Weak global cues drag Nifty below 22,600

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Nifty opened 185 points lower at 22,609.35, tracking weak overnight cues from U.S. markets. After an initial dip, it traded within a narrow range before slipping further to test the 22,550 level. For the next few hours, it remained between 22,550 and 22,580 before attempting to reclaim 22,620. However, selling pressure pushed it down again, touching an intraday low of 22,518.80.

In the final hour, the index remained range-bound and failed to recover, closing at 22,553.35, down 1.06%. Market sentiment was weak amid global uncertainties and concerns over U.S. consumer sentiment and potential trade restrictions.

Broader Market Performance:

The broader market indices saw further deterioration today. Out of the 2,971 stocks traded on the NSE, 767 advanced, 2,108 declined, and 96 remained unchanged.

Sectoral Performance:

The Nifty FMCG sector emerged as the top gainer, closing at 52,285.80, up 0.36%, while Nifty IT was the biggest loser, dropping 2.71% to 39,446.60. Out of the 12 sectoral indices, only three sectors—Nifty FMCG, Nifty Auto, and Nifty Pharma—ended in the green, while the remaining nine sectors closed in the red.

Note: The above numbers for Commodity futures were taken around 4 pm.

Net Flow Breakdown for the day:

FII: Net outflow of ₹6,286.70 crore (Bought ₹7,905.53 crore, Sold ₹14,192.23 crore)

DII: Net inflow of ₹5,185.65 crore (Bought ₹12,552.14 crore, Sold ₹7,366.49 crore)

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 27th February:

The maximum Call Open Interest (OI) is observed at 23,000, followed by 22,800. Meanwhile, The maximum Put Open Interest (OI) is at 22,500, closely followed by 22,600.

Immediate support is identified in the 22,500–22,400 range, while resistance is expected between 22,800 zones followed by 23,000.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

RBI's curbs slowed personal loan growth to 13.7% in December 2024 from 15.2% in September, while overall bank credit growth eased to 11.8%. Lending for trade and finance increased, but credit to agriculture and industry moderated. Term deposits surged 14.3% YoY, now making up 62.1% of total deposits. Dive deeper

SEBI plans to expand the qualified institutional buyer (QIB) definition and remove the 200-investor cap for angel funds. The move aims to broaden investor participation, boost startup funding, and ensure only financially strong investors engage in high-risk investments. Dive deeper

RBI will inject $10 billion via a forex swap on Feb. 28 to ease a cash crunch in the banking system. The three-year swap aims to boost rupee liquidity as banks face fiscal year-end pressure. This follows a $5 billion swap last month amid tightening liquidity conditions. Dive deeper

HSBC plans to raise $1 billion through a perpetual Additional Tier 1 (AT1) dollar bond issuance at an initial price guidance of 7.5%, sources said. The proceeds will be used to strengthen its capital base and for general corporate purposes. Dive deeper

KKR to acquire a majority stake in HealthCare Global Enterprises for ₹3,350 crore from CVC Asia. The deal involves an open offer at ₹504.41 per share, with KKR expected to hold between 54-77% stake upon completion by Q3 2025. Dive deeper

India Inc. is set for 7-8% YoY revenue growth in Q4 FY25, driven by a rural demand rebound and improving urban consumption, says ICRA. Key earnings drivers include a strong kharif harvest, a favourable rabi outlook, and tax relief measures. However, sustaining momentum will depend on a well-distributed monsoon in 2025. Dive deeper

Vedanta shares closed 3.5% lower at ₹422.85 despite securing the highest bid for Madhya Pradesh's Kauhari Diamond Block. The final grant of the licence is subject to regulatory approvals, following a 1.10% final price offer in the e-auction. Dive deeper

Swiggy shares closed 1.14% higher at ₹364.65 after the company announced plans to invest up to ₹1,000 crore in subsidiary Scootsy Logistics through a rights issue to expand supply chain and distribution services. Dive deeper

Western Coalfields Ltd (WCL) bid for two Maharashtra coal blocks in its first commercial auction participation. Bandhak West received 15 bids, the highest, while Dahegaon Makardhokra IV saw three. The final allocation is due in a month. Dive deeper

Granules India announced the acquisition of Switzerland-based Contract Development and Manufacturing Organization (CDMO) firm Senn Chemicals AG for ₹192 crore, expanding its peptide therapeutics and CDMO capabilities. Dive deeper

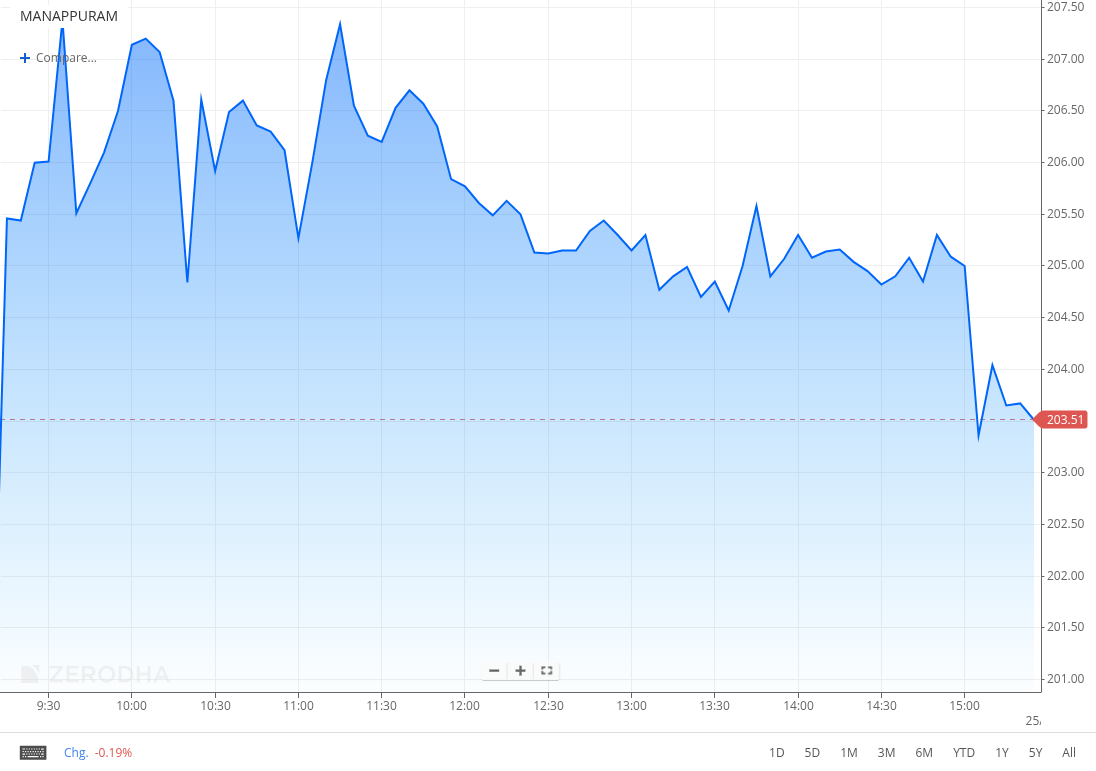

Manappuram Finance shares closed 1.35% higher at ₹204.03 as talks with Bain Capital for a significant promoter stake acquisition reached the final stage. The deal includes a preferential allotment and a secondary share sale, potentially valuing Bain’s stake at up to 46%. Dive deeper

Pfizer shares surged nearly 9% to an intraday high of ₹4,470 after announcing a five-year marketing and supply agreement with Mylan Pharmaceuticals for Ativan and Pacitane. The deal aims to enhance distribution and in-clinic presence. Despite the rally, the stock closed 2.38% higher at ₹4,192.75. Dive deeper

NTPC Green Energy shares dropped 9% to a 52-week low of ₹96.20 as its three-month lock-in period ended, unlocking 183 million shares (2% of total). The expiry triggered selling pressure, leading to a short-term dip. The stock closed 6.77% lower at ₹98.40. Dive deeper

Havells India plans to enter the EV charging market within the next six months, targeting automakers, charging infrastructure, consumers, and real estate developers. Executive VP Vivek Yadav highlighted India's rapidly expanding EV sector, particularly in anticipation of Tesla’s entry. Dive deeper

Meta is hiring engineers in Bengaluru, with 41 positions listed, even as it lays off U.S. employees in performance-based cuts. The company is reportedly establishing a new Bengaluru site while expanding its AI integration efforts across social media platforms. Dive deeper

What’s happening globally

WTI crude oil futures fell to around $70.2 per barrel, nearing a two-month low, as expectations of resumed Kurdistan exports and potential sanctions relief on Russian oil weighed on prices. Meanwhile, Middle East tensions persist, with uncertainty surrounding the Gaza ceasefire and ongoing Ukraine peace talks. Dive deeper

Gold climbed above $2,940 per ounce, nearing record highs, as safe-haven demand grew amid concerns over Trump’s tariff plans and economic uncertainty in the US. Dive deeper

US stock futures edged higher as markets attempted to recover from last week’s sharp decline, with the Dow losing 2.51%, its worst since October. Investors are watching the upcoming Personal Consumption Expenditures (PCE) price index and earnings from Home Depot, Lowe’s, and Nvidia for consumer and AI sector insights. Dive deeper

The euro rose 0.6% before easing to just below $1.05 as markets reacted to Germany’s election results. The Christian Democratic Union/Christian Social Union (CDU/CSU) won 28.6%, with Alternative for Germany (AfD) at 20.8% and Social Democratic Party (SPD) at 16.4%, but coalition talks could delay policy decisions. Dive deeper

Euro Area inflation held at 2.5% in January 2025, the highest since July, driven by rising energy costs. Core inflation remained steady at 2.7% for the fifth straight month, its lowest since early 2022, while monthly consumer prices declined by 0.3%. Dive deeper

New Zealand’s retail sales rose 0.9% in Q4 2024, the strongest gain in three years, beating forecasts of 0.6%. Growth was driven by electronics (+5.1%), department stores (+4.2%), and accommodation (+7.6%), while pharmaceutical sales fell 3.4%. Dive deeper

China’s 10-year bond yield rose to a two-month high of 1.8%, supported by Beijing’s 2025 action plan aimed at attracting foreign investment and Alibaba’s $52 billion AI push. However, gains were capped by renewed US-China trade tensions, as President Trump moved to restrict Chinese investments in critical sectors. Dive deeper

Singapore’s inflation dropped to 1.2% in January 2025, its lowest since February 2021, led by declines in food, housing, and healthcare costs. Core inflation also eased to 0.8%, well below expectations, while transport costs rose due to higher private transport prices. Dive deeper

Trump’s deregulatory push has boosted global bank stocks by 20-25%, while Switzerland plans stricter capital rules for UBS after Credit Suisse’s collapse. UBS may need $25 billion to meet higher capital requirements, with final reforms expected in May. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Donald Trump, US President on imposing reciprocal tariffs

"We'll soon impose reciprocal tariffs because that means, they charge us, we charge them. Its very simple. Whatever a company or a country, such as let's say India or China or any of them, whatever they charge, we want to be fair ... so reciprocal. Reciprocal meaning, 'they charge us, we charge them'," - Link

Aadit Palicha, Co-founder & CEO of Zepto on Quick commerce for food and beverages

Zepto Café has hit 100K orders/day. That’s closing in on a $100 million annual gross merchandise value with an approximately 50% steady-state gross margin. It hasn't been easy to get Café the ground and many challenges are still work-in-progress, but I believe this is the beginning of a revolution in India's QSR industry. - Link

Piyush Gupta, Chief Executive Officer (CEO) of DBS Bank on AI and Jobs

“My current prediction, in the next three years, we’d shrink our workforce by 4,000, 10%. And that is because, AI is different”

“The fact that technology will be good for customers and employees is a utopian view. This was because unlike other technologies, AI is self-creating,” - Link

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.