Calm before the storm in Markets?

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

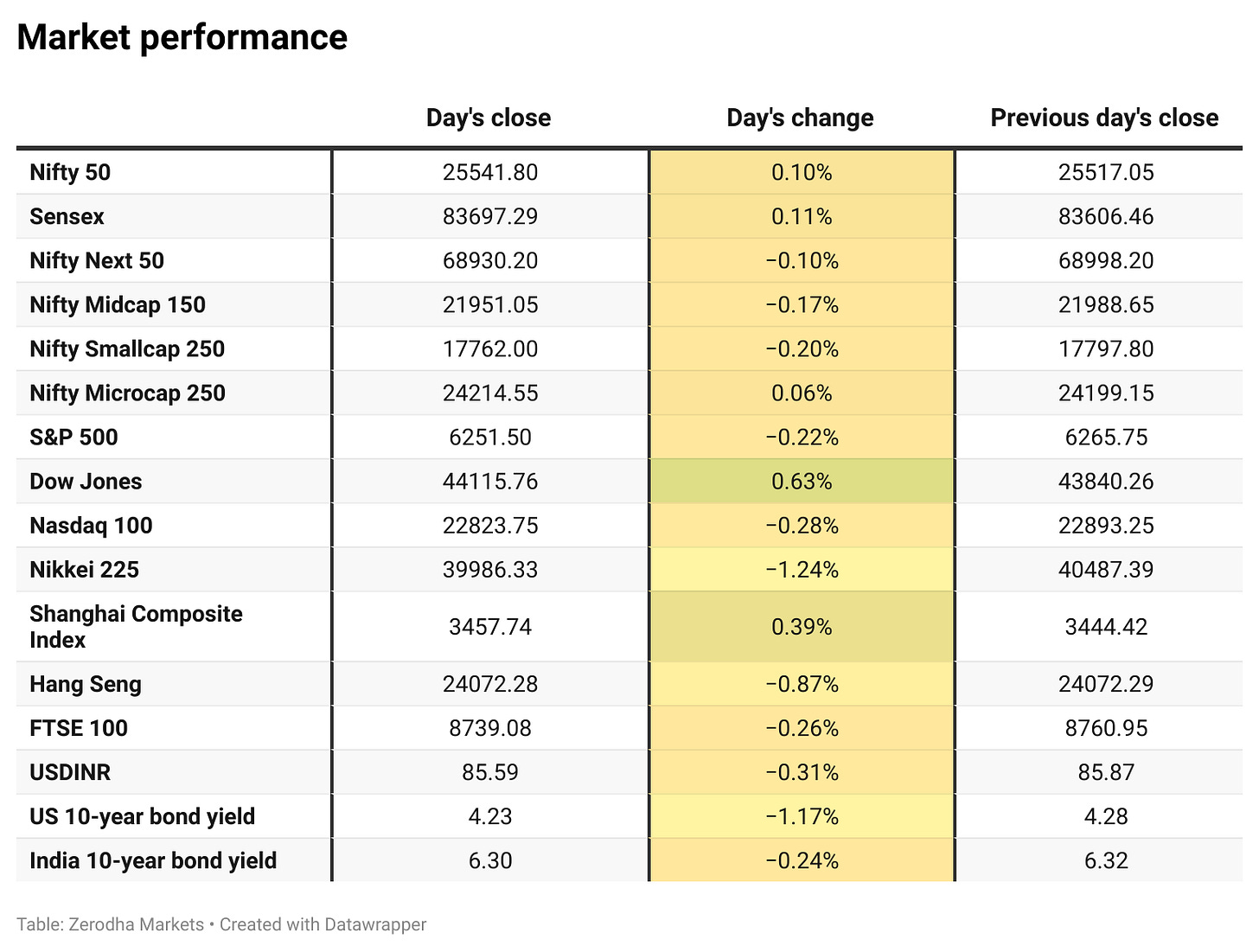

Market Overview

Nifty opened with a 34-point gap-up at 25,551.35 and, after some initial volatility, climbed to 25,590 in the first hour. It then retreated to the 25,530–25,540 zone and remained rangebound in a narrow 30-point band between 25,520 and 25,550 for the rest of the session. The index eventually closed at 25,541.80, up 0.09%.

While key indices like Nifty and Bank Nifty crossed important milestones of 25,500 and 57,000, respectively, investor sentiment remains cautious at higher levels amid ongoing geopolitical tensions and lingering uncertainty over global tariff developments.

Broader Market Performance:

Broader markets had a mixed session today. Of the 3,020 stocks traded on the NSE, 1,491 advanced, 1,452 declined, and 77 remained unchanged.

Sectoral Performance:

The top-gaining sector for the day was Nifty PSU Bank, which rose by 0.71%, while the worst-performing sector was Nifty Media, which declined by 1.31%.

Out of the 12 sectoral indices, 5 sectors closed in the green and 7 sectors ended in the red, indicating a largely negative bias in sectoral performance for the day.

Note: The above numbers for Commodity futures were taken around 5 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 3rd July:

The maximum Call Open Interest (OI) is observed at 26,000, followed closely by 25,600, suggesting strong resistance at 25,700 - 25,800 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed closely by 25,400, suggesting strong support at 25,400 to 25,300 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Mahindra & Mahindra’s June sales rose 14% YoY to 78,969 units, with SUV sales up 18% to 47,306 units. Tractor sales grew 13% to 53,392 units, aided by strong farm activity. Three-wheeler sales rose 37%, while CV sales dipped 0.1%. Dive deeper

Adani Enterprises plans to raise up to ₹1,000 crore via a retail bond issue opening July 9, offering tenors of 2 to 5 years with annual coupons between 8.95% and 9.30%. Dive deeper

The government has extended the tenure of Financial Services Institutions Bureau (FSIB) chairperson Bhanu Pratap Sharma and other part-time members by one year till June 30, 2026. FSIB, the body that recommends appointments for state-run banks and insurers, includes former officials from RBI, LIC, and IRDAI. Dive deeper

The RBI reduced its forward dollar book for the third straight month, bringing the net short position to $45 billion as of May, down from a $78 billion peak in February. To offset the liquidity impact, it conducted ₹1.25 lakh crore worth of OMOs in May. Dive deeper

Sony India aims to reach a ₹10,000 crore turnover in the next 2–3 years, driven by premiumisation and product expansion across categories like PlayStation, imaging, and medical devices. FY24 revenue rose 20.6% to ₹7,663.74 crore, with the company optimistic about double-digit growth ahead. Dive deeper

SEBI has proposed revising IT norms for commodity derivatives platforms, suggesting exchanges and clearing corporations maintain at least twice the projected peak load capacity, down from the current 4x requirement. The move aims to address underutilisation and ensure system resilience through stress testing, real-time monitoring, and stricter oversight. Public comments are invited by July 20. Dive deeper

Federal Bank’s board has approved raising up to ₹6,000 crore via various debt instruments, subject to shareholder and regulatory approvals. It also cleared potential equity fundraising through multiple routes and re-appointed Varsha Purandare as an independent director for a second term of three years. Dive deeper

RBI data shows rising stress in unsecured retail loans, with private banks accounting for nearly 80% of fresh slippages between September 2024 and March 2025. Public sector banks had the highest SMA ratio at 10.5%, while the GNPA ratio for the system stood at 1.8%. Both segments face elevated risks to asset quality. Dive deeper

Paras Anti-Drone Technologies, a unit of Paras Defence, received a ₹22.21 crore order from French firm Cerbair for 30 units of its CHIMERA 200 anti-drone system. Dive deeper

Flipkart-backed Shadowfax has filed confidential papers with SEBI for a ₹2,000–2,500 crore IPO, comprising fresh issue and offer for sale. The funds will be used to boost capacity and expand its network business. The logistics firm, valued at ₹6,000 crore in February, now seeks a valuation of around ₹8,500 crore. Dive deeper

Hindustan Power will set up a 100 MW solar project with a 200 MWh battery energy storage system under an ISTS tender awarded by SJVN. The project was secured via tariff-based bidding and e-reverse auction, as part of a broader 1200 MW solar and 2400 MWh storage initiative across India. Dive deeper

The Union Cabinet has approved a ₹1.07 lakh crore Employment Linked Incentive scheme aimed at creating over 3.5 crore jobs in two years. The scheme offers up to ₹3,000 per month per first-time employee and covers salaries up to ₹1 lakh. For manufacturing, incentives will extend to the third and fourth years. Dive deeper

What’s happening globally

WTI crude hovered near $65.7 amid volatility ahead of OPEC+’s expected output hike of 411,000 bpd in August, pushing 2025's total increase to 1.78 million bpd. Easing Israel-Iran tensions and tariff concerns from the U.S. dampened risk sentiment, keeping investor caution high. Dive deeper

Gold rose to around $3,330 per ounce, supported by a weaker US dollar, trade uncertainty, and expectations of Fed rate cuts. Dive deeper

The US Logistics Managers’ Index rose to 60.7 in June, marking elevated supply chain activity driven by an 8.3-point jump in Inventory Levels amid a tariff pause. Inventory Costs crossed 80 for the first time since 2022, while Warehousing Capacity slipped into contraction at 47.8. Dive deeper

Eurozone inflation edged up to 2.0% in June, matching the ECB’s target, with services inflation rising and energy price declines easing. Core inflation held steady at 2.3%, its lowest since January 2022, while national trends diverged across Germany, France, Spain, and Italy. Dive deeper

Germany’s jobless rate held at 6.3% in June, below expectations but still the highest since 2020, with unemployment nearing 3 million. Job openings dropped to 632,000, reflecting weak hiring demand amid ongoing economic softness, according to the labour office. Dive deeper

UK house price growth slowed to 2.1% YoY in June, the weakest since July 2024, amid softer demand following April’s stamp duty hike. Monthly prices fell 0.8%, defying expectations of a rise. Still, supportive fundamentals may sustain housing activity through the summer. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

CS Setty, Chairman, State Bank of India on global ranking and growth outlook

“Breaking into top 10 banks globally by assets will probably take some time... In terms of assets, we are already among the top 50 and recently it has entered the top 100 corporates by profits.”

“The potential to grow in India is immense and we would like to capitalise on that.”“We are setting up a Centre of Excellence within SBI, so that we not only help our own people, but understand the technologies and fund them. We would also help the industry raise the finance.” - Link

S. Jaishankar, External Affairs Minister on India-U.S. trade deal negotiations

“Obviously, my hope would be that we bring it to a successful conclusion. I cannot guarantee it, because there's another party to that discussion.”

“And just like the U.S. or people in the U.S. may have views about India, people in India have views about the U.S. too. And we’ll have to find a kind of meeting ground. I believe it’s possible.”

“You are really looking at thousands of lines and doing very intricate trade-offs… These are not simple, back-of-the-envelope calculations.” - Link

India Remains Fastest Growing Economy in Coverage: Morgan Stanley GIC

“India remains the fastest growing economy in our coverage, with real GDP growth at 5.9 per cent, Q4/Q4 in 2025 and 6.4 per cent in 2026.”

“We anticipate global growth stepping down by a percentage point in 2025 from 2024, with US trade policy and the uncertainty it engenders serving as the main drivers.”

“While Indian equities are considered expensive when compared to historical levels, the strong domestic retail and institutional investment flows will support high valuations.”- Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.