Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Market Overview

The Nifty opened flat at 24,729.45 and traded within a narrow 20-point range until 10 AM. A sudden wave of selling was triggered till 24,620 when no rate cut was announced, but the index quickly recovered to test 24,740 following the announcement of a CRR cut.

For the rest of the day, the index remained within a 30-point range, showing limited volatility. It eventually closed at 24,677.80, down by 0.12%.

This highlights a day of cautious trading with limited movement influenced by key announcements made by RBI.

Broader market performance:

The overall market breadth remained positive, with 1,694 stocks advancing, 1,127 declining, and 77 unchanged out of 2,898 traded stocks, though it showed some weakening compared to recent days.

Sectoral indices were mixed:

Metals, Autos, PSU Banks, and FMCG sectors saw buying interest, contributing to the gains.

Private Banks, IT, and Pharma sectors experienced profit booking and sluggishness, weighing on their performance.

Note: The above numbers for Commodity futures were taken around 5 pm.

Note: NSE has not yet released today’s DII-FII data

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 12th December:

The maximum CE OI is at 25000 followed by 24700, and the maximum Put OI is at 24500 closely followed by 24700.

Immediate support on the downside can be seen at 24500 levels followed by 24400 levels. Resistance on the upside is at 24800 levels followed by 25000.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

The RBI kept the repo rate steady at 6.5% in November and cut the Cash Reserve Ratio (CRR) by 50 basis points to 4%, the first reduction since 2020, to boost liquidity. It introduced the Secured Overnight Rupee Rate (SORR) to strengthen interest rate benchmarks. GDP growth for FY25 is projected at 6.6%, down from 7.2%, while inflation is expected to rise to 4.8%. Dive deeper

The RBI proposed allowing small finance banks to offer pre-sanctioned credit lines via UPI, aiming to expand credit access for new borrowers. Guidelines will be issued soon. The RBI also plans to launch podcasts to improve public awareness and transparency. Dive deeper

Canara Bank (+1.06%) rose to its highest since October 1 after receiving RBI approval to divest 13% and 14.5% stakes in Canara Robeco AMC and Canara HSBC Life Insurance, respectively, via IPO. The bank plans to reduce its stake in these entities to 30% by October 2029, as per government directives. Dive deeper

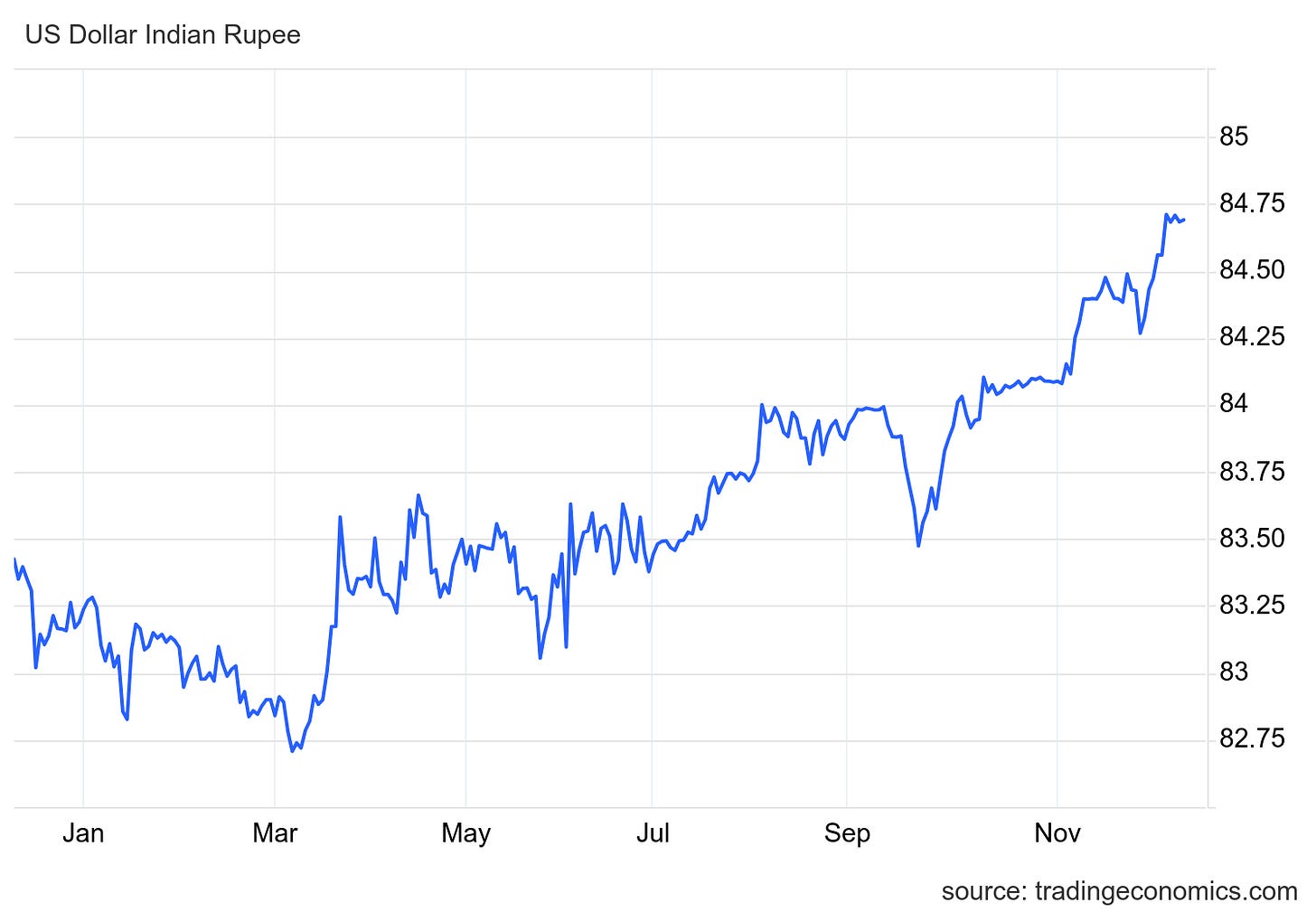

The Indian rupee traded near 84.6 per USD, close to record lows, as the RBI kept the repo rate at 6.5% and cut the cash reserve ratio to 4% to boost liquidity and support growth. The RBI also allowed higher deposit rates for Indians abroad to attract capital inflows. GDP growth slowed to 5.4% in Q3, and the RBI revised its FY25 growth forecast to 6.6% while raising inflation estimates to 4.8%. Dive deeper

Mishtann Foods shares dropped 20% after SEBI issued a notice alleging financial mismanagement and fraudulent transactions. SEBI also banned the company, its promoter, and four others from the securities market, citing issues like negative cash flow and circular fund flows. Dive deeper

Adani Wilmar Limited (+0.68%) has named Mr Shrikant Kanhere as Deputy CEO, in addition to his role as CFO. With over 25 years of experience, he will handle business development, investor relations, and financial management, working with COO Mr Saumin Sheth and MD & CEO Mr Angshu Mallick to drive the company’s growth. Dive deeper

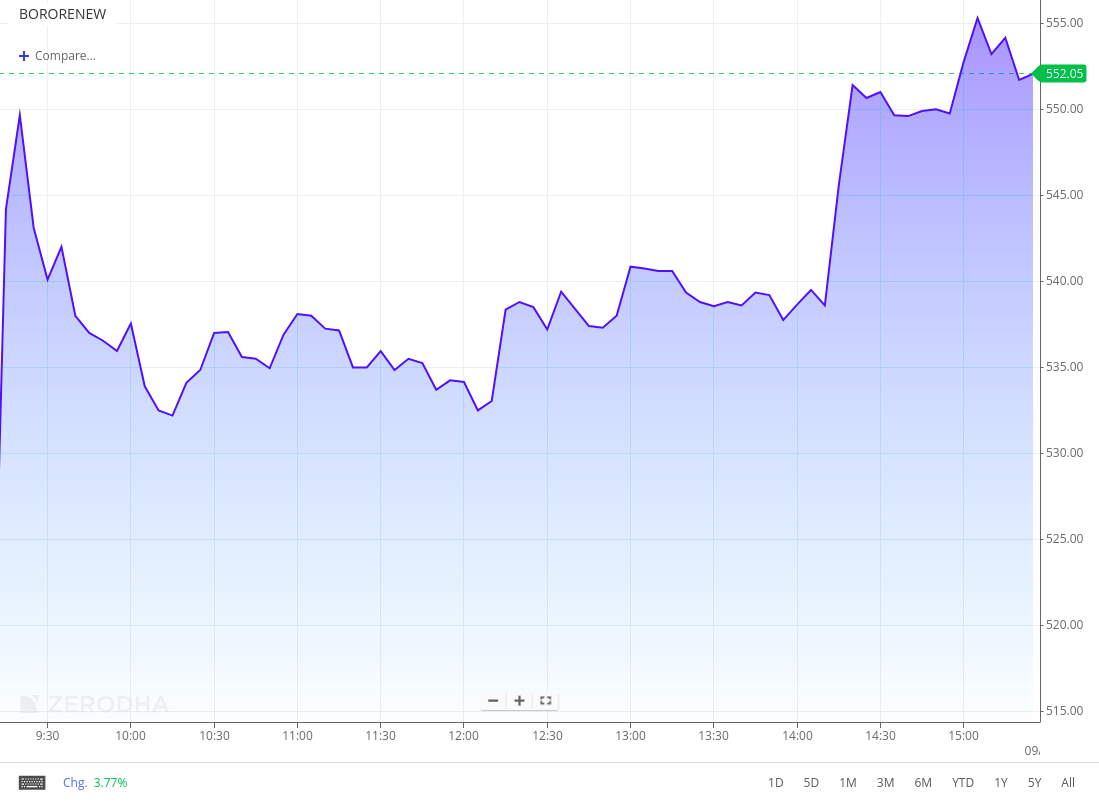

Borosil Renewables (+8.08%) rose for the fourth straight session, hitting its highest since August 2, after the Finance Ministry imposed a six-month provisional anti-dumping duty on solar glass imports from China and Vietnam, effective December 4, 2024. The measure aims to protect domestic manufacturers from low-priced imports dominating the market. Dive deeper

The Confederation of Indian Textile Industry (CITI) raised concerns over the proposed GST hike on garments, warning of its impact on jobs and the economy. Garments priced ₹1,500–₹10,000 may face 18% GST, and those above ₹10,000, 28%. CITI fears reduced demand, growth hurdles, and a shift to informal markets. Dive deeper

Maruti Suzuki India (+1.21%) announced plans to raise car prices by up to 4% across all models, effective January 1, 2025, to address rising input and operational costs. Dive deeper

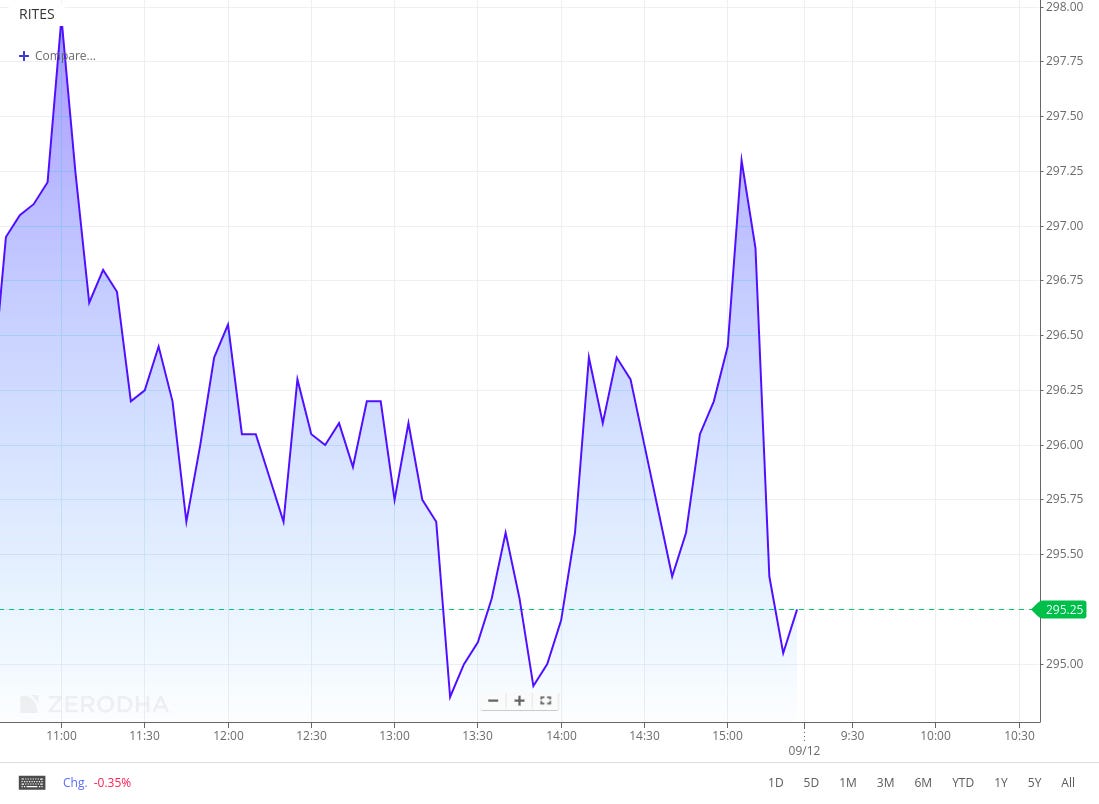

RITES (+3.06%) rose to ₹296.20 after winning a ₹148.25 crore contract from IIM Raipur for Phase II campus development in Chhattisgarh, to be completed in 23 months. Dive deeper

Thomas Cook (India) Limited (+0.38%) and SOTC Travel reported a 33% rise in online searches for winter tourism, with interest in destinations like Switzerland, France, Kashmir, and Himachal Pradesh. Emerging spots like Georgia and Iceland are gaining popularity. Their packages include activities like skiing, snowboarding, and festive markets, catering to various travellers and budgets. Dive deeper

Samvardhana Motherson International Limited (+2.03%) will acquire a 95% stake in Japan-based Atsumitec Co., Ltd. through its subsidiary, SMRP B.V. Atsumitec produces precision components like gear shifters and transmission parts for cars and bikes. The deal, valued at ~JPY 8.5 billion (~USD 57 million), is expected to close by Q1FY26, subject to approvals. Dive deeper

Kalpataru Projects International Limited (+1.77%) has received new orders worth ₹2,174 crores for an elevated metro rail project, Transmission & Distribution (T&D) works, and a residential building project. This brings KPIL's total orders for the year to over ₹16,300 crores, with 85% from T&D and Building & Factories projects. Dive deeper

Mahindra & Mahindra Limited (+0.05%) has announced the incorporation of Target Hybren Private Limited as a wholly-owned subsidiary of Mahindra Susten Private Limited. Target Hybren will focus on renewable energy, including power generation, rooftop solar installations, and energy storage systems. The subsidiary, incorporated on December 6, 2024, has an authorized and paid-up share capital of ₹15 lakh. Dive deeper

Wipro Limited (-0.65%) has partnered with SIAM.AI and NVIDIA to create ‘Sukjai,’ an AI assistant for the Tourism Authority of Thailand. Sukjai will provide tourists with personalized recommendations, real-time updates, and emergency alerts, supporting Thailand’s AI goals. Dive deeper

Nykaa (-0.61%) announced the resignation of Fashion CEO Nihir Parikh, effective December 5, 2024, due to personal reasons. Dive deeper

What’s happening globally

The Eurozone economy grew by 0.4% in Q3 2024, the fastest in two years, driven by household spending and investments. Exports fell 1.5%, while imports rose 0.2%, weighing on growth. Germany avoided a recession with 0.1% growth, while France and Spain grew by 0.4% and 0.8%, respectively. Year-on-year, GDP rose 0.9%, the best since early 2023. Dive deeper

The FAO Food Price Index rose 0.5% in November 2024 to 127.5 points, its highest since April 2023. Vegetable oil prices surged 7.5%, dairy increased 0.9% on strong demand for milk powders, cereal prices fell 2.7% with better wheat supplies, sugar dropped 2.4%, and meat declined 0.9%. Dive deeper

Thailand's economy showed growth in October 2024, supported by higher tourism revenue, private spending, and government stimulus. Tourism income rose with more arrivals and slightly higher spending per trip, despite fewer tourists from Malaysia and China. Private consumption improved across all categories, while manufacturing saw growth in chemicals, electrical appliances, and food production. Inflation increased due to energy costs, and the baht weakened against the U.S. dollar amid global uncertainties. Dive deeper

U.S. job growth is expected to improve in November, with payrolls expected to rise by 200,000 as the impact of hurricanes and Boeing strikes eased. October had a small gain of 12,000 jobs, and the unemployment rate is expected to increase slightly to 4.2%. Dive deeper

The UAE's non-oil private sector grew steadily in November, with the S&P Global PMI rising slightly to 54.2. New orders increased sharply to 58.0, boosting activity but adding backlogs. Job creation slowed, and businesses remained cautious about future growth. Dive deeper

OPEC+ has delayed plans to increase oil output until at least April, citing weak global demand. The return of Donald Trump as U.S. president adds uncertainty, with his focus on lowering fuel prices and easing regulations potentially boosting U.S. oil and gas production. However, U.S. crude production faces capacity constraints despite record levels. Dive deeper

OpenAI launched ChatGPT Pro at $200 per month, offering advanced models like o1 Pro mode for more accurate responses. The plan includes unlimited access to tools like OpenAI o1, GPT-4o, and Advanced Voice. OpenAI also announced grants for medical researchers to use the technology in studying diseases and biomedical data. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Nirmala Sitharaman, Union finance minister

"Q2 GDP is not a systemic slowdown, it is more due to absence of activity on capex and public spending. I expect Q3 to make up for all this,"

"Growth numbers won't necessarily get badly affected. I still think this year and next year there are still very good chances for the country to remain the fastest growing economy in the world,"

"there are also concerns about wages saturating. We are aware of these factors that may have a play on India's own consumption," - Link

RBI Governor Shaktikanta Das on Inflation

"The horse has made a valiant effort to bolt, our job is to keep it on a tight leash,"

Underlying slowdown in growth due to inflation.

Private companies are hesitant to invest as demand appears moderate.

Growth in the second half (H2) of FY25 looks better than the first half (H1).

The credibility of flexible inflation targeting needs to be preserved. - Link

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Like your reports