Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Nifty opened at 25,255.50, nearly 100 points lower, and briefly climbed to 25,322.45 before reversing sharply. It fell to a low of 25,130.45 and traded flat for the rest of the session. The index closed at 25,149.85, down 0.81%, near the day’s low, reflecting continued weakness.

Weak Q1 results from TCS and renewed global tariff concerns, following fresh US duties on Canadian imports, weighed on investor sentiment. Broader uncertainty around global trade and muted cues kept investors cautious. Near-term direction will likely depend on upcoming earnings announcements and key macroeconomic data.

Broader Market Performance:

Broader markets stayed weak through the session. Out of 3,012 stocks traded, 1,029 advanced, 1,891 declined, and 92 remained unchanged.

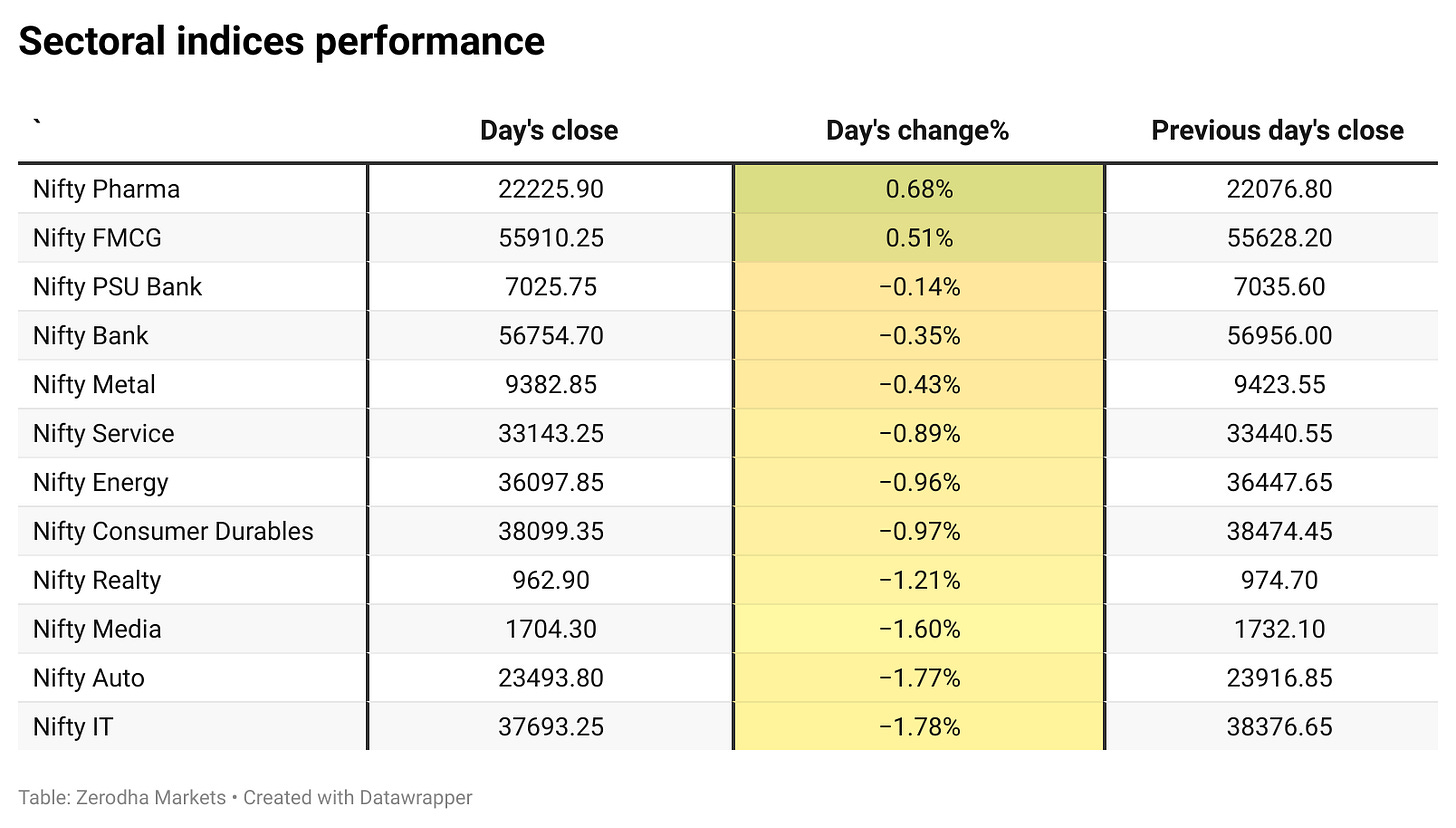

Sectoral Performance:

Pharma led the gains, rising 0.68%, followed by FMCG up 0.51%. These were the only two sectors to end in the green.

On the downside, IT and Auto were the worst performers, falling 1.78% and 1.77% respectively. Media declined 1.60%, while Realty, Consumer Durables, and Energy also saw notable losses. Most other sectors ended in the red with mild to moderate declines.

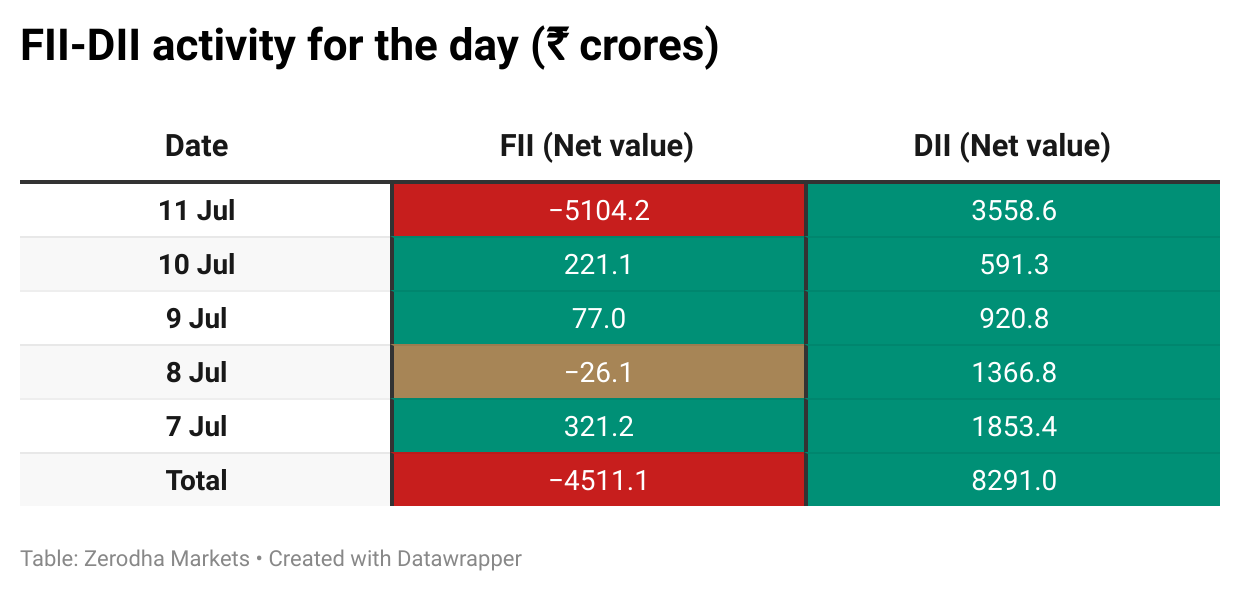

Note: The above numbers for Commodity futures were taken around 4 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 17th July

The maximum Call Open Interest (OI) is observed at 25,500, followed closely by 25,300, suggesting strong resistance at 25,400 - 25,500 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed closely by 25,200, suggesting strong support at 25,000 - 25,100 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India has doubled its proposed retaliatory duties on US-origin products at the WTO after the US raised steel and aluminium tariffs to 50%. The move aims to recover $3.8 billion in duties, up from the earlier $1.9 billion. Fresh trade talks are underway ahead of the August 1 deadline. Dive deeper

TCS reported a Q1 FY26 net profit of ₹12,760 crore, up 6% YoY, and revenue of ₹63,437 crore, up 1.3% YoY. EBIT margin rose to 24.5%, and the company declared an interim dividend of ₹11 per share. Total contract value for the quarter stood at $9.4 billion. Dive deeper

Titan has announced key leadership changes effective January 2026. Ajoy Chawla, currently CEO of the jewellery division, will become MD, succeeding C K Venkataraman. Arun Narayan will take over the jewellery division, while Kuruvilla Markose will head the watches division from August 13, 2025. Dive deeper

India has expanded access to its ₹639 trillion credit market by allowing global banks like HSBC and Standard Chartered to offer total return swaps for corporate bonds via GIFT City. These swaps enable foreign investors to gain exposure without opening local accounts. The move follows rising demand amid booming corporate debt issuance. Dive deeper

Used car sales volume is projected to grow 8-10% in FY26, reaching around six million units, with the market valued at ₹4 lakh crore, per Crisil Ratings. Growth is driven by digital adoption and financing access, though organised players face high costs and cash losses. Breakeven is expected soon, aided by past equity raises and sustained liquidity. Dive deeper

HUL has appointed Priya Nair as its next MD & CEO for a five-year term starting August 1, 2025, succeeding Rohit Jawa. The board approved the decision based on the Nomination Committee’s recommendation, pending shareholder and statutory approvals. Dive deeper

Kinetic Green will launch three new e-scooters in 18 months, starting this festive season, in partnership with Italy’s Torino Design. The company has sold over 80,000 units and built a 400-dealer network. It expects strong growth in India’s ₹40,000 crore e-scooter market. Dive deeper

SBI’s board will meet on July 16 to consider raising funds via Basel III-compliant bonds and a potential ₹25,000 crore QIP. The capital raise aims to strengthen core equity rather than fuel immediate growth. SBI’s CET-1 ratio stood at 10.81% as of March 2025. Dive deeper

NHAI plans to bid out 124 highway and expressway projects worth ₹3.4 lakh crore in FY26, covering 6,376 km. Projects will be executed under BOT, HAM, and EPC models, with varying concession and maintenance periods based on the mode. Dive deeper

BSE shares fell amid reports that SEBI is expanding its probe into Jane Street’s alleged index manipulation to include Sensex options. The initial investigation focused on Nifty and Bank Nifty options, with SEBI estimating gains of ₹36,671 crore. Jane Street has denied the allegations. Dive deeper

Tesla will open its first India showroom on July 15 at Mumbai’s Bandra Kurla Complex, marking its official market entry. The 4,003 sq. ft. space was leased for five years with a monthly rent of ₹35.26 lakh. Tariff concerns persist, but the company is proceeding with a phased rollout. Dive deeper

Ola Electric will announce its Q1 FY26 results on Monday, July 14, and host an earnings call at 2 pm with MD Bhavish Aggarwal and CFO Harish Abichandani. Dive deeper

INOX Clean Energy has confidentially filed draft papers for a ₹6,000 crore IPO, aiming for a market capitalization of ₹50,000 crore. The proceeds will be used to fund renewable energy and manufacturing projects, with total capex planned at ₹6,500 crore. Dive deeper

Tata Steel has infused $125.25 million into its wholly owned subsidiary T Steel Holdings by acquiring over 124 crore equity shares. The move reinforces its global expansion plans and follows prior disclosures made in May and June 2025. Dive deeper

IREDA’s Q1FY26 standalone net profit fell 36% YoY to ₹247 crore due to a 60% surge in expenses, despite a 29% rise in interest income. The company has also initiated insolvency proceedings against Gensol Engineering over fund misuse and document falsification. Dive deeper

The Reserve Bank of India is closely monitoring global crypto developments, especially after the U.S. shift under Donald Trump. While India plans to release a crypto policy paper soon, the RBI maintains that cryptocurrencies pose risks to financial stability. The central bank continues to back UPI and is developing its own Central Bank Digital Currency (CBDC) as a safer digital alternative. Dive deeper

Bain Capital sold a 1.9% stake in Embassy Office Parks REIT for ₹691 crore via open market transactions, offloading over 1.78 crore units at ₹388 each. Buyer details remain undisclosed. Embassy REIT recently raised ₹1,550 crore to refinance debt and reduce interest costs. Dive deeper

Orient Cables has filed draft papers with SEBI for a ₹700 crore IPO, comprising a ₹320 crore fresh issue and ₹380 crore OFS by promoters. Proceeds will fund capex, debt repayment, and general corporate purposes. The company may also explore a ₹64 crore pre-IPO placement. Dive deeper

Life insurers’ new business premium fell 3% YoY in June to ₹41,117 crore, marking the first monthly decline this fiscal. However, Q1 FY26 premium rose 4.25% to ₹93,545 crore despite a 10% drop in policy count to 48.25 lakh. Dive deeper

PC Jeweller will raise ₹500 crore via preferential allotment to promoters and Capital Ventures to prepay debt. Promoter Balram Garg will contribute ₹175 crore, and ₹325 crore will come from a non-promoter investor. The company aims to be debt-free by FY26. Dive deeper

What’s happening globally

WTI crude rose above $67 as summer travel and power demand boosted short-term consumption, despite oversupply worries. The IEA cut demand forecasts and flagged a surplus, while Saudi Arabia plans record shipments to China. Dive deeper

Gold rose to around $3,330 per ounce on safe-haven demand after Trump’s 35% tariff on Canada and hints at broader trade duties. His call for a 300 bps Fed rate cut stoked inflation concerns and talk of a dovish Fed pick. Dive deeper

Canada’s unemployment rate dropped to 6.9% in June, defying expectations of a rise to 7.1% and marking the first improvement since January. Unemployed individuals fell by 22,100, while total employment jumped by 83,100, well above forecasts of no change. The data eased concerns over US tariffs and economic uncertainty weighing on Canadian growth. Dive deeper

French authorities raided Nestlé’s headquarters near Paris over the alleged use of prohibited filtering methods in its bottled mineral waters. The investigation follows a complaint by consumer group Foodwatch. Nestlé confirmed the raid and said it is cooperating with authorities. Dive deeper

Alibaba has lost $100 billion in market value as its food delivery battle with JD.com and Meituan intensifies. The company may incur a ₹5.7 billion loss in this segment by June 2026, with deep discounting and subsidies straining profits. Dive deeper

Google is set to offer steep discounts on cloud computing services to the U.S. government, with a deal expected in the coming weeks, amid broader federal cost-cutting efforts. Similar price cuts from Microsoft, AWS, and Oracle are also anticipated. Dive deeper

The EU awaits a letter from President Trump outlining new tariffs, amid stalled trade talks and rising tensions. Hopes for a comprehensive deal may give way to an interim pact. Markets remain cautious as tariff uncertainty looms. Dive deeper

Nissan is in talks to supply vehicles to Honda in the U.S., potentially producing pickup trucks at its underused Canton plant, according to Nikkei. This follows failed merger talks but ongoing collaboration on EVs. Nissan is also pursuing cost cuts amid losses and rising debt. Dive deeper

Levi Strauss raised its annual revenue and profit forecasts on strong global denim demand, supported by growth in direct-to-consumer sales and international markets. The company plans to counter U.S. tariffs by shifting sourcing away from China to countries like Bangladesh and Cambodia. Dive deeper

Brazil’s antitrust regulator Cade has approved Goodyear’s $650 million sale of the majority of its chemical business without restrictions. The clearance was issued by Cade’s superintendence, with no further review currently required. Dive deeper

Drone stocks rose after a report said U.S. Defense Secretary Pete Hegseth ordered expanded drone production and deployment. The Pentagon plans to treat small drones as consumables and speed up procurement. New test sites and incentives for U.S. suppliers are also in the works. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Jyotiraditya M. Scindia, Union Minister for Communications, on India’s role in telecom standards

“The government is committed to nurturing next-generation communication technologies like 6G, enabling the transition through robust policy frameworks, increased research funding, and timely spectrum allocation to facilitate testing and innovation.”

“The Bharat 6G alliance should create a focused, strategic, and clear roadmap for driving the innovation in 6G technology.”

“The ambitious target is to achieve 10 per cent intellectual property rights (IPRs) in the 6G technology globally.” - Link

K Krithivasan, CEO & MD, Tata Consultancy Services, on order pipeline and demand outlook

“(Economic) uncertainty has continued throughout the quarter. Till trade discussions are concluded, it will persist. This will weigh on consumer businesses.”

“The frequent changes in the US tariff policies have impacted consumer businesses in the US the most.”

“The company's overall order pipeline remains strong and in the June quarter it was the highest in recent periods.”

“The late-stage pipeline is also strong. The orders are spread out across sectors. We are seeing momentum in banking.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Thanks for reading Aftermarket Report by Zerodha! Subscribe for free to receive new posts and support my work.

I have just a small suggestion regarding the conditional formatting in the "top gainers" table, if you could just change the colours to a lighter shade of green instead of red it would look even better, because the red colour gives a false impression that the stocks have fallen even though they have not.

Love the newsletter, even apart from this I've been reading "The Chatter" and "The daily breif" for a few weeks now and I get to learn something new everyday, thankyou so much for the efforts and work the team puts in everyday!!