Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Nifty opened with a massive 1,150-point gap down at 21,758.40, following a sharp sell-off in US markets, where the Dow Jones and Nasdaq plunged 5.5% overnight and futures dropped another 3–4% this morning. The decline came after the US announced new tariffs, prompting retaliatory measures from China.

After opening at the day's low, the market recovered 400 points to 22,150 before another round of selling. It hovered around 21,950–22,000, then tested 21,820–21,840. In the final two hours, a strong rebound took it to 22,240, closing at 22,161.80, down 3.24% for the day.

All eyes will now be on global cues, with US markets having fallen nearly 10% over the past 2–3 sessions. Whether the sell-off continues or a pullback emerges remains to be seen. Markets will also closely track the upcoming RBI monetary policy decision, inflation data, and the start of earnings season.

Broader Market Performance:

In line with the headline indices closing lower, the broader market had an extremely weak session. Out of 3,036 stocks traded on the NSE, 327 advanced, 2,640 declined, and 69 remained unchanged.

Sectoral Performance:

On a highly volatile day, all sectoral indices closed in the red, with no sector managing to end in positive territory. Among the worst performers, Nifty Metal took the biggest hit, plunging 6.75%, followed by Nifty Realty, which dropped 5.69%, and Nifty Media, which fell 3.94%. On the relatively better side, Nifty FMCG was the least affected, closing down just 1.10%, making it the top-performing sector of the day in relative terms.

In total, all 12 sectoral indices closed in the red, indicating broad-based selling pressure across the market.

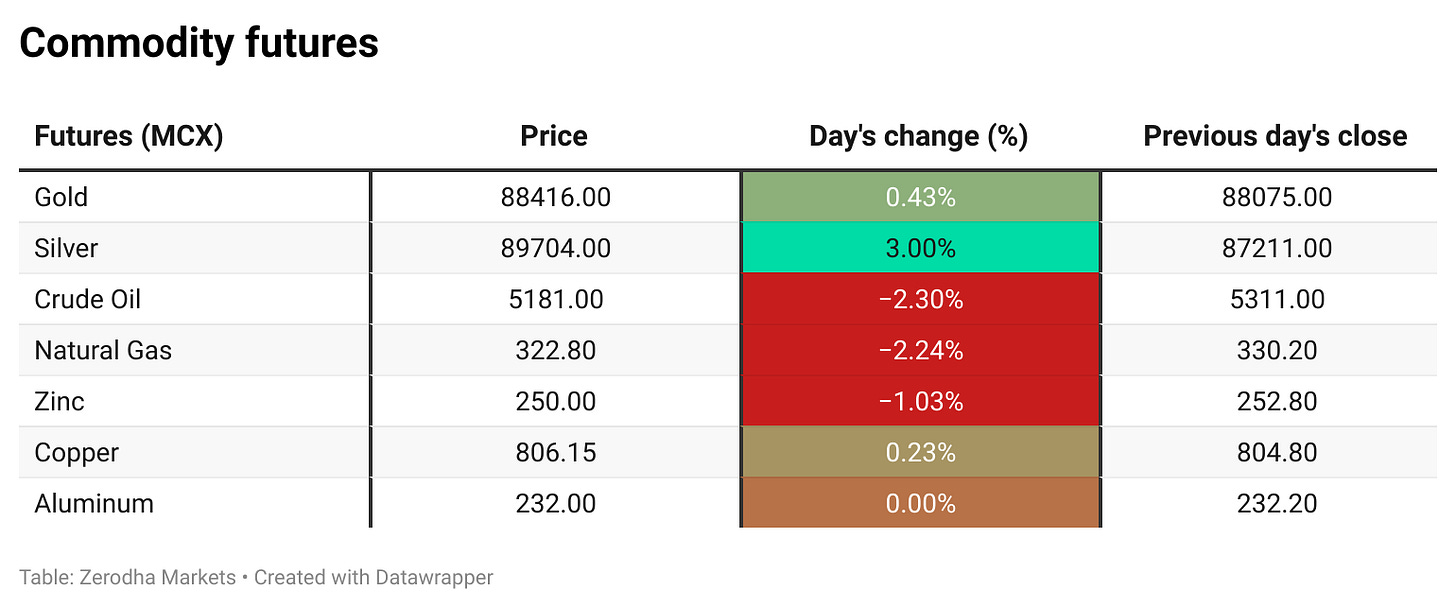

Note: The above numbers for Commodity futures were taken around 5 pm. NSE has not released today’s FII-DII data yet. Here’s the trend from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 9th April:

The maximum Call Open Interest (OI) is observed at 22,000, followed by 22,500, indicating strong resistance at 22,400 to 22,500 zone.

The maximum Put Open Interest (OI) is at 22,000, followed by 21,800, suggesting strong support at 22,000, with additional support at 21,800.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

India VIX surged by 65.62% to 22.79 as global markets sold off due to U.S.-China trade tensions and recession fears.

The government has increased the excise duty on petrol and diesel by ₹2 per litre, raising petrol duty to ₹13 per litre and diesel duty to ₹10. However, retail prices will remain unchanged, with the hike likely offsetting reductions due to falling international oil prices. Dive deeper

Economists widely expect the Reserve Bank of India to cut the repo rate by 25 basis points due to easing domestic inflation. However, opinions vary on whether the RBI will shift to an accommodative stance amid global trade uncertainty and volatile market conditions. Dive deeper

Tata Group is set to raise $1.3 billion for its digital assets, BigBasket and 1mg, with $1 billion for BigBasket to shift towards quick commerce and $300 million for 1mg’s expanded healthcare services. The fundraising process, led by Citi and Moelis, aims to strengthen Tata Digital's growth strategy amidst competition from Blinkit and Zepto. Dive deeper

The IL&FS Group has discharged ₹45,281 crore to creditors as of March 2025, completing the resolution of 197 out of 302 entities. This marks an 18.9% increase from the previous report in October 2024. The group aims for an overall recovery of ₹61,000 crore, with 105 entities left to resolve. Dive deeper

Metropolis Healthcare Ltd. has agreed to acquire DAPIC, a pathology and imaging center in Dehradun, for ₹35.01 crore. The acquisition, through Metropolis Histoxpert Digital Services, will enhance the company’s growth strategy, particularly in Uttar Pradesh and Uttarakhand. Dive deeper

The Central Government has released over Rs 4,200 crore to Andhra Pradesh for the Amaravati Capital Development project, following the first disbursement of $205 million from the World Bank. The total funding commitment from the World Bank and ADB is Rs 13,600 crore for phase I. Further funds will be released after progress and submission of utilization certificates. Dive deeper

Delhivery’s share price rose after announcing its acquisition of Ecom Express for Rs 1,407 crore. The deal, set to enhance scale and service quality, is expected to foster growth. Dive deeper

Mazagon Dock shares fell 8.39% to ₹2,329 after the government decided to exercise the oversubscription option, selling an additional 1.18% stake, increasing the total offer size to 4.01%. Dive deeper

Bajaj Housing Finance reported a 26% growth in Assets Under Management (AUM), reaching Rs 1,14,680 crore as of March 31, 2025. The company also saw a significant rise in gross disbursements, totaling Rs 14,250 crore in Q4 FY25, up from Rs 11,393 crore the previous year. Dive deeper

Glenmark Pharmaceuticals appointed Anurag Mantri as President and Global CFO, effective April 7, 2025. Mantri, with over 24 years of experience, previously served as CFO at Jindal Stainless. His appointment follows the early retirement of VS Mani, Glenmark's current CFO. Dive deeper

boAt's parent company, Imagine Marketing, has filed draft IPO papers through the confidential pre-filing route with Sebi. This marks their second attempt at going public, with the flexibility to adjust the offering size by up to 50% until later stages. Dive deeper

ITC has acquired a 43.75% stake in Ample Foods for ₹131 crore, strengthening its position in the growing frozen and ready-to-cook food market. This acquisition includes brands like Prasuma and Meatigo, aligning with ITC's strategy to expand its value-added food portfolio in the FMCG sector. Dive deeper

Tata Motors shares fell 5.34% after Jaguar Land Rover paused US shipments due to a 25% tariff imposed by the Trump administration. The decline came amid muted domestic sales for March 2025. Dive deeper

What’s happening globally

Brent crude oil futures fell over 3% to $63.5 per barrel, hitting its lowest since April 2021, as the escalating trade war raised concerns about weakening global demand. The U.S.-China tariffs, coupled with OPEC+ output hikes and Saudi Aramco's price cuts, further pressured oil prices. Dive deeper

Gold dropped below $3,030 per ounce, extending losses for the third session, as margin calls and profit-taking spread. The escalation of the trade war and inflation concerns further weighed on the market. Dive deeper

Silver hovered near $30/oz on Monday, staying volatile amid escalating US-China trade tensions. It fell 16% over three sessions as investors sold metals to cover broader market losses. Dive deeper

European natural gas futures dropped over 5% to below €35/MWh, nearing September 2024 lows due to fears of reduced industrial activity amid the global trade war. Dive deeper

The Nikkei 225 and Topix Index plunged 7.8%, the lowest since October 2023, as global recession fears grew amid escalating trade tensions. Japanese banks and major stocks led the decline, with sharp losses across various sectors. Dive deeper

The US 10-year Treasury yield fell to 3.9%, a six-month low, as Trump’s trade war raised recession fears. Despite this, markets are pricing in 100 basis points of rate cuts by year-end. Dive deeper

Australian job ads rose 0.4% in March 2025, reversing the prior month's decline and remaining 15.5% above pre-pandemic levels. Despite a 7.9% annual drop, sectors like retail, sales, and management showed growth. The labor market remains relatively tight, with a slight rebound in tech. Dive deeper

Japan's foreign reserves rose by $19.23 billion to $1.27 trillion in March 2025, the highest since April 2024. The reserves include foreign currency reserves, gold, and SDRs, with no foreign exchange interventions from October to December 2024. Dive deeper

SoftBank Group plans to raise 600 billion yen ($4.10 billion) through bond issuance to retail investors. The funds will be used to redeem existing bonds and partially cover the acquisition of chip designer Arm. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Nilesh Shah, MD, Kotak AMC on India’s role in a global tariff war

“Our markets are fairly valued, not cheap. In the short term, we’ll face pressure due to global uncertainty, but if we capture opportunities from the US tariff shift, we can emerge stronger”

“Tariffs on India are lower compared to peers, and sectors like IT and pharma are currently outside the ambit. But if the global pie shrinks, even a larger share may not help us grow meaningfully”

“Investor decisions may turn emotional, not rational, amid geopolitical tension. That could benefit emerging markets like India, which look far cheaper than developed peers” - Link

Sonal Varma, Chief Economist, Nomura, on US tariffs and India’s growth outlook

“India’s direct exposure to US tariffs is small, but the indirect effects like weaker global demand and tighter financial conditions could shave off 20 to 30 basis points from GDP”

“We estimate India’s FY26 GDP growth at 6 percent but there’s downside risk even to that. We’ve cut projections more sharply for other open economies in Asia and the US”

“The risk of a global trade war is real. Countries may impose anti-dumping duties and the second phase could see excess products redirected putting pressure on global goods prices” - Link

Calendars

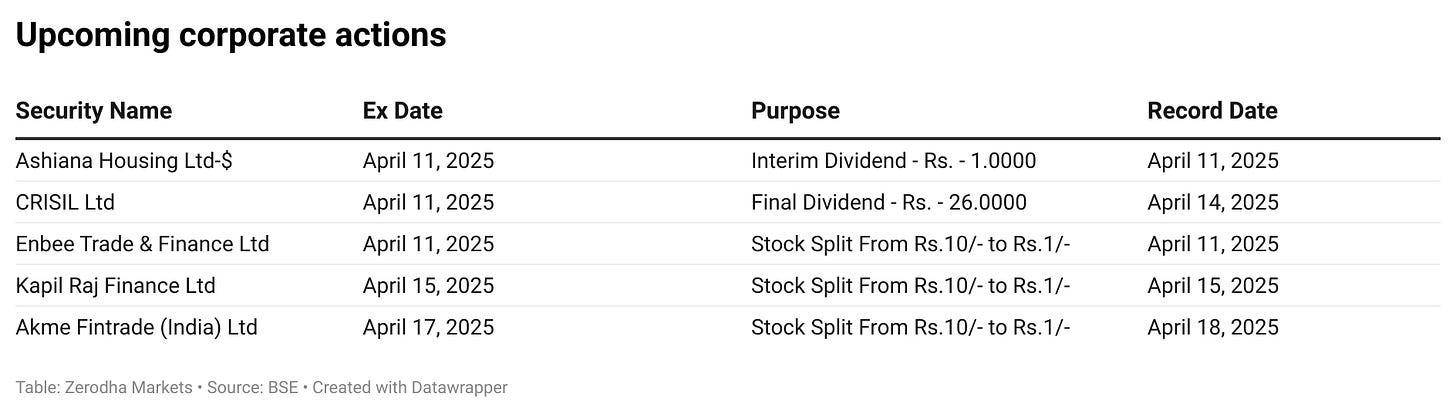

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word! You can join the conversation around the 26% tariffs on India on TradingQnA

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.