Markets turn cautious as uncertainty over trade deals caps upside

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Nifty opened 47 points higher at 25,588 but soon started falling, dropping nearly 100 points to test 25,500 within the first hour. It then stayed between 25,470 and 25,500 until 1 PM before slipping below 25,400 and hitting an intraday low near 25,380. In the last 45 minutes, Nifty recovered about 70 points and closed at 25,453, down 0.35%.

While key indices like Nifty and Bank Nifty continue to hold above crucial levels of 25,200 and 56,000, respectively, Investor sentiment remains cautious at higher levels amid ongoing geopolitical tensions and persistent uncertainty surrounding global tariff developments.

Broader Market Performance:

Broader markets had a mixed session with bearish bias today. Of the 3,028 stocks traded on the NSE, 1,205 advanced, 1,723 declined, and 100 remained unchanged.

Sectoral Performance:

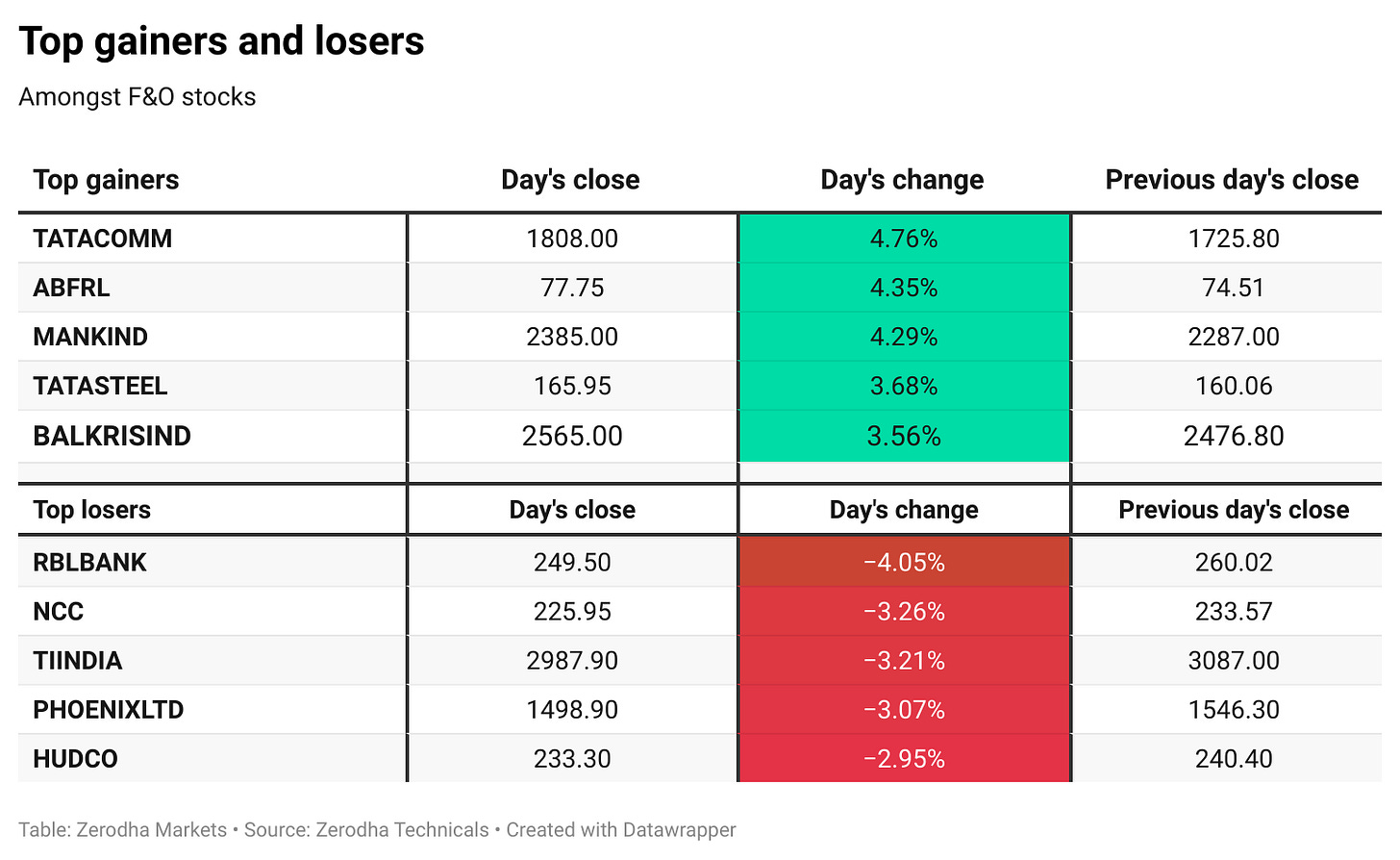

Nifty Metal was the top gaining sector, rising by 1.41%, followed by Consumer Durables with a 1.04% gain. On the other hand, Nifty Realty was the worst performer, declining by 1.44%.

Out of the 12 tracked sectoral indices, 5 closed in the green while 7 ended in the red, reflecting a broadly negative market breadth across sectors.

Note: The above numbers for Commodity futures were taken around 4 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 3rd July:

The maximum Call Open Interest (OI) is observed at 25,600, followed closely by 25,500, suggesting strong resistance at 25,500 - 25,600 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed closely by 25,400, suggesting strong support at 25,300 to 25,200 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s 10-year government bond yield dropped to 6.35% due to lower inflation, a smaller budget deficit, and the RBI cutting rates to 5.5%. Dive deeper

Adani Defence has completed the ₹400 crore acquisition of an 85.1% stake in Air Works, marking Adani Group’s entry into the aircraft MRO segment. The move expands its aviation services footprint, with Air Works operating across 35 Indian cities and serving both civil and defence sectors. Dive deeper

HDB Financial Services shares closed nearly 14% above the IPO price on debut, valuing the company at ₹69,758 crore. Dive deeper

SBI has classified Reliance Communications’ loan account as ‘fraud’ and will report Anil Ambani’s name to the RBI under regulatory norms. The move pertains to transactions from 2016, with RCom currently under insolvency proceedings and awaiting final approval from the NCLT on its resolution plan. Dive deeper

Maruti Suzuki’s total sales declined 6% YoY to 1.68 lakh units in June, with domestic sales down 12%. Compact and mini car sales fell 17% and 37% respectively, while utility vehicles dropped 8%. Exports, however, rose 22% to 37,842 units. Dive deeper

Bajaj Auto’s domestic two-wheeler sales fell 16% YoY to 1.49 lakh units in June, while exports rose 18%. Overall, two-wheeler sales declined 2%, and domestic commercial vehicle sales were flat, with exports up 49%. Year-to-date, total sales remained flat. Dive deeper

SBI Cards received a GST show cause notice alleging wrongful input tax credit claims of ₹81.93 crore for FY19–FY21, citing filing mismatches and vendor compliance issues. The company maintains its claims are valid and expects a favourable outcome. Dive deeper

Raymond Realty drew attention after a block deal involving Norges Bank was executed near the listing price but below the discovery price. Parent company Raymond also saw large institutional exits, with block deals totalling over ₹221 crore. Dive deeper

Biocon plans to lead copycat Wegovy sales in Canada by 2026, aiming to file for generic Ozempic approvals by September. The company is also targeting emerging markets like Brazil, Mexico, and India, where it will soon begin phase-3 trials, betting on its insulin expertise amid growing competition. Dive deeper

The call money market saw volumes rise by ₹3,000 crore to ₹16,015 crore on the first day of extended trading hours till 7 pm, with strong participation from public sector banks and primary dealers. The move aims to boost overnight market activity and reduce reliance on the standing deposit facility. Dive deeper

NMDC has reduced prices of iron ore lump and fines by ₹600 and ₹500 per tonne, setting new rates at ₹5,700 and ₹4,850, respectively. The move follows weak demand in the domestic steel market and a poor response to recent auctions from its Chhattisgarh mines. Dive deeper

Lloyds Metals has acquired nearly 80% stake in Thriveni Earthmovers for ₹70 crore, aiming to cut mining costs and strengthen its consolidated financials. The acquisition, approved by the CCI in May, also opens up new domestic and global mining opportunities. Dive deeper

RITES secured a $3.6 million international order from African Rail Company to supply and commission two overhauled ALCO diesel-electric locomotives for deployment in Zimbabwe, Mozambique, and Botswana. The project, including warranty and technical support, will be completed within nine months. Dive deeper

Emirates NBD is reportedly in advanced talks to acquire up to a 20% stake in RBL Bank through a capital infusion via preferential allotment. The proposed deal, subject to regulatory approval, would support Emirates NBD’s Asia expansion and mirror recent strategic investments in Indian banks. Dive deeper

What’s happening globally

Brent crude hovered near $67.1 per barrel ahead of OPEC+’s planned August production increase of 411,000 bpd. US crude inventories unexpectedly rose, while easing geopolitical tensions and tariff uncertainties weighed on prices. Dive deeper

US employers announced 47,999 job cuts in June 2025, the lowest this year, according to Challenger, Gray & Christmas. While economic conditions remained the main reason, Q2 cuts rose 39% YoY to 2.47 lakh, marking the highest second-quarter total since 2020. Dive deeper

The average interest rate for 30-year fixed mortgages in the US fell by 9 bps to 6.79% for the week ended June 27, the lowest in nearly three months, amid declining Treasury yields and rising expectations of Fed rate cuts. Dive deeper

The Euro Area unemployment rate rose to 6.3% in May 2025, with youth unemployment steady at 14.4%. Germany and the Netherlands reported the lowest rates, while Spain, France, and Italy had higher unemployment levels. Dive deeper

Jeff Bezos sold Amazon shares worth $736.7 million, marking his first stock sale of the year under a pre-set trading plan. He also donated nearly $190 million in Amazon shares to nonprofits in 2025, continuing his philanthropic efforts through the Earth Fund and Day One Fund. Dive deeper

Boeing CEO Kelly Ortberg named Stephen Parker as permanent head of its defense unit and appointed Jay Malave as CFO. The leadership changes follow a turbulent year for Boeing. The company recently secured the F-47 stealth fighter jet contract. Dive deeper

Meta has hired top AI researchers from OpenAI, Google DeepMind, and Anthropic, signaling an aggressive push under new Chief AI Officer Alexandr Wang. The move, announced alongside Nat Friedman, marks a major shift as Meta aims to reshape the AI landscape with leading talent. Dive deeper

Netflix is in talks with Spotify to collaborate on live TV projects, including music award shows, concerts, and celebrity interviews, as part of Netflix’s push to expand live content and boost advertising revenue. Dive deeper

Ferrari regained rights to the Testarossa brand after the EU court overturned a 2023 decision citing non-use. The court ruled that licensing and dealer approvals for second-hand cars count as genuine use. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Sashidhar Jagdishan, CEO, HDFC Bank, on HDB Financial’s IPO and future outlook

“We will continue to support HDB as it navigates the opportunities and challenges of the public market.”

“The IPO will provide independent capital and visibility for the company to accelerate its growth trajectory.”

“HDB is well positioned to capitalise on the opportunity by the underserved credit segments in the country, which provide a large runway.” - Link

Chandra S Pemmasani, Union MoS for Communications on Vodafone Idea and telecom competition

“Not at the moment.” (on plans for relief for Vodafone Idea)

“Government wants fair competition. In a free market with large capex-related businesses like telecom, it's not easy to create 5-6 companies. Ideally, we want 3-4 companies. In the end, the consumers will decide.”“Each situation is different, depending on the circumstances. We are taking a call on Vi because we want a good alternative, but we do not think there is a need for these kinds of things for other players.” - Link

Lip-Bu Tan, CEO, Intel, on chip manufacturing strategy and foundry business

“We are committed to strengthening our roadmap, building trust with our customers, and improving our financial position for the future.”

“A manufacturing process that prior CEO Pat Gelsinger bet heavily on, known as 18A, was losing its appeal to new customers.”

“The move is part of a play for big customers like Apple and Nvidia, which currently pay TSMC to manufacture their chips.”

“Intel is tailoring 14A to key clients’ needs to make it successful.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.