Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

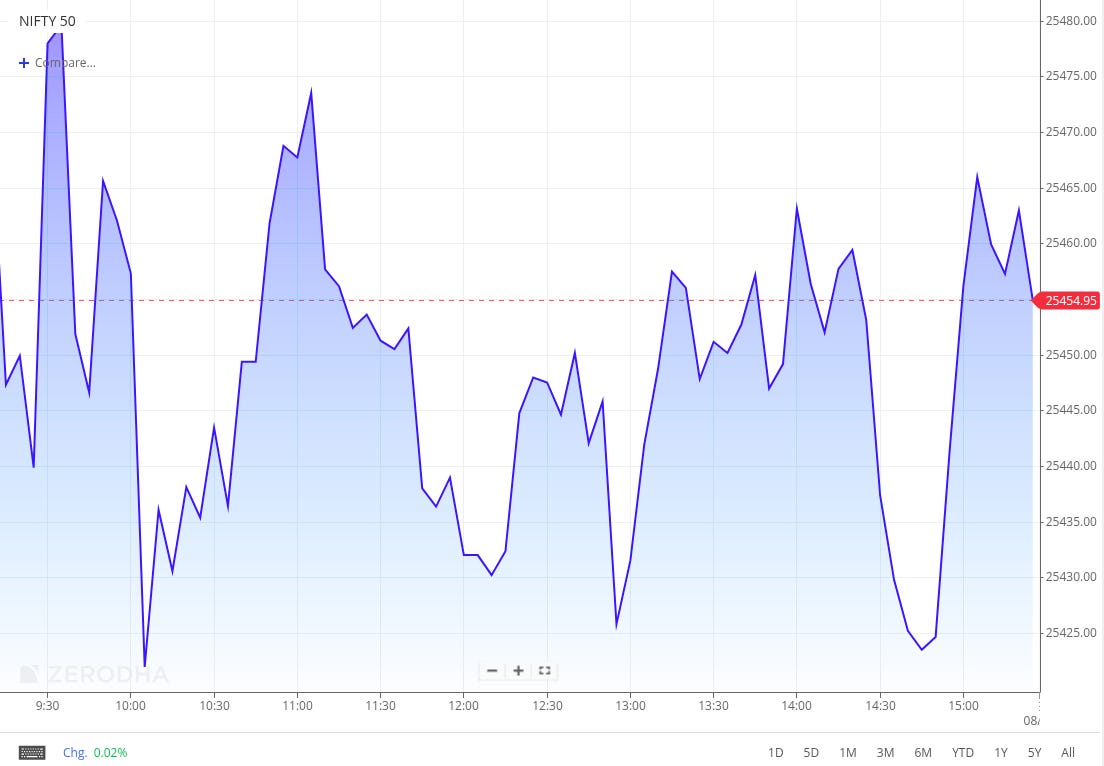

Nifty opened slightly lower at 25,450.45 and climbed to the day’s high within the initial hour of trade. It remained largely range-bound through the session before recovering modestly in the final hour to close at 25,461.30. The index ended flat, posting no change for the day.

Investor sentiment remained subdued as markets awaited clearer cues ahead of the June quarter earnings season. Global uncertainty, including weak Asian market trends and foreign fund outflows, added to the cautious mood. Market participants await the outcome of U.S.-India trade talks ahead of the August tariff deadline, which may impact near-term direction.

Broader Market Performance:

Broader markets ended on a weak note. Out of 3,060 stocks traded, 1,154 advanced, 1,795 declined, and 111 remained unchanged.

Sectoral Performance:

Nifty FMCG led the gains with a 1.68% rise. Realty and Energy followed with marginal gains of 0.08% and 0.06%, respectively.

On the downside, Nifty Media was the worst performer, slipping 1.03%, while IT and Metal dropped 0.76% and 0.61%. Other sectors, including Bank, Services, and Auto, ended with mild losses under 0.25%.

Note: The above numbers for Commodity futures were taken around 4 pm. Here’s the trend of FII-DII activity from the last 5 days:

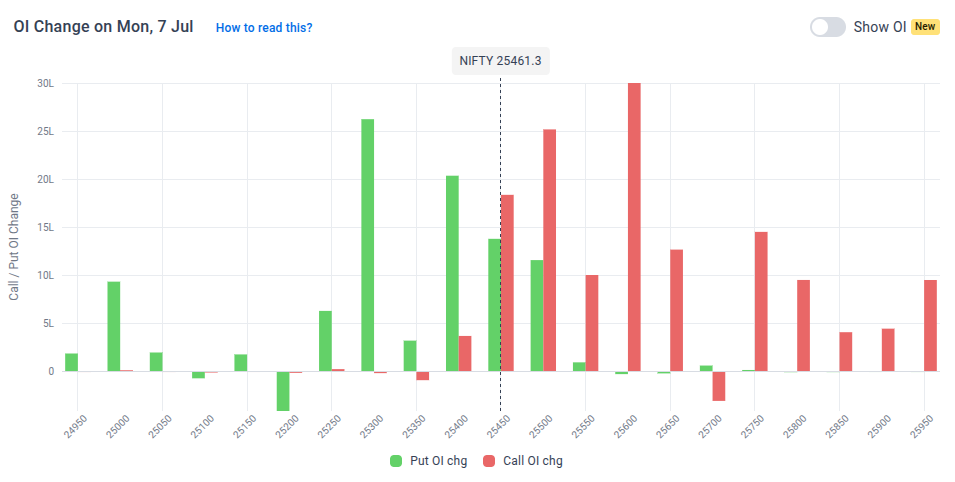

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 10th July:

The maximum Call Open Interest (OI) addition is observed at 25,600, followed closely by 25,500 and 25,700, suggesting strong resistance at 25,500 to 25,700 levels.

The maximum Put Open Interest (OI) addition is seen at 25,300, followed by 25,000 and 25,400, indicating strong support at 25,200 to 25,400 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in the Call OI indicates resistance in a falling market, and an increase in the Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

BEML secured two export orders worth $6.23 million, including one from the CIS region for heavy-duty bulldozers and another maiden order from Uzbekistan for motor graders. The orders fall under its regular course of business. Dive deeper

Jubilant FoodWorks reported a 17% YoY rise in Q1 revenue and added 73 stores, with Domino’s India posting 11.6% like-for-like growth. However, Domino’s Turkey saw a 2.2% decline in LFL growth, tempering the overall update. Dive deeper

Adani Enterprises will open its ₹1,000 crore NCD issue on July 9, offering up to 9.30% yield across tenors of 24 to 60 months. Dive deeper

Borosil Renewables has filed for insolvency of its German subsidiary GMB due to sustained losses from Chinese dumping and weak EU protection. The company will now focus on India’s growing solar glass market, backed by strong demand and policy support. It plans a 60% capacity expansion with a ₹950 crore investment. Dive deeper

Aditya Mangla will take over as CEO of Eternal’s food delivery business following Rakesh Ranjan’s exit on July 6 after a two-year stint. Mangla, currently head of product, has held key roles in supply and customer experience since joining in 2021. His two-year term begins after board approval. Dive deeper

IndusInd Bank reported a 3.9% YoY drop in net advances and a 0.3% dip in deposits for Q1FY26, with corporate loans falling 14.4%. The CASA ratio weakened to 31.49%, and LCR also declined marginally. Dive deeper

Cochin Shipyard has signed an MoU with South Korea’s HD Korea Shipbuilding to jointly explore global shipbuilding opportunities, enhance technical collaboration, and improve productivity. The partnership also includes workforce upskilling and aligns with India's maritime ambitions. Dive deeper

Dabur India expects low single-digit revenue growth for Q1 FY26, with urban demand aiding its Home and Personal Care segment and strong gains in healthcare led by Honitus. Beverages were impacted by unseasonal rains, while international markets delivered double-digit growth. The company remains optimistic amid easing inflation and monsoon support. Dive deeper

Nuvama is in advanced talks for a potential $1.6 billion stake sale by PAG, with bidders including CVC, Permira, EQT, and HSBC. The deal may trigger an open offer for minority shareholders, while Jane Street-related concerns continue to linger. Binding offers are expected by July-end. Dive deeper

PC Jeweller reported an 80% YoY rise in standalone revenue for Q1FY26, driven by strong wedding and festive demand despite gold price volatility. The company also reduced debt by over 7% in the quarter and aims to be debt-free by FY26. Management remains optimistic about sustained momentum. Dive deeper

Jindal (India) Ltd. has received approval for a ₹3,600 crore greenfield steel project in Odisha, with plans to invest ₹15,000 crore in three phases by 2030. The facility will produce coated steel products with an annual capacity of 9.6 lakh MT, expanding to 30 lakh MT by 2030. A steel pipe unit with 2 lakh MT capacity is also planned. Dive deeper

What’s happening globally

WTI crude hovered around $67 as OPEC+ announced a larger-than-expected August output hike of 548,000 barrels per day, citing strong market fundamentals. Saudi Arabia also raised crude prices to Asia, pointing to tight physical markets. A similar increase may follow in September, with further review on August 3. Dive deeper

Eurozone retail sales fell 0.7% MoM in May 2025, the sharpest drop since August 2023, driven by weaker demand across all categories. Major economies like Germany, the Netherlands, Italy, and France saw declines, while Spain saw a slight uptick. Annual retail trade growth slowed to 1.8% from 2.7% in April. Dive deeper

Copper futures dipped below $5 per pound, extending losses for a third session amid rising global trade tensions. The drop followed President Trump’s tariff warning targeting BRICS-aligned nations, raising concerns over industrial metal demand. Dive deeper

UK house prices rose 2.5% YoY in June 2025, the slowest pace in 11 months, with prices flat month-over-month at £296,665. Improved mortgage approvals and stable interest rates are supporting buyer activity. Halifax expects modest price growth ahead, aided by rising wages and anticipated BoE rate cuts. Dive deeper

Germany’s industrial production rose 1.2% MoM in May 2025, rebounding from April’s decline and beating expectations. Gains in autos, pharma, and energy offset drops in construction and energy-intensive industries. Output grew 1.0% YoY, pointing to a modest manufacturing recovery. Dive deeper

Vietnam’s GDP grew 7.96% YoY in Q2 2025, the fastest since Q3 2022, driven by strong gains across services, industry, and agriculture. Trade remained resilient despite global headwinds, with exports and imports both rising over 18%. H1 growth reached 7.52%, the highest for the period since 2011. Dive deeper

Capgemini will acquire outsourcing firm WNS for $3.3 billion to strengthen its AI-driven business process services, with a focus on generative and agentic AI. Dive deeper

Nissan plans to raise $4 billion through U.S. dollar and euro-denominated senior unsecured bonds across multiple tenors, along with a ¥150 billion convertible bond. Expected coupon rates range from mid-5% to low-8% depending on the tranche. Proceeds will be used to refinance existing debt. Dive deeper

Samsung Electronics is expected to report a 39% YoY drop in Q2 operating profit to 6.3 trillion won, its lowest in six quarters, due to weak AI chip sales. Delays in supplying HBM chips to Nvidia and ongoing US-China trade restrictions have weighed on performance. Dive deeper

Apple has appealed a €500 million EU fine, arguing the Commission’s decision oversteps legal bounds and harms users and developers. The penalty was for restricting app developers from directing users to cheaper deals outside the App Store. The case now moves to Europe’s second-highest court. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Tuhin Kanta Pandey, Chairman, SEBI, on Jane Street ban and market surveillance

“We are watching this as a surveillance issue, and surveillance at both the exchange level and the SEBI level will continue going ahead.”

“It is a great deal of analytical work which has been done based on high volume of data. But, manipulative practices can be worked out by different players in different ways.”

“Our regulations, as you know, PF, UTP regulations very clearly mention that manipulative and fraudulent practices are not allowed in the market.”

“SEBI has all the powers to investigate such practices within the regulation, and surveillance mechanisms will be upgraded further to strengthen oversight.”

“Everyone also has freedom to challenge those actions, and there we are living in a democratic world where people have avenues to do that.”

“What SEBI had to do at the interim stage, they have already indicated. And the order itself speaks for itself.” - Link

Rama Mohan Rao Amara, MD, International Banking & Treasury, State Bank of India on monetary policy and banking challenges

“We expect the short term rates to still come down further, with the long term moving sideways.”

“We expect the ten year to be in a broad range of 6.1% to 6.4% and the rupee to be in the ₹84 to ₹86 per dollar range.”

“So when transmission is complete, if inflation plays out as expected, the RBI may look at the data points and definitely there is further scope for a 25 basis point cut in repo this calendar year, and that is our house view also.”

“Banks have to adopt a multi-pronged approach in improving customer engagement, creating innovative products which is possible thanks to technology advancement and use of AI-ML.” - Link

C S Vigneshwar, President, Federation of Automotive Dealers Associations (FADA), on June 2025 automobile retail sales

“Overall automobile retail sales in India grew 4.84% year-on-year in June this year to 20,03,873 units, driven by festival and marriage-season demand.”

“Two-wheeler retails dipped 12.48% month-on-month but still notched a 4.73% gain on a year-on-year basis.”

“Several dealers cited compulsory billing and forced stock lifts often via auto-debit wholesalers leading to mandated high days of inventory aligned with festival-season targets.”

“June demonstrated a resilient two-wheeler performance amid mixed market signals.” - Link

Saurabh Mukherjea, Chief Investment Officer and Founder, Marcellus Investment Managers, on India-US trade deal and investment strategy

“The Indian market has baked in the factor that there will be an FTA. However, if there is no FTA, we expect to see a pullback in the market.”

“The Indian market is expensive, and the Indian economy is slowing down.”“Chances of rupee depreciation over the next few years is extremely high, and the devaluing factor is going up by the passing day.”

“Small caps in US are trading at their deepest discounts possible to large caps in the quarter of a century... Indian small caps are trading at their richest valuations in a century... Switch out of Indian small caps and switch into US small caps.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

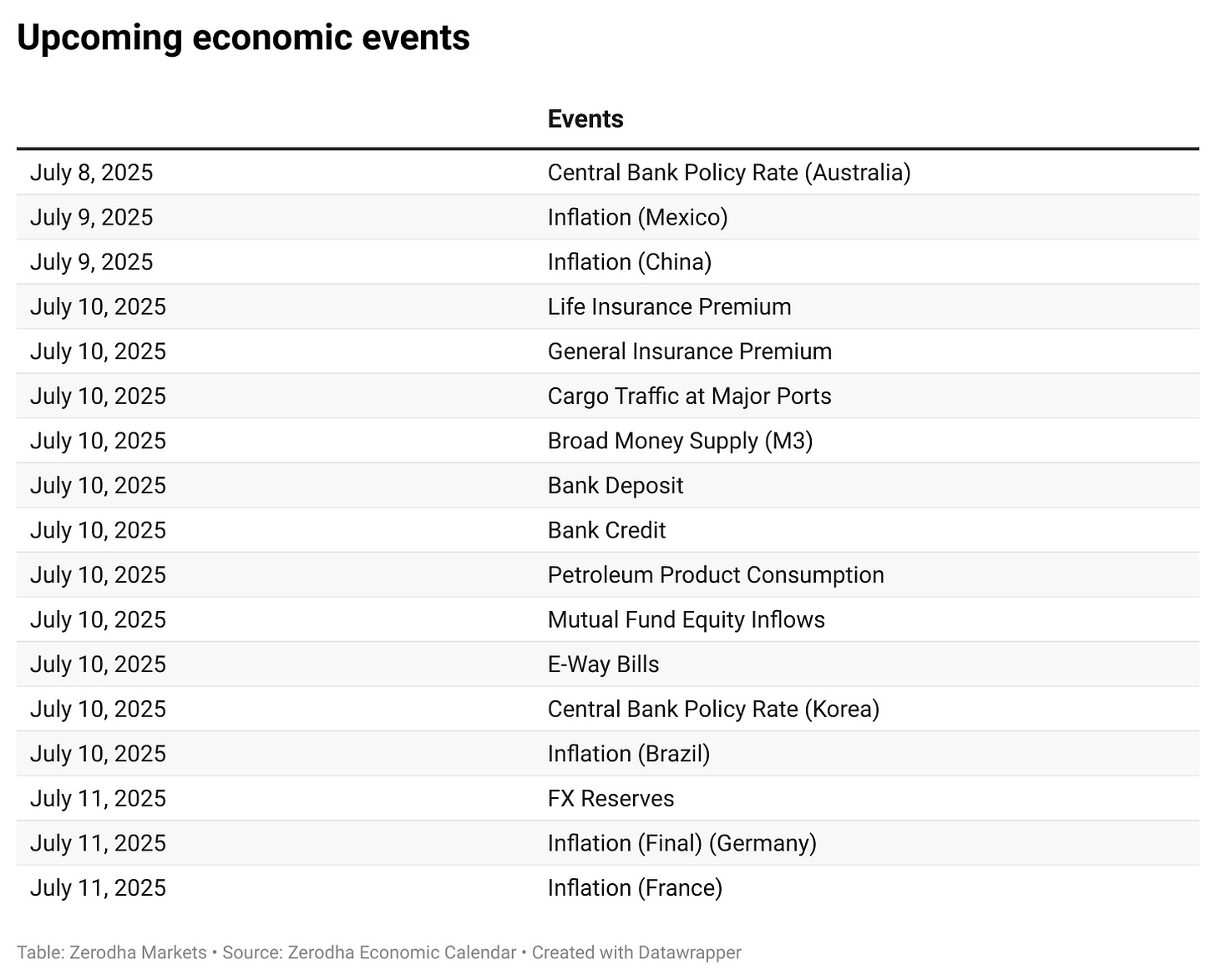

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.