Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Nifty opened 55 points lower at 22,857.20, tracking weak overnight cues from US markets, but briefly turned positive before a sell-off dragged it down by 140 points to 22,770. After two hours of range-bound movement, it hit its intraday low again in the second half, reaching 22,720. The market saw a slight recovery in the last 90 minutes but closed weak at 22,795.90, down 0.51%.

Market sentiment stayed cautious amid global uncertainties and persistent FII selling.

Broader Market Performance:

Broader market indices ended their two-day recovery and underperformed compared to the headline indices today. Of the 2,916 stocks traded on the NSE, 1,100 advanced, 1,744 declined, and 72 remained unchanged.

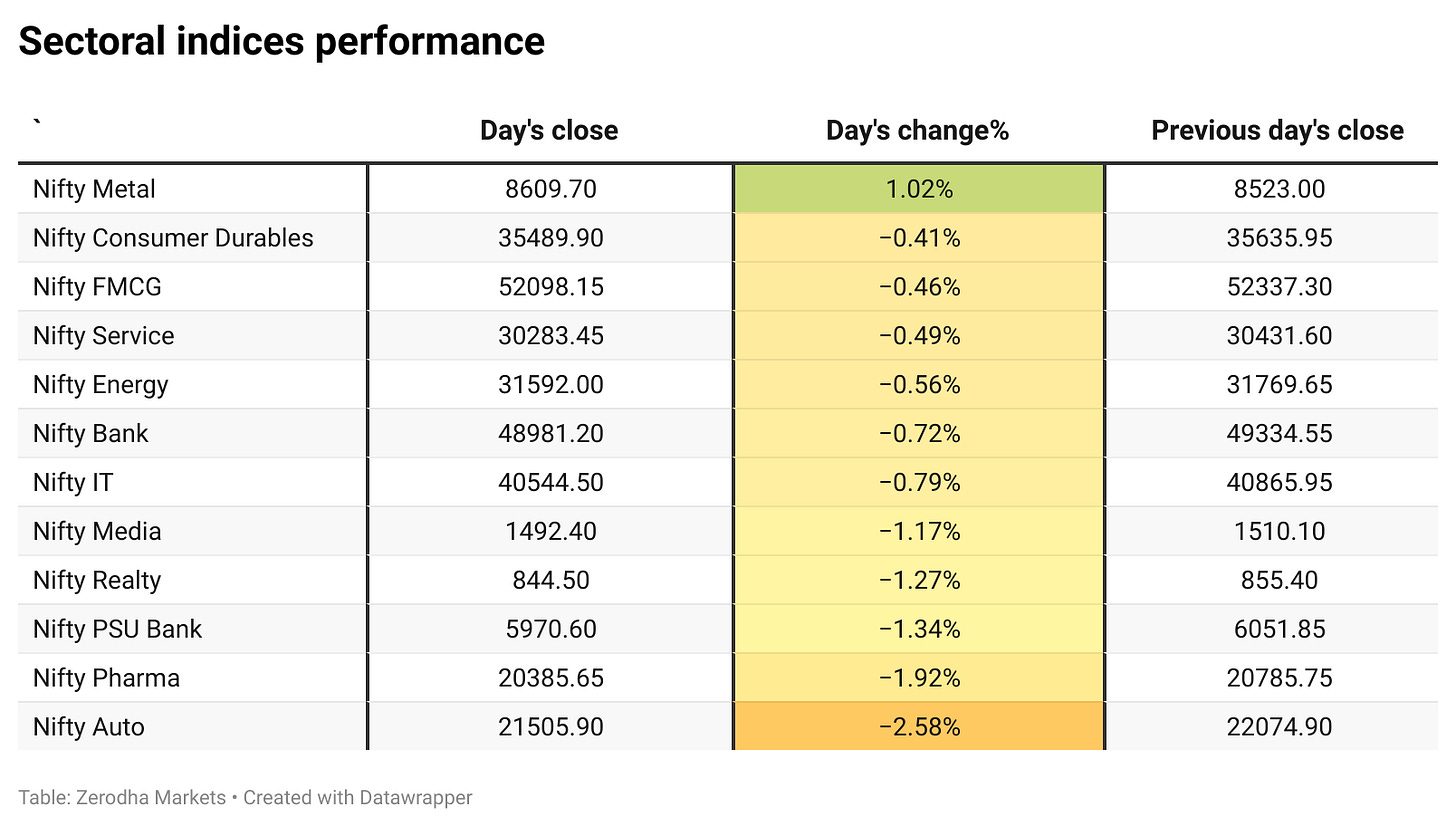

Sectoral Performance:

Based on the sectoral indices' performance, Nifty Metal was the top gainer, closing 1.02% higher, while Nifty Auto was the biggest loser, declining by 2.58%. Out of the 12 sectors, only one sector, Nifty Metal, closed in the green, while the remaining 11 sectors ended in the red, reflecting broad-based weakness in the market.

Note: The above numbers for Commodity futures were taken around 4 pm.

Net Flow Breakdown for the day:

FII: Net outflow of ₹3,449.15 crore (Bought ₹10,144.33 crore, Sold ₹13,593.48 crore)

DII: Net inflow of ₹2,884.61 crore (Bought ₹12,889.44 crore, Sold ₹10,004.83 crore)

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 27th February:

The maximum Call Open Interest (OI) is observed at 23,000, followed by 23,100. Meanwhile, The maximum Put Open Interest (OI) is at 22,500, closely followed by 22,300.

Immediate support is identified in the 22,800–22,700 range, while resistance is expected between 23,080 zones followed by 23,200.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

HSBC India Manufacturing PMI eased to 57.1 in February 2025 from 57.7, reflecting a slight slowdown amid competitive pressures. Despite this, international demand remained strong, input purchases increased, and supplier delivery times improved for the 12th straight month. Dive deeper

SEBI proposed a fast-track follow-on offer framework for REITs and InvITs to enhance fundraising efficiency. It also suggested a three-year lock-in for 15% of units allotted to sponsors and sought public comments by March 13 on the proposals. Dive deeper

Walmart-owned PhonePe has begun preparations for an IPO in India, citing strong top-line and bottom-line growth. The fintech leader redomiciled from Singapore to India in 2022 and restructured its non-payment businesses into fully owned subsidiaries. Dive deeper

The Customs Department defended its $1.4 billion tax demand against Skoda Auto Volkswagen India, alleging misclassification of CKD units as individual parts to pay lower duties. The Bombay High Court is hearing the company’s challenge, calling the demand "arbitrary and illegal." Dive deeper

Hitachi Energy India has sought shareholders' approval to raise its borrowing limit to ₹11,500 crore from ₹6,500 crore, citing expected business growth and high-value projects. The results of the postal ballot will be announced on March 25. Dive deeper

The Finance Ministry will review the performance of public sector banks (PSBs) on March 4, focusing on financial performance and financial inclusion schemes like PM SVANidhi. PSBs posted a record ₹1.29 lakh crore net profit, with improved asset quality and 11% business growth. Dive deeper

The RBI is integrating AI and machine learning (ML) to enhance risk assessment, predictive analysis, and stress testing in banking supervision. The revamped analytics committee will assess advanced statistical models, staff training, IT resources, and global regulatory practices for improved financial oversight. Dive deeper

Electricity derivatives are nearing launch as Sebi and CERC finalize contract specifications, with stock exchanges directed to submit proposals. The move aims to provide a forward price curve, enabling hedging and investment decisions, while 24-hour commodity trading was rejected due to risk concerns. Dive deeper

The RBI will conduct a ₹75,000 crore 45-day variable rate repo (VRR) auction on February 21, set to reverse on April 7, ahead of its monetary policy announcement. This follows multiple liquidity infusion measures, including bond purchases, long-term VRRs, and forex swaps. Dive deeper

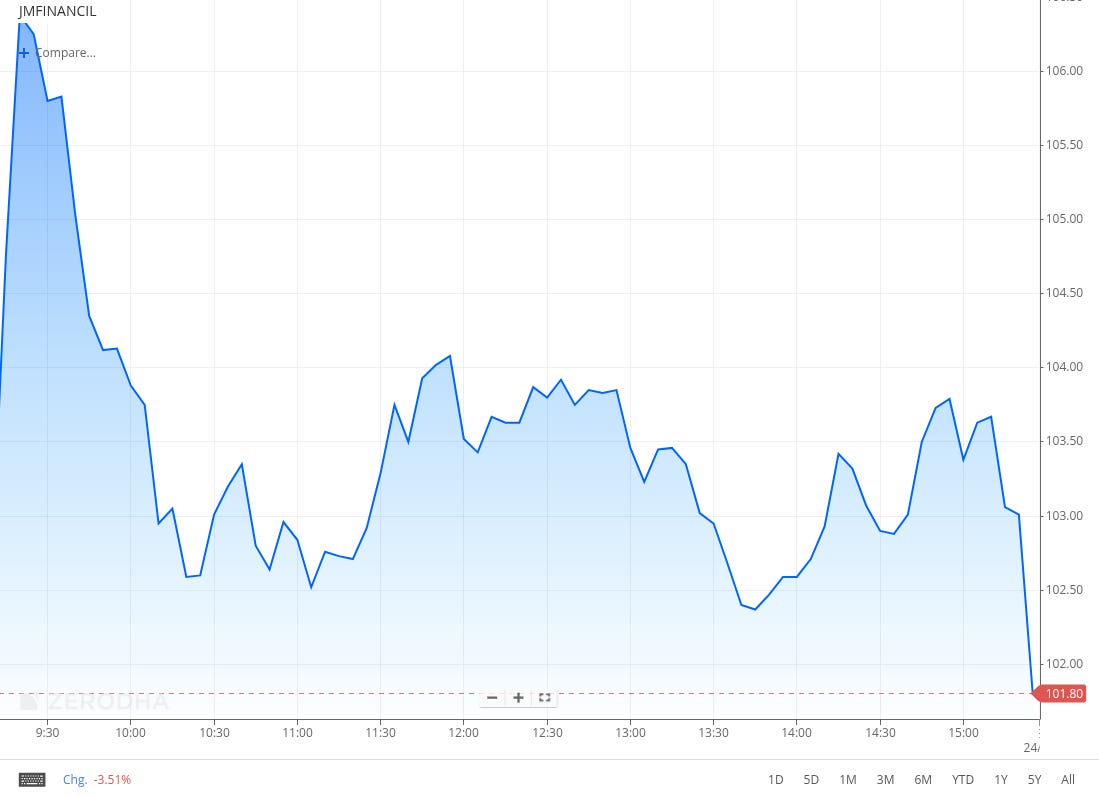

JM Financial shares closed at ₹101.8, down 1.17%, despite an intraday high of ₹108 following the announcement of a ₹230 crore tax refund from the Income Tax Department for AY 2008-09. Dive deeper

Tata Steel acquired an additional ₹2,603 crore stake in its Singapore subsidiary, T Steel Holdings, after a ₹2,348 crore investment last year. The stock closed at ₹140.6, up 1.85%. Dive deeper

ITI Ltd shares hit a 5% upper circuit at ₹282.65 after receiving a revised ₹200 crore order for land transfer in Electronic City, Bangalore. The company has already received ₹100 crore upfront, with the remaining amount pending statutory formalities. Dive deeper

Religare Enterprises shares surged 15.01% to ₹256.49 after the Burman Group secured control, becoming the promoters of the financial services firm. The acquisition follows a prolonged battle, with US investor Danny Gaekwad’s competing bid failing due to regulatory hurdles. Dive deeper

What’s happening globally

Brent crude dipped below $76 per barrel but remained on track for a 1.5% weekly gain, driven by Russian supply disruptions and rising US and Chinese demand. A Ukrainian drone attack cut Caspian Pipeline oil flows, while US refinery maintenance reduced fuel inventories. Dive deeper

Gold traded around $2,930 per ounce, near its record high, poised for an eighth straight weekly gain amid rising global uncertainties. Trade tensions escalated with Trump’s new tariff plans, while reports of potential US policy shifts on Ukraine added to geopolitical risks. Dive deeper

US natural gas futures surged 5% to $4.3 per million British thermal units (MMBtu), the highest since December 2022, with weekly gains of over 16% as cold weather strained supply. Production fell to a four-week low, while LNG exports hit record levels, and storage draw exceeded forecasts at 196 bcf. Dive deeper

The UK Manufacturing PMI fell to 46.4 in February 2025, marking the sharpest contraction since December 2023 as output and sales weakened. Employment declined, while input costs rose due to higher raw material and energy prices. Dive deeper

The Shanghai Composite rose 0.85% to 3,378, while the Shenzhen Component gained 1.82% to 10,991, driven by strong interest in AI and tech stocks. Optimism surged on DeepSeek’s AI model, Alibaba’s 14% rally, and hopes for regulatory easing in China. Dive deeper

UK retail sales rose 1.7% MoM in January 2025, the strongest since May 2024, surpassing forecasts of 0.3%. Growth was led by food stores (+5.6%), while non-food, clothing, and fuel sales declined. Annual sales grew 1%, beating expectations of 0.6%. Dive deeper

Malaysia’s inflation held steady at 1.7% in January 2025, the lowest in 11 months, matching forecasts. Prices rose for food, housing, and transport, while clothing and communication costs declined. Core inflation increased to 1.8% YoY, with monthly CPI up 0.1%. Dive deeper

Japan’s inflation rose to 4.0% in January 2025, the highest since January 2023, driven by food prices (+7.8%) and elevated electricity and gas costs. Core inflation hit a 19-month high at 3.2%, while monthly CPI increased 0.5%. Dive deeper

Apple CEO Tim Cook met President Donald Trump at the White House, as Trump's 10% tariff on Chinese goods threatens iPhone sales. Cook, who previously secured tariff exemptions, faces uncertainty as Trump signals stricter import policies with fewer carve-outs. Dive deeper

Citi, HSBC, Morgan Stanley, and RBC agreed to pay over £100 million in fines after the UK’s Competition and Markets Authority found traders shared sensitive gilt pricing information via Bloomberg chat rooms between 2009 and 2013. Deutsche Bank received immunity for reporting the conduct. Dive deeper

Nissan shares jumped over 9% after reports that a Japanese group, including former PM Yoshihide Suga, plans to seek Tesla’s investment following failed merger talks with Honda. The group believes Tesla may acquire Nissan’s U.S. plants. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

TV Narendran, MD and CEO, Tata Steel on the impact of US trade policies on the steel sector

“The tariffs in the US will impact us directly and indirectly. For whatever we export as a country, it matters what the tariffs are. At Tata Steel, we also export from Europe to the US. So there is a direct impact from that point of view. The indirect impact is whatever doesn't go to the US ends up somewhere else, so which will have a bearing on international prices and it will have a bearing on the margins in India,” - Link

Chairperson Madhabi Puri Buch, SEBI in an event organized by AMFI

“On midcaps and smallcaps, I think that at a point in time when the regulator felt the need to make a statement about it, the statement was made. Today, the regulator feels no need to make an additional statement," - Link

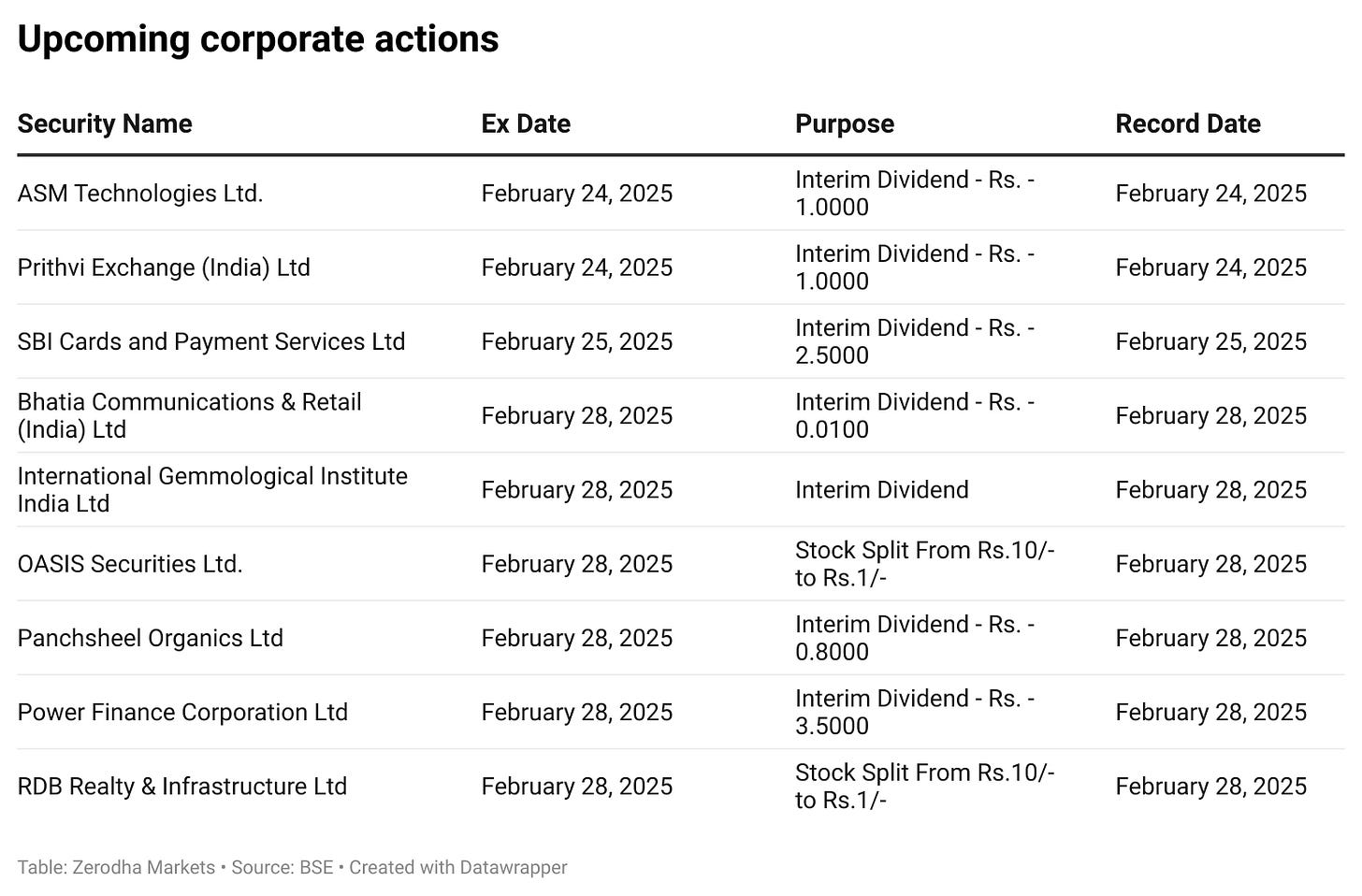

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

should i activate my DDPI ? If yes, then why?