Nifty struggles at highs, closes near 22,400; Broader markets lag

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Nifty opened with a 70-point gap up, quickly hitting the day’s high of 22,541.50 before flattening out. It then climbed again, testing 22,558.05 within the first hour. However, markets soon turned negative, dipping to 22,400 around noon. In the second half, Nifty traded within a narrow range of 22,400 to 22,460. During the final hour, it remained near the day's lows, closing at 22,397.20, down 0.32%.

Looking ahead, Nifty’s direction will depend on whether it retests the resistance zone near 22,800 or moves lower toward 22,200–22,000. A key factor to watch is whether U.S. markets stabilize or if the recent decoupling between Indian and U.S. markets continues in the short term.

Broader Market Performance:

The broader markets underperformed the headline indices, indicating weak market breadth. Out of 2,948 stocks traded on the NSE, 984 advanced (down from 1,030 yesterday), while 1,894 declined (up from 1,854 in the previous session). Meanwhile, 70 stocks remained unchanged.

Sectoral Performance:

The top gaining sector of the day was Nifty PSU Bank, which closed at 5783.85, registering a 0.43% gain.

The top losing sector was Nifty Realty, which ended at 800.15, down by 1.83%.

Out of the 12 sectoral indices, only 2 sectors closed in the green (Nifty PSU Bank and Nifty Bank), while 10 sectors ended in the red, indicating broad-based weakness across most sectors.

Note: The above numbers for Commodity futures were taken around 5 pm. NSE has not released today’s FII-DII data yet. Here’s the trend from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 20th March:

The maximum Call Open Interest (OI) is observed at 22,500, followed by 22,700, indicating strong resistance at these levels. First strong resistance levels shall most likely be at 22,600, followed by 22,800.

The maximum Put Open Interest (OI) is at 22,000, followed by 22,400, suggesting potential support at 22,200, with additional support at 22,000.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

India’s passenger vehicle sales rose 3.7% YoY to 331,254 units in February, marking the fifth straight month of growth, according to SIAM. However, monthly sales declined 5.7% after a sharp rise in January. The sector posted its highest-ever February sales, with demand expected to remain strong during upcoming festivities. Dive deeper

Jio Finance issued its maiden commercial paper worth ₹10 billion at a 7.80% yield ahead of its planned ₹30 billion bond sale later this month. The firm's bonds are rated 'AAA', supported by strong liquidity and capital buffers. The five-year bonds are expected to carry a 7.75% coupon, pending investor commitments. Dive deeper

Equity mutual fund inflows dropped 27% to ₹29,300 crore, among the lowest in FY25, amid weak market performance. AUM growth slowed to 18%, reaching ₹64.5 lakh crore, the lowest in nine months. SIP contributions declined for the second month to ₹26,000 crore. Dive deeper

IndusInd Bank reported a 2.35% hit to its net worth due to hedging miscalculations, prompting the RBI to review banks' derivatives exposures. Lenders have been asked to provide details on overseas borrowings, deposits, and forex hedges. If discrepancies emerge, banks may face external audits to assess potential systemic risks. Dive deeper

Canara Bank plans to raise to ₹4,000 crore through Basel III-compliant Tier II bonds, rated AAA/Stable by CRISIL and CARE. The bonds have a 10-year tenor with a five-year call option. Bidding will take place on March 17 via the NSE Electronic Bidding Platform. Dive deeper

MTNL shares closed 11.47% higher at ₹48.20, following the government's disclosure of ₹2,134.61 crore earnings from asset monetization. Dive deeper

Coromandel International acquired a 53% stake in NACL Industries for ₹820 crore and plans an open offer for an additional 26%. The acquisition aims to strengthen its crop protection business and expand contract manufacturing. The deal is expected to be completed in the coming months. Dive deeper

Nazara Technologies' COO Sudhir Kamath will step down on April 1 after a two-and-a-half-year tenure. Dive deeper

Bharat Electronics Ltd (BEL) secured a ₹2,463 crore contract from the Ministry of Defence to supply Ashwini Radars to the Indian Air Force. These indigenous AESA radars, developed with DRDO, offer advanced surveillance and ECCM capabilities. Dive deeper

Polycab secured a ₹3,003 crore contract from BSNL for the BharatNet project in Bihar. As the Project Implementation Agency, it will oversee network design, construction, and maintenance. The project includes a three-year execution phase and a ten-year maintenance period. Dive deeper

What’s happening globally

WTI crude oil eased to $67.5 per barrel as trade tensions, weak Chinese demand, and OPEC+ supply concerns weighed on prices. However, US data showing strong demand and lower gasoline inventories provided some support. Dive deeper

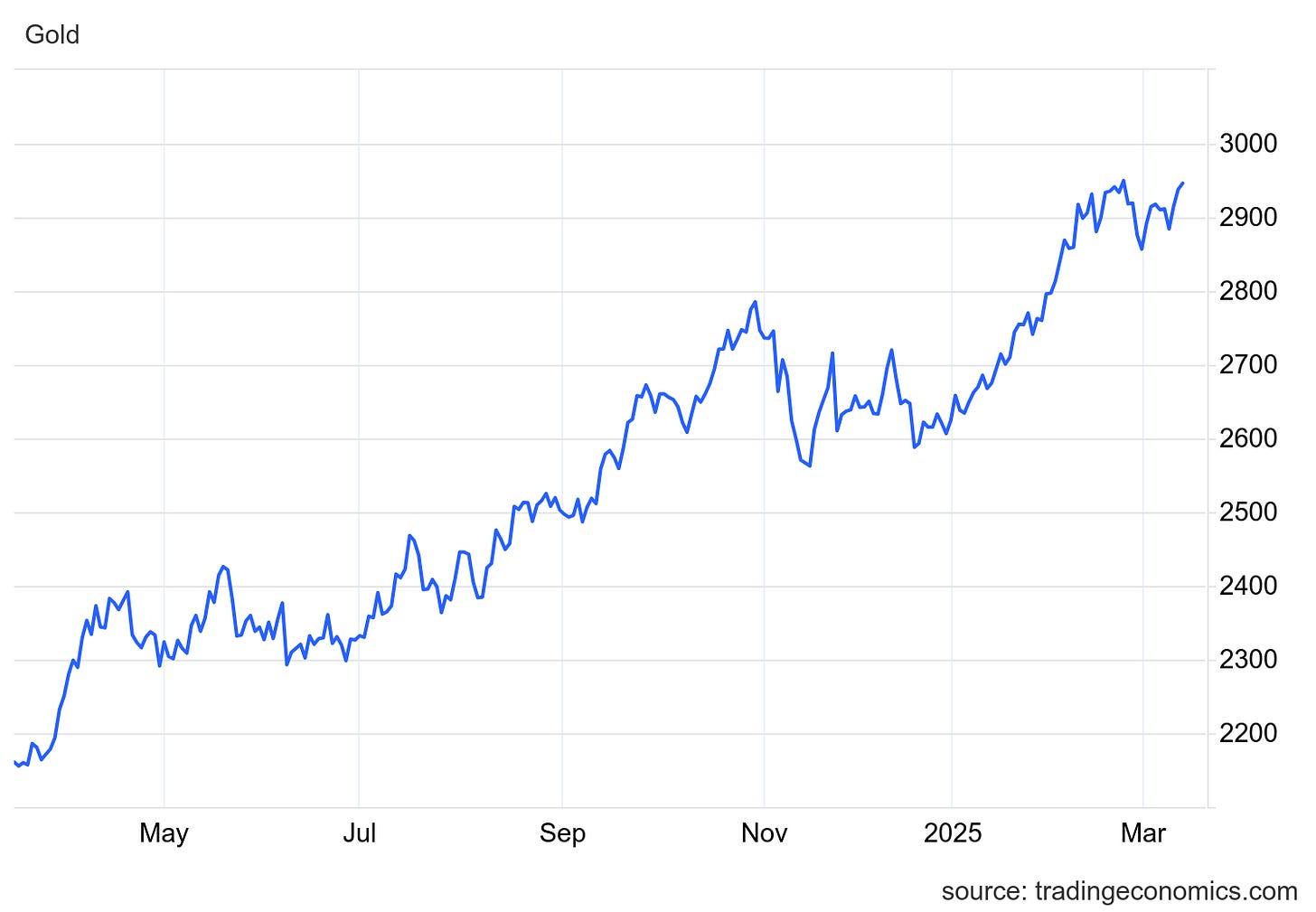

Gold climbed above $2,940 per ounce, nearing record highs, driven by safe-haven demand amid escalating US-EU trade tensions and lower-than-expected US inflation, which eased Fed policy concerns. However, inflation risks from tariffs remain. Dive deeper

US stock futures rose, extending gains led by tech stocks. Intel surged over 10% after naming a new CEO, while Adobe fell 4% on weak guidance. The S&P 500 and Nasdaq rebounded Wednesday, while the Dow slipped for a third session. Dive deeper

US producer prices are expected to rise 0.3% MoM in February, easing from 0.4% in January, with annual PPI inflation forecast at 3.3% (down from 3.5%). Core PPI is projected to increase by 0.3% MoM, while annual core inflation may slow to 3.5% from 3.6%. Dive deeper

The US budget deficit widened to $307 billion in February, exceeding expectations. Revenue rose 9% to $296 billion, while spending increased 6% to $603 billion, driven by higher interest payments, expanded tax credits, and Social Security adjustments. Dive deeper

France’s 10-year bond yield rose to 3.6%, the highest since April 2011, ahead of Fitch’s credit review on Friday. Investors are concerned about fiscal risks, rising defence spending, and the ECB’s cautious stance on rate cuts amid elevated inflation forecasts. Dive deeper

Ireland’s inflation eased to 1.8% in February, down from 1.9% in January, as price growth slowed for food, housing, and transport. However, recreation and communication costs rose. On a monthly basis, prices rebounded by 0.9% after a 0.8% decline in January. Dive deeper

South Africa’s manufacturing output fell 3.3% YoY in January, marking the third straight decline and the steepest drop since June 2024, led by weaker petroleum, food, and auto production. Monthly output rose 0.2%, rebounding from December’s 2.2% drop but missing forecasts. Dive deeper

Eurozone industrial output rebounded 0.8% MoM in January, exceeding forecasts and reversing December’s decline, driven by a recovery in intermediate and capital goods production. Annual output stabilized, ending a 20-month contraction. Dive deeper

Switzerland’s producer and import prices fell 0.1% YoY in February, marking the 22nd straight month of deflation, though at a softer pace. Monthly prices rose 0.3%, the fastest since April 2024, driven by higher pharmaceutical and electricity costs. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Keki Mistry, Former VC & CEO, HDFC on Inflation and RBI’s upcoming policy

We have seen that inflation this month has come down very significantly. If we see the February number, which was released yesterday, it clearly shows that there is a substantive reduction in inflation. Now, given the reduction in inflation, my personal view is that RBI may enhance or increase the rate cuts that they were earlier looking at. My sense was we would have looked at probably one rate cut in the next quarter, which would have been a 25 basis points cut. I still think it will be a 25 bps cut, but the overall sentiment will be a lot better and a lot easier for RBI because this inflation number has been lower than what they were targeting. - Link

Nandan Nilekani, co-founder, Infosys on the Indian IPO market

“Already it is the market with the largest number of IPOs, though the value is less compared to the US. In fact, what is happening is people are coming back. Companies that are incorporated in Singapore or the US are actually flipping here, paying more taxes so that they can list in India. Ghar waapsi is happening.’‘ - Link

Calendars

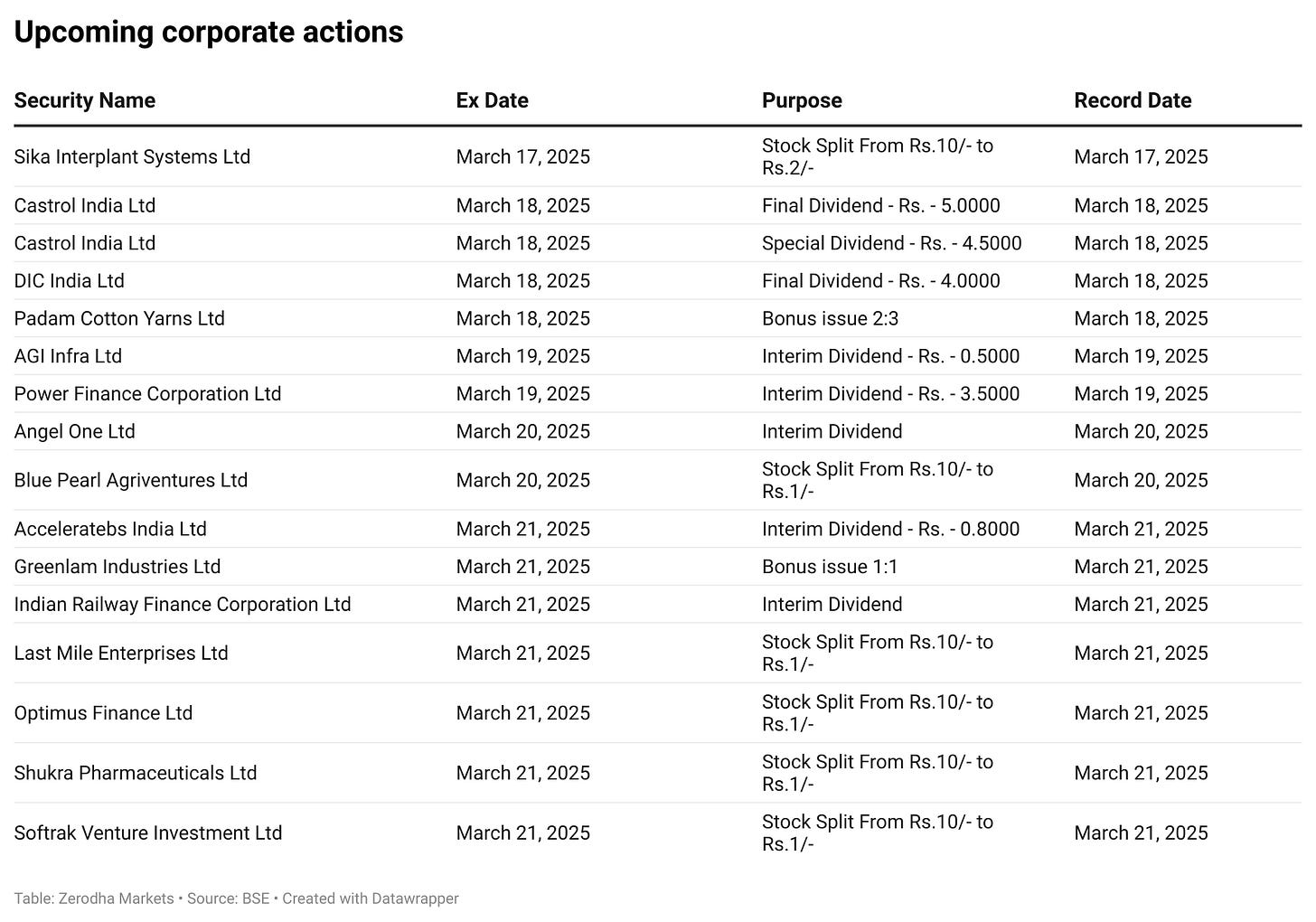

In the coming days, we have the following significant events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.