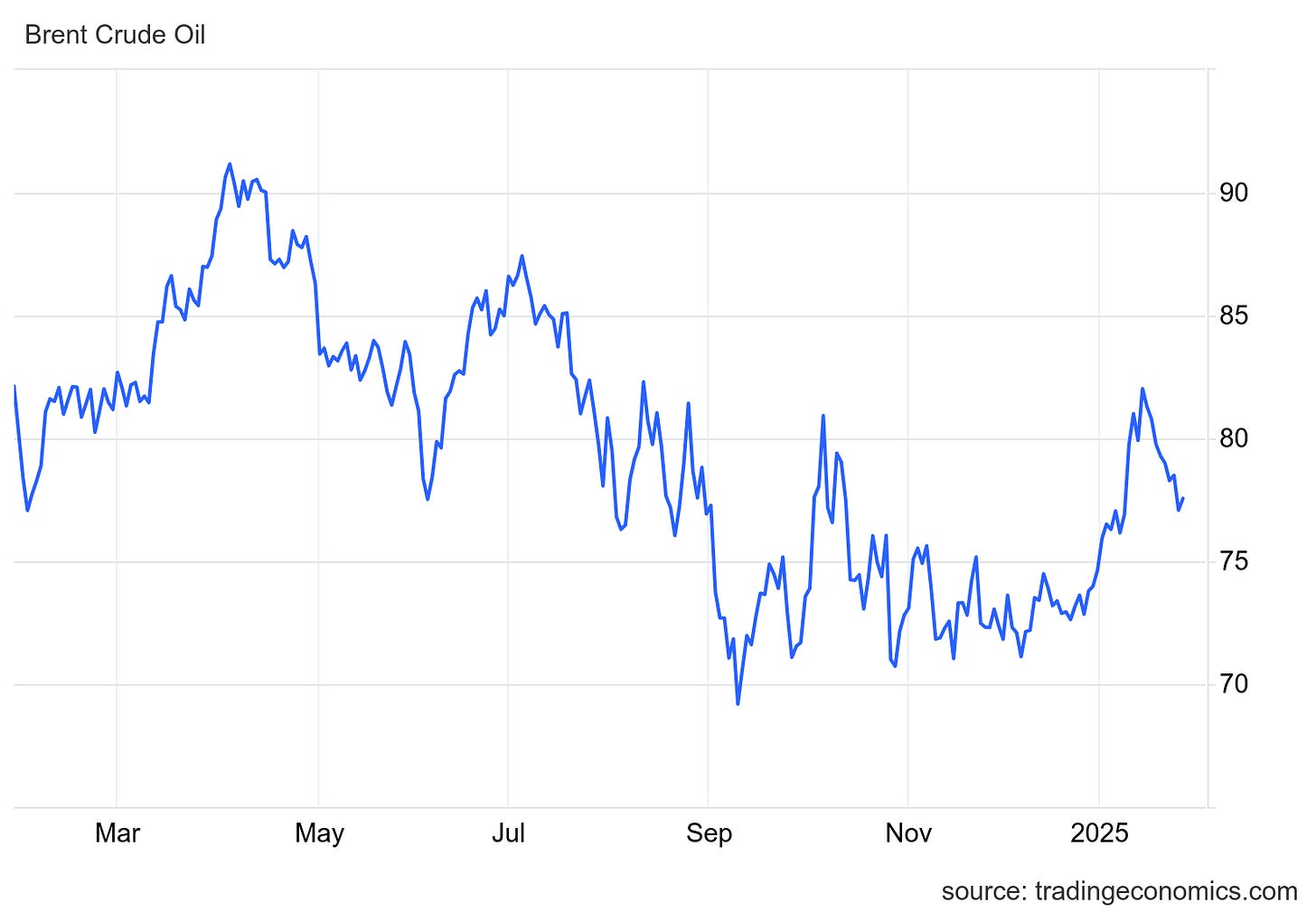

Brent crude rose to $77.3 but remained near a two-week low amid concerns over Trump’s tariff threats and weak Chinese manufacturing data. Market sentiment is weighed down by calls for OPEC to lower prices and boost U.S. production. Dive deeper

The Nikkei 225 declined, led by losses in chip and AI-related stocks like Advantest and Tokyo Electron, amid concerns over China's DeepSeek and a hawkish Bank of Japan. Investors await key economic data for further direction. Dive deeper

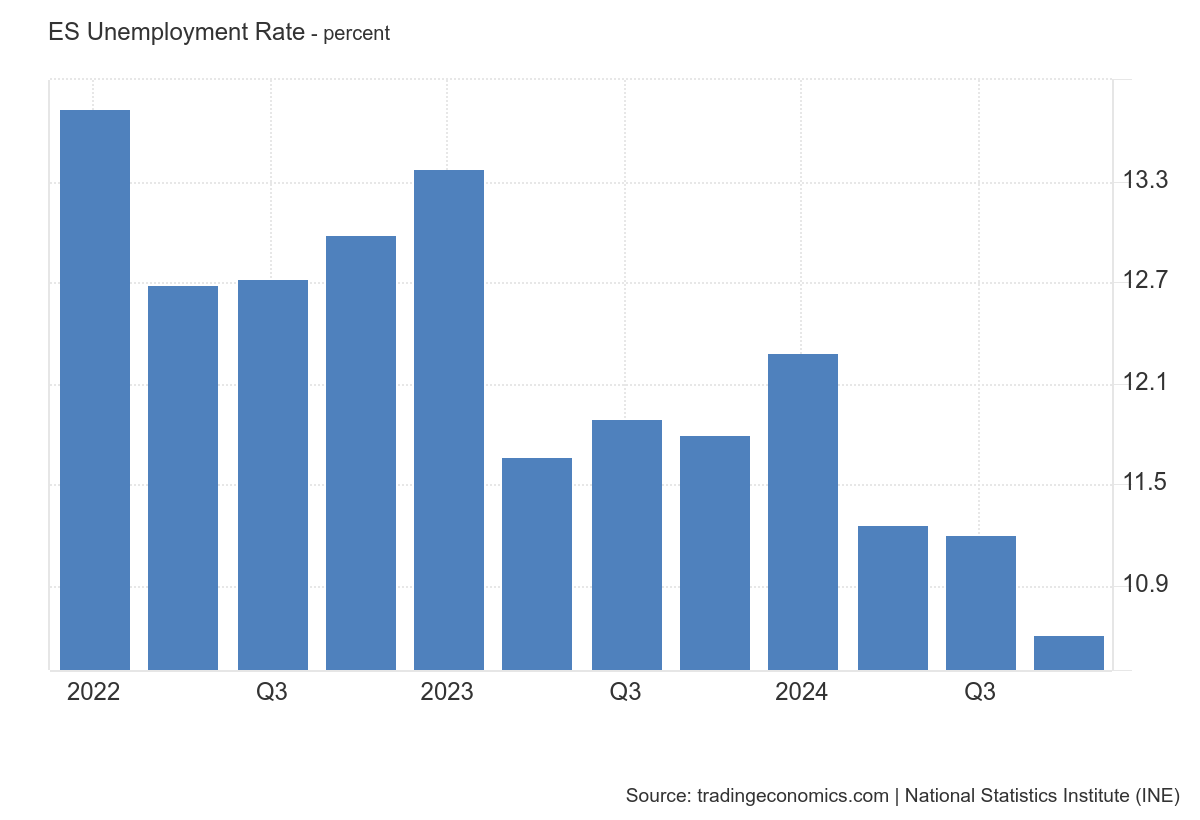

Spain's unemployment rate fell to 10.61% in Q4 2024, the lowest since 2008, with 158.6k fewer unemployed and 34.8k more employed, reaching 21.86 million. Job gains were driven by services, industry, and agriculture, while construction saw minimal growth. Dive deeper

Germany’s 10-year Bund yield rose to 2.55% amid US tariff concerns following President Trump’s comments on steel, copper, and autos. Markets await the ECB’s expected 25 bps rate cut and signals on future policy, while the Fed is likely to hold rates steady. Dive deeper

France’s consumer confidence rose to 92 in January 2025, a three-month high, as households showed less pessimism about finances, living standards, and unemployment. Saving capacity and intentions improved, while fewer households expected price acceleration. Dive deeper

Norway's household goods consumption fell by 1.1% in December 2024, driven by declines in food, beverages, and energy spending. Vehicle and petrol purchases rose, but annual consumption dropped 0.7%. Dive deeper

Singapore's Domestic Supply Price Index rose 1.5% year-on-year in December 2024, its first increase in five months, driven by a sharp rise in machinery and transport equipment costs. On a monthly basis, the index jumped 4.5%. Dive deeper

The UAE has unveiled a $6bn, 5GW solar project with 19GWh battery storage, showcasing its push towards renewable energy. Gulf nations, including Saudi Arabia and Kuwait, are scaling up renewables to diversify energy sources and boost exports, though grid integration poses challenges. Dive deeper

Nissan aims to streamline operations by consolidating production lines and adjusting shifts, avoiding factory closures as it works toward a capital tie-up with Honda. Honda has emphasized Nissan’s recovery as key to their planned integration under a single holding company. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

Bajaj Housing Finance Limited (BAJAJHFL) (+5.13%)

Financials:

Net Interest Income (NII): ₹806 crore, a 25% YoY increase.

Net Total Income (NTI): ₹933 crore, up 25% YoY.

Profit After Tax (PAT): ₹548 crore, up 25% YoY.

Earnings Per Share (EPS): ₹0.66

Key Highlights:

AUM increased by 26% YoY, with PAT and NII growing by 25% each, reflecting robust financial performance.

Operating expenses are reduced as a percentage of NTI, showcasing cost efficiency.

The IPO raised ₹3,560 crore, fully utilised to strengthen the capital base.

Outlook:

Continued emphasis on increasing loan assets and leveraging the strong capital adequacy ratio for expansion.

Emami Limited (EMAMILITD) (+3.83%)

Financials:

Revenue: ₹1,049.48 crore, up 5.33% from ₹996.32 crore YoY.

Net Profit (PAT): ₹278.98 crore, up 7% from ₹260.65 crore YoY.

Key Highlights:

Key brands like Healthcare and BoroPlus showed strong growth, while Navratna and Pain Management achieved low single-digit growth despite mild winters.

Focused efforts on new-age channels, Kesh King, and male grooming categories, along with a revival in international business, are expected to drive sustained growth.

Outlook:

The company remains confident in achieving robust growth through targeted distribution strategies, strengthening core brands, and leveraging rural resilience and international opportunities.

Indraprastha Gas Ltd. (IGL) (+1.40%)

Financials:

Revenue: ₹4,146.09 crore, up by 5.58% YoY.

Net Profit (PAT): ₹325.42 crore, down by 31.47% YoY.

EPS: ₹4.66

Key Highlights:

An interim dividend of ₹4.00 per share (200%) was paid during the quarter.

Approved a 1:1 bonus issue, effective January 31, 2025.

Outlook:

The company aims to focus on scaling operations by leveraging its distribution network and investments in subsidiaries and associates.

360 ONE (360ONE) (-5.90%)

Financials:

Revenue: ₹678 crore, up 45.4% YoY.

Profit: ₹275 crore, up 41.7% YoY.

Assets Under Management (AUM): AUM reached ₹5,79,222 crore

Key Highlights:

The acquisition of B&K Securities is expected to strengthen 360 ONE WAM's market position by enhancing research, advisory, and execution capabilities.

The continued focus on expanding product offerings and improving client outcomes indicates a robust growth strategy for the wealth and asset management segments.

Outlook: The company is poised to leverage its strong ESG rating and operational efficiencies to create long-term value.

Tata Steel (TATASTEEL) (+1.78%)

Financials

Net Profit (PAT): ₹295.49 crore, down 43.4% from ₹522.14 crore YoY.

Revenue: ₹53,231 crore, down 2.7% YoY.

Key Highlights:

Revenue decline attributed to weaker steel prices, impacted by a supply glut from China.

Significant reduction in net profit due to higher input costs and reduced margins.

Outlooks:

The company is expected to benefit from rising domestic steel demand but faces short-term challenges from weak prices and global oversupply.

Aditya Birla Sun Life AMC Limited (ABSLAMC) (-4.92%)

Financials:

Revenue: ₹445.11 crores, up by 30% YoY from ₹341.46 crores.

Net Profit (PAT): ₹224.47 crores, up by 52% YoY from ₹147.11 crores.

EPS (Basic): ₹7.78, compared to ₹7.27 YoY.

Key Highlights:

Strong growth in revenue driven by higher assets under management (AUM).

Profit margins expanded due to cost management and higher operational efficiencies.

Outlook:

Continued focus on scaling AUM and leveraging digital initiatives to enhance market position and profitability.

TTK Prestige (TTKPRESTIG) (-8.02%)

Financials:

Revenue: ₹727.23 crores, down by 1.5% YoY from ₹738.40 crores.

EBITDA: ₹79.5 crores.

Net Profit (PAT): ₹58.45 crores, down by 6.45% YoY from ₹62.48 crores.

Key Highlights:

Domestic sales contributed ₹651.3 crores, while exports stood at ₹15.4 crores.

Total sales declined to ₹666.7 crores from ₹686.6 crores YoY.

Outlook:

The company aims to focus on strengthening domestic market presence and expanding export opportunities to regain growth momentum.

JSW Infrastructure (JSWINFRA) (+0.17%)

Financials:

Revenue: ₹1,181.83 crores, up by 25.71% YoY from ₹940.11 crores.

Net Profit (PAT): ₹329.76 crores, up by 31.56% YoY from ₹250.66 crores.

Key Highlights:

Handled 29.4 million tonnes of cargo driven by higher capacity utilization at the coal terminal in Paradip and contributions from PNP port and the Liquid Storage Terminal in UAE.

Third-party cargo volumes grew by 31% YoY, contributing 49% to total volumes (up from 39% last year).

Outlook:

The company remains focused on increasing third-party volumes and optimizing capacity utilization to drive sustained growth.

Hyundai (HYUNDAI) (-1.18%)

Financials:

Revenue: ₹16,647.99 crores, down by 1.34% YoY from ₹16,874.71 crores.

EBITDA: ₹1,875.4 crores, down by 13.7% YoY.

EBITDA Margin: 11.26%, compared to 12.2% YoY.

Net Profit (PAT): ₹1,160.73 crores, down by 18.56% YoY from ₹1,425.22 crores.

Key Highlights:

Passenger vehicle sales during the quarter were 186,408 units (domestic: 146,022 units, export: 40,386 units).

Substantial SUV segment contribution and highest-ever CNG penetration at 15%, up from 12% YoY.

Outlook:

The company remains focused on leveraging strong business fundamentals, expanding rural reach, and improving volumes despite global challenges.

Cipla (CIPLA) (+1.75%)

Financials:

Revenue: ₹7,072.97 crores, up by 7.10% YoY from ₹6,603.81 crores.

EBITDA: ₹1,989 crores.

EBITDA Margin: 28.1%, compared to 25.1% YoY.

Net Profit (PAT): ₹1,570.51 crores, up by 48.74% YoY from ₹1,055.90 crores.

Key Highlights:

India's Business grew 10% YoY, with a strong performance in Branded Prescription and Consumer Health businesses.

North America’s revenue of $226 Mn was driven by traction in differentiated assets, offsetting supply challenges.

South Africa saw a 21% growth YoY in local currency terms.

Outlook:

The company aims to grow its key markets, strengthen flagship brands, expand future pipelines, and resolve regulatory challenges.

TVS Motor (TVSMOTOR) (+4.68%)

Financials:

Revenue: ₹11,134.63 crore, up by 10.09% YoY.

Net Profit (PAT): ₹609.35 crore, up by 19.57% YoY.

Key Highlights:

Total sales (2W & 3W) grew by 10% to 12.12 lakh units.

Motorcycle sales grew by 6% to 5.56 lakh units.

Scooter sales grew by 22% to 4.93 lakh units.

Electric Scooter sales grew by 57% to 0.76 lakh units.

Outlook:

The company shows steady growth, with strong electric vehicle performance, but faces challenges in three-wheeler sales and market fluctuations.

Colgate Palmolive (COLPAL) (-1.08%)

Financials:

Revenue: ₹1,461.84 crore, up by 4.74% YoY.

EBITDA: ₹454.3 crore.

Net Profit (PAT): ₹322.78 crore, down by 2.22% YoY.

Key Highlights:

Net sales grew by 4.7% YoY to ₹1,452 crore in Q3 and by 9.2% YoY to ₹4,547 crore for nine months.

Profit declined by 2.22% YoY in Q3.

Outlook:

Sales growth was fueled by higher net sales, while the decline in profit was attributed to rising cost pressures that impacted overall margins.

Hindustan Zinc (HINDZINC) (-3.91%)

Financials:

Revenue: ₹8,315 crore, up by 17.66% YoY.

EBITDA: ₹4,499 crore.

Net Profit (PAT): ₹2,678 crore, up by 32.05% YoY.

Key Highlights:

Profit surpassed estimates, rising 32.05% YoY.

Revenue growth of 17.66% YoY.

Outlook:

The company expects continued strong performance, with higher revenue and profit growth.

Union Bank (UNIONBANK) (+4.72%)

Financials:

Net Profit (PAT): ₹4,604 crore, up 28% YoY from ₹3,590 crore.

Net Interest Income (NII): ₹9,240 crore, up 0.8% YoY from ₹9,168 crore.

Gross NPA: 3.85%, down from 4.36% in Q2FY25.

Provision: ₹1,599.1 crore, down from ₹1,747.8 crore YoY.

EPS: ₹6.06.

Key Highlights:

The gross NPA stood at 2.91%, a decrease from 3.85% year-on-year. Net NPA was at 0.63%, down from 0.98% YoY.

Gross advances rose by 16.44% YoY, reaching ₹2.09 lakh crore.

Total deposits increased by 9.36% YoY, totalling ₹2.80 lakh crore.

The credit-deposit ratio stood at 74.45%, up from 64.83% in March 2023.

Outlook:

The bank anticipates sustained growth in the RAM (Retail, Agriculture, and MSME) segment, leveraging advances in retail, agriculture, and micro, small, and medium enterprises to further strengthen its balance sheet.

Arvind (ARVIND) (-9.05%)

Financials:

Revenue from Operations: ₹1,926.65 crores, up by 9.8% YoY

Net Profit: ₹97.08 crores, up by 6.9% YoY

EPS: ₹3.71, up by 7.2% YoY

Total Comprehensive Income: ₹83.86 crores, up by 3.0% YoY

Other Income: ₹18.39 crores, up by 74.9% YoY

Key Highlights:

Exceptional items include provisions for impairment and losses on investments of ₹27.30 crores.

The operations at the Santej plant were partially affected by a strike in Q2 FY25, which has since been resolved.

Outlook:

The company remains stable with ongoing regulatory processes, including the approval of the scheme for the transfer of the Advanced Materials Division.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Sridhar Vembu, Founder, Zoho Corp. on stepping down as CEO

"I will step down as CEO of Zoho Corp and take a new role as Chief Scientist, responsible for deep R&D initiatives."

"The future of our company entirely depends on how well we navigate the R&D challenge and I am looking forward to my new assignment with energy and vigor. I am also very happy to get back to hands-on technical work." - Link

K Satyanarayana Raju, CEO, Canara Bank on Growth and NIM Guidance

"Our expectations are near to reality and that's why we expect credit growth of 10% next year. This is because we are reaching an optimal level of CD ratio and we may have to garner deposits also at 10%."

"If tight liquidity conditions persist, NIMs of the bank will remain around 2.75-2.8% in fiscal 2026."

"We are focusing on retail term deposit growth. In the March quarter, we will cross 9% deposit growth. We will grow advances over 10% so that we can touch a CD ratio of 77%."

"Even if the LCR guidelines are implemented from April 1, the impact on our LCR will not be much, we will still maintain it over 110%." - Link

Calendars

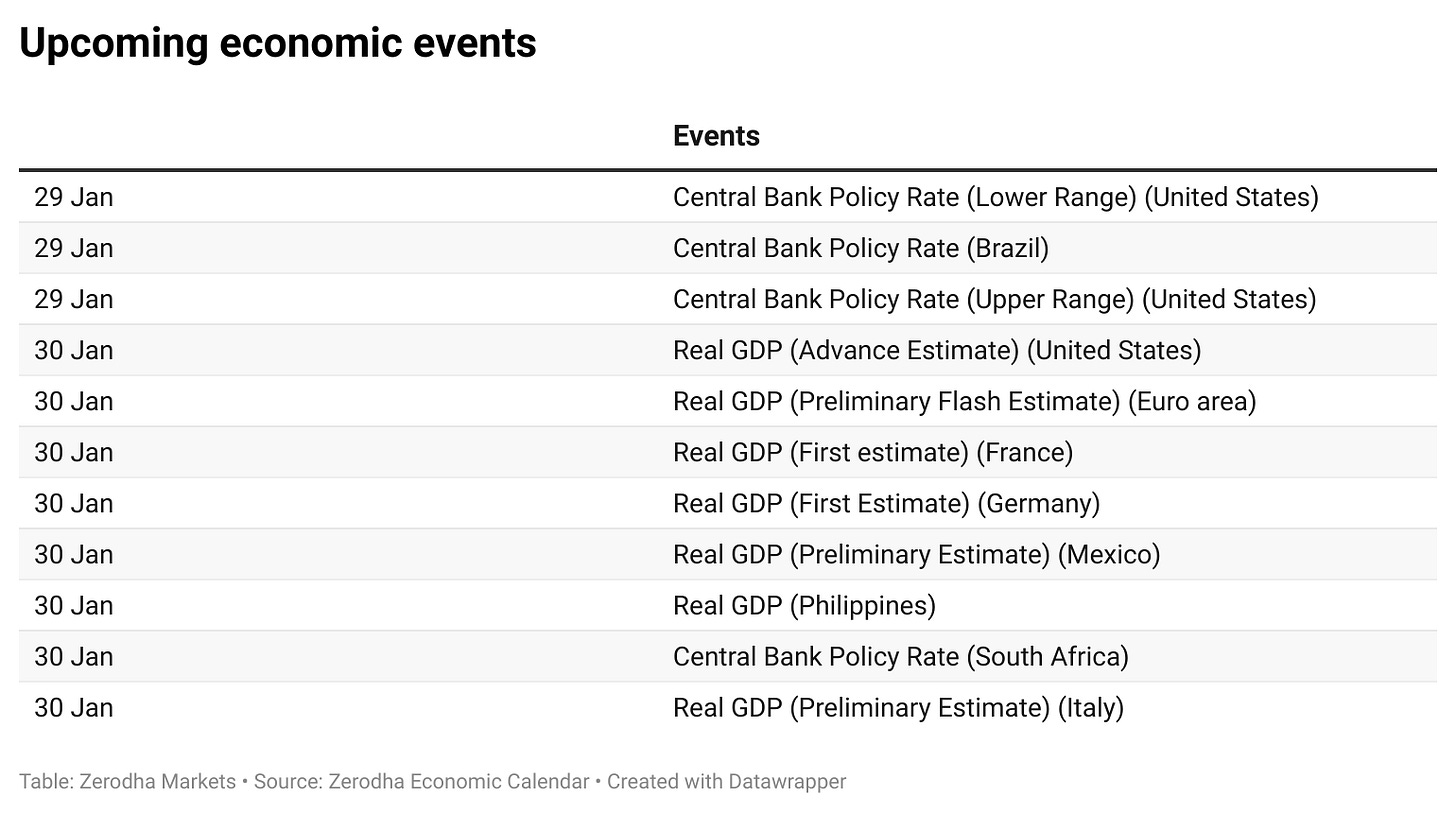

In the coming days, we have the following major events, corporate actions, and upcoming earnings releases:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

FII and DII buying and selling data?

There seems to be an error in Union Bank results number, Please edit the post accordingly.