Profit booking in markets ahead of the Fed event

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Market Overview

Nifty ended its 2-day recovery, closing at 24,199.35, down 1.16%, after failing to cross a key resistance level. While headline indices fell by 1.16%, midcaps and small caps showed relatively smaller declines. On the NSE, there were 1,087 stocks advancing and 1,727 declining. The market dip was largely due to profit booking following a 700-point recovery over the past two days ahead of tonight’s Federal Reserve’s Interest rate decision.

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market.

What’s happening in India

Elara Capital sees mixed impact on India, Key sector gains under Trump

What’s the potential Impact?

Trump's Potential Second-Term Impact on Markets: Elara Capital's report predicts that a second term for Donald Trump as US President could favor US equities and provide a mixed but generally positive impact on India's economy.

Sectoral Gains and Challenges for India: Indian sectors like IT, pharmaceuticals, electronics manufacturing services (EMS), and defense could benefit from Trump's policies, while higher tariffs on Indian exports are a possible risk.

US Federal Reserve Stance: Under a Trump administration, the Federal Reserve may adopt a hawkish stance, potentially raising interest rates further unless there is a significant dip in inflation and growth rates.

Indian Rupee Pressure: Strengthening of the US dollar and rising US bond yields could depreciate the Indian rupee, with the USD/INR exchange rate possibly hitting 84.5.

Global Trade Tensions and Opportunities: Increased tariffs on Chinese goods by the US could create mixed results for Indian exports in overlapping categories but may also open up new manufacturing opportunities for India.

Why?

Economic Policies Under Trump: Expected economic and foreign policies under a potential second Trump term include a focus on domestic manufacturing and a "Make in America" agenda, which could impact Indian exports.

US Dollar and Bond Yields: The Federal Reserve's potential hawkish stance could strengthen the US dollar, pressuring emerging market currencies, including the rupee.

Sector Resilience: Indian sectors like IT and pharma have strong US exposure, making them resilient to potential global economic shifts.

Trade Dynamics: Anti-China policies may benefit Indian exports, while trade barriers could pose risks in some sectors.

Energy Market Changes: Trump's emphasis on fracking and boosting US oil output could benefit oil-importing economies like India by keeping global oil prices lower.

Source: The Hindu business line

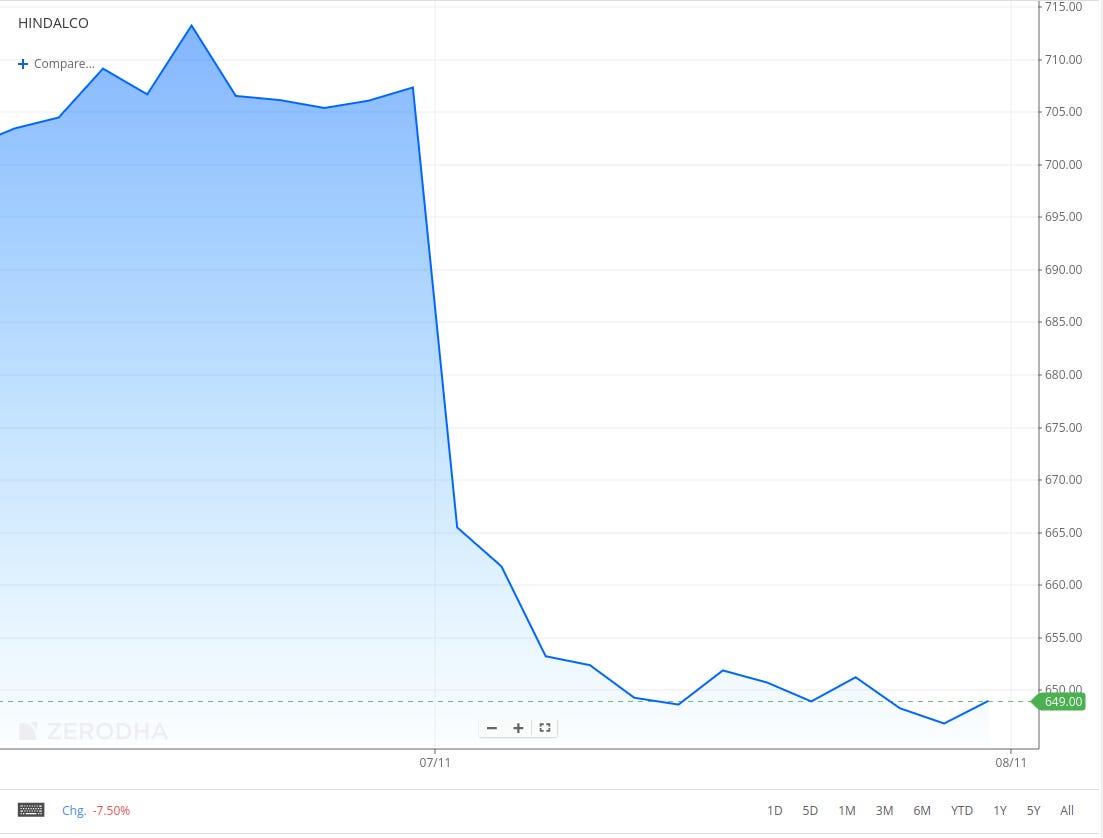

Hindalco (-8.5%) shares slide

What happened:

Hindalco Ltd., part of the Aditya Birla Group, was the top loser on the Nifty 50 index on Thursday, November 7.

The decline followed the quarterly results announcement from its unit, Novelis, late Wednesday night.

Why?

The primary reason for the fall was Novelis withdrawing its short-term EBITDA per tonne guidance of $525.

Novelis cited tight scrap spreads due to accelerated scrap purchases by China as the reason for suspending its guidance.

Source: CNBC TV18

Banks asked to boost loans for the agri-allied sector

The finance ministry has asked public sector banks (PSBs) to meet their loan targets for agri-allied activities like animal husbandry, dairying, and fisheries this financial year. The progress was reviewed in a meeting led by M Nagaraju, Secretary of the Department of Financial Services, along with banks, NABARD, and state representatives.

Why is this important?

These sectors play a key role in supporting agriculture and creating rural jobs.

Reducing regional gaps in loans can help areas with untapped potential, such as animal farming and fisheries.

The National Bank for Agriculture and Rural Development (NABARD) is working to ensure fish farmers can access benefits like the Kisan Credit Card (KCC).

Improving loan access helps boost growth and strengthen rural livelihoods.

Source: Economic Times

India’s FMCG sector resilient with rural growth outpacing urban amid softening demand

What happened:

FMCG Sector Growth: India’s FMCG sector grew by 5.7% in value and 4.1% in volume during the July-September quarter, according to NielsenIQ.

Rural Leads Urban: Rural volume growth rose by 6%, outpacing urban growth for the third consecutive quarter, despite softer consumption in both regions.

Small Manufacturers’ Comeback: Small manufacturers saw a resurgence after previous declines, while major players lagged in value growth.

HUL’s Performance: Hindustan Unilever (HUL) reported a gradual recovery in rural demand but a moderation of urban market growth.

Price Increases: Crude palm oil price hikes prompted HUL to consider increasing product prices gradually.

Traditional vs. Modern Trade: Traditional trade volume grew by 4.1%, while modern trade slightly outpaced urban growth.

Packaged Food Growth: Consumption of packaged foods grew to 3.4% in July-September from 2.1% in the previous quarter.

Why?

Economic Resilience: Despite softer overall consumption, the FMCG sector showed resilience due to steady value growth and marginal price increases.

Rural Recovery: Improved rural demand supported by growth in packaged food consumption and traditional trade.

Market Adjustments: Urban demand moderated after being the primary growth driver in recent quarters.

Commodity Price Pressures: Rising crude palm oil and other commodity costs pushed large players like HUL to plan price adjustments.

Small Manufacturer Gains: Small manufacturers bounced back with strong volume growth, especially in food products, following declines in previous quarters.

Source: Business Standard

SEBI plans independence for Clearing Corporations

What happened?

Clearing corporations, responsible for settling trades, are currently fully owned by their parent stock exchanges. To address concerns about conflicts of interest, SEBI is considering separating them. A public consultation on this proposal will be launched soon.

Why?

SEBI wants clearing corporations to work independently and ensure transparency in their operations. It also plans to conduct independent evaluations of market infrastructure institutions (MIIs) to strengthen their role as public service providers.

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

Mahindra & Mahindra (-2.41%)

What happened:

Standalone net profit increased 13% YoY to ₹3,841 crore.

Revenue from operations rose 12% YoY to ₹28,919 crore.

EBITDA stood at ₹5,270 crore, with margins at 18.2%.

Total standalone volumes grew 9% YoY to 2.31 lakh units, including record Utility Vehicle (UV) sales of 1.36 lakh units and SUV sales increasing by 18% YoY.

Tractor volumes increased 4% YoY to 92,382 units.

Consolidated net profit rose 35% YoY to ₹3,171 crore, with consolidated revenue up 10% YoY to ₹37,924 crore.

Why?

Record UV sales and overall growth in the auto segment supported higher volumes and revenue.

Operational improvements in the farm machinery segment contributed to better margins.

Page Industries (+1.69%)

What happened:

Page Industries’ Q2 profit rose 30% YoY to ₹1.95 billion

Revenue increased 11% YoY to ₹12.46 billion.

EBITDA margin expanded from 20.5% to 22.6%.

Declared an interim dividend of ₹250 per share for FY25.

Why?

Increased demand for premium products targeted at high-income consumers fueled revenue growth.

Rising health-consciousness and gym activities boosted the athleisure segment.

Stable input costs and improved efficiency contributed to higher operating profits.

Anticipated festive season demand is expected to further boost sales.

Trent (-6.77%)

What happened:

Net profit increased 47% YoY to ₹355 crore vs ₹228 crore last year.

Revenue rose 39% YoY to ₹4,156.67 crore vs ₹2,982.42 crore in the previous year.

EBIT margin improved to 10.8% vs 9.8% in Q2 FY24.

Standalone revenue grew 39% YoY to ₹4,035.56 crore vs ₹2,902 crore, while net profit was ₹423.44 crore vs ₹289 crore.

Why?

Growth was driven by 7 new Westside stores and 34 Zudio stores, including one in Dubai, across 27 cities.

Improvements in product offerings, supply chain, and store management contributed to better margins.

RVNL (0.24%)

What happened:

Q2 FY25 net profit dropped 27% YoY to ₹286.88 crore

Revenue declined 1.21% YoY to ₹4,854.95 crore.

On a QoQ basis, profit increased by 28.12%, and revenue rose by 19.18%.

Why?

Lower operational revenue from key projects and steady fixed costs limited profit margins.

Slower project execution timelines in certain segments contributed to reduced revenue generation during the quarter.

Increased tax expenses QoQ also affected profitability, further impacting the net profit margin.

Escorts Kubota (-2.87%)

What happened:

Q2 net profit jumped 54% YoY to ₹324 crore,

Revenue remained flat at ₹2,488.5 crore.

EBITDA was flat at ₹265 crore with margins steady at 10.6%.

Tractor sales decreased by 0.9% and construction equipment sales dropped 18.4%.

The company signed a deal to sell its railway equipment business to Sona BLW Precision Forgings for ₹1,600 crore.

Why?

The decline in tractor and construction equipment sales impacted overall sales volumes.

Flat revenue and margins were due to limited top-line growth performance in core operations.

Abbott India (-3.44%)

What happened:

Q2 FY25 revenue rose 9.3% YoY to ₹1,632.67 crore.

Net profit increased 14.6% YoY to ₹358.61 crore.

PBT reached ₹479.43 crore, up 15.4% YoY.

Why?

Consistent growth is driven by effective strategies and market resilience.

A strong position in the healthcare sector enabled adaptation to changing market dynamics.

What’s happening globally

German industry output falls in September

German industrial production fell by 2.5% in September, exceeding expectations of a 1% decline. Key sectors such as automotive and chemicals experienced significant declines. Exports also fell by 1.7% during the same period.

Why the decline?

Weak global demand continues to impact industrial activity.

Political uncertainty following the collapse of Germany’s ruling coalition.

Threats of U.S. tariffs create additional risks for exports, especially in the automotive sector.

Challenges in transitioning to electric vehicles have led to job cuts and production adjustments.

Source: Bloomberg

China continues to pause gold purchases

China’s central bank has not bought gold for six months. However, with gold prices surging 33% this year, the value of its reserves rose to $199.06 billion in October.

Why has China paused gold purchases?

Gold prices have risen sharply this year, driven by U.S. interest rate cuts, global tensions, and strong demand from central banks. This may have led China to hold off on adding more to its reserves for now.

Source: Reuters

Management chatter

In this section, we pick out interesting comments made by the management of major companies.

Gopal Vittal – Managing Director & Chief Executive Officer, Bharti Airtel on the possibility of raising tariff further

Well, I think time will tell. All I would say is that this is my favorite subject which is that if you take the two axis and plot the rate per GB and ARPU on two different axis and put all the countries of the world on that graph you will find India at the extreme left on both much lower than Sub Saharan Africa, much lower than Bangladesh, much lower than Indonesia and so on, so the opportunity to take up tariffs over a period of time is high. Equally, I think the architecture of pricing as I mentioned before needs to change that you do have an ability for customers to upgrade from low, medium, high, and super high in terms of plans and I think that is the part that also would change and then that will naturally play to our upgrades. - Link

Rajesh Jejurikar, CEO, M&M on the company’s guidance for the 2nd half

We maintain mid to high teens growth guidance for the full year, had good festival offtake, our inventory is below 30 daysWe have no plans for electrification of truck business (HCV) as of now, looking at other fuel options than electrification for HCVs. - Link

Calendars

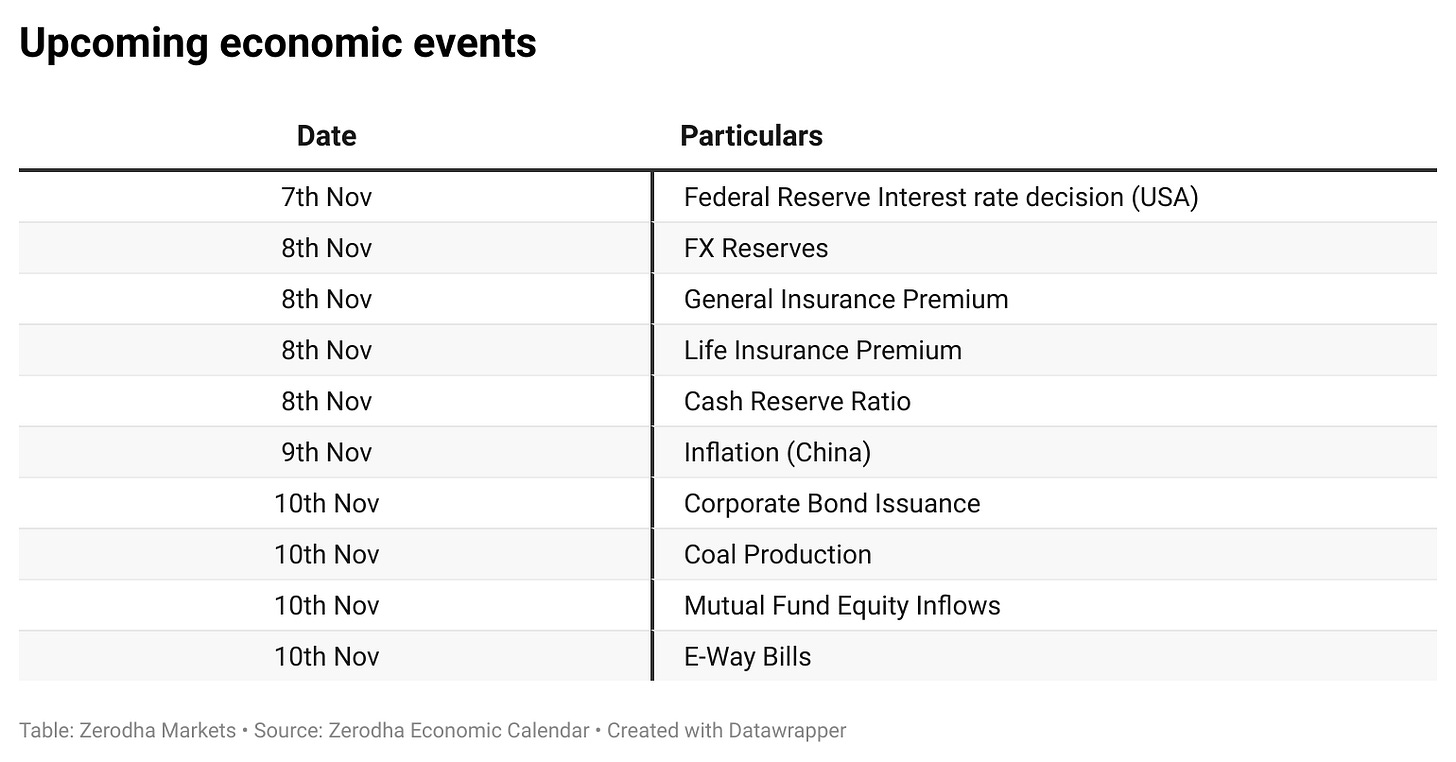

In the coming days, We have the following quarterly results and other major events:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.