Nifty resilient at 24,800 despite Intraday sell-off

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Nifty opened with a 30-point gap-up at 24,977.85 but quickly fell by 100 points within the first 15 minutes. It then traded in a narrow 50-point range between 24,850 and 24,900 until noon. In the second half, the index weakened further, with the range shifting lower to 24,820–24,860. Nifty eventually closed at 24,853.40, down 0.37%.

The RBI’s sharper-than-expected rate and CRR cuts provided early support. However, sentiment turned cautious as escalating tensions in the Middle East drove oil prices higher. Investors are now closely watching the U.S. Federal Reserve’s interest rate decision and policy commentary due on Wednesday.

Broader Market Performance:

Broader markets had a weak session today. Of the 2,961 stocks traded on the NSE, 939 advanced, 1,946 declined, and 76 remained unchanged.

Sectoral Performance:

On the day, Nifty IT emerged as the top-gaining sector, closing 0.72% higher, while Nifty Pharma was the top loser, declining 1.89%. Out of the 12 sectors listed, only 1 sector closed in the green, whereas 11 sectors ended in the red, reflecting broad-based weakness across the market.

Note: The above numbers for Commodity futures were taken around 5 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 19th June:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 25,200, suggesting strong resistance at 25,100 - 25,200 levels.

The maximum Put Open Interest (OI) is observed at 24,500, followed closely by 24,600, suggesting strong support at 24,600 to 24,500 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

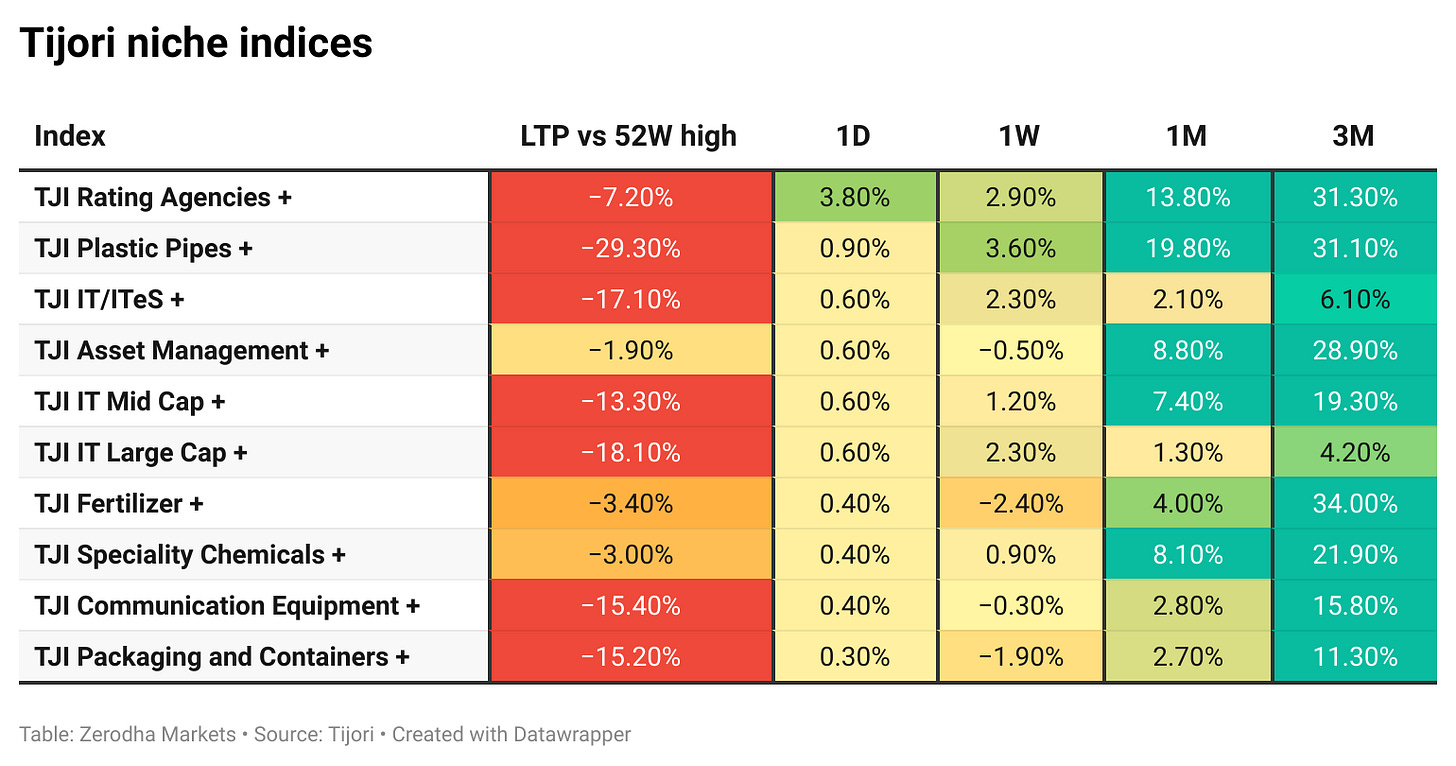

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

NSE will change its F&O expiry day from Thursday to Tuesday starting September 1, 2025, with contracts before August 31 expiring on Thursday. BSE will switch its expiry day from Tuesday to Thursday from the same date, keeping earlier contracts expiring on Tuesday. Dive deeper

India’s passenger vehicle sales rose 0.8% year-on-year to 303,099 units in May 2025, marking eight consecutive months of growth but at the slowest pace. Monthly sales dipped 0.2% after a 7.9% drop in April. RBI rate cuts and a forecast of above-normal monsoons are expected to boost affordability and consumer sentiment ahead. Dive deeper

Maruti Suzuki launched India’s largest in-plant railway siding at its Manesar facility to cut reliance on road transport and reduce carbon emissions. The ₹452 crore project will handle 4.5 lakh vehicles annually, cutting 65,000 truck trips and saving 6 crore litres of fuel. Dive deeper

SEBI is set to approve fixed annual pay of up to ₹30 lakh for Public Interest Directors (PIDs) at market infrastructure institutions, alongside existing sitting fees. The board will also consider easing appointment norms by reducing documentation and shortening cooling-off periods. These changes aim to attract more experienced professionals while balancing regulatory oversight. Dive deeper

RBI approved the reappointment of Sandeep Batra as ICICI Bank’s executive director for two years, subject to shareholder approval. Dive deeper

India’s steel sector is set for resilient growth in FY26, driven by strong domestic demand and stable raw material costs. JSW Steel and SAIL expect better margins despite a seasonal monsoon slowdown. Dive deeper

Blackstone acquired Kolkata’s South City Mall, covering over 1 million sq ft, for ₹3,250 crore. The mall generates over ₹1,800 crore annually and sees daily footfall of 55,000 - 60,000. Blackstone plans to leverage its retail expertise to ensure long-term growth. Dive deeper

Zee Entertainment plans a Rs 2,237 crore capital infusion via convertible warrants, raising promoter stake to 18.39%. The move follows a strategic review by J.P. Morgan India to support growth plans. Dive deeper

RBI accepted bids worth ₹9,296 crore out of a notified ₹25,000 crore in a government switch auction, aiming to exchange nine securities maturing in FY27 for those maturing beyond FY32. Dive deeper

India will export 150 advanced locomotives worth over ₹3,000 crore to Guinea for iron ore transport, with deliveries over three years. Built in Bihar, they feature AC propulsion, regenerative braking, and synchronized wireless control. The locomotives include air-conditioned cabs and modern safety and comfort features. Dive deeper

SEBI proposed half-yearly disclosures for securitised debt, covering asset performance, structure, and credit quality. Trustees must report detailed data to regulators and exchanges, varying by asset type. This aims to enhance transparency and align with RBI’s securitisation guidelines. Dive deeper

Biocon is raising ₹4,500 crore via QIP to buy back shares from private equity investors in Biocon Biologics, delaying its listing. Post-buyback, Biocon will hold 73.84% of the subsidiary valued at ₹69,719 crore. The funds will also help reduce debt and repay financial commitments. Dive deeper

CG Power secured its largest single order worth Rs 641 crore from Power Grid Corp. to supply 765/400 KV transformers and reactors, with delivery expected over 18 to 36 months. The company designs and manufactures a wide range of transformers and reactors used across various industries. Dive deeper

Knowledge Realty Trust, backed by Blackstone and Sattva Developers, plans a Rs 4,800 crore IPO in July, potentially one of India’s largest REIT listings. The trust has already raised Rs 1,400 crore through a pre-IPO allotment. Proceeds will be used to repay debt and for general corporate purposes. Dive deeper

NTPC plans to raise up to Rs 18,000 crore through bonds, with a board meeting scheduled for June 21 to consider the proposal. The funds will support capital expenditure, loan refinancing, and general corporate purposes. Dive deeper

Godrej Properties acquired a 16-acre land parcel in Upper Kharadi, Pune, with an estimated revenue potential of Rs 3,100 crore, marking its second acquisition in the area this month. The project will feature premium housing and retail, enhancing its footprint in a key growth corridor. Dive deeper

Reliance Industries sold 85 lakh shares of Asian Paints for ₹1,876 crore via an open market transaction, representing a 0.88% stake. ICICI Prudential Mutual Fund purchased these shares, raising its holding to 2.12%. Dive deeper

What’s happening globally

Brent crude rose over 1% to around $74.2 per barrel as Israel pledged more strikes on Iran, raising fears of energy disruptions. Despite airstrikes, Iran signals willingness to resume nuclear talks, easing some tensions. Dive deeper

Gold rose toward $3,390 per ounce amid Middle East tensions, boosting safe-haven demand, despite a recent dip on hopes of de-escalation and resumed US-Iran talks. Dive deeper

The US dollar index held above 98 as Middle East tensions boosted demand for the safe-haven currency. Investors await the Federal Reserve’s rate decision, widely expected to hold rates steady, focusing on forward guidance amid reduced rate cut expectations. Dive deeper

US retail sales fell 0.9% month-over-month in May 2025, the largest drop in four months and worse than the expected 0.7% decline. Major declines came from motor vehicle dealers (-3.5%), building material suppliers (-2.7%), and gasoline stations (-2%). This pullback occurred amid concerns over upcoming tariffs. Dive deeper

Germany’s ZEW Economic Sentiment Indicator rose 22.3 points to 47.5 in June 2025, surpassing expectations. Optimism is driven by increased investment, consumer demand, fiscal support, and ECB rate cuts. The current conditions index improved 10 points to -72, the sharpest rise since April 2023. Dive deeper

The Bank of Japan held its short-term rate at 0.5%, the highest since 2008, amid geopolitical risks and U.S. tariff uncertainties. Trade talks with Washington will continue after no G7 breakthrough. The BoJ plans gradual bond purchase cuts through March 2027, easing policy cautiously. Dive deeper

Netflix will open its third themed venue in Las Vegas in 2027, following launches in Philadelphia and Dallas in 2025. These immersive spaces feature experiences, merchandise, and dining based on popular shows. The move diversifies revenue and boosts brand engagement. Dive deeper

The European Commission proposed banning all Russian gas and LNG imports by the end of 2027. Short-term contracts would be banned starting January 2026, followed by long-term contracts from January 2028. This aims to end the EU’s reliance on Russian gas by 2028. Dive deeper

MakeMyTrip announced a share repurchase deal with Trip.com, funded by new convertible notes and ordinary share offerings. The company plans to buy back Class B shares from Trip.com using proceeds from a $1.25 billion convertible notes issuance and a primary equity sale. Dive deeper

Yum Brands named CFO Chris Turner as CEO starting in October, succeeding David Gibbs, who will retire in 2026. Turner helped grow digital sales to over 50% during his CFO tenure. Dive deeper

Nissan launched its third-generation Leaf EV, aiming to revive its electric vehicle presence despite US tariffs and cooling demand. Dive deeper

Mitsubishi Corp is in talks to acquire U.S. shale production and pipeline assets from Aethon Energy Management for about $8 billion. The deal would give Mitsubishi a significant natural gas operation near the U.S. Gulf coast and related energy export facilities. Talks are ongoing with no guarantee of a transaction. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Sundararaman Ramamurthy, CEO, BSE, on derivatives expiry shift and volume impact

“Thursday expiry has been there in India for a long time. We cannot make an assessment yet.”

“Transaction revenue is based on market volumes, which are influenced by many factors. It cannot be pre-judged.”

“We were very happy with Tuesday as expiry, but NSE said they are going with it. In the interest of the market, we have taken Thursday.” - Link

Shantanu Roy, Chairman & MD, BEML, on order book growth and segment outlook

“We ended the year at ₹14,610 crore, and I am looking at the same number as a further order inflow.”

“These new changes are stabilizing now and FY25-26 should see a mark change in the numbers as well… Slowly, we are going up from 5-5.5% to 13.2%.”

“We would be delivering 20 metros to Bengaluru Metro in the current financial year… we are also ready to roll out the prototype Vande Bharat Sleeper trains.” - Link

Santosh Iyer, MD & CEO, Mercedes-Benz India, on pricing, demand, and EV growth

“We have increased our prices in the range of 1-1.5% each in January and June. We have priced our cars for the rupee-euro exchange to be in the range 89-90. Now it has breached the 98 mark for the first time.”

“We cannot pass on the entire shock of price hikes to customers in one go. We have to do it in a phased manner.”

“When you look at the combustion engine models, there is a 48% GST and 20% road tax. Whereas in the case of EVs, the GST is 5%, and most States have exempted road tax, and some have given a 50% waiver on road tax.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.