Nifty stabilizes after declines; Broader markets take the lead

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

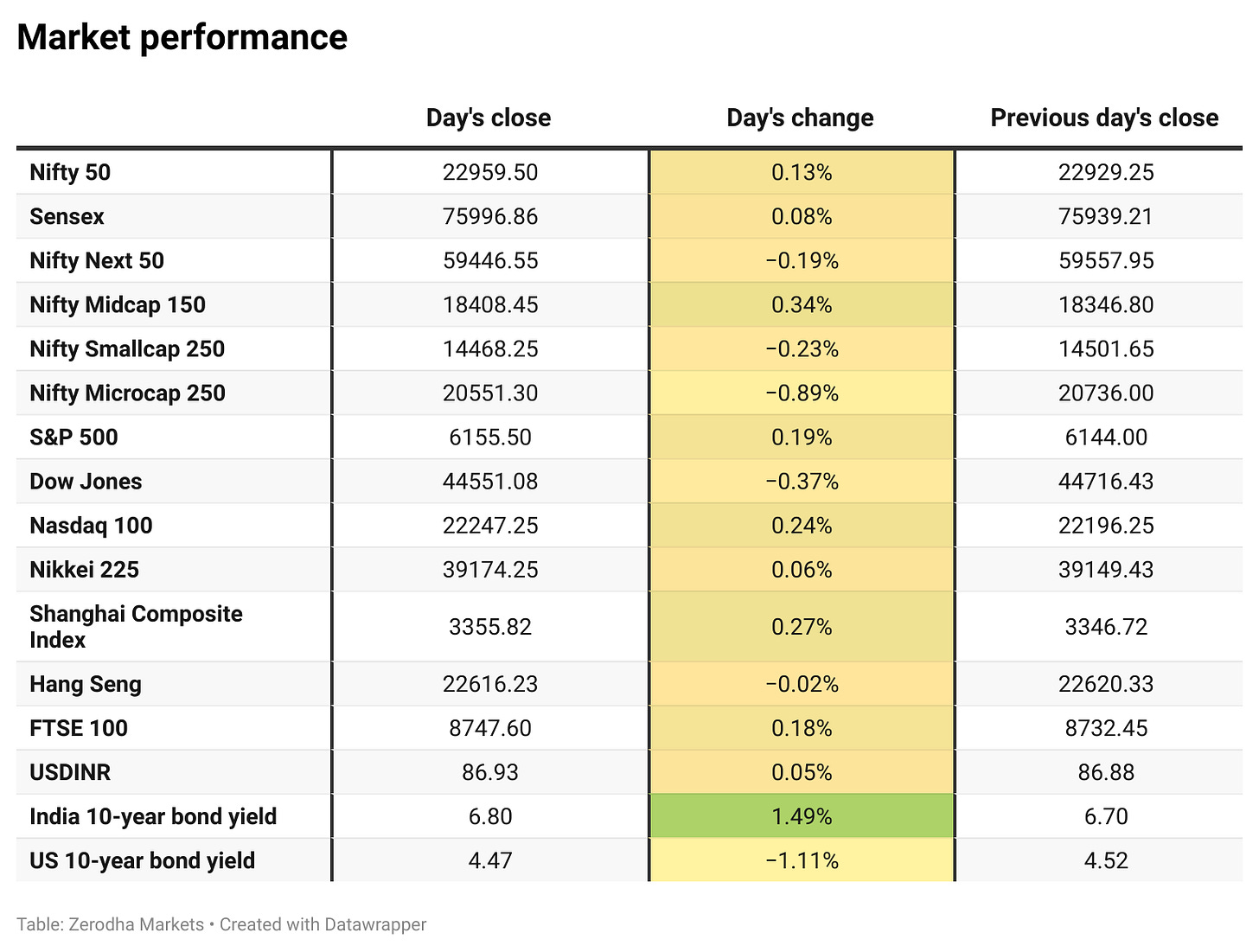

Market Overview

Nifty opened with a 120-point gap down at 22,809.90 and continued to decline without any respite. After hitting the day’s low of 22,725.45 within the first hour, it began a recovery, crossing 22,900 before retracing nearly 80 points. For nearly three hours, the index remained range-bound between 22,825 and 22,875. However, in the final two hours, the market regained momentum, breaching the previous intraday high and eventually closing near the day’s high at 22,959.50, marking a 0.13% gain.

Market sentiment remains shaky and weak, with Nifty expected to take direction from global developments and domestic economic factors in the coming sessions.

Broader Market Performance:

Although the Midcap index closed in the green, broader market indices underperformed the headline index, with a negative advance-to-decline ratio. Out of 2,955 stocks traded on the NSE, 1,014 advanced, 1,871 declined, and 70 remained unchanged.

Sectoral Performance:

The sectoral indices performance shows that Nifty Pharma emerged as the top gainer, closing 1.27% higher, while Nifty Media was the worst performer, declining by 0.71%. Overall, market sentiment was mixed, with seven sectors closing in the green and five sectors ending in the red.

Note: The above numbers for Commodity futures were taken around 4 pm.

Net Flow Breakdown for the day:

FII: Net outflow of ₹3,937.83 crore (Bought ₹6,826.98 crore, Sold ₹10,764.81 crore)

DII: Net inflow of ₹4,759.77 crore (Bought ₹12,504.11 crore, Sold ₹7,744.34 crore)

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 20th February:

The maximum Call Open Interest (OI) is observed at 23,300, followed by 23,200. Meanwhile, The maximum Put Open Interest (OI) is at 22,500, followed by 22,600.

Immediate support is identified in the 22,800–22,700 range, while resistance is expected between 23,200 zones followed by 23,300.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

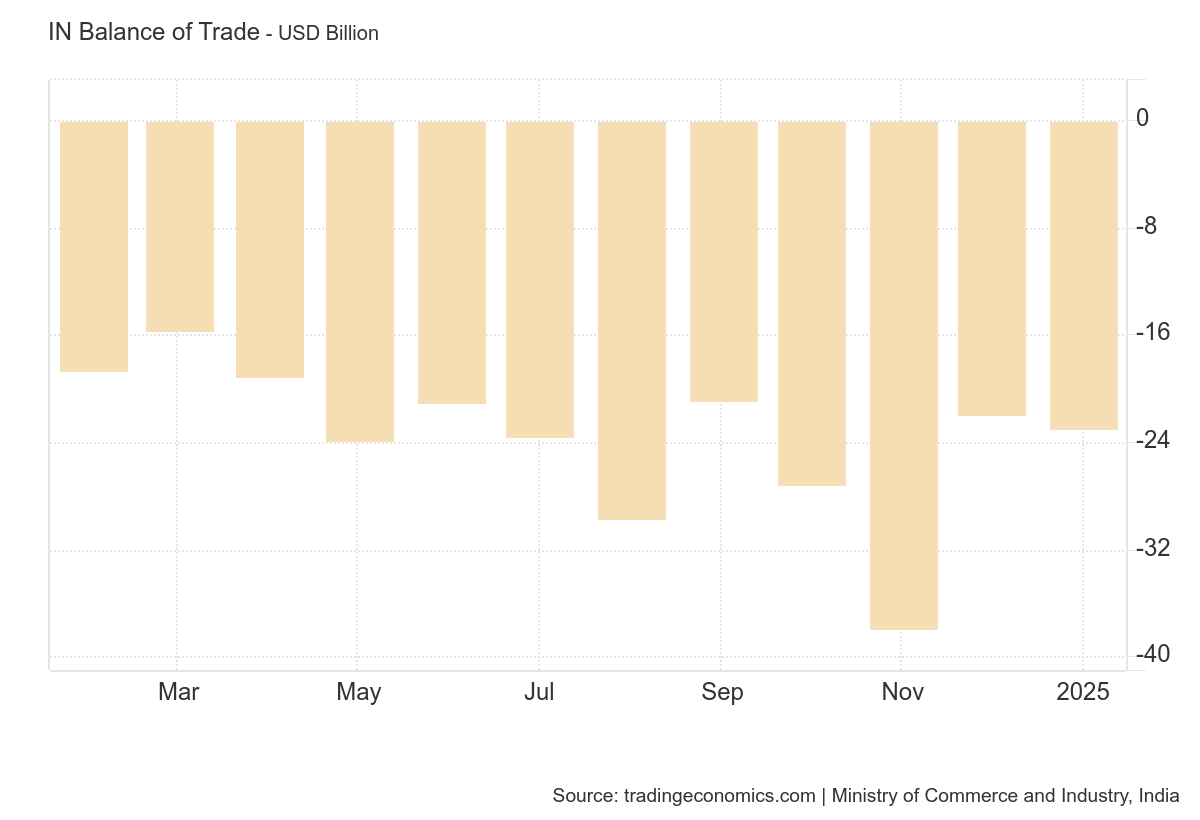

India’s trade deficit widened to $23 billion in January 2025 from $17.5 billion a year earlier, slightly above market estimates of $22.35 billion. Imports grew 9.2% YoY to $59.4 billion, while exports dipped 1.3% to $36.4 billion, despite a weaker rupee supporting competitiveness. Dive deeper

BPCL has partnered with the National Sugar Institute (NSI) to develop sweet sorghum as a sustainable biofuel source, allocating ₹5 crore for R&D to optimize ethanol production. The collaboration aligns with India’s Ethanol Blended Petrol program, aiming to enhance energy security and rural development. BPCL will conduct field trials and explore commercial viability to establish a scalable ethanol production framework. Dive deeper

Bharti Airtel has landed the SEA-ME-WE 6 submarine cable in Chennai, following its earlier landing in Mumbai. The 21,700 Rkm cable connects India to Singapore and France, enhancing global connectivity with 220 TBPs of capacity. Integrated with Airtel’s Nxtra data centres, this investment strengthens Airtel’s network presence and supports India's growing data demands. Dive deeper

Redington’s subsidiary Arena has completed the divestment of Paynet to Turkey’s leading payment firm Iyzico for $89.29 million, following regulatory approvals. Arena will now focus on strengthening its core technology distribution business and exploring investments in AI and Robotic Process Automation (RPA). Dive deeper

Eurobank partnered with LTIMindtree to enhance banking technology, supported by Fairfax Digital Services. A new Global Delivery Center in Pune will drive digital innovation and modernization. LTIMindtree will also support Eurobank Luxembourg’s Temenos implementation. Dive deeper

BHEL secured a ₹6,700 crore order from Singareni Collieries to set up an 800 MW thermal power unit in Telangana. The project, executed on an EPC basis, highlights BHEL’s role in India’s energy security. Dive deeper

Wipro appoints Amit Kumar as Managing Partner and Global Head of Wipro Consulting to lead AI-driven consulting growth and business transformation. Dive deeper

Uno Minda will acquire the remaining 49.9% stake in its Joint Venture with FRIWO, along with e-drive technologies, for ₹195 crore. The deal includes intellectual property, R&D assets, and control hardware/software from Germany and Vietnam. Dive deeper

Paytm Cloud Technologies Ltd., a wholly-owned subsidiary of Paytm, has completed the acquisition of a 25% stake in Seven Technology LLC, Delaware, for $1 million (₹8.7 crore). Dive deeper

Reliance Industries Ltd. has acquired a 100% equity stake in Lakadia B Power Transmission Ltd. for ₹6.73 crore, making it a wholly-owned subsidiary. Dive deeper

Mahindra Electric's Origin SUVs, the XEV 9e and BE 6, secured 30,179 bookings on the first day, amounting to ₹8,472 crore in booking value. This marks a significant milestone in India’s EV market, with the top-end Pack Three variant accounting for 73% of total bookings. Dive deeper

Zen Technologies' Board has approved the acquisition of Applied Research International Private Limited (ARIPL) and ARI Labs Private Limited (ALPL), making them wholly owned subsidiaries. Additionally, Zen will invest in Bhairav Robotics Private Limited, acquiring a 45.33% stake, and Vector Technics Private Limited, securing a 51% stake, making it a subsidiary. These strategic investments aim to strengthen Zen's capabilities in simulation, robotics, and defence technology. Dive deeper

Narayana Hrudayalaya’s subsidiary, Health City Cayman Islands Ltd, acquired a 4.01% stake in Doctors Hospital Health System Limited, Bahamas for B$4.99 million. This investment strengthens its presence in the Caribbean, enhancing clinical collaboration, operational efficiencies, and patient referrals. Dive deeper

Welspun Corp secured ₹3,000 crore orders in the US for HSAW and HFIW pipes, mainly for natural gas pipelines. Execution is set for FY26-27, reinforcing its market position in US O&G transmission. Dive deeper

ONGC, SOCAR, and MRPL signed a tripartite MoU at India Energy Week 2025 to enhance energy trade and cooperation. The agreement facilitates crude oil, LNG, and petroleum product trade while optimizing supply chains. Each party retains independent commitments, ensuring long-term strategic synergy. Dive deeper

Bhoruka Supply Chain Solutions Holdings Ltd. acquired 11,200 equity shares of Transport Corporation of India Ltd., increasing its stake from 44.15% to 44.17%. The acquisition was made through a market purchase on February 14, 2025. Dive deeper

Shakti Pumps (India) Limited invested ₹4 crore in its wholly owned subsidiary, Shakti EV Mobility Private Limited, by subscribing to 40 lakh equity shares of ₹10 each. This raises the total investment to ₹39 crore. Dive deeper

RBI approved Prabdev (PD) Singh as CEO of Standard Chartered India and South Asia, effective April 1, succeeding Zarin Daruwala. Singh, a corporate banking veteran, joins as StanC pivots towards wealth management. Dive deeper

Lenskart is preparing for a $10 billion IPO, aiming to file its draft papers by May, doubling its last funding round valuation. Backed by SoftBank and Temasek, the eyewear retailer is expanding globally, with India operations already profitable. Dive deeper

IL&FS Group is distributing ₹5,000 crore to creditors, including ₹3,500 crore in InvIT units and ₹1,500 crore in cash. This takes its total debt resolution to ₹43,000 crore, over 70% of its ₹61,000 crore target. Dive deeper

What’s happening globally

Brent crude stayed below $75 as Russia-Ukraine talks and Iraq’s Kurdistan export plans raised supply hopes, while trade war fears capped gains. Dive deeper

Japan’s GDP grew 0.7% QoQ in Q4 2024, beating forecasts of 0.3%, driven by a rebound in business investment, rising exports, and shrinking imports. Government spending accelerated, while private consumption edged up despite inflation and higher borrowing costs. Dive deeper

Spain's trade deficit rose to EUR 4.12 billion in December 2024 from EUR 3.44 billion a year earlier, as imports grew 4.7% while exports increased 2.7%. Higher purchases of equipment, chemicals, and consumer goods offset lower energy imports. For 2024, the deficit narrowed slightly to EUR 40.3 billion. Dive deeper

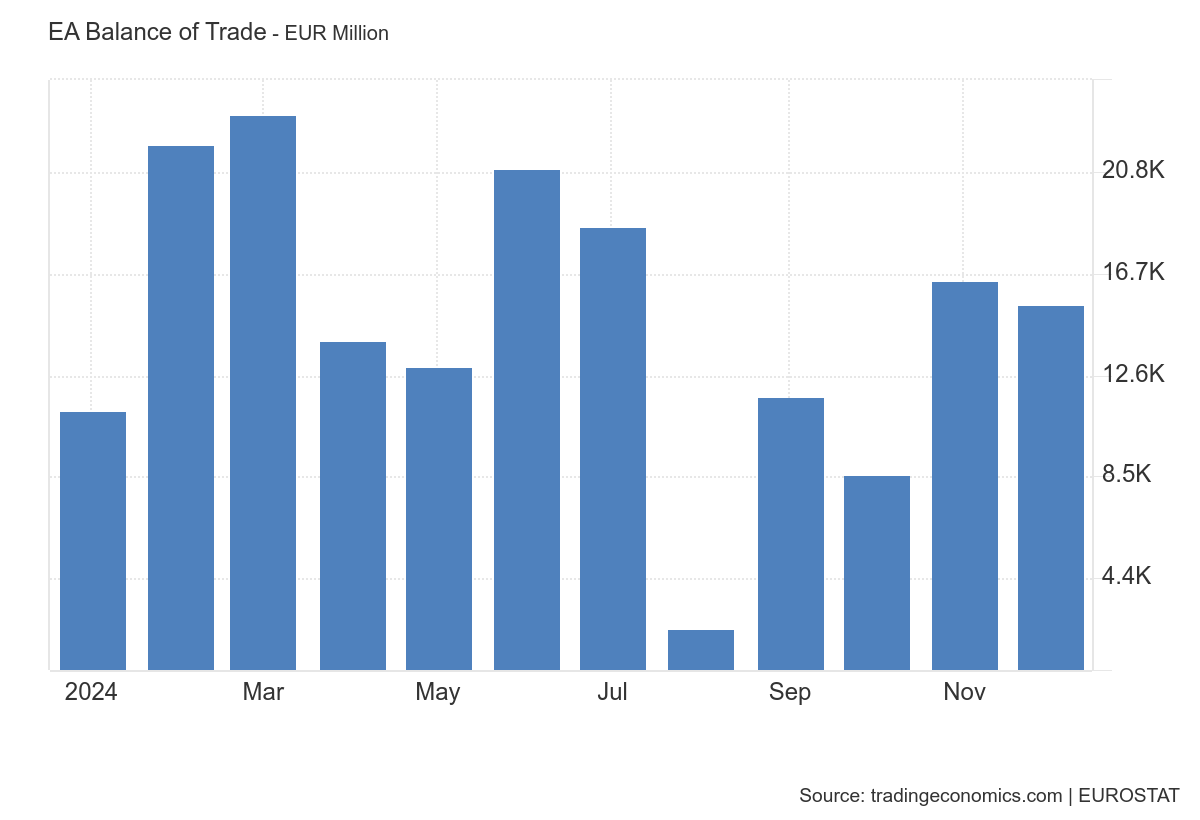

The Eurozone's trade surplus narrowed to €15.5 billion in December 2024 from €16.4 billion a year earlier, exceeding forecasts. Imports rose 3.8% to €211 billion, while exports increased 3.1% to €226.5 billion. For 2024, the EU's trade surplus surged to €150.1 billion from €34.4 billion. Dive deeper

Newcastle coal futures fell to $102 per tonne, nearing a four-year low, amid oversupply concerns. China's coal output is set to rise 1.5% in 2025, while Indonesia's record production and high inventories added pressure. Strong demand from China was not enough to offset the surplus. Dive deeper

Germany’s 10-year bond yield rose to 2.488% amid concerns over higher defence spending and borrowing. The ECB is expected to cut rates, potentially bringing the deposit rate below 2% by 2026. Dive deeper

China’s vehicle sales fell 0.6% YoY to 2.423 million units in January 2025, the first drop in four months, mainly due to the Lunar New Year holiday. NEV sales surged 29.4% to 944,000 units, with total car sales expected to grow 4.7% in 2025. Dive deeper

Thailand's GDP grew 3.2% YoY in Q4 2024, the fastest since Q3 2022 but below forecasts of 3.9%. Growth was driven by higher private consumption, investment, and exports, while government spending slowed. Full-year GDP expanded by 2.5%, slightly below the 2.7% target. Dive deeper

Shein is under pressure to cut its valuation to $30 billion ahead of its London IPO, down from an earlier expected $50 billion. Shareholders suggest the adjustment to boost approval chances, with the listing now likely postponed to the second half of 2025. Dive deeper

Cocoa stockpiles have hit record lows due to poor harvests in Ivory Coast and Ghana, driving prices up threefold since 2023. Chocolate makers are using lower-grade beans and alternative ingredients to cope. Consumers face higher prices and reduced cocoa content in chocolates. Dive deeper

South Korea plans to secure 10,000 GPUs in 2025 to strengthen its AI capabilities amid rising global competition. The initiative, led by acting President Choi Sang-mok, combines public and private efforts to accelerate the launch of a national AI computing centre. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

Reliance Infrastructure Limited (-2.32%)

Revenue: ₹5,033 crores, up by 9% YoY.

EBITDA: ₹606 crores, up by 15% YoY.

Net Profit: ₹-3,186 crores (loss), widened by 71% YoY.

EPS: ₹-83.26, down by 683% YoY.

Key Highlights:

Revenue increased due to growth in the power segments and infrastructure projects.

EBITDA improved on the back of cost control measures and operational efficiencies.

Net loss widened significantly due to exceptional items related to asset impairments and regulatory provisions.

Finance costs remained high due to ongoing debt restructuring.

Outlook:

Reliance Infrastructure plans to focus on debt reduction, optimize costs, and leverage infrastructure growth opportunities to stabilize performance.

Samvardhana Motherson International Limited (-1.13%)

Revenue: ₹27,666 crores, up by 8% YoY.

EBITDA: ₹2,686 crores, up by 13% YoY.

Net Profit: ₹984 crores, up by 62% YoY.

EPS: ₹1.25, up by 56% YoY.

Key Highlights:

Revenue growth is driven by higher sales in wiring harness and polymer product segments.

EBITDA margin expanded to 9.7%, supported by operational efficiencies.

Net profit surged 62% YoY, aided by cost management and improved operating performance.

Strong order book across geographies, particularly in North America and Europe.

Outlook:

The company is focused on expanding global operations, enhancing cost efficiencies, and leveraging growth in the automotive components industry.

Rail Vikas Nigam Limited (-4.85%)

Revenue: ₹4,591 crores, down by 2% YoY.

EBITDA: ₹263 crores, up by 7% YoY.

Net Profit: ₹295 crores, down by 10% YoY.

EPS: ₹1.41, down by 10% YoY.

Key Highlights:

Revenue declined due to slower project execution in certain rail infrastructure projects.

EBITDA improved due to operational efficiencies and better cost control.

Net profit declined owing to higher interest expenses and reduced other income.

Order book remains strong, providing revenue visibility for future quarters.

Outlook:

RVNL continues to focus on project execution and cost optimization to support growth in India's rail infrastructure sector.

PTC Industries Limited (-8.84%)

Revenue: ₹66.9 crores, up by 21% YoY.

EBITDA: ₹15.2 crores, down by 1% YoY.

Net Profit: ₹14.2 crores, up by 80% YoY.

EPS: ₹9.50, up by 60% YoY.

Key Highlights:

Revenue growth is driven by strong demand for metal components across domestic and export markets.

EBITDA declined slightly due to higher raw material costs and increased operational expenses.

Net profit surged 80% on account of improved cost efficiencies and favorable product mix.

Expanded global presence with the acquisition of Trac Holdings Limited and its subsidiaries in Q3.

Outlook:

PTC Industries is focused on scaling up international operations and leveraging its advanced manufacturing capabilities for sustained growth.

Borosil Renewables Limited (-3.25%)

Revenue: ₹361 crores, up by 10% YoY.

EBITDA: ₹-10.1 crores (negative), down by 150% YoY.

Net Profit: ₹-30.1 crores (negative), down by 71% YoY.

EPS: ₹-2.05, down by 72% YoY.

Key Highlights:

Revenue growth is driven by increased domestic demand and improved pricing.

EBITDA turned negative due to higher power and fuel costs.

Net loss widened due to weak performance in overseas operations, particularly in Europe.

Furnace cooldown implemented at its German subsidiary to manage costs effectively.

Outlook:

Borosil Renewables plans to optimise costs, focus on domestic demand growth, and enhance operational efficiency in global markets.

Puravankara Limited (+0.17%)

Key Highlights:

Revenue decline due to slower project execution and lower inventory turnover.

EBITDA turned negative amid higher subcontractor costs and increased land purchase expenses.

Finance costs rose 36% YoY due to increased borrowings for project expansions.

Legal proceedings related to property titles and land acquisitions continue to impact performance.

Outlook:

Puravankara plans to focus on project completions, streamline costs, and resolve pending legal matters to improve profitability.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

VS Mani, ED & Global CFO, Glenmark Pharma on the US business

Let me take the overall US business. In the current and the last couple of quarters, we have not had any meaningful launches. That is the reason why even in this quarter, it is more like a flat quarter. But going forward, we have already given in our call as well that we have our generic Flovent coming up and as well as we also have some nasal sprays and respiratory launches coming up.

Besides that, we also have eight injectable products coming up. All in all, in the next couple of years, we look at US business improving from here on. As far as the pricing environment goes, it is all lower single-digit erosion, but product launches are key and in the coming quarters, we have lined up quite a few exciting opportunities. Those should help us to do well. - Link

Finance Minister Nirmala Sitharaman on Tariffs

"India has already taken several measures on tariffs by rationalisation. Anti-dumping duties are periodically reviewed,"

"This budget is a major step forward to reform India's customs duty regime. We are becoming an investor-friendly country," - Link

Calendars

In the coming days, we have the following major events, corporate actions, and upcoming earnings releases:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.