Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

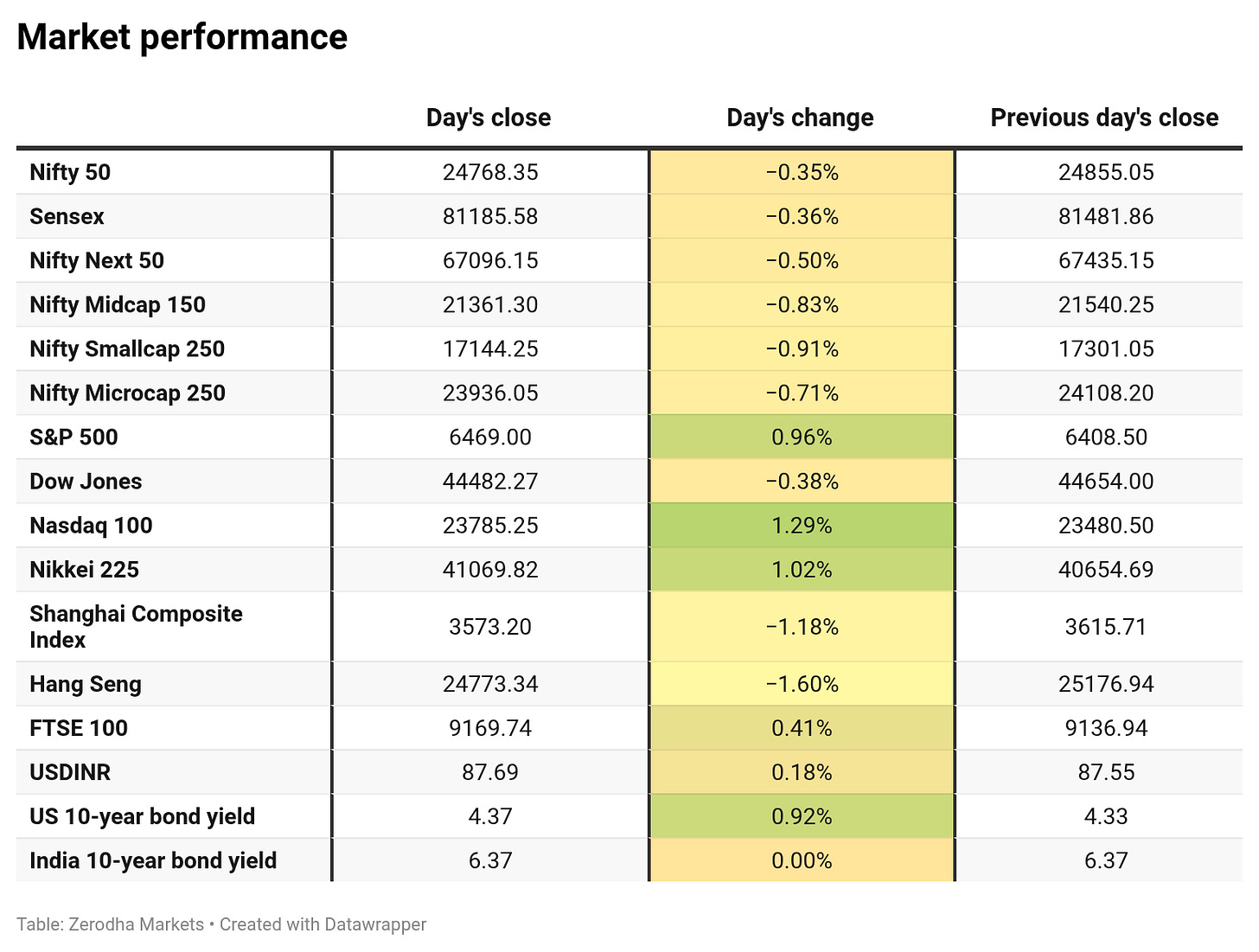

Nifty opened with a sharp 213-point gap-down at 24,642.25 after the US President announced a 25% tariff along with penalties on Indian exports to the US. Post the open, the index remained rangebound between 24,650 and 24,700 until 11 AM. It then turned bullish, staging a strong recovery and briefly turning positive to test 24,950 by 2 PM. However, in the last 90 minutes, Nifty slipped once again, falling nearly 200 points, most of it in the final 45 minutes before eventually closing at 24,768.35, down 0.35%.

Overall, market sentiment stayed cautious, weighed down by weak earnings or muted investor reactions to otherwise decent results. Going forward, investors remain focused on upcoming earnings and, more importantly, developments around global trade, particularly India’s response to the US tariffs and any subsequent trade-related announcements.

Broader Market Performance:

Broader markets had a weak session today. Of the 3,044 stocks traded on the NSE, 1,045 advanced, 1,907 declined, and 92 remained unchanged.

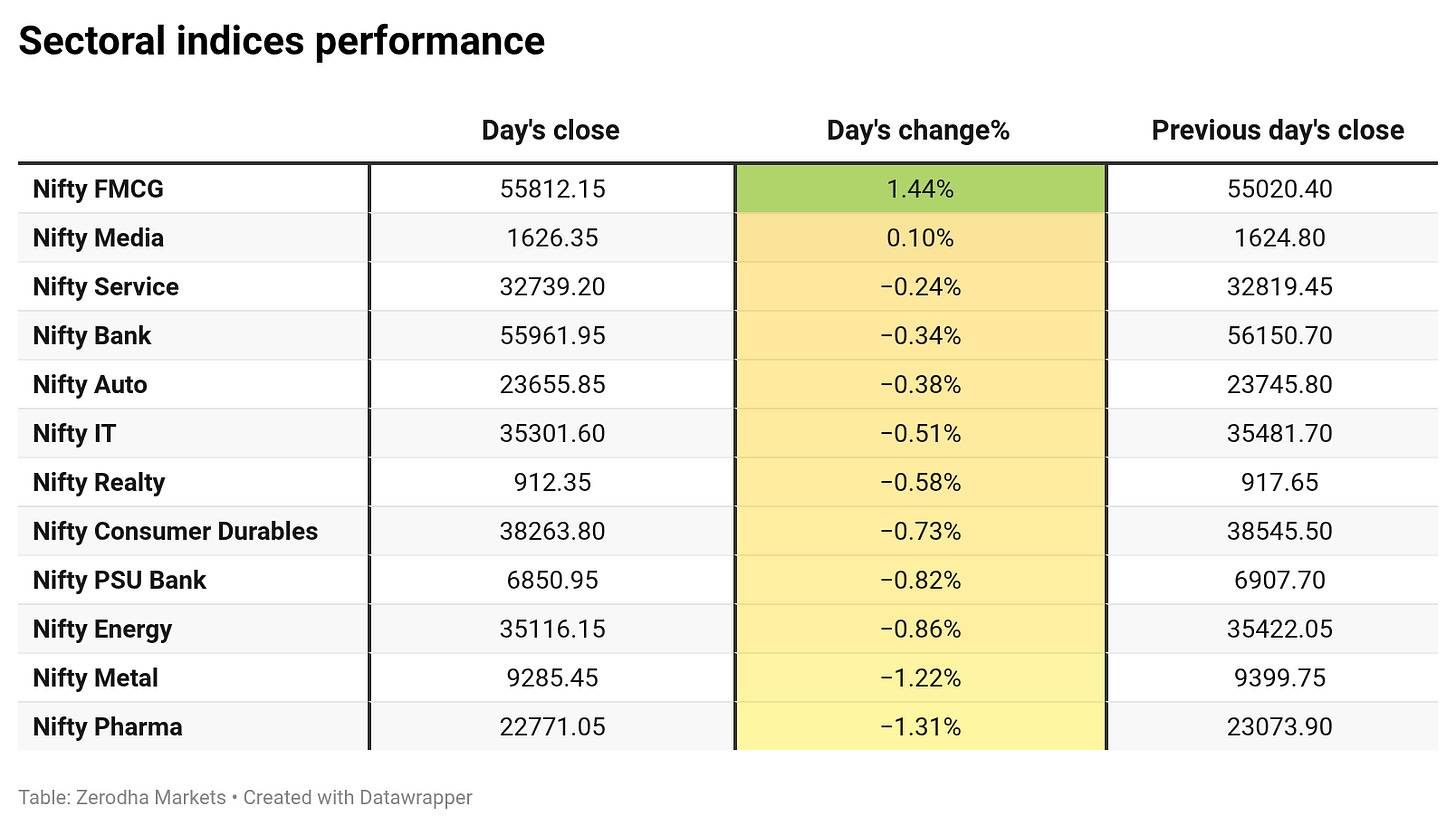

Sectoral Performance

Among the sectoral indices, Nifty FMCG emerged as the top gainer, rising by 1.44%, while Nifty Pharma was the top loser, falling by 1.31%.

Out of the 12 sectors listed, 2 sectors closed in the green (FMCG and Media), while the remaining 10 sectors ended in the red, reflecting a broadly negative sentiment across the market.

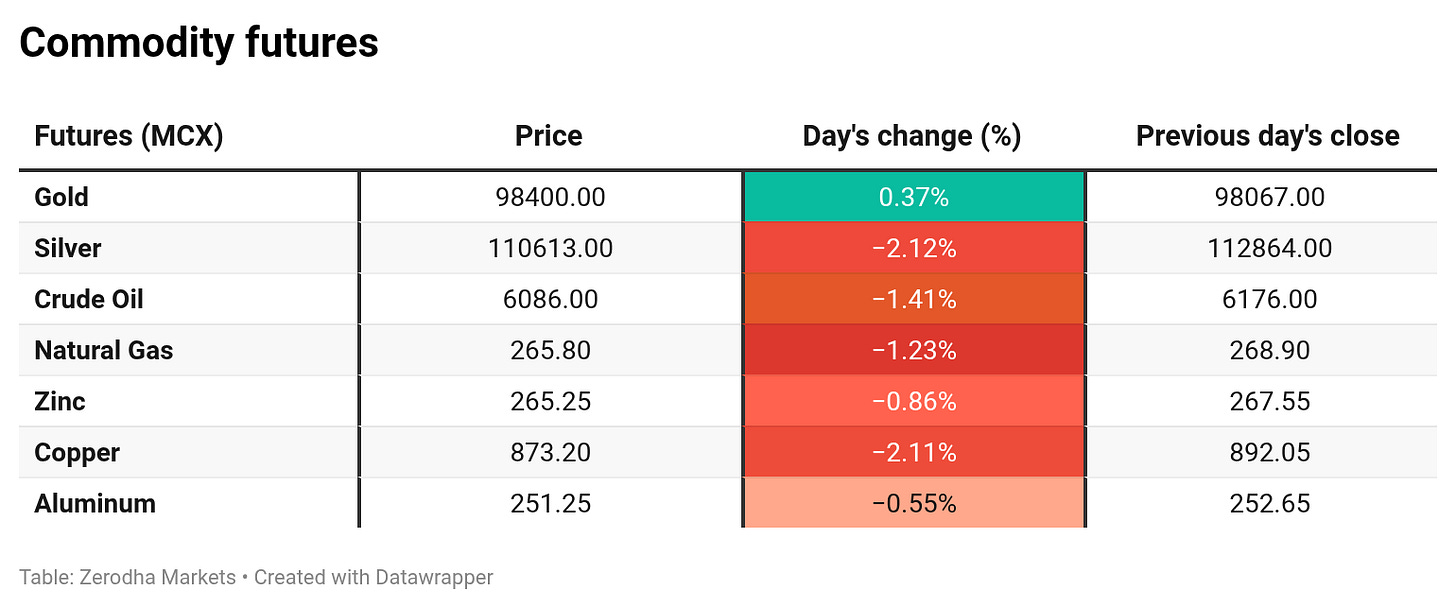

Note: The above numbers for Commodity futures were taken around 4 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 7th August:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 25,200, suggesting strong resistance at 25,000 - 25,100 levels.

The maximum Put Open Interest (OI) is observed at 24,500, followed closely by 24,800, suggesting strong support at 24,700 to 24,600 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

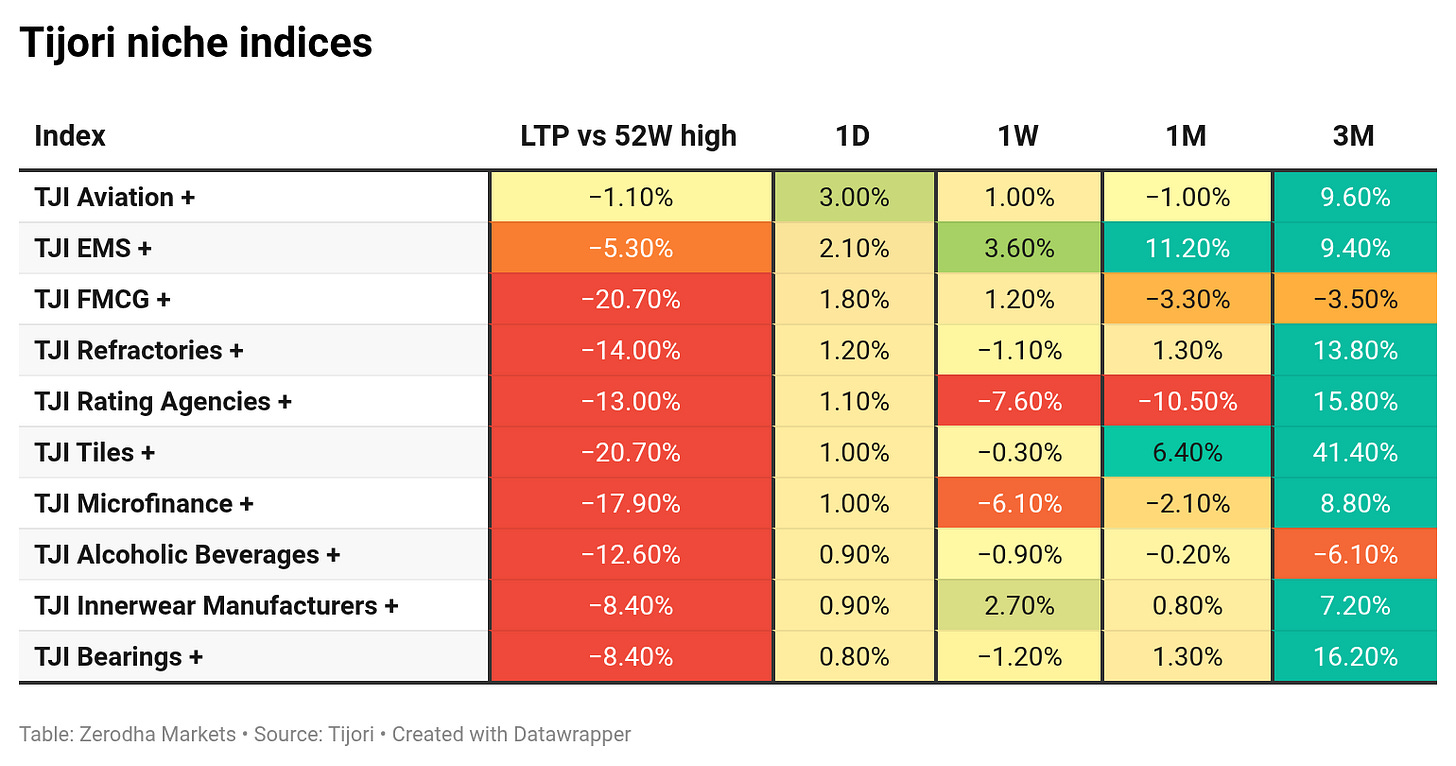

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

Trump’s 25% tariffs on Indian goods and added penalties linked to Russian energy and defence deals pose risks to India’s export competitiveness. Key sectors facing headwinds include pharmaceuticals, textiles, oil refining, auto components, capital goods, chemicals, and solar equipment. Dive deeper

RBI will conduct a ₹50,000 crore overnight VRRR auction on July 31 to absorb surplus liquidity, after mopping up ₹46,058 crore via a three-day VRRR on July 29. The overnight call rate stood at 5.38%, below the 5.50% repo rate. Dive deeper

Jio Financial Services will receive a ₹15,825 crore capital infusion from its promoter group through a preferential issue, increasing their stake from 47.12% to 54.19%. The company reported a 4% rise in Q1 net profit to ₹325 crore and acquired full ownership of Jio Payments Bank during the quarter. Dive deeper

TVS Motor reported a 35% YoY rise in Q1 net profit to ₹779 crore, with revenue up 20% to ₹10,081 crore. Total vehicle sales rose 17% to 12.77 lakh units, with growth across motorcycles, scooters, three-wheelers, and electric scooters. Dive deeper

DGCA flagged 263 safety issues across eight airlines over the past year, with Tata Group airlines accounting for 93, including 19 Level 1 violations. Air India alone had 51 findings, while IndiGo, SpiceJet, and others reported only Level 2 lapses. DGCA noted such findings are typical for larger carriers. Dive deeper

HSBC India's H1 2025 profit before tax rose 17% YoY to $931 million, driven by strong growth in corporate and institutional banking. India is now the bank’s third-largest global profit centre after Hong Kong and the UK, overtaking China and Canada. Dive deeper

The IT Department conducted a search at Nuvama Wealth in connection with the Jane Street probe, where Nuvama served as the firm’s local trading partner. Jane Street, accused of index manipulation, deposited ₹4,844 crore with Sebi and has been allowed to re-enter the market with certain trading restrictions. Dive deeper

Vedanta reported an 8.6% QoQ decline in Q1 net profit to ₹3,185 crore, with revenue down 6.5% to ₹37,824 crore. EBITDA fell 13.5% to ₹9,918 crore, and margins narrowed to 26.2% from 28.3%. Dive deeper

Adani Enterprises reported a 45% YoY decline in Q1 consolidated net profit to ₹976.48 crore, while revenue fell 13.7% to ₹21,961.20 crore. Lower trade volumes and index price volatility impacted performance, though EBITDA from incubating businesses rose 5%, aided by Airports and Roads. Dive deeper

Ambuja Cements reported a 23.8% YoY rise in Q1 net profit to ₹969.66 crore, with revenue from operations up 23.45% to ₹10,244.11 crore. The company’s cement capacity stands at 104.5 MTPA, with plans to expand to 118 MTPA by March 2026. Dive deeper

ITD Cementation reported its highest-ever Q1 net profit of ₹137 crore, up 37% YoY, with revenue rising 7% to ₹2,542 crore. EBITDA grew 5.2% to ₹233 crore, and the order book stood at ₹18,820 crore after securing new contracts worth over ₹2,900 crore during the quarter. Dive deeper

Jio Financial Services shares rose 2.5% after the board approved raising ₹15,825 crore via preferential issue of warrants to promoter entities. Q1 net profit grew 4% YoY to ₹325 crore, and revenue rose 46.6% to ₹612.46 crore. SEBI also cleared Jio BlackRock’s launch of four passive funds. Dive deeper

Tata Motors will acquire Italy-based Iveco S.p.A. for €3.82 billion (approx. ₹33,360 crore) in an all-cash deal, excluding its defence business. The offer, backed by committed financing, aims to delist Iveco and is expected to close in H1 2026. Brokerages flagged potential margin dilution despite strategic synergies. Dive deeper

Indus Towers reported a 9.8% YoY decline in Q1 net profit to ₹1,737 crore due to rising expenses, despite a provision write-back from Vodafone Idea. Revenue grew 9.1% to ₹8,058 crore, with additions in towers and co-locations. Dive deeper

Ambuja Cements reported a 24% YoY rise in Q1 net profit to ₹969.66 crore, with revenue up 23.5% to ₹10,244.11 crore. EBITDA margin improved to 19.1%, and cement capacity reached 104.5 MTPA. The company remains debt-free with plans to scale up to 118 MTPA by March 2026. Dive deeper

SEBI has confirmed its interim order barring Gensol Engineering and co-founders Anmol and Puneet Jaggi from the securities market over fund diversion and governance lapses. The Jaggi brothers remain debarred from holding key positions at Gensol, which is currently under insolvency proceedings. A forensic audit is underway, with SEBI citing unresolved concerns. Dive deeper

What’s happening globally

The Fed held rates at 4.25%–4.50% for a fifth straight meeting, with two governors dissenting in favor of a cut. It noted softer economic activity in H1 and persistent inflation, maintaining a data-dependent stance amid trade war concerns and outlook uncertainty. Dive deeper

WTI crude fell to $69.5 per barrel after a three-day rally, as markets weighed US inventory buildup and geopolitical risks. Trump’s tariff threats over the Ukraine war added uncertainty, while strong US gasoline demand partly offset bearish crude stock data. Dive deeper

Germany’s annual inflation held steady at 2% in July 2025, slightly above expectations. While food inflation rose to 2.2%, energy prices declined at a slower pace. Service inflation eased, and EU-harmonised inflation fell to 1.8% from 2%. Dive deeper

Italy’s annual inflation held steady at 1.7% in July 2025, defying expectations of a drop to 1.5%, while EU-harmonized inflation eased slightly to 1.7%. Food and service prices rose, but energy and recreational costs slowed; core inflation remained unchanged at 2%. Dive deeper

US copper futures fell up to 6% to $5.35/lb, extending losses after Trump excluded refined copper from upcoming tariffs. The selloff followed a surge driven by pre-tariff stockpiling and supply tightness, which had pushed prices to a record $5.9/lb. Tariffs will now target only copper in semi-finished products. Dive deeper

US PCE inflation is expected to rise 0.3% MoM in June 2025, the highest in four months, with annual headline inflation seen at 2.5%. Core PCE is projected to rise 0.3% MoM, while the YoY rate is likely to remain steady at 2.7%, keeping pressure on the Fed’s policy outlook. Dive deeper

The Bank of Japan kept its benchmark rate steady at 0.5% in July, the highest since 2008, aligning with expectations. It raised FY25 core inflation forecast to 2.7% and slightly upgraded GDP growth to 0.6%, citing reduced trade uncertainty after a US deal. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Saurabh Mukherjea, Founder & CIO, Marcellus Investment Managers, on India-US trade tariffs

“My reckoning is that in the next couple of months, India and America will crack a deal. I strongly suspect India will end up with tariffs better than the 25% angle.”

“Trump is using this as a way to browbeat India into reducing its purchase of Russian oil. I'm not so sure that it'll succeed. India quite rightly buys Russian oil because it's cheaper than the stuff available from elsewhere in the world.”

“I think IT, pharma, and electronics will be exempt even if this 25% tariff were to go through. There is a high chance that the three big Indian exports to America will be completely exempt from the tariff.”

“America needs India on two fronts. America needs India to reduce its dependence on China for electronics, Apple being the star player there. And America needs India to reduce its dependence on China for active pharmaceutical ingredients.”

“China still supplies 70-80% of America's API. India supplies the remaining 20-30%. So, America clearly wants to diversify away from China.” - Link

Shweta Mantri, head of rider verticals, Uber India and South Asia

“At the end of CY 2024, Uber Intercity was present across 2,000 routes. Uber has increased the intercity routes by 50% to over 3,000 and hopes to grow at the same rate during the next year.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

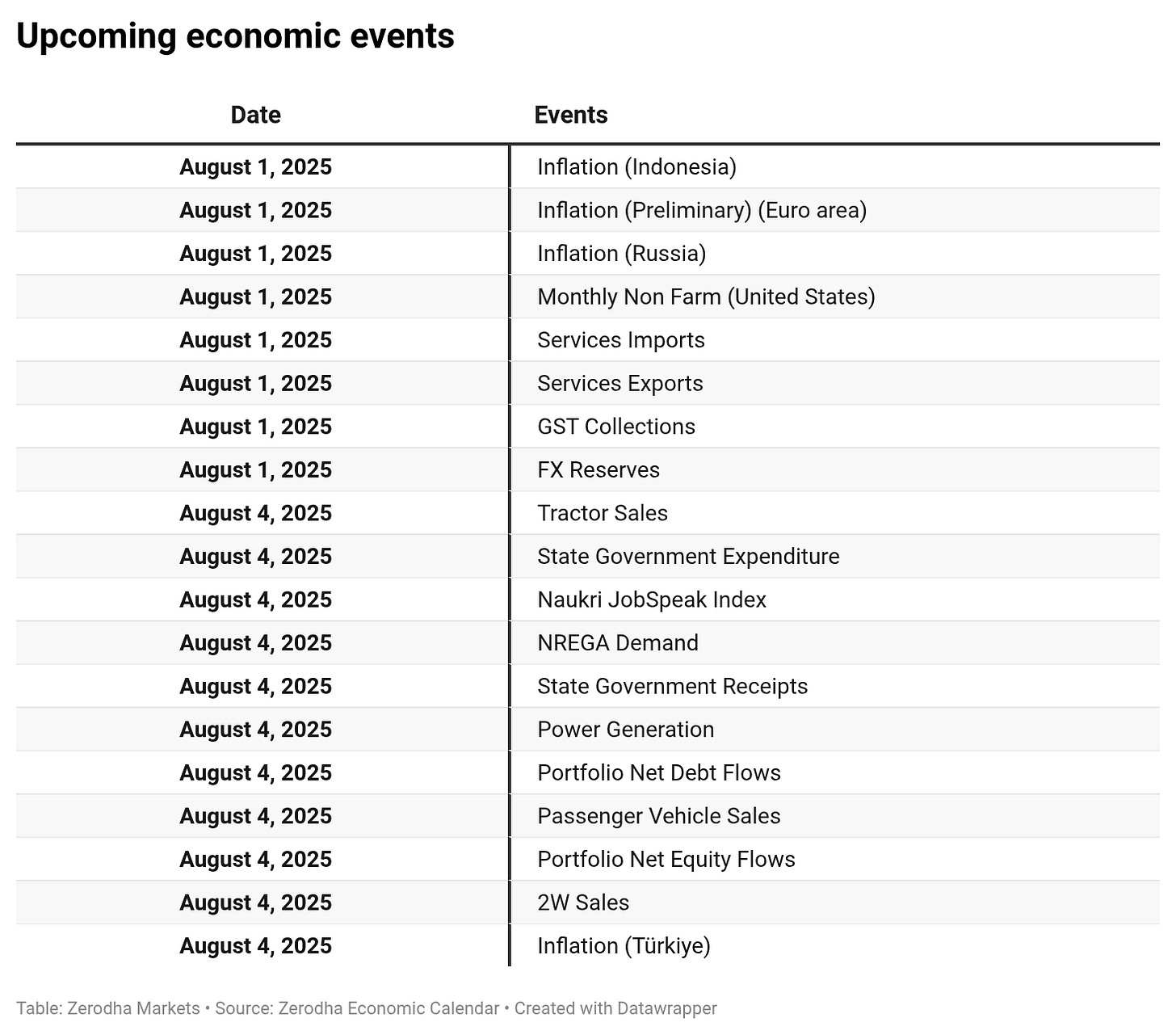

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.