Nifty surges past 23,400 Intraday as markets extend winning streak

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Nifty opened 23 points lower, reacting to Accenture’s cautious commentary on the uncertain macro environment. The weakness was led by the IT sector, which opened 2% lower. However, after hitting the day's low of 23,132.80 within the first 15 minutes, The index rebounded sharply, gaining 120 points in the first hour as IT stocks recovered.

Following a period of consolidation, It extended its gains by another 150 points, testing 23,400. After hovering around that level, an intraday sell-off dragged it down to 22,275. However, the bears couldn’t maintain control, and in the final hour, Nifty rebounded once again, closing at 23,350.40, up 0.68%.

This marked Nifty’s best week in nearly four years, surging 1,000 points over the week. With this strong momentum, the key question now is whether the market will continue its upward trajectory or take a breather.

Broader Market Performance:

The broader market outperformed the headline indices. On the NSE, a total of 2,988 stocks were traded, with 2,120 advancing (up from 1,759 yesterday), 804 declining (down from 1,143), and 64 remaining unchanged.

Sectoral Performance:

The top-gaining sector of the day was Nifty Media, which closed 2.20% higher at 1,547.70, marking the strongest performance among all sectoral indices.

On the other hand, the top losing sector was Nifty Consumer Durables, which declined by 0.77%, closing at 36,250.40. Nifty Metal also ended in the red, down 0.55%, while Nifty IT saw a marginal gain of 0.07%, barely staying in positive territory.

In terms of market breadth, nine sectors closed in green, while three sectors ended in red, reflecting an overall positive sentiment in the market.

Note: The above numbers for Commodity futures were taken around 5 pm. NSE has not released today’s FII-DII data yet. Here’s the trend from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 27th March:

The maximum Call Open Interest (OI) is observed at 23,600, followed by 23,500 indicating strong resistance at 23,500 levels followed by 23,600. As the Index is above 23,000 it remains to be seen if the call writers go for cover or whether the previous 23,000 resistance will be retested again.

The maximum Put Open Interest (OI) is at 23,000, followed by 23,200, suggesting strong support at 23,200, with additional support at 23,000.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

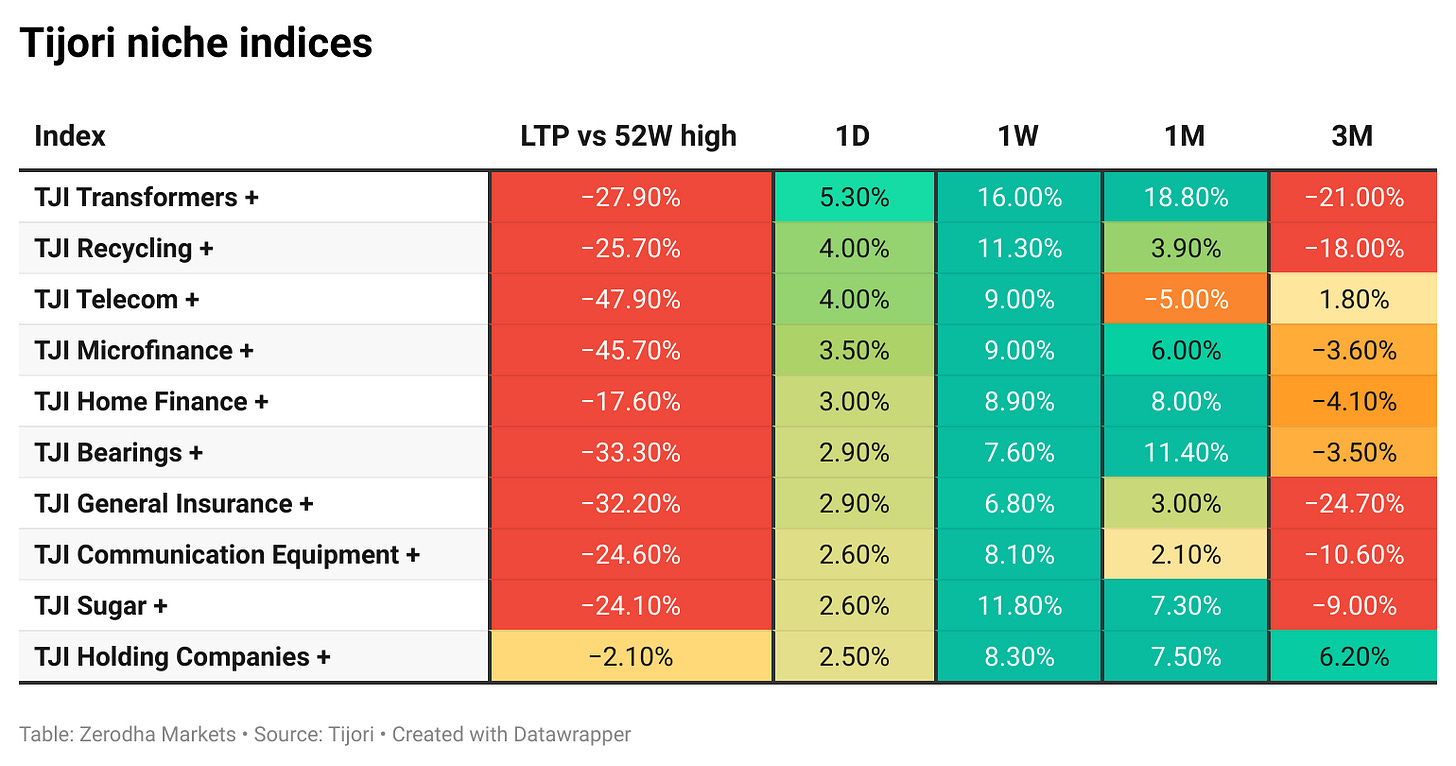

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

India's sugar exports are slowing due to rising domestic demand, especially during summer. Production estimates for 2024-25 have been revised down, with exports expected at 10 lakh tonnes. Domestic prices are increasing due to lower output and higher consumption. Dive deeper

SBI Mutual Fund sold a 4.7% stake in National Highways Infra Trust (NHIT) for ₹815 crore, reducing its stake from 9.34% to 4.69%. The units were sold at an average price of ₹133.50 each, with Larsen & Toubro and Vidyaniti LLP acquiring nearly 6 crore units. Dive deeper

Maharashtra, Kerala, and Tamil Nadu received a significant portion of India's total remittances in FY24. A shift in remittance sources is noticeable, with advanced economies playing a larger role. Projections suggest a continued increase in remittances in the coming years. Dive deeper

Adani Energy Solutions has secured a ₹2,800 crore transmission project in Mundra, Gujarat, aimed at supporting green hydrogen and ammonia production. The project includes upgrading the Navinal substation and constructing new transmission lines, boosting the company's infrastructure capacity. Dive deeper

Manappuram Finance shares rose after Bain Capital announced it would acquire an 18% stake for Rs 4,385 crore, aiming to drive growth and enhance operations. The deal includes a mandatory open offer for an additional 26% stake, with Bain's stake potentially rising to 41.7%. The promoters will remain fully invested, and the transaction will help fuel the company's next phase of growth. Dive deeper

Hindalco plans to invest Rs 45,000 crore in its aluminium, copper, and speciality alumina businesses over the next 3-4 years, focusing on upstream operations and green initiatives. The investment will support its growth strategy, which includes contributions to EV mobility, renewable energy, and advanced technologies. Dive deeper

Hero MotoCorp has made an investment of ₹525 crore in Euler Motors, marking its entry into the electric three-wheeler market. This move aims to strengthen its position in the fast-growing EV sector, where electric vehicles are expected to account for 35% of total sales soon. Dive deeper

JSW Energy raised ₹800 crore through non-convertible debentures (NCDs) in two tranches. The unsecured NCDs have a face value of ₹1 lakh each, with the first tranche raising ₹400 crore and the second tranche also ₹400 crore. The company had earlier approved raising to ₹3,000 crore through NCDs. Dive deeper

Indian Bank plans to raise an additional ₹5,000 crore via long-term infrastructure bonds, on top of the ₹10,000 crore already raised this fiscal. The bank's board approved the proposal, which will take place over one or more tranches. Dive deeper

Hindustan Construction Company's shares surged nearly 15% after securing a ₹2,470 crore contract for a 1,000 MW pumped storage project in Maharashtra. The joint venture with Tata Projects will handle significant civil and hydro-mechanical works, strengthening HCC’s position in India's hydropower sector. Dive deeper

Larsen & Toubro shares rose nearly 2% after securing large orders worth between ₹2,500 crore and ₹5,000 crore from Brigade Group for residential and commercial projects in Hyderabad and Chennai. The projects include luxury towers, a commercial tower, and retail and hotel spaces. Dive deeper

Zomato has received approval to change its name to Eternal Ltd., aligning with its broader business strategy. The company will now operate under the Eternal brand, which will encompass multiple verticals. Despite the change, Zomato's food delivery service will continue under its existing name. Dive deeper

Sebi has revised shareholding pattern disclosures to improve transparency. The new format includes details on pledged shares, non-disposal undertakings, and shares on a fully diluted basis. These changes will take effect from the quarter ending June 30, 2025. Dive deeper

What’s happening globally

Gold remained near record highs at $3,030 per ounce on Friday, heading for a third consecutive weekly gain. This was driven by dovish signals from the Federal Reserve, rising economic uncertainty, and demand for gold as a safe haven. Dive deeper

The US dollar index rose to 104 on Friday, marking its third consecutive session of gains, as investors weighed the Federal Reserve's policy outlook. The Fed signaled two rate cuts this year while citing growth, employment, and inflation risks. Global growth concerns and trade tensions contributed to the dollar's strength. Dive deeper

Japan's annual inflation rate eased to 3.7% in February 2025, down from 4.0% in January, with a slowdown in electricity and gas prices due to energy subsidies. Core inflation dropped to 3.0%, while monthly CPI fell by 0.1%, marking the first decline since September. Dive deeper

The Bank of Russia maintained its key interest rate at 21% in March 2025, signaling no immediate need for further tightening. Inflationary pressures persist, but risks have eased. The decision contrasts with earlier hawkish stances amid a ruble surge and improved U.S.-Russia relations. Dive deeper

UK's public sector net borrowing rose to £10.7 billion in February 2025, exceeding expectations. Increased spending on goods, services, and local government drove the rise, while higher income and corporation tax receipts helped offset the costs. Total borrowing for the financial year reached £132.2 billion, £20.4 billion above the forecast. Dive deeper

US natural gas futures dropped to $3.9/MMBtu after a larger-than-expected inventory build, with utilities adding 9 billion cubic feet of gas to storage. LNG exports reached a record 15.7 bcfd, and production in the Lower 48 states rose to 105.7 bcfd in March. Dive deeper

Trading on the Istanbul stock exchange was halted twice on March 21, 2025, after a sharp drop in the main index, driven by political unrest and protests. The market decline followed the detention of a prominent political leader, leading to increased volatility and reactions in the financial markets. Dive deeper

Malaysia's inflation dropped to 1.5% in February 2025, the lowest since January 2024, with food and transport costs slowing. Core inflation rose to 1.9%, marking the largest increase in six months. Prices for clothing and communication continued to fall. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Donald Trump, President of the United States on Federal Reserve Rate Cuts

“The Fed would be MUCH better off CUTTING RATES as US Tariffs start to transition (ease!) their way into the economy.”

“Do the right thing. April 2nd is Liberation Day in America!!!” - Link

K N Radhakrishnan, Director & CEO, TVS Motor on appointing Peyman Kargar as Head of International Business

“Peyman’s prolific global leadership experience and expertise will add significant value to the company.”

“The company has been strengthening its position in international markets and has plans to expand further in advanced economies.”

“We are confident that under his leadership, we will further strengthen our market position and continue to set benchmarks. We wish him the very best and welcome him to the TVS Motor family.” - Link

Julie Sweet, Chair and Chief Executive Officer, Accenture on US Government spending cuts

First, Accenture Federal Services. Federal represented approximately 8% of our global revenue and 16% of our America’s revenue in FY 2024. As you know, the new administration has a clear goal to run the federal government more efficiently. During this process, many new procurement actions have slowed, which is negatively impacting our sales and revenue. - Link

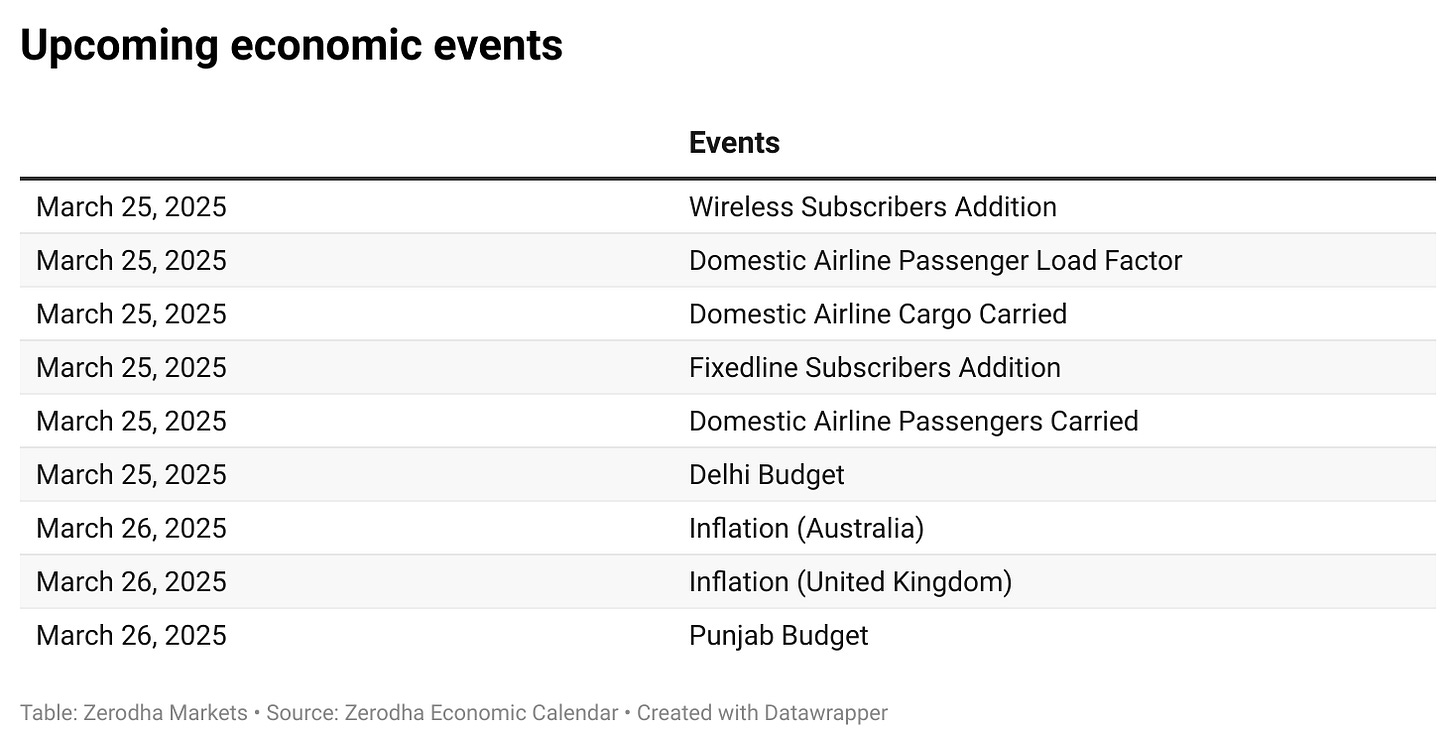

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.