Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

This post might break in your email inbox. You can read it in the web browser on your device by clicking here.

After taking a breather on Tuesday, markets were back in the red on Thursday. Nifty opened at 23,488.45 and quickly declined to hit the day’s low of 23,263.15. While the index managed to recover some losses, it traded within a narrow range for the rest of the session, closing at 23,346.75, reflecting limited momentum after the early fall.

Market sentiment remained negative with 827 advancing, 1,991 declining, and 70 remaining unchanged.

The decline was driven by weak global cues and pressure on Adani group stocks following reports of legal challenges.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

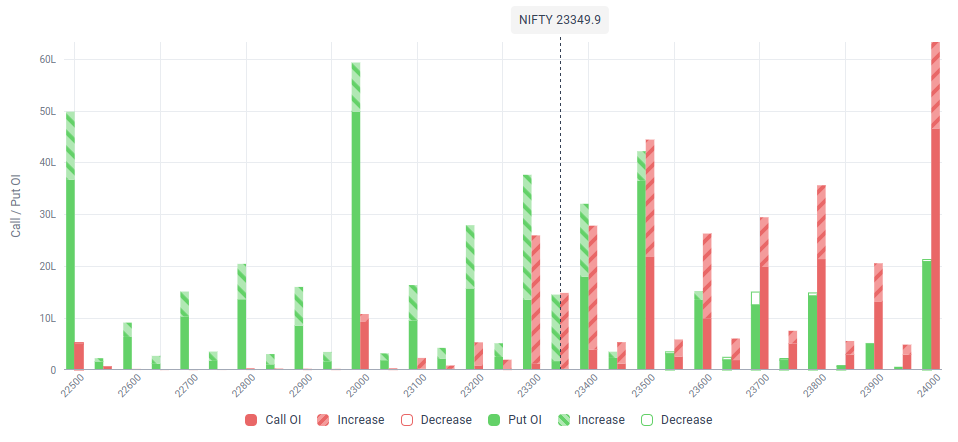

The following is the change in OI for Nifty contracts expiring on 21st November;

The maximum CE OI is at 24000 followed by 23500 and Put OI is at 23000 followed by 23500.

On the CE side, 23400 saw an OI addition of 23.9 lakh and 23500 saw an addition of 22.66 lakhs. On the PE side, 23300 saw an OI addition of 24.12 lakhs.

Immediate support on the downside can now be seen at 23300 which has the maximum OI for contracts expiring on 28th November followed by 23000 and resistance at 23500 followed by 24000.

Note: This is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

Bharti Airtel has partnered with Nokia in a multi-billion-dollar deal to enhance its 4G and 5G networks using advanced equipment and AI-based network management tools. This strategic move aims to improve network capacity, coverage, and energy efficiency while preparing for future demands. Airtel shares are also in focus after the Supreme Court allowed telecom companies to claim credit for duties on parts like tower components. Dive deeper

Oil prices rose slightly as geopolitical tensions escalated, with Brent crude at $73.09 and U.S. crude at $69.03. Supply concerns were influenced by the Russia-Ukraine war and potential changes in OPEC+ production plans, while U.S. crude stocks and gasoline inventories increased last week. Dive deeper

The RBI highlighted risks from rising inflation, warning it could impact urban demand, corporate earnings, and exports if unchecked. Despite global challenges like FPI outflows and a depreciating rupee, India’s economy shows resilience driven by festival demand, a recovering farm sector, and stable financial conditions. Dive deeper

Apple India's revenue rose 36% in FY24 to ₹66,727 crore, driven by strong product and service sales, while profits increased 23% to ₹2,746 crore. The company continues to expand its presence in India, supported by strong financial performance and local manufacturing partnerships. Dive deeper

UPL has announced a $350 million deal with Alpha Wave Global for a 12.5% stake in its hybrid seeds subsidiary, Advanta Enterprises. The investment includes $100 million to support Advanta’s growth and $250 million to help UPL reduce its $3.28 billion debt. Advanta operates in over 80 countries, focusing on hybrid seeds. Dive deeper

The company also plans to raise ₹3,378 crore through a rights issue, offering shares at ₹360 each, which is 34% below the current market price. The funds will strengthen the company’s finances. Dive deeper

Honasa Consumer's shares dropped 10% on Thursday to ₹237.40 amid concerns raised by the All India Consumer Products Distributors Federation (AICPDF) about unsold inventory. The company clarified that its total inventory was ₹40.69 crore as of October 31, countering claims of ₹300 crore in unsold stock.

The stock has fallen 36% in three days, following weak Q2FY25 results, which showed a ₹19 crore net loss compared to a ₹29 crore profit in the same period last year. Dive deeper

The Adani Group stocks faced a sharp sell-off across its listed entities following allegations by U.S. authorities of improper practices to secure solar energy contracts. The group's market capitalization declined significantly, with major stocks like Adani Enterprises and Adani Energy Solutions falling 20%. Dive deeper

What’s happening globally

UK inflation climbed to 2.3% in October 2024, its highest in six months, exceeding the Bank of England's 2% target and forecasts. The rise was driven by higher electricity and gas costs following Ofgem's energy price cap changes, along with increases in housing, utilities, and restaurant prices. Core inflation edged up to 3.3%, while food prices stayed steady. Month-on-month, CPI rose by 0.6%. Dive deeper

The People's Bank of China, the country's central bank, kept its benchmark lending rates unchanged, with the 1-year loan prime rate at 3.1% and the 5-year rate at 3.6%, as it assesses the impact of recent stimulus measures. Recent data showed steady retail sales but weaker industrial production and real estate investment growth. Dive deeper

Sugar futures dipped below 22 cents per pound due to a reduced global deficit forecast and increased output from Thailand. The International Sugar Organization lowered its 2024/25 deficit estimate to 2.51 million tonnes from 3.58 million, citing reduced consumption. Thailand expects an 18% rise in production to 10.35 million tonnes, while Brazil’s Louis Dreyfus plans a new terminal to boost sugar logistics by mid-2025. Dive deeper

Calendars

In the coming days, We have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Could you please add a section on notable block deals and bulk deals in select scripts?

Love the work. More power to you guys.

Wow.. this is some extraordinary stuff. Salute to zerodha for these kind of information sharing! #proudKiteUser