Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Nifty opened 52 points higher at 25,505 but quickly dropped 80 points to 25,425 within 15 minutes. It then bounced back sharply, crossing 25,550 in the first hour of trading. Later, the market stayed between 25,500 and 25,530 until 1:30 PM. In the afternoon, Nifty hit a high of 25,587 before falling sharply by 200 points over the next 30 minutes. The index settled lower and closed at 25,405, down 0.18%.

While key indices opened higher, foreign fund outflows and a weaker rupee caused volatility and losses by the close. Investors stayed cautious amid uncertainty in US-India trade talks and mixed global cues.

Broader Market Performance:

Broader markets had a mixed session today. Of the 3,025 stocks traded on the NSE, 1,450 advanced, 1,472 declined, and 103 remained unchanged.

Sectoral Performance:

Nifty Media emerged as the top gainer for the day with a strong gain of 1.45%, while Nifty PSU Bank was the worst performer, closing down by 0.89%. Out of the 12 sectoral indices, 6 ended in the green, led by Consumer Durables, Auto, Pharma, FMCG, and Energy, whereas 6 sectors closed in the red, including IT, Services, Bank, Realty, Metal, and PSU Bank. The market breadth across sectors remained slightly negative, reflecting a cautious tone.

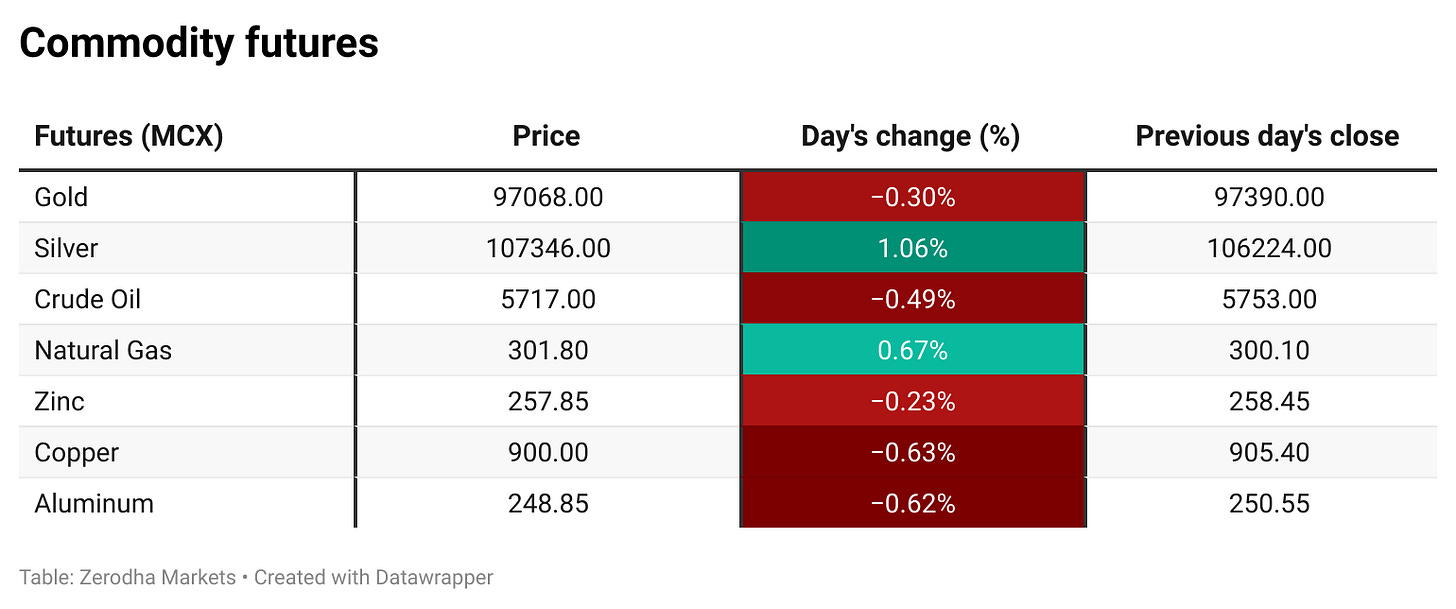

Note: The above numbers for Commodity futures were taken around 4 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 10th July:

The maximum Call Open Interest (OI) is observed at 25,500, followed closely by 25,600 & 25,700, suggesting strong resistance at 25,500 - 25,600 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed closely by 25,500, suggesting strong support at 25,300 to 25,200 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

HSBC India Services PMI was revised to 60.4 in June 2025, marking the fastest expansion since last August, driven by domestic sales. Employment grew for the 37th month, while input cost inflation hit a 10-month low. However, business sentiment weakened below its long-term average. Dive deeper

Biocon Biologics received European Commission approval for Vevzuo and Evfraxy, biosimilars of Denosumab used to treat various bone diseases. These approvals follow positive opinions from the European Medicines Agency and mark a significant milestone in Biocon’s expansion in Europe. Dive deeper

IL&FS has approached the NCLT to cancel Brookfield’s ₹1,080-crore bid for its Mumbai BKC headquarters, citing Brookfield’s failure to renew a ₹108-crore performance guarantee as required. The property remains vacant pending resolution of the legal dispute. Dive deeper

Maharashtra approved ₹1.35 lakh crore in investments across high-tech sectors, including semiconductors, EVs, and defense, expected to create around 1 lakh jobs. The state expanded incentives and increased thrust sectors from 22 to 30. Dive deeper

Spright Agro completed commodity supply orders worth ₹299 crore for institutional clients in Gujarat, reflecting its strong execution and supply chain capabilities. Dive deeper

Indian Overseas Bank shareholders approved a ₹4,000 crore equity fundraise through multiple routes for FY26. The capital will support growth in lending and digital banking. The resolution passed with a strong majority at the 25th AGM. Dive deeper

Voltas received a GST show cause notice for alleged short payment of ₹265.25 crore related to Universal Comfort Products from FY18-19 to FY20-21. The notice was issued by the Central GST Commissionerate in Dehradun. Dive deeper

Tata Power was ordered by an arbitration tribunal to pay $490 million, plus interest and legal costs, to Kleros Capital Partners. Dive deeper

Unsecured loan growth slowed to around 8% in May amid rising delinquencies and cautious lending. Private banks saw higher stress, while gold loans surged. Growth may pick up later this year with seasonal demand. Dive deeper

Reliance is spinning off its consumer goods brands into a new subsidiary, New Reliance Consumer Products Ltd (RCPL), ahead of its retail IPO. The move aims to provide focused management and attract distinct investors for the capital-intensive consumer goods business. Dive deeper

Alembic Pharmaceuticals’ US subsidiary acquired Utility Therapeutics for $12 million to strengthen its US presence. The deal includes commercializing Utility’s FDA-approved drug Pivya for urinary tract infections, with plans to launch in late 2025. Dive deeper

Adani Airport Holdings will provide lounge access through its in-house platform, partnering with other operators to offer a seamless experience without intermediaries. This initiative aligns with India’s fintech-led digital innovation. Dive deeper

Godrej Industries plans to invest over ₹750 crore to expand capacities in its chemicals business, aiming to become a $1 billion global firm by 2030. The expansion includes doubling fatty alcohol and uric acid production and tripling fermentation capacity. The company also aims to increase renewable energy usage to 75%. Dive deeper

MobiKwik Securities, the broking arm of MobiKwik, received Sebi approval to operate as a stockbroker and clearing member, enabling it to execute and settle equity trades. Dive deeper

PNB Housing Finance’s board recommended issuing up to ₹10,000 crore in non-convertible debentures via private placement, subject to shareholder approval at the August AGM. The company also set August 1 as the record date for a ₹5 per share dividend, pending AGM approval. Dive deeper

What’s happening globally

Brent crude futures fell toward $68 per barrel as US crude stockpiles rose sharply, raising demand concerns. OPEC+ plans to increase production by 411,000 bpd in August, adding supply pressure. Dive deeper

Gold hovered near $3,350 an ounce as trade optimism reduced its safe-haven demand, following a US-Vietnam trade deal easing tariffs. Dive deeper

The ECB delivered its eighth straight rate cut in June amid global uncertainties and trade tensions. A pause in July is likely as officials await clearer data. Inflation is expected to remain below 2%, with one more cut anticipated this year before possible tightening in 2026. Dive deeper

US Non-Farm Payrolls rose by 147,000 in June 2025, slightly above the long-term average of 125,000. The record high was 4,631,000 in June 2020, and the record low was -20,471,000 in April 2020. Dive deeper

Turkey’s annual inflation eased to 35.05% in June, the lowest since November 2021, with slower price growth in most sectors. Transport, clothing, and recreation saw rising inflation. Core inflation rose slightly to 35.64%, while monthly CPI increased 1.37%. Dive deeper

The Bank of Japan kept its short-term interest rate at 0.5%, maintaining the highest level since 2008 amid geopolitical risks and U.S. tariff uncertainties. It plans to gradually reduce government bond purchases by JPY 400 billion quarterly through March 2026, then slow cuts to JPY 200 billion quarterly until March 2027. Dive deeper

Nike and Lululemon shares rose sharply after President Trump announced a trade deal with Vietnam, a key manufacturing hub for the apparel and footwear industry. Dive deeper

OpenAI clarified that it has not partnered with Robinhood for the stock tokens recently launched by the trading platform in the EU. Dive deeper

Domino’s Pizza Enterprises CEO Mark van Dyck resigned voluntarily after implementing a five-year turnaround plan and closing 205 underperforming stores. The board supported the plan but wanted faster results. A global search for his replacement is underway. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Swaminathan S Iyer, Member (Life), IRDAI on life insurance mis-selling

“The number of mis-selling complaints are not alarming. They currently stand at around 0.41 per 100 policies.”

“While it is not alarming, the regulator has consistently told the industry that the number must keep going down.”

“Irdai does not mandate IPOs but encourages insurers to consider it as they grow.” -Link

Sanjeev Kumar Bijli, Executive Director, PVR Inox, on expansion plans

“This financial year, 2025-26, we have about 100 screen openings planned, and out of which we have opened about 20 already in the first quarter, and we have another 82 to go.”

“Out of the 100 screens, 40 screens are in South India, including Hyderabad, Bangalore, and Hubli.”

“For the 200 screens that the company has planned, its investment will be around Rs 350-400 crore.” - Link

Rajiv Memani, President, CII, on rare earth supply challenges in the auto sector

“In auto, the concern is more serious than what's come out so far.”

“It’s not just about EVs. The concern is wider, and it affects multiple sectors.”

“This is a moment to re-examine all critical supply chain dependencies.”

“Talks with Japanese industry are ongoing, and Indian industry should proactively pursue self-reliance in critical minerals.” - Link

Tim Lamb, Vice President, Meta, on EU fine and compliance

“This decision is both incorrect and unlawful, and we are appealing it.”

“Yet the decision ignores [the 2023 EU court] ruling. Instead, it claims that the crucial judgment is not relevant and incorrectly concludes that Meta's user choice does not comply with the DMA.”

“This stance is perplexing.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.