Nifty sees sharp moves post-RBI event, settles flat

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Nifty opened higher by around 45 points at 23,649.50 and initially traded within a narrow 30-point range between 23,590 and 23,620 ahead of the RBI announcement. Once the announcement was made, volatility spiked, pushing the index up to 23,650 before a sharp sell-off took it down to 23,520. However, Nifty rebounded towards the day's high of 23,694.50, only to experience a 250-point decline to the day's low of 23,443.20. In the final hour, the market recovered 120 points, closing at 23,559.95, marking a 0.18% decline for the day.

Looking ahead, markets are expected to track global cues alongside domestic economic developments and market-related news, including the final phase of the earnings season.

Broader Market Performance:

In line with the headline indices, The broader market had a mixed session with negative bias. A total of 2,895 stocks were traded, of which 1,042 advanced, 1,756 declined, and 97 remained unchanged on the NSE.

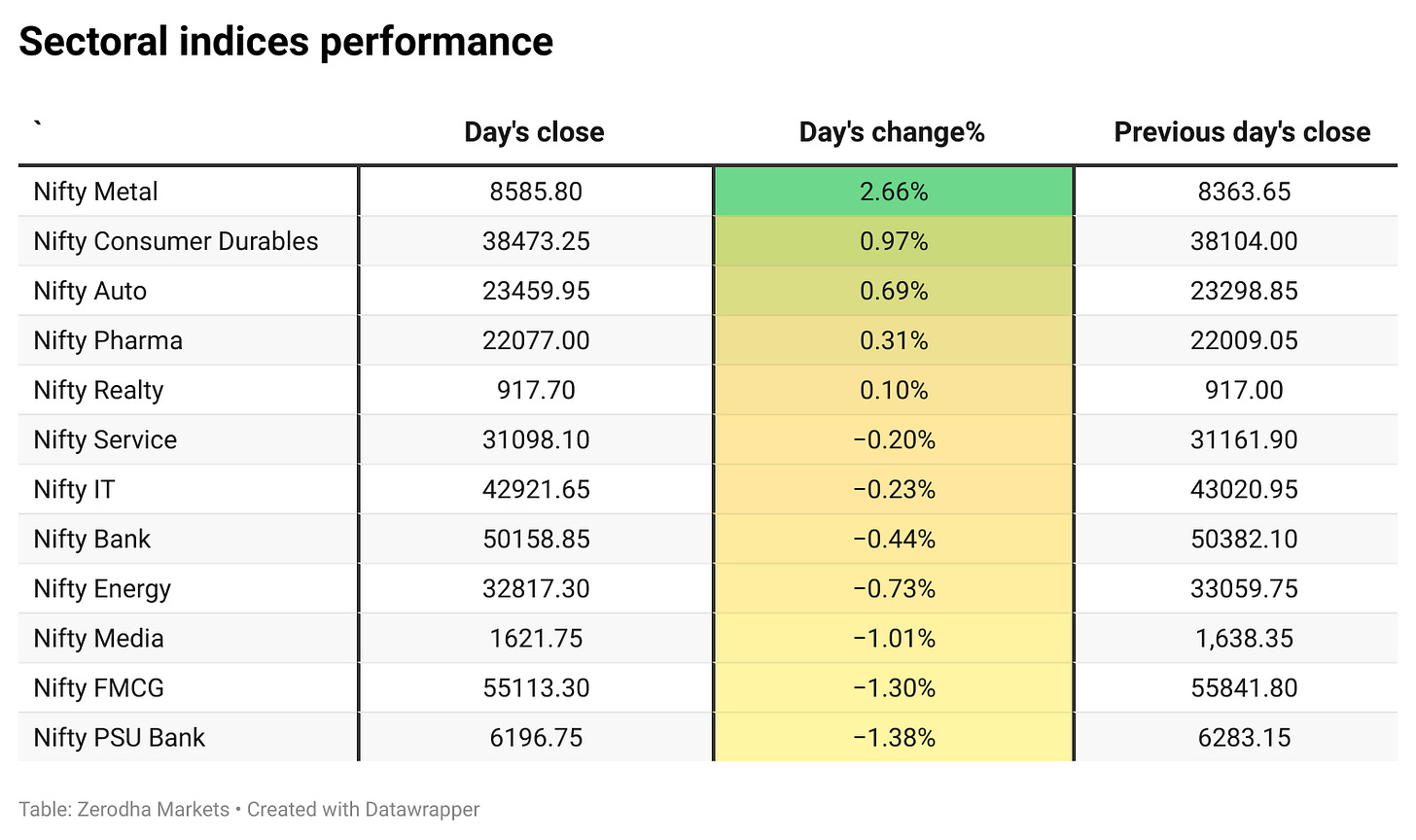

Sectoral Performance:

The top-gaining sector for the day was Nifty Metal, which surged 2.66%, while the biggest loser was Nifty PSU Bank, declining by 1.38%. Out of the sectoral indices, five sectors closed in green, On the other hand, seven sectors ended in the red. The overall market sentiment appeared mixed, with gains led by metal and consumer durables, while banking and FMCG sectors faced pressure.

Note: The above numbers for Commodity futures were taken around 4 pm.

Net Flow Breakdown for the day:

FII: Net outflow of ₹470.39 crore (Bought ₹12,482.21 crore, Sold ₹12,952.60 crore)

DII: Net inflow of ₹454.20 crore (Bought ₹12,185.62 crore, Sold ₹11,731.42 crore)

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 13th February:

The maximum Call Open Interest (OI) is observed at 24,000, followed by 23,800. Meanwhile, The maximum Put Open Interest (OI) is at 23,200, followed by 23,500.

Immediate support is identified in the 23,500–23,400 range, while resistance is expected between 23,850 zones followed by 24,000.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

The Reserve Bank of India (RBI) has cut its key repo rate by 25 basis points to 6.25% for the first time in nearly five years to support economic growth. RBI Governor Sanjay Malhotra, in his first major address since taking office, stated that real GDP growth for the current financial year is estimated at 6.4%, with projections of 6.7% in the next financial year.

The Reserve Bank has projected retail inflation at 4.2 percent for the next financial year beginning April while retaining the forecast for 2024-25 at 4.8 percent. Dive deeper

Shares of project financing companies like REC and PFC surged on Friday after RBI Governor Sanjay Malhotra postponed the implementation of new project finance norms to 2026. The governor extended the timeline for liquidity coverage ratio norms and confirmed that no new project finance regulations will take effect before March 31, 2026. Dive deeper

Waaree Energies received approval for investments in green hydrogen production and won a SECI bid for 90,000 tons of green hydrogen. Q3 revenues grew 115% YoY to INR3,545 crores. Dive deeper

Ministry of Defence awards Solar Industries India a INR 6,084 Crore contract for producing PINAKA rocket systems. Dive deeper

Samvardhana Motherson has formed a joint venture with Sanko to provide sustainable packaging solutions in India and Europe, enhancing decarbonization efforts. Dive deeper

Raymond Limited announces a joint development agreement for a residential project in Mahim West, Mumbai with a revenue potential of Rs. 1,800 crore, marking strategic expansion. Dive deeper

Food and delivery platform Zomato has announced a rebranding, changing its name to "Eternal" and introducing a new logo. The new identity will encompass its four key businesses: Zomato (food delivery), Blinkit (quick commerce), District (live events), and Hyperpure (kitchen supplies). Dive deeper

ITC Ltd. has signed agreements to acquire Prasuma, a ready-to-cook and frozen food brand, strengthening its presence in this high-growth segment, which it estimates to be a ₹10,000 crore market. The company will first acquire a 43.8% stake for ₹131 crore by March 2025, followed by an increase to 62.5% through secondary purchases worth ₹56 crore by April 2027. The remaining stake will be acquired by June 2028, based on a pre-agreed valuation. Dive deeper

What’s happening globally

Global food prices declined in January, driven by lower sugar and vegetable oil costs, according to the Food and Agriculture Organization (FAO). The FAO's food price index averaged 124.9 points, down 1.6% from December but still 6.2% higher than a year ago. Dive deeper

Gold prices rose on Friday, staying close to record highs as investors sought safe havens ahead of key U.S. nonfarm payrolls data. The metal was on track for strong weekly gains, driven by renewed U.S.-China trade tensions and a weaker dollar, which boosted demand. Dive deeper

Oil prices edged lower with Brent and WTI crude staying below $75 and $71 per barrel respectively after U.S. President Donald Trump reaffirmed his commitment to increasing domestic oil production, unsettling traders just a day after a larger-than-expected rise in U.S. crude stockpiles. Trump's pledge to further boost U.S. output, already the highest globally, was aimed at curbing oil prices and easing consumer inflation but added pressure to the market. Dive deeper

The Bank of England cut interest rates for the third time in six months, lowering the key rate by 0.25% to 4.5%, citing weak economic growth and slowing inflation. However, it warned of a temporary inflation rise and potential risks from a global trade war. Dive deeper

Amazon’s Q4 2024 earnings showed a strong 10% revenue growth to $187 billion, driven by a strong holiday season and online sales. Operating income beat estimates, but a weaker Q1 outlook—due to potential tariffs and U.S. policy shifts—raised concerns on Wall Street. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

Mazagon Dock Shipbuilders Limited (+1.44%)

Revenue: ₹3,143.62 crores, up by 33.06% YoY.

EBITDA: ₹817 crores, up by 51.4% YoY.

Net Profit: ₹807.04 crores, up by 28.76% YoY.

Key Highlights:

The revenue boost is attributed to enhanced production efficiencies and successful project completions.

EBITDA and net profit substantially increased, reflecting operational excellence and effective cost management.

Outlook:

Mazagon Dock is well-positioned for future growth, focusing on expanding production capabilities and exploring new market opportunities. The company benefits from strong order book visibility and governmental support in defence manufacturing sectors.

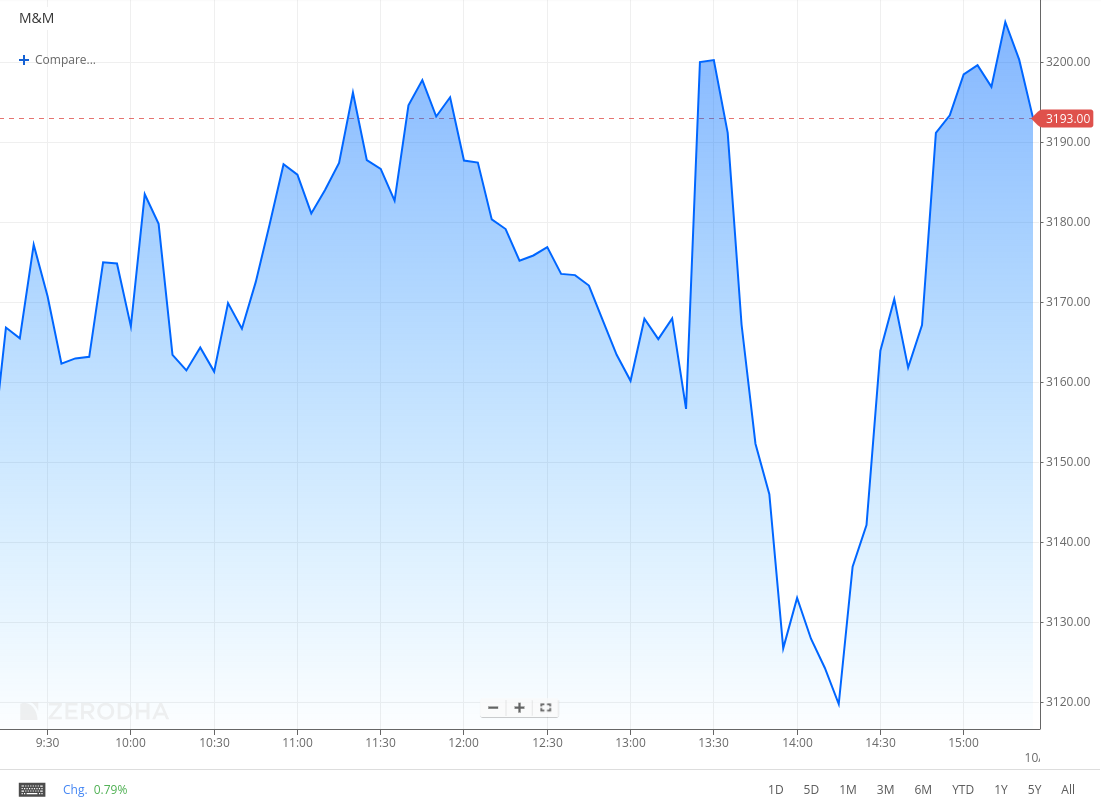

Mahindra & Mahindra Ltd (+1.86%)

Revenue: ₹41,470 crores, up by 17% YoY

EBITDA: ₹8,231 crores, up by 32% YoY

Net Profit: ₹3,624 crores, up by 20% YoY

Earnings Per Share (EPS): ₹25.58, up by 20% YoY

Key Highlights:

Significant growth in the automotive segment, driving revenue increases.

Robust performance in the farm equipment sector contributes to EBITDA growth.

Profitability sustained despite market challenges, showcasing effective cost management and operational efficiency.

Outlook:

The company remains focused on expanding its market presence in the automotive and farm sectors with innovative strategies to enhance consumer engagement and product offerings. Future growth is expected to be supported by market recovery and ongoing strategic initiatives.

Ola Electric (-2.60%)

Revenue: ₹1,045 crores, down by 19% YoY.

EBITDA: -₹460 crores, down by 53% YoY.

Net Loss: -₹564 crores, down by 52% YoY.

EPS: ₹-1.28, up by 33% YoY.

Key Highlights:

Ola Electric continued to face challenges this quarter with significant revenue and EBITD drops driven by decreased sales volumes and higher operational costs.

The company's net losses widened significantly despite a notable percentage increase in EPS, indicating some positive movements in other business areas.

Outlook:

The company remains focused on streamlining operations and improving cost efficiencies to navigate current market adversities.

SML ISUZU (-0.97%)

Financials:

Revenue: ₹331.80 crores, down by 14% YoY from ₹386.13 crores.

EBITDA: ₹18.3 crores, down by 16% YoY from ₹21.8 crores.

Net Profit: ₹0.53 crores, down by 80% YoY from ₹2.68 crores.

EPS: ₹0.37, down by 80% YoY from ₹1.85.

Key Highlights:

SML ISUZU faced a challenging quarter with significant declines across key financial metrics due to increased material costs and operational challenges.

The company managed to reduce expenses in some areas, which mitigated the impact of declining sales on overall profitability.

Outlook:

The company is focused on optimizing production and managing costs effectively to navigate the current market conditions and improve financial performance in upcoming quarters.

3M India (-0.48%)

Financials:

Revenue: ₹1,090 crores, up by 8% YoY.

EBITDA: ₹154 crores, down by 14% YoY.

Net Profit: ₹114 crores, down by 16% YoY.

EPS: ₹100.99, down from ₹120.05 YoY.

Key Highlights:

The company registered a sequential decline in sales but saw growth compared to the previous year.

EBITDA and PAT declined both sequentially and year-over-year.

Growth was primarily led by the Health Care segment.

Outlook:

The company remains cautious amid soft market conditions but is selectively investing in commercial execution to outperform in automotive, consumer, and healthcare segments despite facing material and freight cost headwinds.

Honeywell Automation (+0.65%)

Financials:

Revenue: ₹1,090.8 crores, up by 1.85% YoY.

EBITDA: ₹142 crores, down by 11.6% YoY.

Net Profit: ₹132.1 crores, up by 3.28% YoY.

Key Highlights:

Revenue saw a modest increase compared to the previous year.

EBITDA experienced a significant decline, reflecting cost pressures or reduced operational efficiency.

Profit growth was mild, indicating tight control over expenses unrelated to production or operations.

Outlook:

Honeywell Automation will focus on optimizing operations and possibly increasing its market reach in subsequent quarters to counteract the drop in EBITDA and boost profitability.

Delhivery (+0.02%)

Financials:

Revenue: ₹2,378.3 crores, up by 8.4% YoY.

EBITDA: ₹102.4 crores, down by 6.2% YoY.

Net Profit: ₹25 crores, up by 114% YoY from ₹11.7 crores.

Key Highlights:

Despite challenging market conditions, revenue growth was driven by increased scale and service expansion.

EBITDA faced pressure due to higher operational costs and strategic investments in technology upgrades.

Outlook:

Delhivery is focusing on optimizing operational efficiencies and expanding its service offerings to navigate the competitive logistics market effectively.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

RBI Governor Sanjay Malhotra on Growth and Inflation going forward

"These are difficult questions to answer, but nevertheless, I would like to stick my neck out and say that certainly India can achieve 7 percent plus growth rate, and we should certainly aspire for"

It (inflation) is expected to go down... We will maintain a neutral stance so that we are able to proactively respond to the evolving macroeconomic conditions - Link

Commerce and Industry Minister Piyush Goyal on Exports growth in the current FY

"Exports have been growing and have risen significantly in the last four years. This year also, there will be growth. We will end the year with over USD 800 billion exports for the very first time in India's history," - Link

Calendars

In the coming days, we have the following major events, corporate actions, and upcoming earnings releases:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.