Markets pause after 4-day surge; Nifty ends just above 25,500

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Nifty opened with a lacklustre 24-point gap-up at 25,661.65, despite record-high closes on the S&P and Nasdaq. The index soon turned weak, falling by 130 points to test the 25,540 level. It then traded in a narrow range between 25,550 and 25,600 until noon, before slipping further by 125 points to test the 25,475 mark. In the final hour, markets remained rangebound, and Nifty eventually closed at 25,517.05, down 0.47%.

While key indices like Nifty and Bank Nifty crossed significant milestones of 25,500 and 57,000, respectively, investor sentiment remains cautious amid ongoing geopolitical tensions and uncertainty around global tariff measures.

Broader Market Performance:

Broader markets had a positive session today. Of the 3,052 stocks traded on the NSE, 1,756 advanced, 1,188 declined, and 108 remained unchanged.

Sectoral Performance:

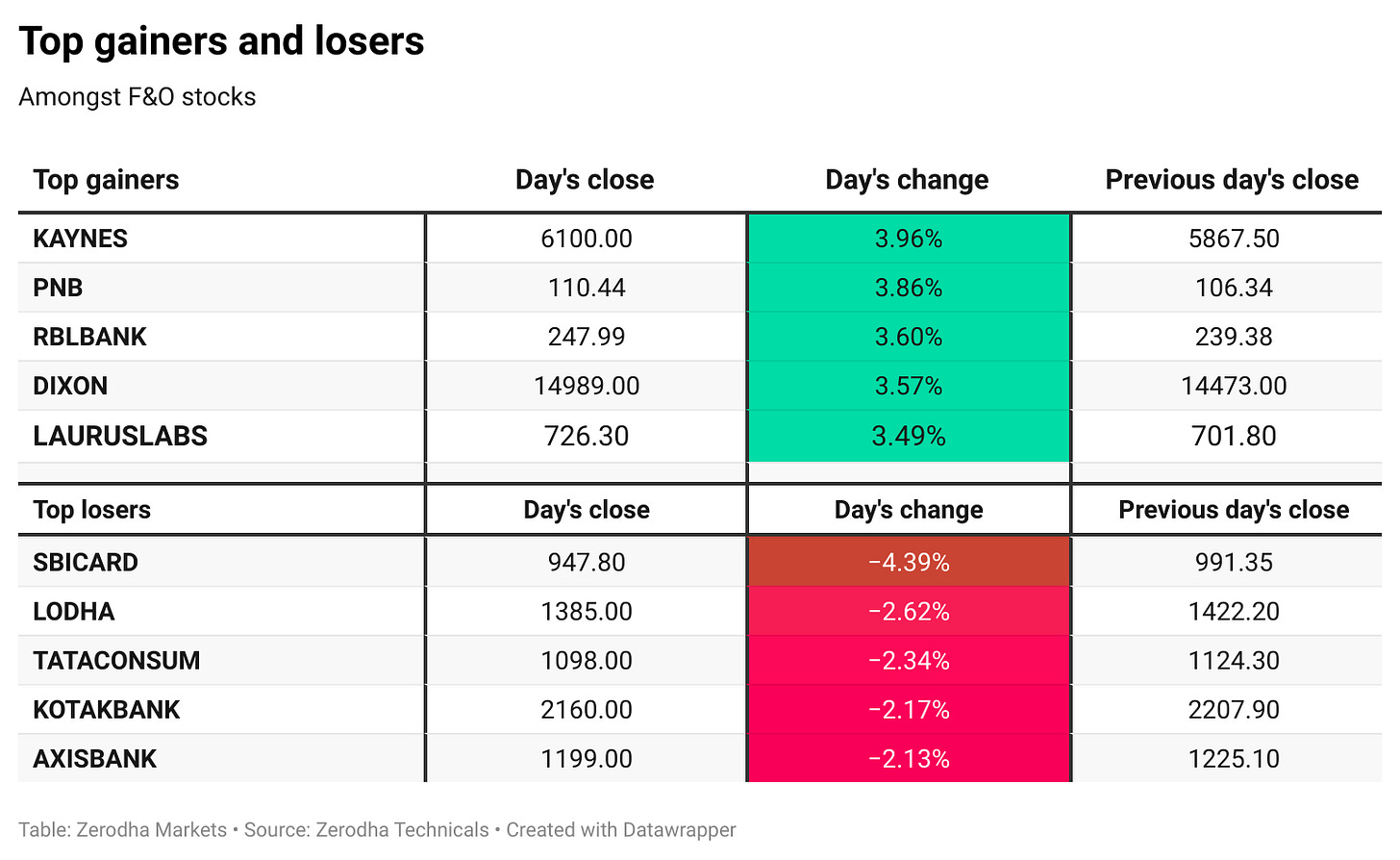

The top-gaining sector for the day was Nifty PSU Bank, which surged 2.66%, while the biggest loser was Nifty Realty, declining by 0.74%.

Out of the 12 sectoral indices listed, 6 sectors closed in the green—led by PSU Bank, Consumer Durables, and Pharma—while 6 sectors ended in the red, with Realty, Auto, and Metal seeing the sharpest declines.

Note: The above numbers for Commodity futures were taken around 5 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 3rd July:

The maximum Call Open Interest (OI) is observed at 26,000, followed closely by 25,600, suggesting strong resistance at 25,700 - 25,800 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed closely by 25,000, suggesting strong support at 25,400 to 25,300 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s industrial output rose 1.2% in May 2025, marking the slowest growth since August 2024. Manufacturing grew 2.6%, while electricity and mining contracted by 5.8% and 0.1%, respectively. Dive deeper

India’s fiscal deficit for April–May 2025–26 dropped to ₹0.13 trillion, just 0.8% of the full-year target, compared to 3.1% last year. Revenue rose 28% while spending grew 19.7%, with strong capital expenditure momentum. Dive deeper

Gross GST collection hit a record ₹22.08 lakh crore in FY25, doubling from FY21 and rising 9.4% over the previous year. Average monthly mop-up increased to ₹1.84 lakh crore from ₹1.68 lakh crore in FY24. Dive deeper

Tata Steel received a show-cause notice alleging irregular input tax credit claims of over ₹1,000 crore between FY19 and FY23. The company stated it has already paid ₹514 crore and believes the notice lacks merit. Dive deeper

RBL Bank plans to improve interest margins by expanding into commercial vehicle and used car financing, targeting smaller cities. It aims to leverage its existing network and shift towards higher-yielding retail assets. Dive deeper

BHEL received a fresh order from Adani Power for six 800 MW thermal power units, boosting its total order book beyond ₹2 lakh crore. This adds to Adani’s earlier order of 14 boilers, making them BHEL’s largest private client. Dive deeper

Torrent Pharma will acquire a controlling stake in JB Chemicals from KKR in a ₹25,689 crore deal, involving a 46.39% stake buy, open offer, and merger. JB Pharma shareholders will get 51 Torrent shares for every 100 held. The deal expands Torrent’s India and global presence, especially in chronic therapies and CDMO. Dive deeper

Godrej Properties acquired 43 acres in Panipat for a plotted township project with an estimated revenue potential of ₹1,250 crore. This marks its fourth residential township in North India. The company aims to achieve ₹32,500 crore in bookings and ₹21,000 crore in collections in FY26. Dive deeper

Waaree Energies’ U.S. unit secured a 540 MW solar module order from an American developer, with deliveries spread between 2025 and 2028. This is its third major U.S. deal recently, boosting its 25 GW order book. Dive deeper

ITD Cementation secured a ₹580 crore international marine contract for jetty works in Abu Dhabi’s Ruwais LNG project. The order strengthens its global marine infrastructure presence. Dive deeper

Ahluwalia Contracts won two construction projects worth ₹1,104 crore, one in Gurugram for ₹821 crore and another in Bengaluru for ₹283 crore. Both are residential developments slated for completion in 32 to 36 months. Dive deeper

Amazon will open its Delhi and Bengaluru fulfilment centres for free public tours starting Q4 2025. Visitors can witness the behind-the-scenes logistics in 45-60 minute guided sessions. The initiative offers a closer look at how packages are processed before delivery. Dive deeper

Alembic Pharma received final USFDA approval for its generic Doxorubicin Hydrochloride Liposome Injection used in treating ovarian cancer, multiple myeloma, and AIDS-related Kaposi’s sarcoma. The U.S. market size for the drug is estimated at $29 million. Dive deeper

Karnataka Bank announced the resignation of its MD & CEO Srikrishnan Hari Hara Sarma and board member Sekhar Rao, both citing personal reasons. A committee has been formed to find replacements, with the bank assuring operational continuity. Dive deeper

Embassy REIT raised ₹1,550 crore via NCDs and term loans at its lowest rate in four years to refinance existing debt. The move is expected to save 113 bps in annual interest and reflects strong investor confidence. This supports the REIT’s strategy to optimise its balance sheet and fund future growth. Dive deeper

Sebi is probing a stock manipulation scam in Ahmedabad involving over 4,000 duped investors through pump-and-dump tactics in revived defunct firms. Shell companies were allegedly used to inflate prices before offloading shares. Dive deeper

Raymond’s realty arm, Raymond Realty, will list on BSE and NSE on July 1 following its demerger to sharpen focus on the real estate business. The firm plans to launch six new residential projects in the Mumbai Metropolitan Region this fiscal. Dive deeper

Inox Neo Energies, a subsidiary of Inox Clean Energy, has acquired Skypower Solar India at an enterprise value of ₹265 crore. The acquired 50 MW (AC) solar project in Madhya Pradesh has a 25-year PPA with the state’s power utility. The deal supports Inox’s goal of reaching 3 GW hybrid capacity in 2-3 years. Dive deeper

What’s happening globally

Brent crude fell to around $66.6 per barrel, marking its steepest weekly drop in over two years. The decline was driven by easing Middle East tensions, expectations of increased OPEC+ output, and uncertainty around the Israel-Iran truce. Dive deeper

Gold climbed to around $3,290 per ounce, supported by a weaker US dollar and easing geopolitical concerns. Dive deeper

China's manufacturing PMI rose to 49.7 in June, signaling a softer contraction and matching expectations. Output and new orders improved, aided by US trade progress and domestic stimulus. However, employment declined further and business sentiment hit a nine-month low. Dive deeper

Bank lending to Eurozone households rose 2% YoY in May 2025, the fastest pace since May 2023, supported by ECB policy easing. Lending to businesses eased slightly to 2.5%, while overall private sector credit growth held steady at 2.8%. Dive deeper

Japan’s industrial production rose 0.5% in May 2025, rebounding from April’s decline but falling short of expectations. Gains in machinery and motor vehicle output supported the increase. However, annual output dropped 1.8%, the first fall in five months. Dive deeper

Germany’s inflation eased to 2.0% in June 2025, the lowest since October 2024 and back at the ECB’s target. The slowdown was driven by cooling food inflation and falling energy prices. Core inflation also dipped to a three-month low of 2.7%. Dive deeper

South Africa’s trade surplus widened to ZAR 21.7 billion in May 2025. Exports rose 6.3% to a six-month high on stronger shipments of gold, PGMs, and citrus. Imports edged up 1.2%, led by crude oil and base metals. Dive deeper

UK mortgage approvals rose to 63,032 in May 2025, beating expectations and signaling housing market recovery post-tax break expiry. Remortgaging approvals also saw the biggest jump since February 2024. Dive deeper

Spain’s current account surplus rose to €1.36 billion in April 2025 from €1.01 billion a year ago, led by a higher goods and services surplus. However, the Jan-Apr surplus narrowed to €8.91 billion from €13.01 billion due to a larger income deficit. Dive deeper

Cirsa, backed by Blackstone, is aiming for a €2.52 billion IPO in Spain to raise €400 million. The gambling firm operates in Spain, Latin America, and Europe. A green-shoe option of €68 million may be added based on demand. Dive deeper

Tempus AI announced a $400 million convertible notes offering due 2030, aiming to repay its $275 million term loan and reduce interest costs. Dive deeper

Hyatt will sell Playa’s real estate portfolio to Tortuga Resorts for $2 billion, converting the Playa acquisition into a mostly asset-light deal. The sale includes 15 resort properties, with Hyatt retaining long-term management agreements. Proceeds will go toward repaying acquisition-related debt. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Amit Sarin, Managing Director, Anant Raj Ltd., on India’s data center boom

“India is witnessing one of the fastest growth phases globally for data centers.”

“India currently generates 28% of the world’s data but houses only 1% of it locally, presenting a significant opportunity for expansion as data localization becomes inevitable.” - Link

Amit Shah, Union Home Minister, on turmeric export and farmer support

“You will be surprised to know that the Indian government has set the goal of exporting USD one billion worth of turmeric by 2030.”

“We have also made full preparations to achieve the goal of exporting USD one billion to international markets.”

“The (Turmeric) board that will be formed will work to ensure that the highest price of turmeric reaches the farmers.” - Link

Sudipta Mukherjee, MD, Texmaco Rail on export growth and global positioning

“Global players are looking to diversify their orders away from China. In terms of competition, there were no other Indian players. It was mostly Chinese and European contenders.”

“This is a major milestone in our achievements.”

“Combined, we’re targeting a topline of ₹2,000 crore, with a clear focus on improving profitability over the next three years.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

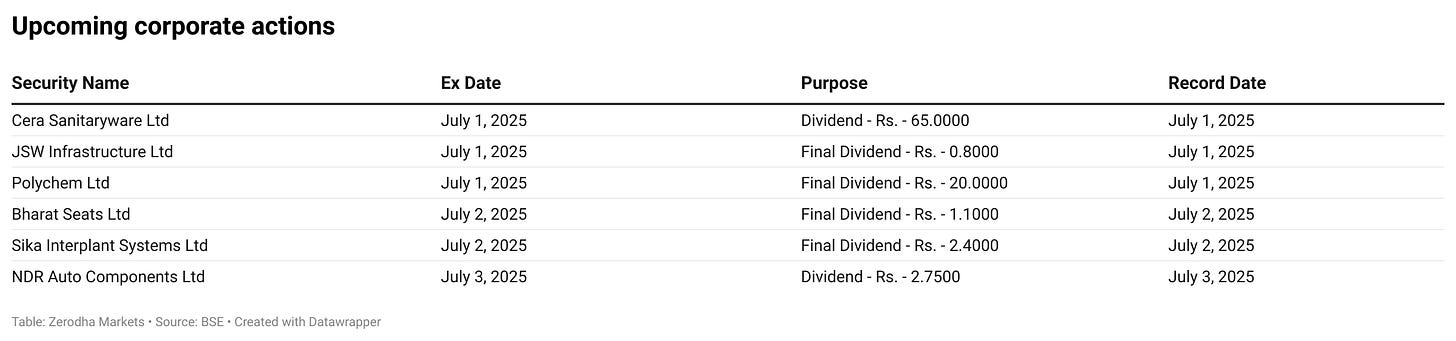

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.