Nifty sustains 22,500 as global optimism fuels market gains

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Nifty opened with a 43-point gap down but quickly rebounded, surging nearly 200 points to 22,577 before cooling off to around 22,460—all within the first 90 minutes. For the rest of the day, it traded in a narrow 60-point range between 22,460 and 22,520, eventually closing at 22,508, up 0.49%.

Looking ahead, Nifty remains in a tight range, and its next move will depend on whether it retests the resistance zone near 22,800 or heads lower toward 22,300–22,200. A key factor to watch is whether U.S. markets stabilize or if the recent decoupling between Indian and U.S. markets persists in the short term.

Broader Market Performance:

The broader markets underperformed the headline indices, indicating weak market breadth. Out of 2,982 stocks traded on the NSE, 1134 advanced (up from 984 yesterday), while 1,781 declined (up from 1,894 in the previous session). Meanwhile, 67 stocks remained unchanged.

Sectoral Performance:

The top-performing sector for the day was Nifty Pharma, which gained 1.56%, leading the market with strong momentum. Following closely behind were Nifty Auto and Nifty Metal.

On the other hand, the worst-performing sector was Nifty Media, which declined by 0.65%, marking the biggest loss among sectoral indices.

Overall, eight sectors closed in green, reflecting positive movement, while four sectors ended in red, showing a slight weakness in those areas.

Note: The above numbers for Commodity futures were taken around 5 pm. NSE has not released today’s FII-DII data yet. Here’s the trend from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 20th March:

The maximum Call Open Interest (OI) is observed at 23,000, followed by 22,800, indicating strong resistance at these levels. First strong resistance levels shall most likely be at 22,700, followed by 22,800.

The maximum Put Open Interest (OI) is at 22,500, followed by 22,000, suggesting potential support at 22,200, with additional support at 22,000.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

India’s trade deficit narrowed to $14.05 billion in February 2025, the lowest since August 2021, as imports fell 16.3% to $50.96 billion due to lower energy prices, while exports declined 10.9% to $36.91 billion. The rupee’s relative strength also impacted export competitiveness. Dive deeper

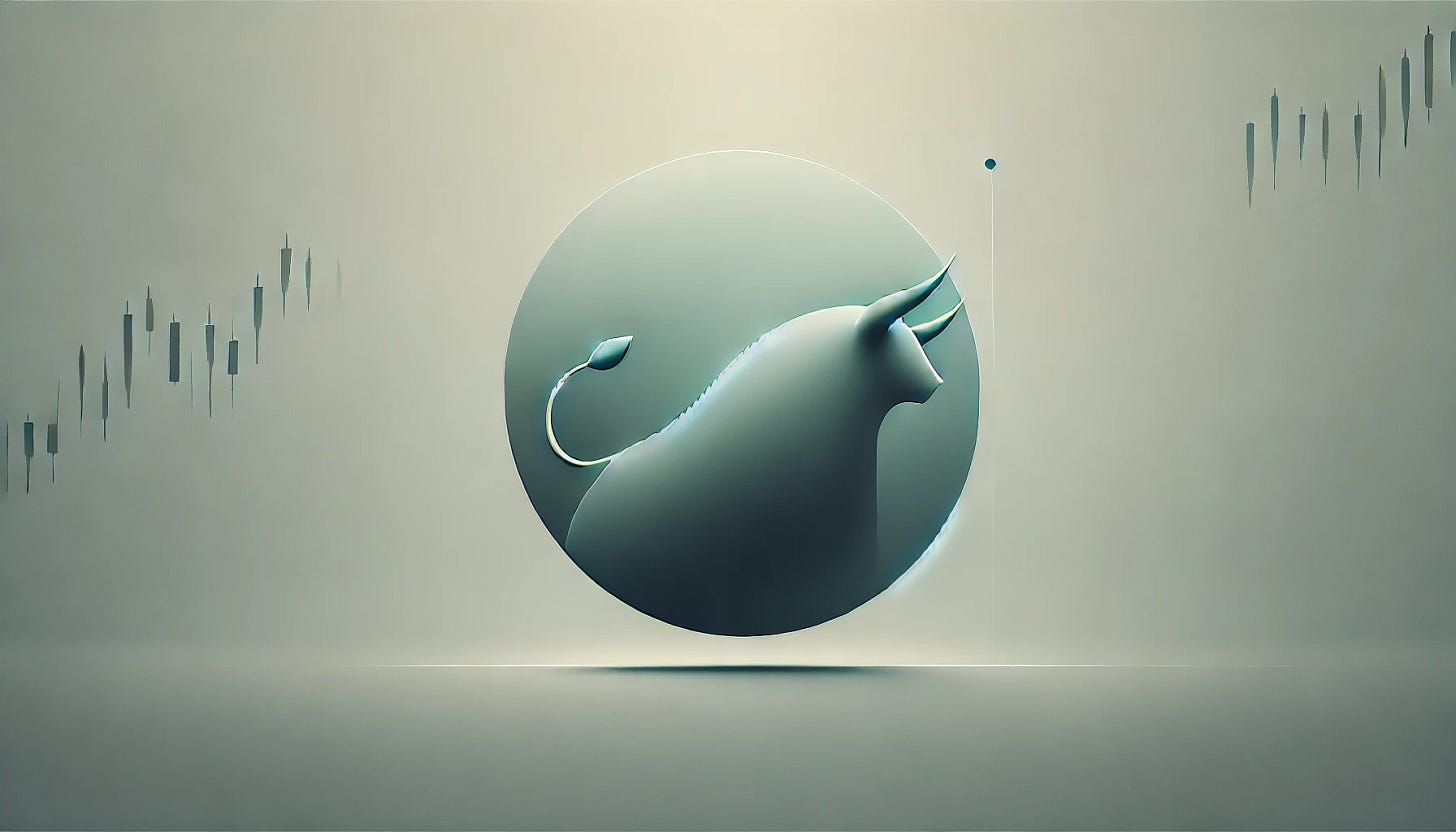

India’s wholesale inflation rose to 2.38% YoY in February, up from 2.31% in January, marking the fastest pace since June 2024. Manufacturing prices surged, while food and primary articles inflation eased. Fuel and power prices saw the smallest decline in five months. Dive deeper

SpiceJet's Ajay Singh sold a 1% stake for ₹52 crore at an average price of ₹45.34 per share, reducing his holding to 22%. This comes amid ongoing insolvency petitions against the airline, while it reported a ₹26 crore profit for Q3FY25. Dive deeper

Andhra Pradesh's Capital Region Development Authority (CRDA) signed an ₹11,000 crore loan agreement with HUDCO for Amaravati's construction. The deal, approved by HUDCO’s board in January, was formalized in the presence of Chief Minister Chandrababu Naidu in Undavalli, Guntur. Dive deeper

KEC International secured new orders worth ₹1,267 crore, raising its year-to-date order intake to ₹23,300 crore. The contracts span transmission and distribution projects in India and abroad, reinforcing growth prospects. Dive deeper

Tata Motors' board committee will meet on March 19 to consider issuing non-convertible debentures (NCDs) worth up to ₹2,000 crore. Shares rose nearly 1% following the announcement, signalling the company’s intent to raise capital through debt markets. Tata Motors also announced a 2% price increase for its commercial vehicles from April 2025, citing rising input costs. Dive deeper

IndusInd Bank shares gained nearly 6% during the session but closed 0.75% higher as the RBI reassured customers about the bank’s financial stability. The central bank highlighted the lender’s capital adequacy ratio of 16.46% and liquidity coverage ratio of 113%, advising depositors against reacting to speculative reports. Dive deeper

Gensol Engineering shares hit a life low, falling over 45% since listing, locked in the lower circuit for the fifth session. Concerns over loan servicing delays and alleged data falsification led to rating downgrades, with ₹2,050 crore in debt marked as default. Dive deeper

Ola Electric shares fell over 7%, hitting a 52-week low, after Rosmerta Digital Services filed an insolvency petition against its subsidiary, Ola Electric Technologies. The company disputes the claims and plans to challenge the proceedings. Dive deeper

Blackstone has launched an open offer to acquire up to 26% of Kolte-Patil Developers for ₹758.56 crore at ₹329 per share. This follows its agreement to acquire a 40% stake for ₹1,150 crore, marking its entry into India’s residential market. Dive deeper

What’s happening globally

Brent crude rose to $71.2 per barrel as China pledged new consumption-boosting measures and the U.S. intensified strikes on Yemen’s Houthis. Stronger-than-expected Chinese economic data and geopolitical risks, including Ukraine tensions, also supported prices. Dive deeper

Gold neared $2,990 per ounce, driven by safe-haven demand amid trade tensions, U.S. strikes on Yemen’s Houthis, and continued central bank purchases. Investors await the Federal Reserve’s policy decision, with markets expecting only two rate cuts this year. Dive deeper

China's industrial production grew 5.9% YoY in Jan-Feb 2025, surpassing forecasts but easing from December’s 6.2% rise. Manufacturing slowed, while mining activity accelerated, with notable growth in sectors like computers, cars, and chemicals. Dive deeper

Indonesia’s exports surged 14.05% YoY to $21.98 billion in February, marking the fastest growth since January 2023, driven by strong non-oil and gas shipments. Sales to ASEAN jumped 46.13%, while mineral fuel exports plunged 18.37%. Dive deeper

The OECD lowered its G20 growth forecast to 3.1% for 2025 (from 3.3%) and 2.9% for 2026 (from 3.2%), citing trade barriers and policy uncertainty. The US, Eurozone, and UK saw growth downgrades, while China’s outlook improved to 4.8% for 2025. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Lee Jae-yong, Chairman, Samsung

"Samsung is facing a do-or-die survival issue. We need to reflect deeply from the top, even if it means sacrificing short-term profits, we must invest for the future," - Link

Pavitra Shankar, Managing Director of Brigade Enterprises Limited

Have seen good traction in Bangalore & Hyderabad for our recent premium residential launches. Market not as frenzied as it was a year ago; prices have stabilised. premium housing still seeing traction; Co expects 15-20% annual sales growth - Link

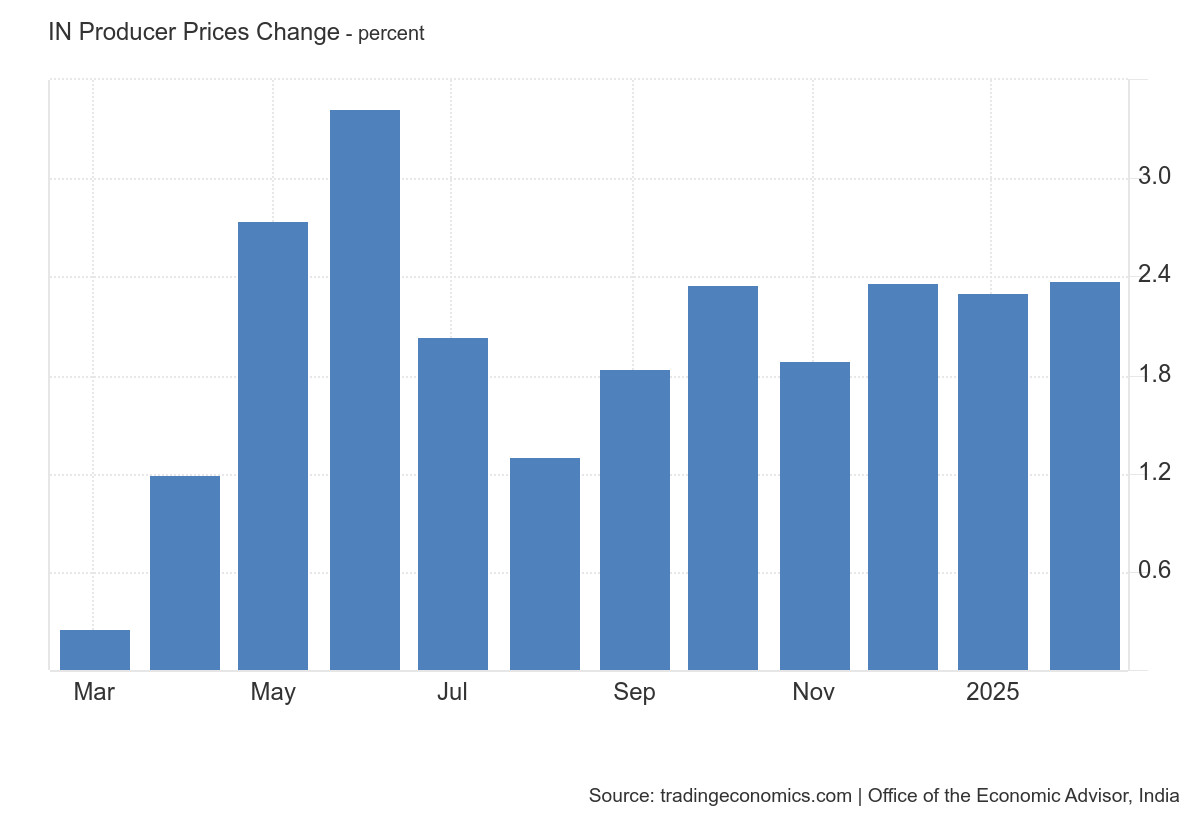

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.