Nifty shrugs off global weakness, IndusInd Bank rout to end firm

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Nifty opened with a gap down of 115 points, tracking weak cues from the U.S. markets, where the Dow Jones plunged 900 points, and the Nasdaq dropped 4%. After hitting the day's low of 22,314.70 within the first five minutes, the market staged a steady recovery throughout the day.

Despite weakness in Nifty Bank, largely due to IndusInd Bank's sharp 27% decline following its disclosure of a 2.4% impact on net worth from changes in derivative transaction valuation, the Index showed resilience. After turning positive post 11 AM and consolidating for some time, Nifty gained momentum, crossing 22,500 and eventually closing at 22,497.90, up 0.16%.

Looking ahead, the future direction will largely depend on whether it retests the higher resistance zone around 22,800 or moves lower toward the 22,200–22,000 range. The key factor to watch will be whether U.S. markets stabilize or if the current decoupling between Indian and U.S. markets continues in the short term.

Broader Market Performance:

The broader markets underperformed the headline indices, with weak market breadth, though showing some improvement from yesterday. Out of the 2,958 stocks traded on the NSE, 1,041 advanced (compared to 607 yesterday), 1,850 declined (versus 2,308 yesterday), and 67 remained unchanged.

Sectoral Performance:

The top gaining sector for the day was Nifty Realty, which surged 3.63%, followed by Nifty Metal and Nifty Energy, which gained 0.53% and 0.51%, respectively. On the losing side, Nifty Bank was the worst performer, declining 0.75%, followed by Nifty IT, which dropped 0.65%, and Nifty Auto, down 0.34%.

In terms of overall market breadth, six sectors closed in the green, while six sectors ended in the red, indicating a mixed performance across different industries.

Note: The above numbers for Commodity futures were taken around 4 pm. NSE has not released today’s FII-DII data yet. Here’s the trend from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 13th March:

The maximum Call Open Interest (OI) is observed at 23,000, followed by 22,900, indicating strong resistance at these levels. First strong resistance levels shall most likely be at 22,800, followed by 22,900.

The maximum Put Open Interest (OI) is at 22,200, followed by 22,000, suggesting potential support at 22,200, with additional support at 22,000.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

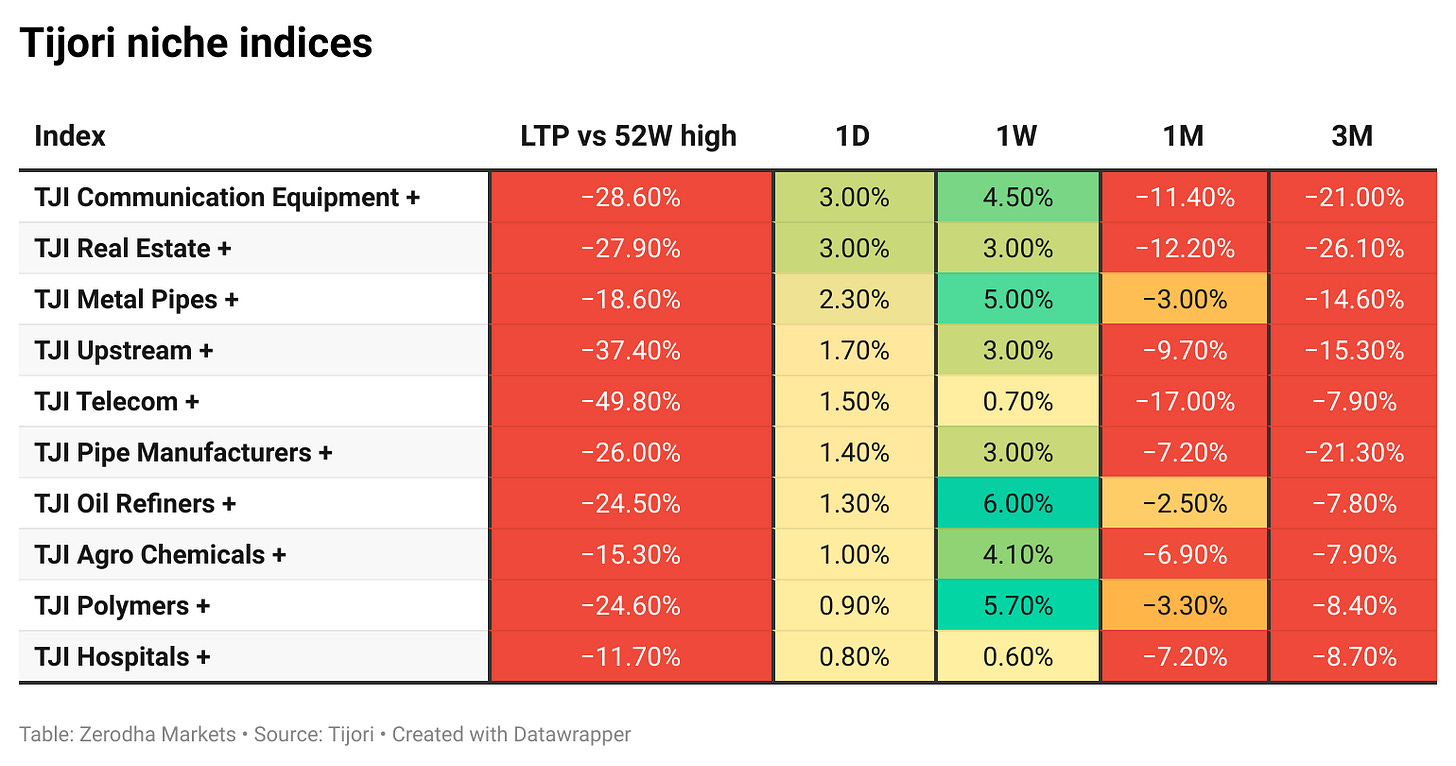

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

IndusInd Bank shares plunged 27.16% to ₹655.95 after revealing ₹1,577 crore in accounting discrepancies in its forex derivatives portfolio, impacting net worth by 2.35%. The issue, spanning 7-8 years, led to overstated profits, prompting an external audit and RBI notification. Dive deeper

Airtel has partnered with SpaceX to bring Starlink's high-speed internet to India, pending regulatory approvals. The collaboration aims to expand connectivity for businesses, rural areas, schools, and healthcare centres. Dive deeper

CDSL shares closed at ₹1,104.45, down 0.26%, as new demat account additions fell 48% YoY in February amid market volatility. The Nifty 50 and Sensex have dropped over 15% from their peaks, marking the worst market decline since 2020. Dive deeper

SEBI issued a warning to IIFL Capital Services over due diligence lapses in debt issues handled between April 2022 and April 2024. The concerns involved disclosure of issue-related expenses and payment timelines in offer documents. The company received an administrative warning after submitting its response. Dive deeper

The life insurance industry’s premiums fell 11.6% YoY to ₹29,985 crore in February, with LIC (-22%) and SBI Life (-18%) seeing declines, while HDFC Life grew 23.5% to ₹3,213 crore. Morgan Stanley attributed the slowdown to muted ULIP growth, though Max Life outperformed with a 10% rise in retail weighted received premiums. Dive deeper

Jindal Stainless will invest ₹700 crore over five years in decarbonisation projects, targeting a 50% reduction in carbon intensity by FY35 and net-zero emissions by 2050. The initiatives include renewable energy, green hydrogen, waste management, and carbon capture technologies across key facilities. Dive deeper

IRDAI has allowed insurers to hedge interest rate risks using bond forwards, aligning with RBI's recent directions. Insurers can take only long positions and must report transactions quarterly, but bond forwards are not permitted for ULIP business. This expands existing hedging options for insurers. Dive deeper

SJVN signed an MoU with the Chhattisgarh government to develop a 1,800 MW Pumped Storage Project in Kotpali with a ₹9,500 crore investment. The project aims to enhance energy security and create 5,000 jobs. Dive deeper

Syngene International acquired its first U.S. biologics facility from Emergent Manufacturing for $36.5 million, boosting its bioreactor capacity to 50,000L. The move strengthens its biologics capabilities, though it may slightly impact operating margins in the short term. Dive deeper

Bharat Electronics Ltd (BEL) secured new orders worth ₹843 crore, raising its FY25 order book to ₹14,567 crore. Dive deeper

Godrej Agrovet approved the acquisition of a 48.06% stake in Creamline Dairy, fully owning it, for ₹930 crore. CDPL became a wholly owned subsidiary, enhancing company control. Dive deeper

Hindustan Zinc expanded its renewable power agreement with Serentica Renewables to 530 MW, covering 70% of its energy needs. This move strengthens its sustainability efforts and boosts renewable energy adoption. Dive deeper

The government extended duty-free URAD imports until March 2026 to stabilize domestic prices. Myanmar remains India's top supplier, accounting for $549 million of the $601 million imports this fiscal. Dive deeper

NSDL is fast-tracking its ₹3,000 crore IPO, expected in April, to comply with SEBI’s ownership norms. The offer for sale (OFS) includes NSE, IDBI Bank, and HDFC Bank as selling shareholders. Dive deeper

What’s happening globally

The Nasdaq Composite plunged 4%, its worst drop since 2022, as part of a broader market sell-off that saw the S&P 500 fall 2.7% and the Dow drop 900 points (2.1%). Tech stocks were hit hardest, with Tesla down 15.4% and major players like Apple, Microsoft, Amazon, Alphabet, Nvidia, and Meta losing 2.4%–5.1%. The sell-off was driven by recession fears, Trump’s comments on economic uncertainty, trade policy concerns, and signs of a slowing global economy. Dive deeper

Tesla's stock plunged 15% on Monday, its worst drop since September 2020, extending a seven-week losing streak, the longest since its 2010 Nasdaq debut. The sell-off was driven by analyst downgrades, weak deliveries, and declining sales in China and Germany, with Elon Musk’s political involvement adding to negative sentiment. These factors have erased over $800 billion from Tesla’s market cap since its peak. Dive deeper

WTI crude rose to $66.3 per barrel despite concerns that U.S. tariffs could slow growth and curb demand. Trade tensions and China’s economic weakness added pressure, while OPEC+ plans to increase production in April, though Russia signaled potential adjustments if market imbalances arise. Dive deeper

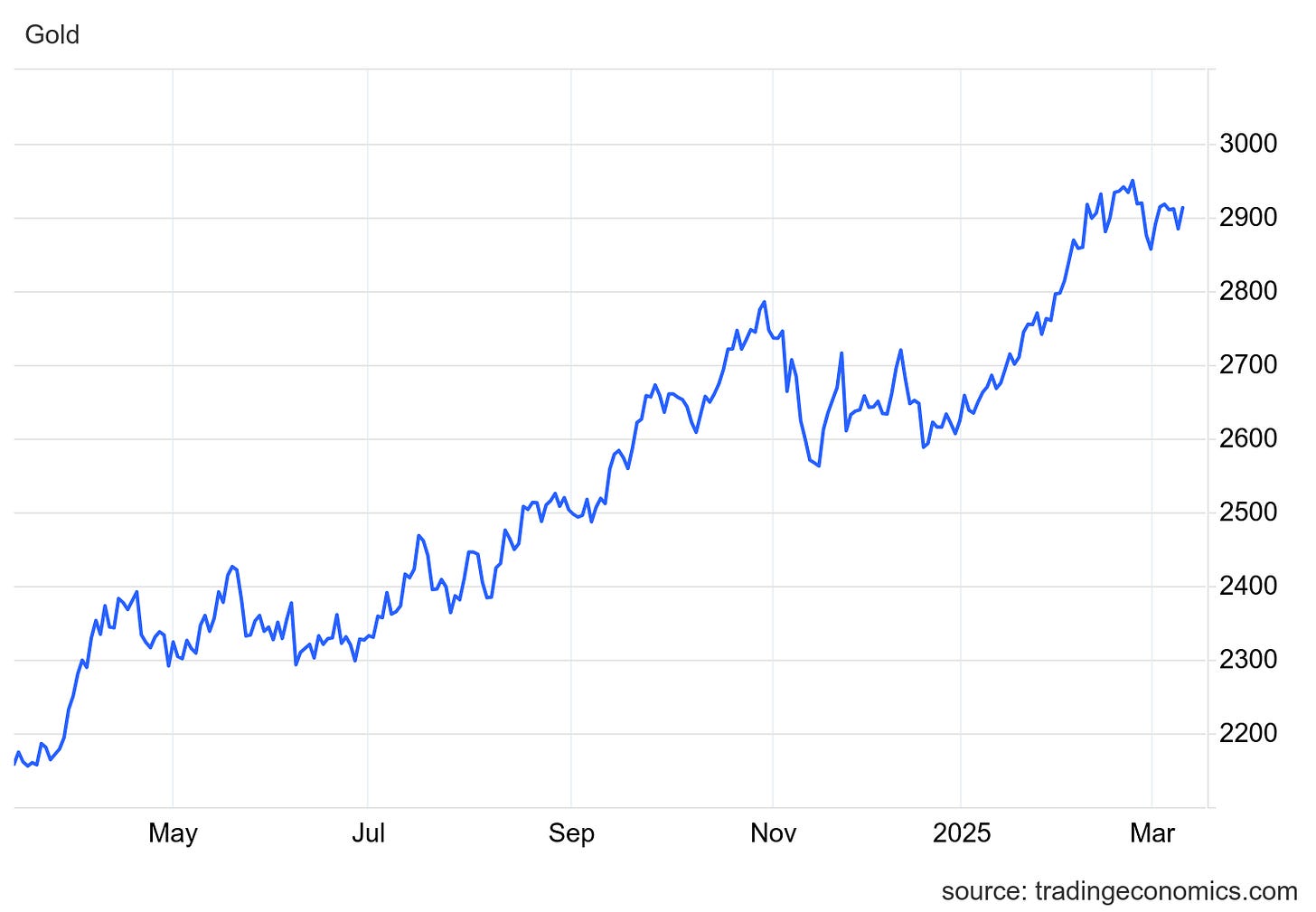

Gold climbed to $2,900 per ounce as a weaker U.S. dollar and trade tensions fueled safe-haven demand. Trump hinted at potential recession risks, while Powell acknowledged economic uncertainty but signalled no urgency for rate cuts. Dive deeper

US consumer inflation expectations for the year ahead rose to 3.1% in February, the highest since May, driven by higher expected price growth for gas, food, and rent. Unemployment expectations surged to 39.4%, while long-term inflation forecasts remained steady at 3%. Household income growth expectations edged up to 3.1%. Dive deeper

European stocks rose on Tuesday, with the STOXX 50 up 0.4% past 5,400 as markets weighed higher Eurozone spending against US trade risks. Industrials outperformed, with Siemens and Airbus gaining, while Volkswagen jumped 3% despite weak profits. Tech stocks lagged after a US selloff. Dive deeper

The Canadian dollar weakened past 1.44 USD, nearing a one-month low, amid political uncertainty, U.S. tariff threats, and weak economic data. New PM Mark Carney’s hardline trade stance and a disappointing jobs report added pressure, while expectations of a Bank of Canada rate cut further weighed on the loonie. Dive deeper

Japan’s GDP grew 0.6% QoQ in Q4 2024, slightly below the 0.7% flash estimate but higher than Q3’s 0.4% expansion. Growth was driven by stronger business investment (0.6%), government spending (0.4%), and net trade, while private consumption remained flat. On an annualized basis, GDP rose 2.2%, up from 1.4% in Q3. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Ashok Hinduja, Promoter of IndusInd Bank on increasing stake, capital raise, assuring shareholders after stock fell 27%

"As soon as we receive approval from the RBI, we will immediately inject capital into the bank as and when required."

"If there is any further capital raise, the promoter is ready to inject. We are awaiting our approval which is in the process with the regulator. But as I understand from the financial numbers, the capital adequacy is no problem. Even in the current situation, the bank has a strong capital adequacy,"

"Shareholders shouldn't panic. These are normal routine problems. I understand their concern is over why they were not informed earlier. Banking businesses are based on integrity and trust,"

"We have seen IndusInd Bank for the last 30 years. It has seen various problems. Those have been handled properly. This problem will also get resolved," - Link

Ben Powell, Chief Middle East and APAC Investment Strategist, BlackRock Investment Institute on Indian Markets

We at BlackRock still completely believe in the well-understood bull story. We just think it is completely true. So, demographics is where global investors tend to go, that is fine. The demographic outlook for India over the medium term is, of course, very favourable. But my favourite bull story in India continues to be the productivity gains that we have seen over the last many years, which are likely to continue, not least with digitalisation. We are seeing an incredible acceleration. It feels like India's advancing 10 years every two or three years, in a way, and digitalisation of the whole economy is going quite well. - Link

Calendars

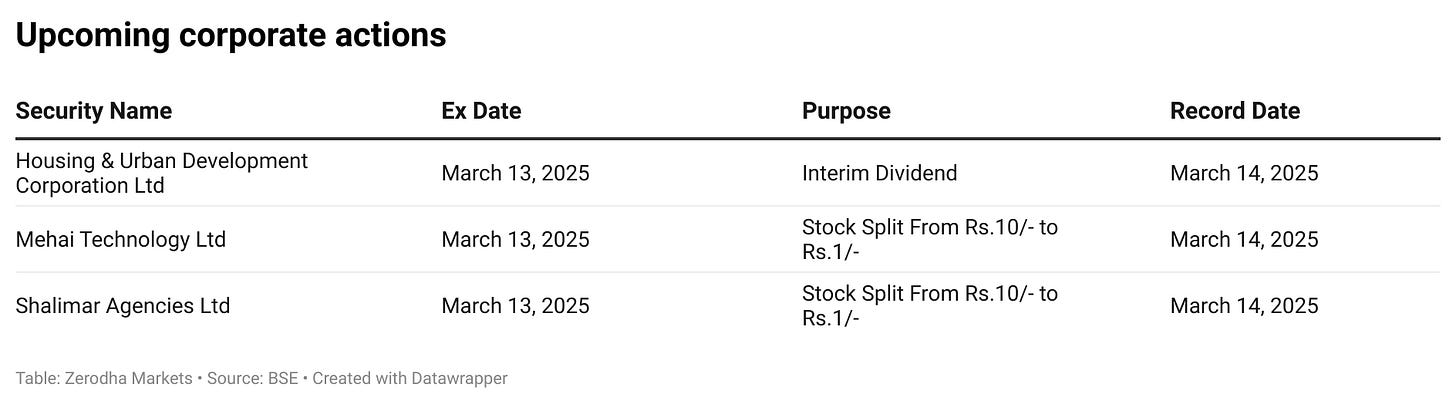

In the coming days, we have the following significant events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.