Ceasefire violation drama triggers sharp reversal in markets

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

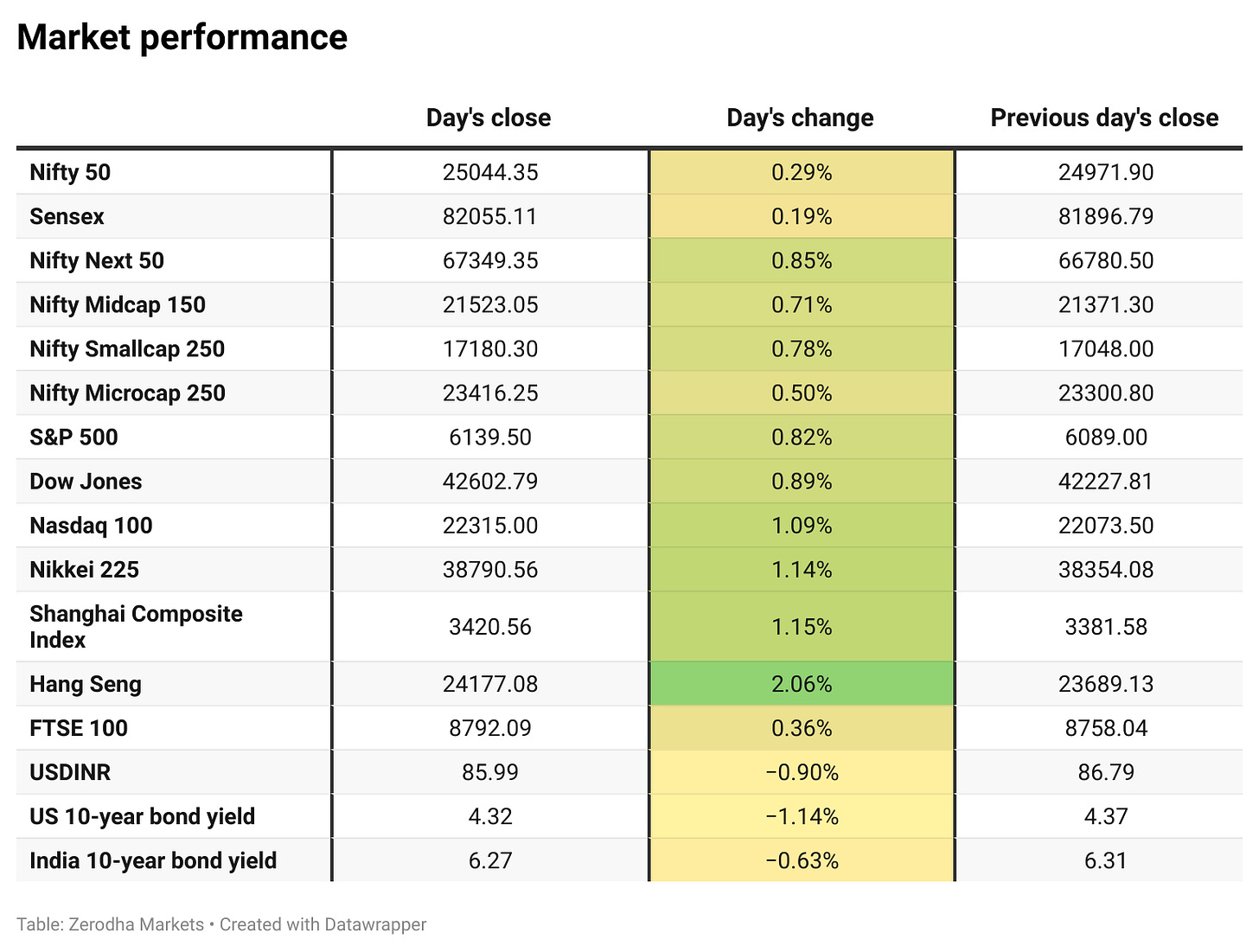

Nifty opened with a 210-point gap-up at 25,179.90 on Iran’s retaliation and ceasefire news, easing crude prices. It touched 25,250, dipped to 25,125, then climbed to 25,300 by 12:15 PM. Markets reversed after reports of a ceasefire breach, dragging Nifty down nearly 300 points to test 25,000. It closed at 25,044.35, up 0.29%, after range-bound trade in the final hour.

Cautious sentiment persisted amid rising Middle East tensions, lifting oil prices. Investors tracked geopolitical cues closely and awaited clarity on global tariff developments.

Broader Market Performance:

Broader markets had a positive session today. Of the 2,976 stocks traded on the NSE, 1,966 advanced, 917 declined, and 93 remained unchanged.

Sectoral Performance:

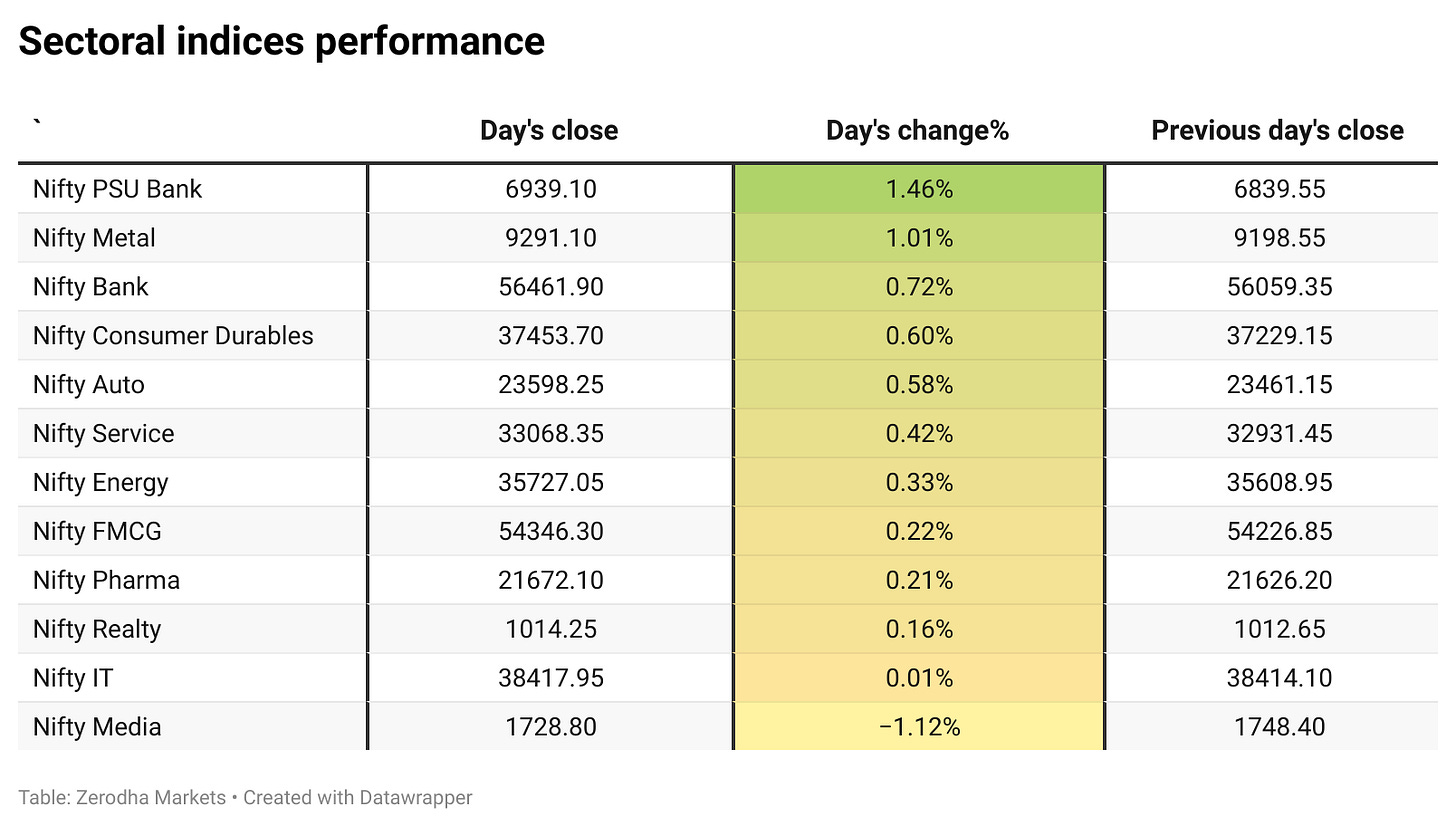

The top-gaining sector for the day was Nifty PSU Bank, which rose by 1.46%, followed by Nifty Metal with a gain of 1.01%. On the other hand, the only sector that ended in the red was Nifty Media, which declined by 1.12%.

Out of the 12 tracked sectors, 11 sectors closed in the green, while 1 sector ended in the red, indicating a broadly positive market breadth.

Note: The above numbers for Commodity futures were taken around 5 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 26th June:

The maximum Call Open Interest (OI) is observed at 25,200, followed closely by 25,500, suggesting strong resistance at 25,300 - 25,400 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed closely by 24,800, suggesting strong support at 24,800 to 24,700 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Adani Airports secured $1 billion in funding for Mumbai International Airport, including $750 million in notes maturing in 2029 to refinance debt. The deal, led by Apollo and backed by investors like BlackRock and Standard Chartered, marks India’s first investment-grade private airport bond issuance. The funds will aid MIAL’s expansion and modernization plans. Dive deeper

Vodafone Idea clarified it hasn't received any official communication from the government regarding AGR relief. The statement follows media reports and a sharp stock surge on speculation that the Centre may offer concessions, owing in part to its 49% stake in the company. Dive deeper

Devyani International will increase its stake in Sky Gate Hospitality, parent of Biryani By Kilo, from 80.72% to 86.13% for up to ₹106.25 crore through equity subscription and share purchase. The move supports further investments in Sky Gate and its subsidiaries, with completion expected by July 31, 2025. Dive deeper

Vedanta Resources reported a $1,617 million profit in FY25, reversing a $400 million loss last year, driven by stronger commodity prices and efficiency gains. Revenue rose 6% YoY to $18.2 billion. The firm is progressing with its demerger plan to unlock value through five focused entities. Dive deeper

BluPine Energy has secured ₹2,416 crore in debt funding for its 150 MW FDRE project in Karnataka under the SJVN tender. The project combines solar, wind, and battery storage to support peak demand. It is expected to be commissioned in 2026 and reduce over 6.8 lakh tonnes of CO₂ emissions. Dive deeper

Biocon will use ₹4,500 crore raised via QIP to repay private equity investors who funded its Viatris biosimilars acquisition. This includes nearly $200 million to Goldman Sachs and dues to Kotak and Edelweiss, freeing up equity and increasing its stake in Biocon Biologics from 72% to 79%. Bank debt remains unchanged at $1.2 billion. Dive deeper

Dixon Technologies shares were in focus after promoter Sunil Vachani sold a 2.77% stake worth over ₹2,221 crore, bringing his holding down to 2.57%. The overall promoter stake dropped from 32.27% to 29.5%. Motilal Oswal Mutual Fund bought 2.39% in the deal. Dive deeper

HG Infra Engineering bagged a ₹118 crore project from the Military Engineer Services to build an Integrated Material Handling Facility at Mumbai’s Naval Dockyard. The project is to be executed over 30 months. Dive deeper

NBCC has secured a ₹296.53 crore redevelopment project from the Meerut Development Authority in Uttar Pradesh. The state-owned firm will execute the project under its project management consultancy arm. Dive deeper

Zen Technologies has acquired a 55% stake in TISA Aerospace for ₹6.56 crore, marking its entry into loitering munitions and UAVs. The move strengthens Zen’s defence tech portfolio by integrating TISA’s R&D capabilities with its anti-drone systems and propulsion tech. Dive deeper

Kalpataru raised ₹708 crore from nine anchor investors, including GIC Singapore, Bain Capital, SBI MF, and ICICI Pru MF, ahead of its ₹1,590 crore IPO. Shares were allotted at ₹414 apiece, the top end of the price band. Dive deeper

Embassy Developments signed a JDA for a 17.9-acre land parcel in Whitefield, Bengaluru, to develop a premium residential project with an estimated GDV of ₹1,600 crore. The project adds to its FY26 launch pipeline of ₹22,000 crore across 10 projects. Dive deeper

What’s happening globally

WTI crude slipped nearly 3% to $66 despite paring earlier losses, after a ceasefire between Israel and Iran eased supply concerns. The truce calmed fears over the Strait of Hormuz, but tensions remain high as Israel warned of possible Iranian violations. Dive deeper

Gold dipped to a two-week low near $3,325 as hopes of a lasting ceasefire between Iran and Israel briefly eased safe-haven demand. However, renewed missile reports and Fed rate cut signals kept uncertainty alive. Dive deeper

Canada’s inflation held steady at 1.7% in May, staying below the Bank of Canada’s 2% target for the second month. Price pressures eased in shelter and food, while core inflation measures edged down to 3%. Monthly CPI rebounded 0.6% after a dip in April. Dive deeper

Germany’s Ifo Business Climate rose to 88.4 in June, the highest in nearly a year, with optimism in services and retail driving gains. Expectations jumped to 90.7, though manufacturers remained concerned about weak order books. Ifo’s president noted that confidence is slowly returning. Dive deeper

UK manufacturing orders fell sharply in June, with the CBI’s net balance at -33, the lowest since January. Output declined across most sectors, though firms expect moderation ahead. Selling price expectations eased, but cost pressures and weak demand remain key challenges. Dive deeper

The US 10-year yield hovered near a seven-week low at 4.35% as markets weighed the fragile Iran-Israel truce and its limited impact on energy flows. Continued tanker movement in the Gulf eased inflation fears, while FOMC members signaled openness to a July rate cut amid disinflation and labor softness. Dive deeper

Starbucks denied reports of a full sale of its China operations but confirmed it’s evaluating options, including a possible stake sale. Over 20 firms, including private equity players, responded to its initial process led by Goldman Sachs. Dive deeper

Ford is recalling nearly 133,000 Lincoln Aviator SUVs (2020–2025 models) in the U.S. due to a risk of parts detaching from rear doors because of poor adhesive retention. Dive deeper

Swedish textile recycler Syre, backed by H&M, is partnering with Gap and Target to supply recycled polyester, tapping into growing demand for sustainable fashion. Gap plans to use 10,000 tons annually, while Target will integrate it into select products. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Gautam Adani, Chairman, Adani Group, on Adani Ports

“Adani Ports and Special Economic Zone Ltd. has emerged as a cornerstone of India’s trade infrastructure, handling a record 450 million metric tonnes of cargo this year.”

“With marine, trucking, warehousing, and even freight forwarding, we are creating a transport utility for the future.”

“Calling Adani Ports the ‘beating heart of India’s trade’.” - Link

D.K. Sunil, Chairman & MD, HAL, on Tejas jet deliveries and engine supply delays

“As of today, we have six aircraft lined up.”

“But the engine deliveries have not happened from GE Aerospace. They were to deliver the engines in 2023. Till date, we have got only one engine.”

“I can assure you that as of today, six aircraft are ready. There is no let-up from our side. We are building those aircraft and getting them ready, and we will be in a position to deliver (by this fiscal).” - Link

Nirmala Sitharaman, Union Finance Minister, on India’s evolving export ecosystem

“So, the decades-old system of SEZs alone promote export, SEZs will have to be specified, specialised export promotion zones, may be where they are, but over the last one decade this government has brought in this dimension that you don’t have to be in an SEZ to export, but you can do it from the districts.”

“Exports are not just growing as they were earlier. Today, they are technology-infused, high-end products that are being exported. High technology-infused areas where innovation and intellectual property will all come in handy. So India is not just bulk-exporting raw foods or commodities. It is exporting well-engineered products with high standards.” - Link

Ram Singh, RBI MPC Member, on forex reserves and inflation outlook

“India’s $700 billion in foreign exchange reserves gives the economy a crucial cushion against rising geopolitical turmoil.”

“I expect the country’s foreign-exchange buffer to help blunt the impact of inflation caused by rising crude and fertilizer prices.”

“The central bank’s rate cut decision is fully justified, coming on the back of strong fundamentals and a stable outlook on the domestic fronts, including fiscal prudence and a benign inflation forecast.” - Link

Pranjul Bhandari, Chief Economist, HSBC, on June PMI surge and labour trends

“Meanwhile, the combination of robust global demand and rising backlogs prompted manufacturers to increase hiring.”

“Employment growth is also healthy in the services sector despite slightly weakening on a sequential basis from May to June.”

“Input prices across the private sector increased only modestly during June… the rate of inflation softened to a ten-month low and was below its long-run average.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.