Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

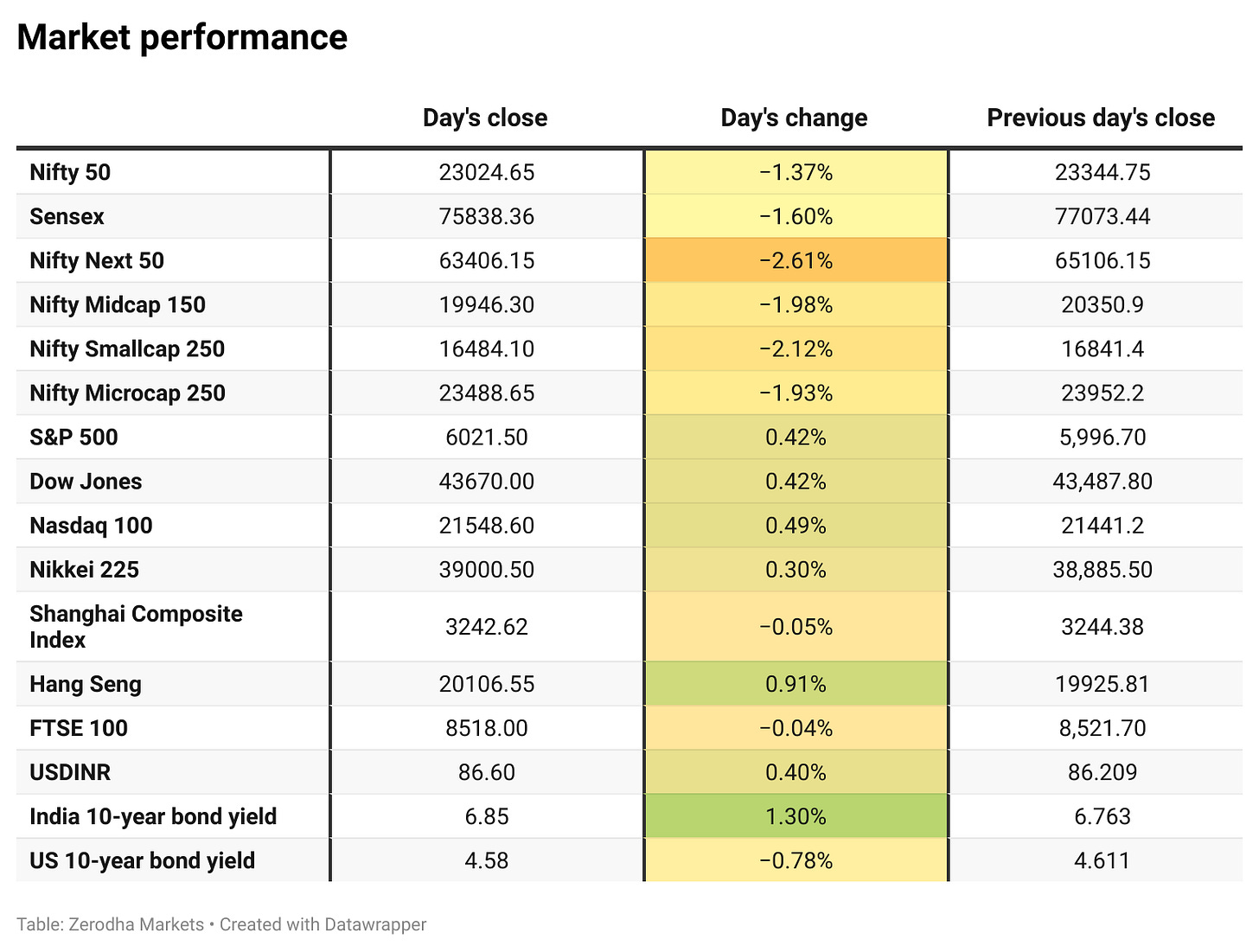

Market Overview

Tracking stable global markets overnight, the Nifty opened with a 77-point gap up. However, after reaching the day's high shortly after the opening, the market experienced a sharp decline, dropping to 23,140 levels. It then consolidated within a narrow range of around 23,200 before staging an upward breakout, briefly testing 23,400. Despite this recovery, the index faced rejection at higher levels once again.

In the second half, the market remained extremely volatile, fluctuating in a range of 50–70 points between 23,150 and 23,300. This rollercoaster session ended with the bulls losing steam in the last hour. The Nifty breached the 23,000 level on an intraday basis before closing at 23,024.65, down 1.37%. The decline was broad-based, with broader indices underperforming the headline indices.

The sell-off was likely driven by persistent FII selling, uncertainty surrounding Trump’s tariff policies, and weaker-than-expected Q3 earnings from several companies. Broader markets faced significant selling pressure, with the Nifty Midcap100 and Smallcap100 indices shedding over 2% each.

Looking ahead, market trends are expected to be shaped by global economic developments and earnings reports from key index heavyweights. Investors will be watching closely for signs of stabilization to ease the ongoing selling pressure, especially with the Union Budget session scheduled for February 1st.

Broader Market Performance:

The broader market ended on a negative note, underperforming the already weak headline indices. On the NSE, 715 stocks advanced, 2,095 declined, and 77 remained unchanged.

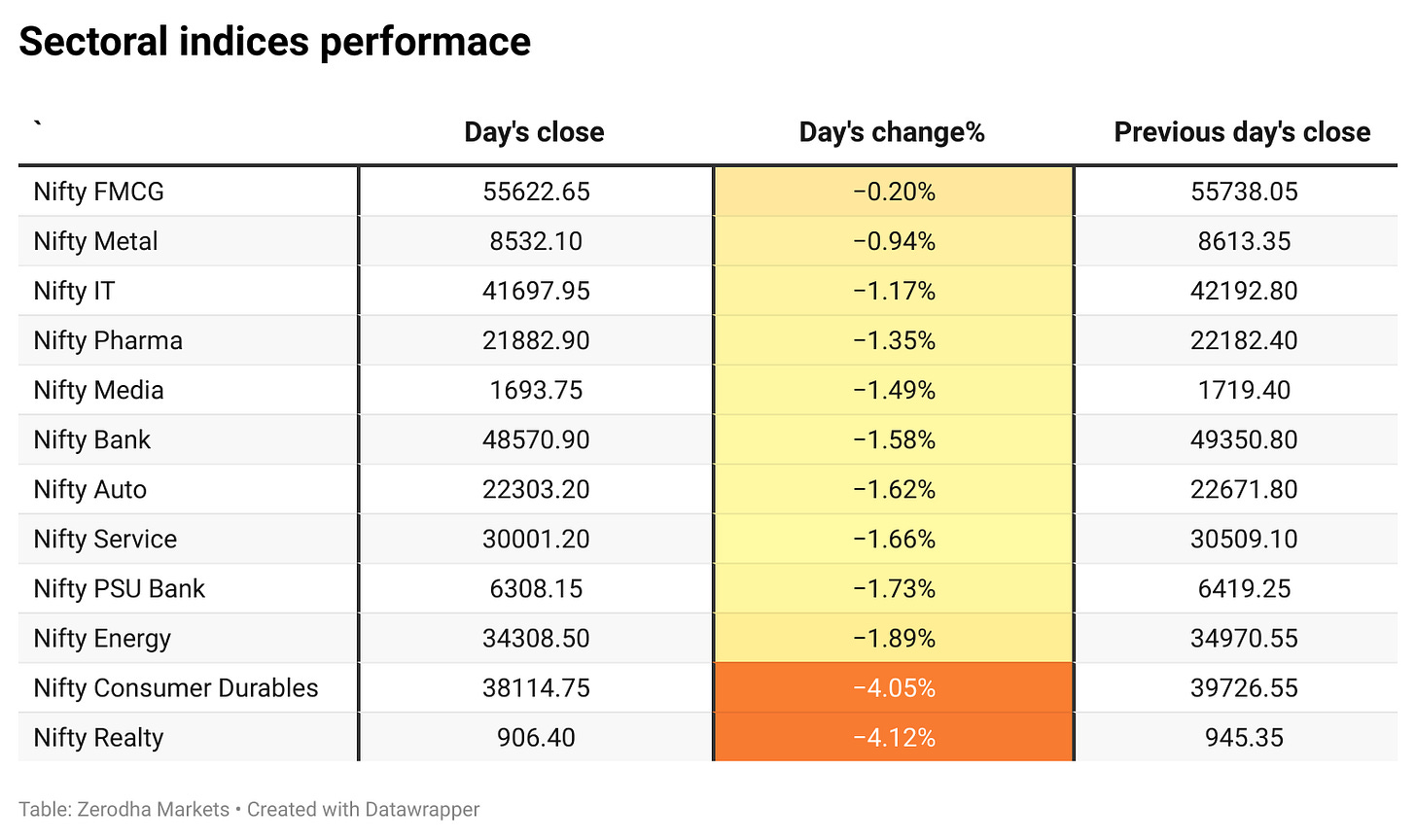

Sectoral Performance:

The overall sectoral performance was decisively negative, with all sectoral indices ending in red. Nifty Realty emerged as the top loser, dropping over 4% due to growth concerns.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 23rd January:

The maximum Call Open Interest (OI) is observed at 23,500, followed by 23,400. Meanwhile, the maximum Put Open Interest (OI) is at 22,500, followed by 23,000.

Immediate support is identified in the 23,000–22,800 range, while resistance is expected between 23,400 and 23,550.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

Adani Energy Solutions Ltd (AESL) has secured a ₹25,000 crore Bhadla-Fatehpur HVDC project to evacuate 6 GW of renewable energy from Rajasthan to North India. The project won under tariff-based competitive bidding, will be executed in 4.5 years on a BOOT basis. Dive deeper

RBI mandates ARCs to get board-approved policies and independent committee clearance for settlements over ₹1 crore. Settlements with defaulters must meet certain value thresholds and be paid lump sum. ARCs must submit quarterly reports. Dive deeper

Reliance Power appointed Neeraj Parakh as CEO for three years, pending member approval. Parakh, with 21 years at Reliance, brings expertise in operations and regulatory compliance. Dive deeper

UTI Mutual Fund has expanded its network with 33 new financial centres, bringing the total to 256. The move aims to enhance accessibility and investor outreach, focusing on North and West India. Dive deeper

LTIMindtree announced that Mr. Sudhir Chaturvedi will resign as Whole-time Director & President Markets, effective January 27, 2025, to pursue new opportunities. Dive deeper

Hatsun Agro Product Limited (HAP) will acquire a 100% stake in Milk Mantra Dairy Private Limited for ₹233 crores, expanding its presence in Eastern India. The acquisition is subject to customary approvals, after which Milk Mantra will become a wholly-owned subsidiary of HAP. Dive deeper

Glenmark Pharmaceuticals USA has introduced an affordable alternative to Vitamin K injection, used to treat vitamin K deficiency. The new product aims to provide a cost-effective option for hospitals and patients. Dive deeper

Hyundai Motor India has achieved 92% localization, saving $672 million in forex and creating 1,400 jobs by sourcing 1,200+ components from 194 vendors, including locally assembled EV battery packs. Dive deeper

PG Electroplast’s step-down subsidiary, Next Generation Manufacturers, has received approval under the 3rd Round of the PLI Scheme for Air Conditioner Components, committing an investment of ₹121.35 crore over five years. Dive deeper

IntellectAI announced that R.E. Chaix has selected its underwriting platform, eMACH.ai Xponent, to enhance efficiency and decision-making in its wholesale and MGA business. Dive deeper

Tata Elxsi and Minespider launched MOBIUS+, a blockchain-based platform for battery lifecycle management, ensuring compliance with global standards and enhancing sustainability. Dive deeper

TCS has become the second global IT services brand to surpass $20 billion in brand value, reaching $21.3 billion. This growth is driven by investments in AI, innovation, and strategic marketing, reinforcing its leadership in the industry. Dive deeper

What’s happening globally

US stock futures struggled after President Trump hinted at 25% tariffs on Canada and Mexico, citing border concerns, with no further details on China. Traders were disappointed, but the focus remains on Trump's pro-business policies. Dive deeper

The dollar index rose to 108.5 after President Trump hinted at 25% tariffs on Canada and Mexico, citing border concerns. Despite cooling US inflation, markets expect two Fed rate cuts this year. The Canadian dollar and Mexican peso weakened. Dive deeper

The Shanghai Composite fell 0.05% to 3,243, while the Shenzhen Component rose 0.48% to 10,306, as markets reacted to Trump's vague tariff remarks on China. Investors had hoped for a softer stance after his call with Xi Jinping. Dive deeper

Germany's ZEW economic sentiment index dropped to 10.3 in January 2025 from 15.7 in December, missing expectations of 15.3, amid ongoing economic contraction and rising inflation. Weak household spending and construction demand are key concerns, with political uncertainty adding to economic challenges. Dive deeper

The Mexican peso weakened past 20.7 per USD after US President Donald Trump signaled plans to impose 25% tariffs on Mexico from February 1st, citing border control concerns. The move could impact Mexico’s economy, pressuring the central bank to consider rate cuts amid slowing investment and industrial output. Dive deeper

European natural gas prices rose to €48 per megawatt-hour, driven by winter demand and the lifting of a US moratorium on new LNG export licenses. The halt in Russian gas flows via Ukraine has further increased Europe's LNG import needs, with storage levels at 60% capacity. Dive deeper

Taiwan's export orders rose 20.8% YoY to USD 52.9 billion in December 2024, driven by strong AI demand, with electronics up 33.5%. The US-led order growth at 31%, followed by Japan, ASEAN, and China. Dive deeper

EU passenger car registrations rose 5.1% YoY in December 2024 to 910,505 units, driven by Spain, while Germany and Italy saw declines. Battery electric vehicle (BEV) registrations fell 10.2%, with a 15.9% market share. For 2024, total registrations grew 0.8% to 10.6 million units, with BEVs accounting for 13.6%. Dive deeper

Saudi Arabia’s Manara Minerals plans to acquire a 10-20% stake in Pakistan’s $9 billion Reko Diq copper-gold project, with a deal expected within six months. The mine, developed by Barrick Gold, aims to produce 400,000 tonnes of copper and 500,000 ounces of gold annually. Dive deeper

Asian automakers and battery makers fell as Trump hinted at tariffs on Canada and Mexico, while Chinese stocks gained as no immediate tariffs were announced. South Korean shipbuilders rallied on expectations of higher demand for gas and oil transport. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

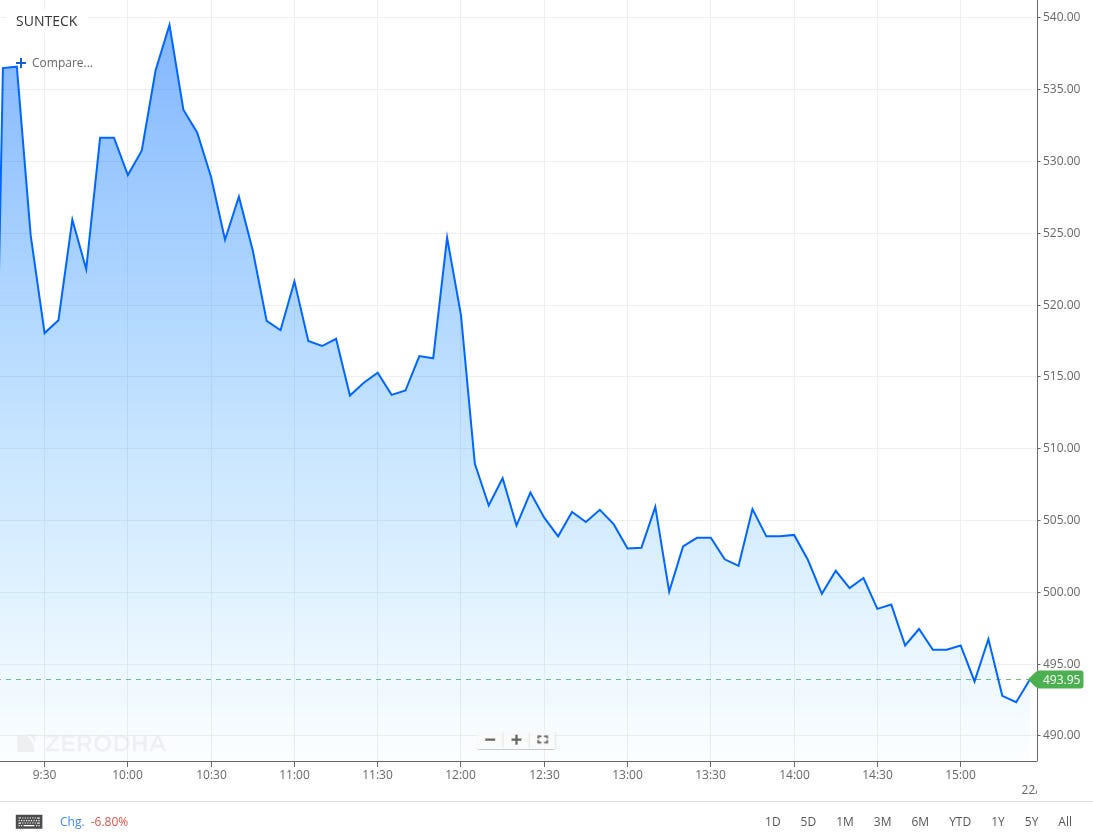

Sunteck Realty Limited (SUNTECK) (0.18%)

Financials:

Revenue: ₹16,175.71 crores, up 2.5% YoY.

Other Income: ₹1,301.15 crores, down 0.1% YoY.

Net Profit (PAT): ₹4,252.06 crores, up 31.2% YoY.

Earnings Per Share (EPS): ₹2.90, up 22.9% YoY from ₹2.36.

Key Highlights:

Total Comprehensive Income increased by 33.0% YoY to ₹4,725.90 crore.

Total Expenses decreased by 2.0% YoY to ₹12,524.20 crore.

Current Tax Expense decreased by 68.0% YoY to ₹277.46 crore.

Net Non-controlling Interest stood at Nil.

Outlook: Sunteck Realty anticipates sustained growth in the real estate sector with an emphasis on developing new projects, expanding operations, and managing financial growth efficiently.

IndiaMART InterMESH Limited (INDIAMART) (1.09%)

Financials:

Revenue from: ₹354.3 crores, up 16.0% YoY.

Other income: ₹44.9 crores, up 7.7% YoY.

Total income: ₹399.2 crores, up 15.1% YoY.

Net Profit (PAT): ₹121.0 crores, up 17.9% YoY (from ₹135.1 crores).

Earnings Per Share (EPS): ₹20.18, up 47.5% YoY.

Key Highlights:

Web and Related Services revenue grew 15.2% YoY to ₹337.3 crore.

Accounting Software Services revenue increased 33.9% YoY to ₹17.0 crore.

Outlook: IndiaMART plans to maintain its growth trajectory in web-based services, focusing on expanding reach and profitability while managing liabilities.

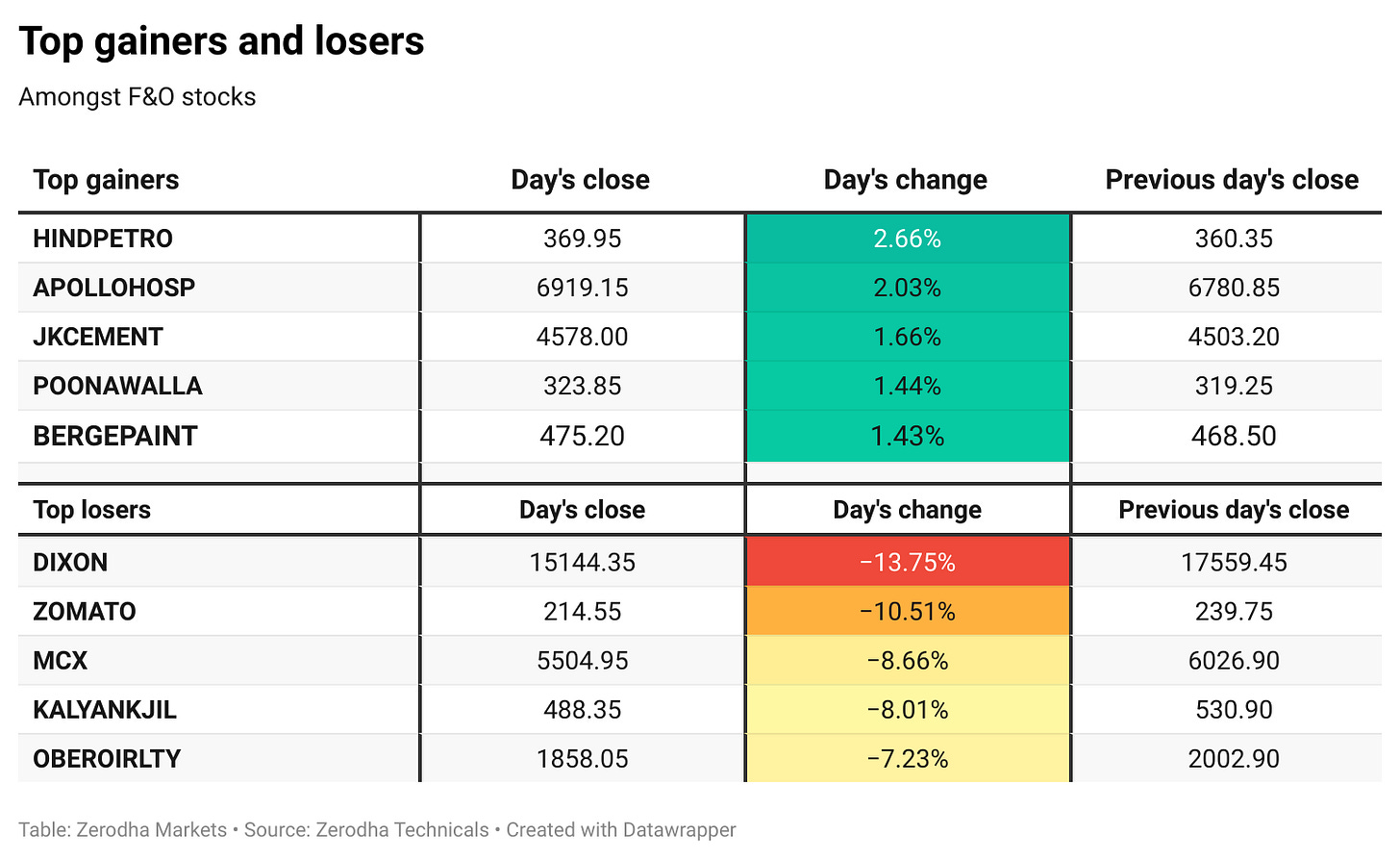

Multi Commodity Exchange of India Limited (MCX) (-8.66%)

Financials:

Revenue: ₹301 crores, up 57% YoY

Net Profit: ₹160 crores, from a loss of ₹5 crores YoY.

EBITDA: ₹216 crores, compared to a loss of ₹2 crores in Q3 FY24.

Key Highlights:

Notional ADT of Options increased 124% YoY to ₹1,82,134 crore.

Total traded clients in derivatives grew 49%, reaching 11 lakhs during 9M FY24-25.

Commodity deliveries included 5.6 MT of Gold, 489 MT of Silver, and 49,986 MT of Base Metals.

Outlook: The company anticipates continued growth driven by increased market participation and operational efficiency, with a focus on maintaining a stable financial position.

Tata Technologies Limited (TATATECH) (0.54%)

Financials:

Net Profit (PAT): ₹168.64 crore, down by 0.92% YoY from ₹170.22 crore.

Revenue from Operations: ₹1,317.38 crore, up 2.16% YoY from ₹1,289.45 crore.

EBITDA: ₹235 crore with an EBITDA margin of 17.8%.

EBIT: ₹211.9 crore, up 3.1% QoQ with EBIT margin improving by 20 bps to 16.1%.

Key Highlights:

Net Profit declined marginally by 0.92% YoY to ₹168.64 crore.

Revenue from operations grew by 2.16% YoY, reaching ₹1,317.38 crore.

EBITDA margin stood at 17.8%, while EBIT margin improved sequentially.

Standalone profit after tax for the quarter was ₹103 crore, showing a 9.7% YoY increase.

Outlook: The company anticipates continued growth with strong performance across its business segments, supported by new deal wins and expansions, especially in high-margin areas like Digital Engineering and Smart Manufacturing.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Jayesh Sanghrajka, Chief Financial Officer, Infosys Ltd. on change in policies around H1B Visa

So, if you look at over the years, our dependence on H1B visas have reduced significantly. First and foremost, our onsite mix has reduced significantly. We used to be in the 30% rate, but now we are at 24% rate. Within that, our nearshore has increased significantly.

And within the US onsite population that we have, our H1 independent folks are now 60 plus percent. We have now built a pretty resilient model from that perspective. And we are therefore much more confident from where we are versus where we used to be earlier.

Donald Trump, US President on BRICS Nations over Dollar Replacement Plans

"If the BRICS nations want to do that, that's okay, but we're going to put at least a 100% tariff on the business they do with the United States." - Link

Calendars

In the coming days, we have the following major events, corporate actions, and upcoming earnings releases:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Excellent report. This has now become my daily evening read.

Fantastic report. Keep it up. Real good!