Markets drift lower as tariff worries grow

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Nifty opened at 25,511.65 and quickly marked the day’s high of 25,524.05 in the first minute of trade. The index then slipped into a steady downtrend, hitting an intraday low of 25,340.45 before a mild recovery into the close. It ended at 25,355.25, down 0.47%, marking a weak finish for the session.

Market remained cautious amid global tariff concerns and limited domestic triggers. Sentiment stayed muted ahead of key earnings and uncertainty over the India-US trade agreement, with everyone waiting on Trump’s announcement before the August 1 tariff deadline.

Broader Market Performance:

Broader markets traded with a slight negative bias. Out of 2,998 stocks traded, 1,387 advanced, 1,521 declined, and 90 remained unchanged.

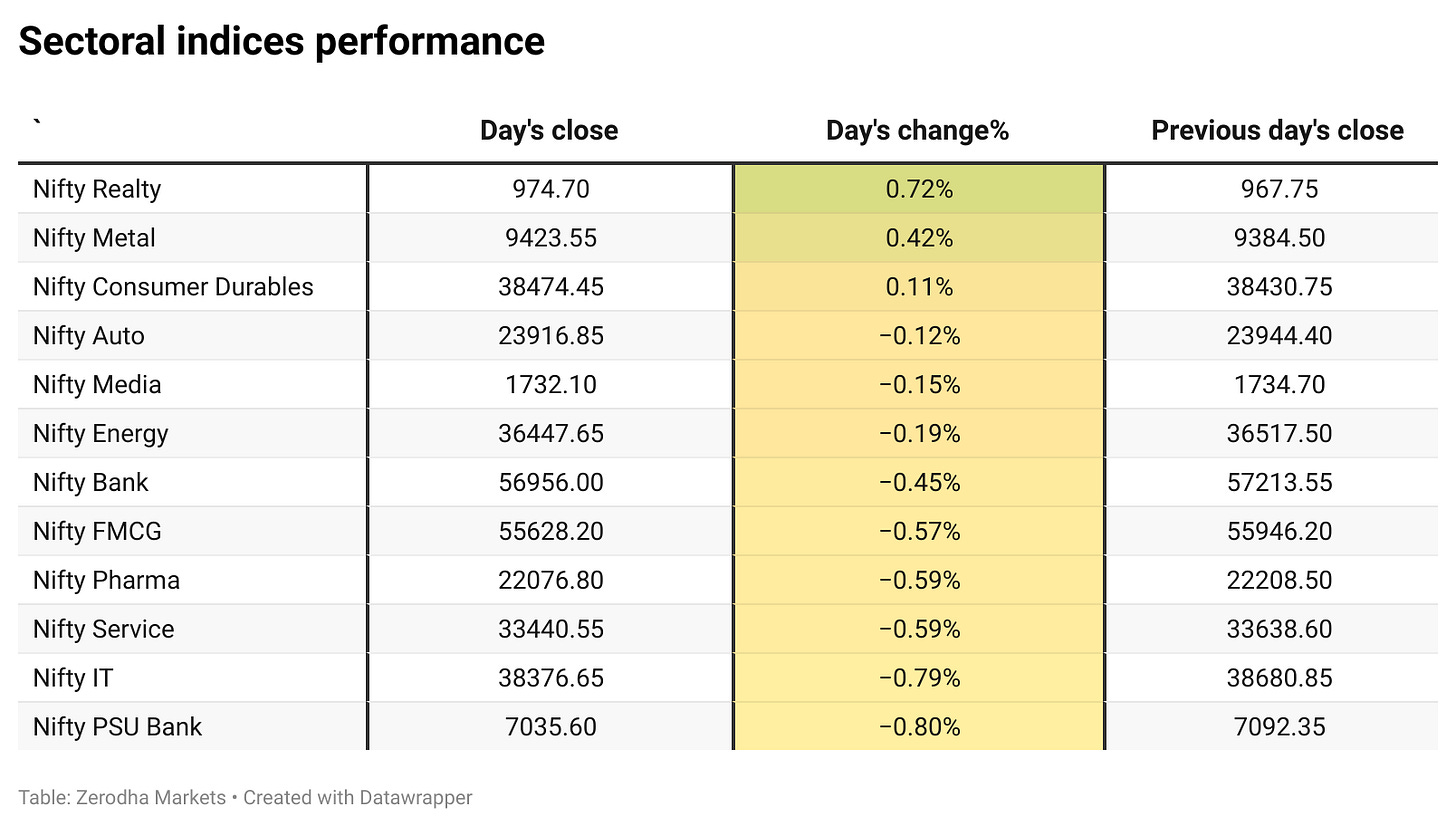

Sectoral Performance:

Nifty Realty was the top gainer, up 0.72%, followed by Metal rising 0.42% and Consumer Durables up 0.11%.

On the flip side, PSU Bank saw the steepest fall, down 0.80%, followed by IT down 0.79% and Services and Pharma, both down 0.59%. Most other sectors, including FMCG, Bank, and Energy, ended in the red with mild losses.

Note: The above numbers for Commodity futures were taken around 4 pm. Here’s the trend of FII-DII activity from the last 5 days:

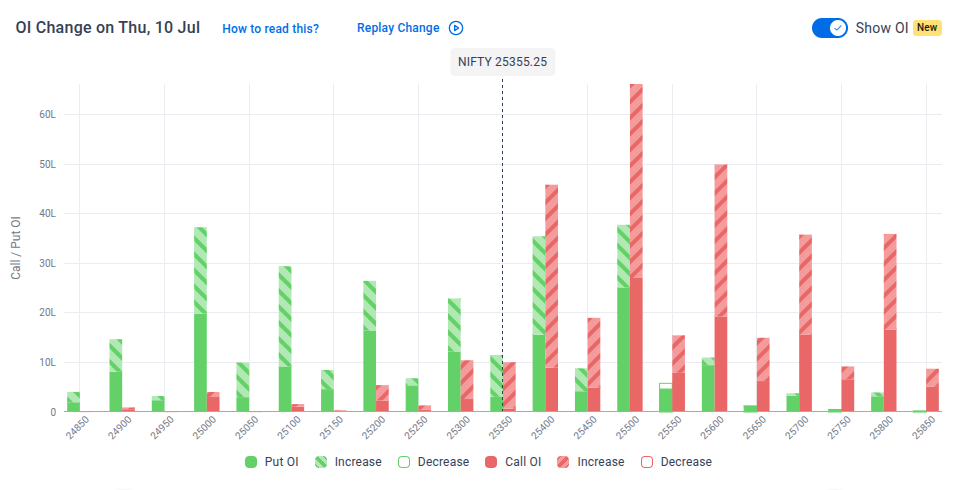

Change in OI for the day

The following is the change in Open Interest (OI) for Nifty contracts expiring on Thursday, 17th July:

The maximum Call Open Interest (OI) is seen at 25,400, followed by 25,500, indicating strong resistance in the 25,500 - 25,600 zone for the coming week.

The maximum Put Open Interest (OI) is placed at 25,350, followed by 25,300, suggesting decent support around the 25,200 - 25,300 range.

Note: Since this is a fresh positioning post-expiry, OI build-up at key levels gives early cues on trader sentiment. Increasing Call OI generally reflects resistance expectations, while increasing Put OI signals support zones.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Sebi has proposed allowing credit rating agencies to rate unlisted securities and products regulated by other financial sector bodies, even without specific guidelines. CRAs must set up separate, ring-fenced units within six months and disclose unregulated activities to clients in advance. Dive deeper

ACC, a subsidiary of Ambuja Cements, has commissioned a 1.5 MTPA grinding unit at Sindri, Jharkhand, taking Ambuja’s total cement capacity to 104.45 MTPA. This follows a 2.4 MTPA expansion at Sankrail, West Bengal, last month. Dive deeper

Adani Ports and Adani Airport Holdings are in advanced talks to raise $250 million in offshore loans from Mitsubishi UFJ Financial Group, marking MUFG’s first bilateral deal with the group since November. The companies may also seek further funding from other Japanese lenders. Dive deeper

Manipal Hospitals has signed a definitive agreement to acquire Pune-based Sahyadri Hospitals from Ontario Teachers’ Pension Plan for around ₹6,000 crore. The deal expands Manipal’s network to 49 hospitals with 12,000 beds, strengthening its presence in western India. Dive deeper

AIFs have requested the RBI to raise the investment cap for regulated entities in a single scheme from 10% to 25%. IVCA argues that the current limit could restrict capital flow. The change would aid long-tenure funds focused on infrastructure and stressed assets. Dive deeper

State Bank of India is planning a ₹25,000 crore share sale via qualified institutional placement as early as next week. If fully subscribed, it would be India’s largest-ever QIP, surpassing Coal India’s 2015 record. The move aims to support loan growth and strengthen SBI’s balance sheet. Dive deeper

HSBC’s 2025 report shows affluent Indians moving toward alternative assets, global exposure, and multi-asset strategies. Gold allocations are rising, while cash holdings decline. Traditional investment approaches are giving way to more diversified portfolios. Dive deeper

Asian Paints has sold its entire 4.42% stake in Akzo Nobel India for ₹734 crore via a bulk deal at ₹3,651 per share. The move marks its complete exit from the company. The sale comes amid heightened activity in the paints sector. Dive deeper

Enviro Infra Engineers and AltoraPro have secured a ₹395.5 crore project from Maharashtra Industrial Development Corp. for pollution control and CETP upgrades in Kolhapur. The project is to be completed in 24 months under a joint venture agreement. Dive deeper

RBI released draft norms for the novation of OTC derivative contracts to simplify regulatory requirements. Novation involves replacing one market maker with another, with prior consent from the remaining party. Standard agreements will be framed by FIMMDA and FEDAI. Dive deeper

IndiGo Ventures raised ₹450 crore in the first close of its maiden fund and announced its first investment in Hyderabad-based Jeh Aerospace. Jeh will use the funds to scale digital manufacturing and AI-driven platforms. Dive deeper

Vodafone Idea COO Abhijit Kishore has been re-elected as Chairperson of the Cellular Operators Association of India (COAI) for 2025–26, with Bharti Airtel’s Rahul Vatts as Vice Chairperson. Dive deeper

What’s happening globally

WTI crude fell below $68 per barrel on Thursday amid trade disruption fears and a surprise 7.1 million barrel US inventory build. Trump’s tariff threats and rising OPEC+ supply added pressure, though Red Sea attacks and strong gasoline demand cushioned losses. Dive deeper

Gold rose to around $3,320 per ounce, driven by a weaker dollar and trade tensions. Markets reacted to Trump’s tariff threats, including new duties on Brazil. FOMC minutes showed a divided Fed on rate cuts, with most expecting easing later this year. Dive deeper

The Brazilian real fell to 5.6 per dollar after the US hiked tariffs on Brazilian imports to 50%, citing unfair trade and Bolsonaro’s prosecution. President Lula vowed retaliation under new legislation. Weak export prices, a wider trade deficit, and contracting industrial output added pressure. Dive deeper

The Nikkei 225 fell 0.44% to 39,646 and the Topix lost 0.56% to 2,812 on Thursday as US-Japan trade talks stalled. Trump announced a 25% tariff on Japanese goods starting August 1, with no deadline extension. Key stocks like Nintendo and Sony declined, and new tariffs may cut Japan’s GDP by 0.8% in 2025. Dive deeper

The Bank of Korea held its base rate at 2.50% in July, following a 25 bps cut in May, to safeguard financial stability amid tariff risks and rising debt. Inflation is forecast at 1.9% for 2025, with June CPI slightly higher at 2.2%. Growth remains weak, with a downgraded 0.8% forecast and Q1 GDP contracting 0.2%. Dive deeper

Donald Trump announced a 50% tariff on copper imports effective August 1, aiming to boost domestic mining and metal processing. This move follows earlier tariffs on steel and aluminum. Global suppliers are accelerating shipments to the US ahead of the deadline. Dive deeper

WK Kellogg shares surged nearly 50% after reports that Ferrero is close to acquiring the cereal maker in a deal valued at around $3 billion. The potential buyout would unite two major consumer food brands and expand Ferrero’s global footprint. A final agreement could be reached this week. Dive deeper

ChatGPT crossed 10% global usage share in June, gaining 80 basis points month-on-month, while traditional search platforms fell to 88.5%, according to Wells Fargo. Google’s overall usage remained steady, though it has lost 6.6 percentage points in market share this year. Gemini saw a modest rise to 0.7%. Dive deeper

BMW reported a 0.4% rise in Q2 deliveries, with strong demand in Europe and resilient U.S. sales offsetting a 13.7% decline in China. BMW and MINI sales grew 10.1% in Europe and 1.4% in the U.S., while the MINI brand saw growth across all regions. Dive deeper

Tesla has scheduled its annual shareholder meeting for November 6, following pressure from major investors to meet legal obligations. The board also set July 31 as the deadline for submitting shareholder proposals for the proxy statement. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Piyush Goyal, Commerce and Industry Minister, on agriculture exports

“India’s agriculture, animal husbandry and fisheries exports crossed Rs 4.5 lakh crore, but could rise nearly fivefold to Rs 20 lakh crore with stronger focus on food processing, branding and packaging.”

“India remains a rain-fed agrarian economy, making it vulnerable to climate variability.”

“With better value addition and export of processed rather than raw products, India can double or triple its farm exports despite global trade headwinds.” - Link

Sudhakar Shetty, President, Indian Hotel and Restaurant Association, on Maharashtra tax hikes

“On July 1, the state government hiked VAT on liquor to 10% from the current 5% followed by a 15% increase in license fees for the financial year 2025-26.”

“The tax burden is not just an economic blow, but it is also a death blow to an industry that contributes significantly to employment and state taxes.”

“These draconian hikes are the final nail in the coffin. Our members are devastated and staring at a bleak future, and our survival is at stake.” - Link

Judson Althoff, Chief Commercial Officer, Microsoft, on AI impact and job cuts

“Artificial intelligence tools are boosting productivity in everything from sales and customer service to software engineering.”

“AI saved Microsoft more than $500 million last year in its call centers alone and increased both employee and customer satisfaction.”“Through the use of Microsoft’s Copilot AI assistant, each salesperson is finding more leads, closing deals quicker, and generating 9% more revenue.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Thanks for reading Aftermarket Report by Zerodha! Subscribe for free to receive new posts and support my work.