Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

This post might break in your email inbox. You can read the full post by clicking here.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

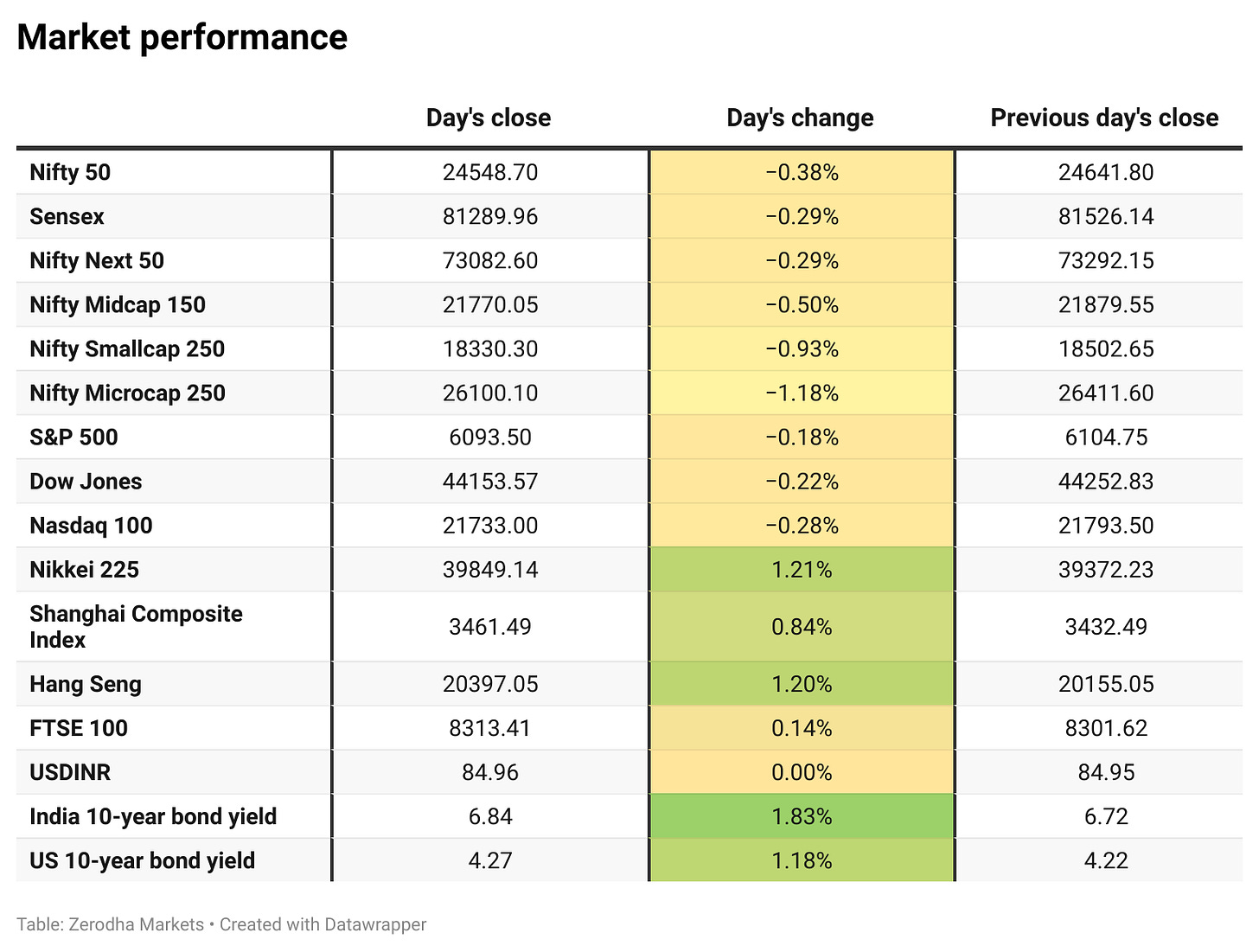

The Nifty opened lower at 24,604.45 and briefly touched the day's high of 24,675.25 within the first 15 minutes. However, the market soon began trending downward and continued its decline throughout the day. By the close, the index had settled at 24,548.70, marking a 0.37% drop for the day.

Broader Market Performance:

The overall market breadth turned negative, with 896 stocks advancing, 1,904 stocks declining, and 73 unchanged.

Sectoral Performance:

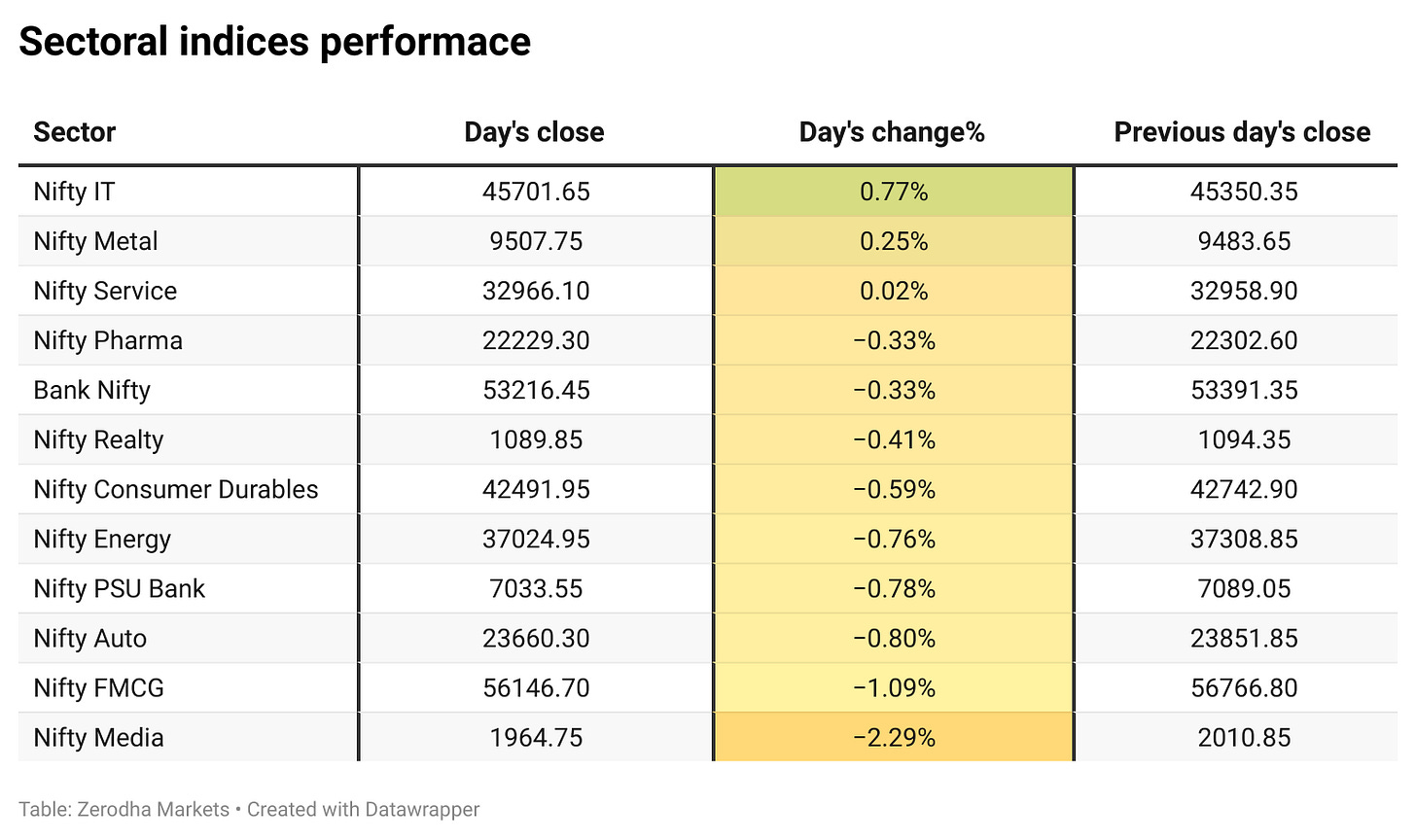

All major sectors, except IT and Metals, ended the day in the red. The Nifty IT index reached a new all-time high of 46,002.65, driven by several positive factors, including a weaker rupee, a softer CPI reading in the US that raised hopes for a Federal Reserve rate cut, and a rally in US tech stocks, which boosted market sentiment.

Note: The above numbers for Commodity futures were taken around 5 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 19th December:

The maximum CE OI is at 25000 closely followed by 24600 and 24700 and the maximum Put OI is at 24600 very closely followed by 24500.

Immediate support on the downside can be seen at 24500 levels followed by 24400-350 levels. Resistance on the upside is at 24600 and 24700 levels followed by 25000.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

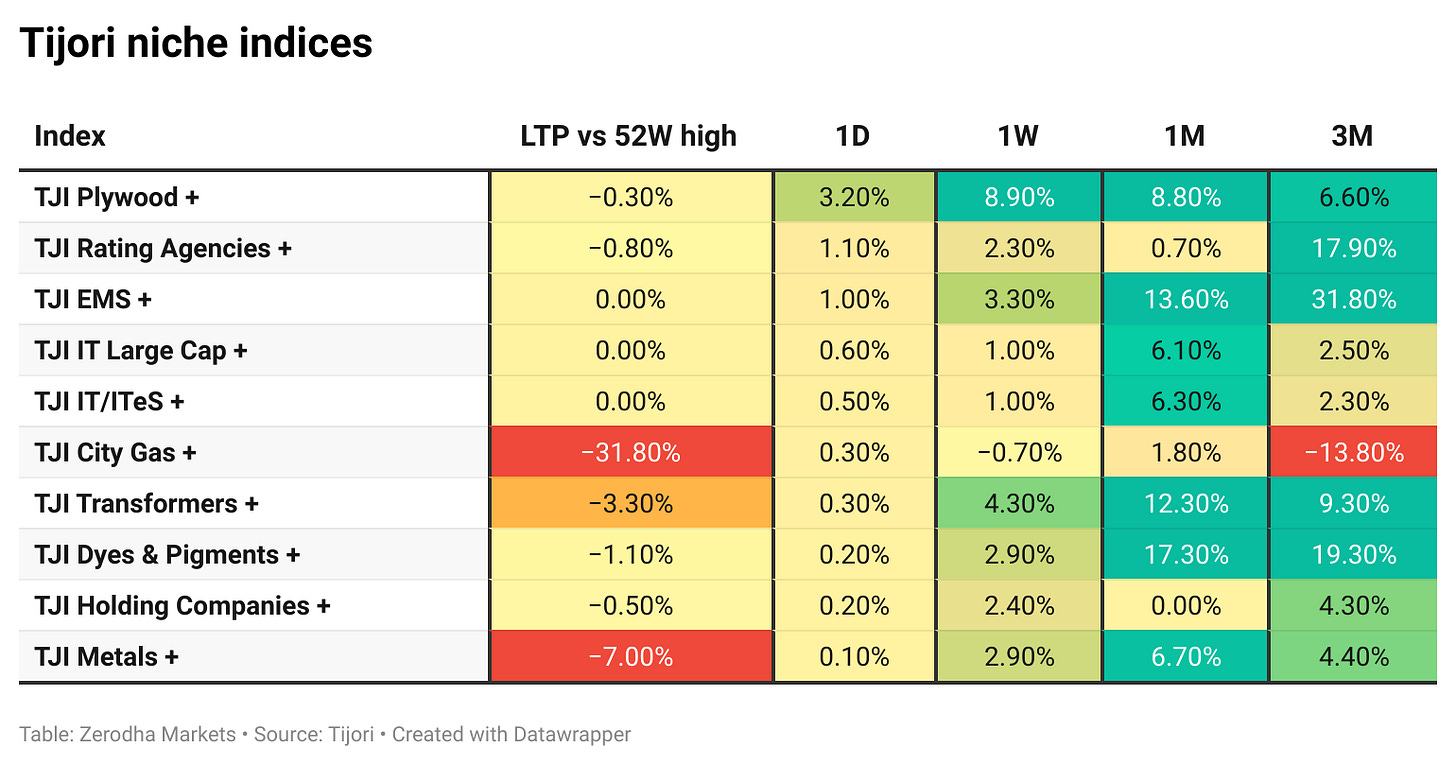

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

India's retail inflation, as measured by the Consumer Price Index (CPI), eased to 5.48% in November 2024, down from 6.21% in October. This decline was largely driven by moderating food prices, particularly vegetables, which experienced a significant slowdown in inflation. Food inflation dropped to 9.04% in November from 10.87% in the previous month. Notably, vegetable prices rose by 29.33% year-on-year in November, a marked reduction from the 42.18% increase recorded in October. Dive deeper

India's industrial output, as measured by the Index of Industrial Production (IIP), increased by 3.5% in October 2024, compared to 3.1% the previous month. Manufacturing rose 4.1%, electricity generation grew 2%, and mining activity was up 0.9%. For the April-October period, industrial output rose 4%, compared to 7% last year. The growth was supported by manufacturing sectors like basic metals, electrical equipment, and refined petroleum products. Dive deeper

Vedanta shares rose by up to 1.86% on December 12, 2024, reaching an intraday high of Rs 523.70. This followed the company's announcement that the Board will meet on December 16, 2024, to consider the Fourth Interim Dividend for FY25, with the record date for dividend entitlement set for December 24, 2024. Dive deeper

Rosneft has signed a 10-year agreement to supply nearly 500,000 barrels per day of crude to Reliance, starting in January. The supply will be delivered to Reliance's refining complex in Jamnagar, with annual reviews of pricing and volumes. Dive deeper

L&T-Cloudfiniti has onboarded its first major customer at the Sriperumbudur Data Centre near Chennai. The client, a cloud service provider, has rented 6 MW of IT load capacity for 10 years. The data centre, with a total capacity of 30 MW, offers 12 MW of live colocation-ready capacity. This contract highlights Cloudfiniti’s infrastructure and its potential in the data centre space. Dive deeper

Marico Limited has achieved 67% of its energy needs from renewable sources, with over 90% of its thermal energy now met by bio-based briquettes. The company has reduced direct GHG emissions by 79% and energy intensity by 71% since FY13. Marico aims to achieve net-zero emissions in India by 2030 and globally by 2040. Dive deeper

Tata Motors Limited has announced a price increase of up to 2% on its trucks and buses, effective from 1st January 2025, to offset rising input costs. The increase will apply across the entire range of models and variants. Dive deeper

NLC India Limited has announced the commencement of commercial operations of the first unit of its 660 MW Ghatampur Thermal Power Plant in Uttar Pradesh, part of a 3-unit, 1,980 MW project. The unit began operations on December 12, 2024, following successful trials. This marks NLCIL's first supercritical power plant, increasing its total capacity to 6,731 MW. The plant is designed to meet growing power demands with higher efficiency and lower emissions. Dive deeper

Tata Communications has introduced Kaleyra AI, an AI-powered suite designed to enhance customer interactions. The portfolio includes Conversational AI Data Reporting, which converts complex data queries into insightful reports, and a No-Code Builder that enables users to create customized responses without programming knowledge. Kaleyra AI will be available in beta to select customers in early 2025. Dive deeper

Tata Consultancy Services (TCS) has extended its partnership with Telenor Denmark to manage its IT infrastructure for the next five years. TCS will continue using its automation technologies to improve operational efficiency and reduce costs. This extension builds on six years of collaboration, reinforcing TCS' role as a trusted partner in managing and enhancing Telenor Denmark's IT infrastructure. Dive deeper

Cummins India unveiled its next-generation aftermarket solutions at baumaCONEXPO India 2024, including DATUM S, OptiNAS+ Hydraulic Oil Filter, and DGBlue Diesel Exhaust Fluid for CPCB IV+ gensets. These products are designed to improve operational efficiency, reduce downtime, and meet strict emission standards in the construction, mining, and infrastructure sectors. Dive deeper

Indian Overseas Bank (IOB) has received an order under Section 250 of the Income Tax Act, 1961, confirming a refund of ₹808.30 Crores for AY 2013-14, including interest under Section 244A. The order was received through the Income Tax Portal on 11.12.2024. Dive deeper

Shakti Pumps (India) Limited has received a Letter of Empanelment from Maharashtra State Electricity Distribution Company Limited (MSEDCL) for 25,000 solar water pumps worth ₹754.30 crores. The company will receive orders over the next year, with execution starting within 60 days of each work order. Dive deeper

Banks' deposit mobilization increased 10.6% in 2024 until November 29, reaching Rs 224.7 lakh crore. Term deposits rose 10.5% to Rs 26.3 lakh crore, while demand deposits grew 10.6% to Rs 198.4 lakh crore. Banks' credit also increased 10.6% to Rs 179.6 lakh crore, according to RBI data. Dive deeper

Britannia Industries Ltd. has implemented a 3-5% price increase on some products starting in Q3 of fiscal 2025 due to rising costs of key commodities like flour, cocoa, and palm oil. CEO Rajneet Singh Kohli mentioned that the price hikes will be rolled out in phases, with some already in effect from December 2024. Dive deeper

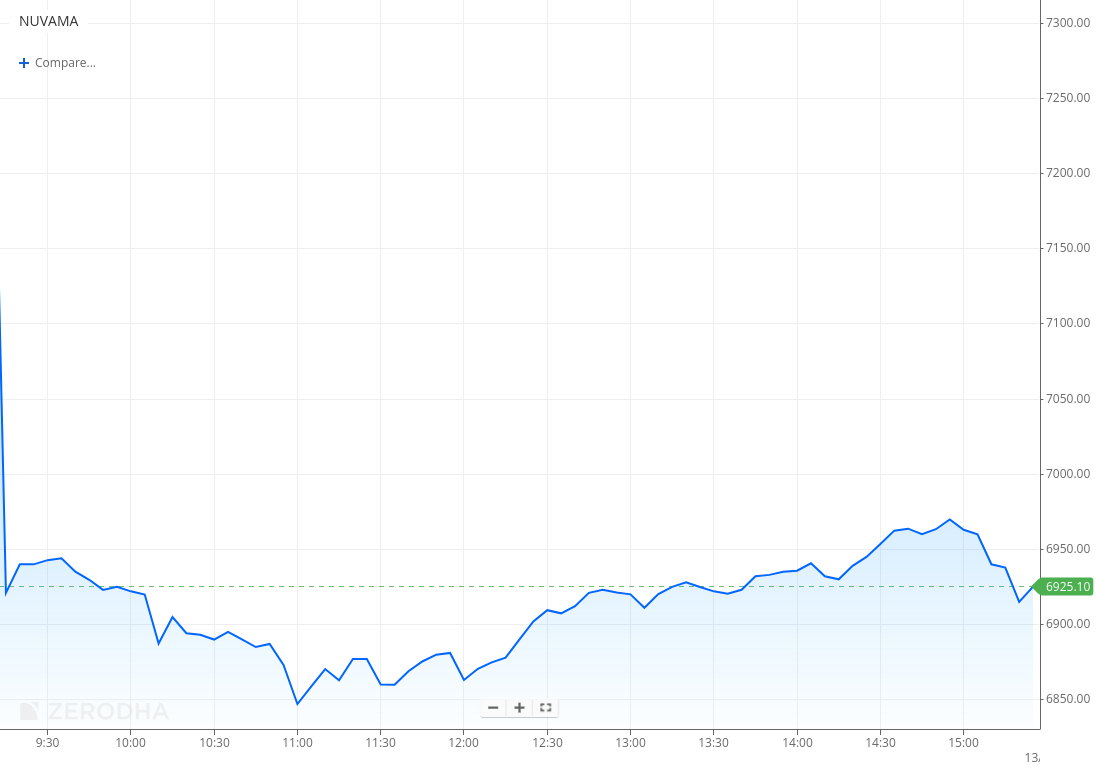

Nuvama Wealth shares closed down 4.82% following a block deal of 30 lakh shares at Rs 7,025, valued at around Rs 2,100 crore. The deal likely involved Edelweiss Group selling its stake. Nuvama Wealth reported Q2 FY25 revenue of Rs 740 crore and PAT of Rs 258 crore, with Rs 4.41 lakh crore in client assets under management. Dive deeper

What’s happening globally

The International Energy Agency (IEA) expects the global oil market to be comfortably supplied in 2025, despite OPEC+ extending supply cuts and a slightly higher demand forecast. The IEA raised its 2025 global oil demand growth forecast to 1.1 million barrels per day (bpd) from 990,000 bpd, driven mainly by growth in Asian countries, particularly China. The outlook highlights ongoing challenges for OPEC+ as it looks to revive output after years of cuts. Dive deeper

The Biden administration will raise tariffs on Chinese solar wafers, polysilicon, and certain tungsten products starting January 1, 2025. Tariffs on solar wafers and polysilicon will increase from 25% to 50%, and duties on certain tungsten products will rise to 25%. This decision follows a review of Chinese trade practices under Section 301 of the 1974 Trade Act. Dive deeper

U.S. inflation rose 2.7% year-on-year in November 2024, with the Consumer Price Index (CPI) increasing by 0.3%. Core prices, excluding food and energy, rose 3.3%. Higher food and housing costs drove the inflation, though rent and motor vehicle insurance growth slowed. Food prices increased 0.4%, led by higher grocery costs. Gas prices rose by 0.6%, but overall inflation remains a concern ahead of the Federal Reserve's upcoming rate decision. Dive deeper

The Swiss National Bank (SNB) cut its key policy rate by 50bps to 0.5% in December 2024, the fourth consecutive reduction. Inflation eased to 0.7% in November, with a forecast of 1.1% in 2024. Swiss GDP is expected to grow around 1% in 2024, with risks from rising unemployment and global uncertainties. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Ajay Piramal, Chairman, Piramal Group

"I just want to say one thing about India's demography. It is a strength but we must look at India as actually there are 3 Indias. One is the really affluent India, which out of 1.4 billion people, is about 60 million people."

The next is middle-income India, around 1.2 billion and 200 million are the ones where there is low poverty, Piramal added. So, if I was to draw a line between North to South, leaving the southernmost parts, till Andhra Pradesh, you would find that that is the most deprived part of India where there is a difference in per capita income. The rest of India is 2.2 times this part.

“To get the real demographic dividend, we have to look at these states like Bihar, Jharkhand, Chhattisgarh, Odisha, Assam, Bengal. It is necessary to see their GDP also grow so India can get into equitable distribution of wealth and on track to become 3rd largest economy” - Link

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.